White House Rejects Moody's US Credit Downgrade: Analysis And Response

Table of Contents

Moody's Rationale Behind the US Credit Downgrade

Moody's decision to downgrade the US credit rating was based on several key factors highlighting concerns about the nation's fiscal strength and governance. The credit rating agency cited a deteriorating fiscal situation, characterized by rising government debt and projected deficits, as a primary reason for the downgrade. Their report emphasizes the increasing risk of debt default and the erosion of governance effectiveness due to persistent political gridlock in Washington D.C. This decision directly impacts the US's ability to borrow money at favorable interest rates and casts a shadow on investor confidence.

- Rising national debt and projected deficits: The US national debt has reached unprecedented levels, with projections indicating continued growth in deficits for the foreseeable future. This unsustainable trajectory is a significant factor contributing to Moody's concerns.

- Erosion of governance effectiveness: The repeated near-misses on the debt ceiling, coupled with political polarization hindering bipartisan compromise, signal a weakening of governance effectiveness in managing fiscal responsibilities. This lack of cohesive fiscal policy planning contributed significantly to the downgrade.

- Increased risk of debt default: The prolonged battles over the debt ceiling significantly increase the risk of a potential US debt default, a scenario that would have severe global economic ramifications. This possibility weighed heavily in Moody's assessment.

- Comparison to other countries with similar ratings: Moody's explicitly compared the US's fiscal trajectory and governance challenges to other countries with similar credit ratings, suggesting the US is lagging behind in addressing its fiscal vulnerabilities.

The original Moody's report provides a detailed breakdown of these factors, offering specific data and projections that support their decision. Understanding this context is crucial to fully grasping the implications of the "Moody's downgrade."

The White House's Response and Counterarguments

The White House vehemently rejected Moody's downgrade, issuing a strongly worded statement criticizing the rating agency's methodology and assessment. The Treasury Department also released a response defending the strength of the US economy and highlighting the administration's efforts to address long-term fiscal challenges.

The White House counterarguments primarily focused on:

- Arguments against Moody's methodology: The administration questioned the validity of Moody's methodology, suggesting that it failed to fully account for the underlying strength of the US economy and the government's commitment to fiscal responsibility.

- Highlighting the strength of the US economy: The White House emphasized positive economic indicators, such as job growth and low unemployment rates, to counter Moody's negative assessment.

- Emphasizing the long-term fiscal health plan: The administration pointed to ongoing efforts to address the national debt and implement responsible fiscal policies over the long term.

- Mentioning the ongoing efforts to address the debt ceiling: The administration highlighted the recent agreement reached to temporarily raise the debt ceiling, suggesting that the situation is under control and the risk of default is mitigated.

The White House's response is a crucial element in understanding the political ramifications of the "White House response to Moody's downgrade."

Potential Economic Consequences of the Downgrade

The Moody's US credit rating downgrade carries significant potential economic consequences, both domestically and internationally. The short-term and long-term impacts could be far-reaching, affecting everything from interest rates to investor confidence.

- Increased borrowing costs for the US government: The downgrade will likely result in higher borrowing costs for the US government, making it more expensive to finance its debt.

- Potential impact on the dollar's value: The downgrade could weaken the value of the US dollar against other currencies, impacting international trade and investment.

- Effect on investor sentiment and market volatility: The downgrade may negatively affect investor sentiment, leading to increased market volatility and potentially decreased investment in US assets.

- Ripple effects on the global economy: The US plays a crucial role in the global economy. A downgrade could trigger ripple effects globally, affecting other countries and international financial markets.

Experts anticipate a range of potential consequences, emphasizing the need to closely monitor market reactions and economic indicators in the coming months.

Long-Term Implications and Future Outlook

The long-term implications of this downgrade extend beyond immediate market reactions. It fuels ongoing debates surrounding US fiscal policy and raises questions about the country's long-term economic stability. The political ramifications are significant, potentially affecting upcoming elections and influencing policy debates.

- Potential for further credit rating changes: Depending on future fiscal policy decisions and economic developments, there is a potential for further downgrades by Moody's or other rating agencies.

- Political ramifications and policy adjustments: The downgrade will undoubtedly intensify the political debate about fiscal policy in the US, potentially leading to significant changes in government spending, taxation, and economic priorities. Potential solutions include long-term deficit reduction plans, increased tax revenues, and controlled spending.

The future outlook remains uncertain, and careful monitoring of economic developments and political actions is crucial in understanding the full ramifications of the "Moody's US Credit Downgrade."

Conclusion: Understanding the Implications of the Moody's US Credit Downgrade

The Moody's downgrade of the US credit rating is a significant event with far-reaching implications. While the White House strongly rejects the assessment, Moody's rationale highlights serious concerns about the nation's fiscal trajectory and governance. The potential economic consequences, from increased borrowing costs to decreased investor confidence, are substantial. It's crucial to maintain a balanced perspective, acknowledging both the White House's counterarguments and the valid concerns raised by Moody's. This complex situation requires continued monitoring to understand the full implications of the "Moody's US Credit Downgrade" and its potential impact on the global economy. Stay informed about further developments by following reputable news sources and economic analyses for ongoing updates on this evolving story.

Featured Posts

-

96 Rt Romance Drama On Netflix Loses Top 10 Spot To True Crime Docuseries

May 18, 2025

96 Rt Romance Drama On Netflix Loses Top 10 Spot To True Crime Docuseries

May 18, 2025 -

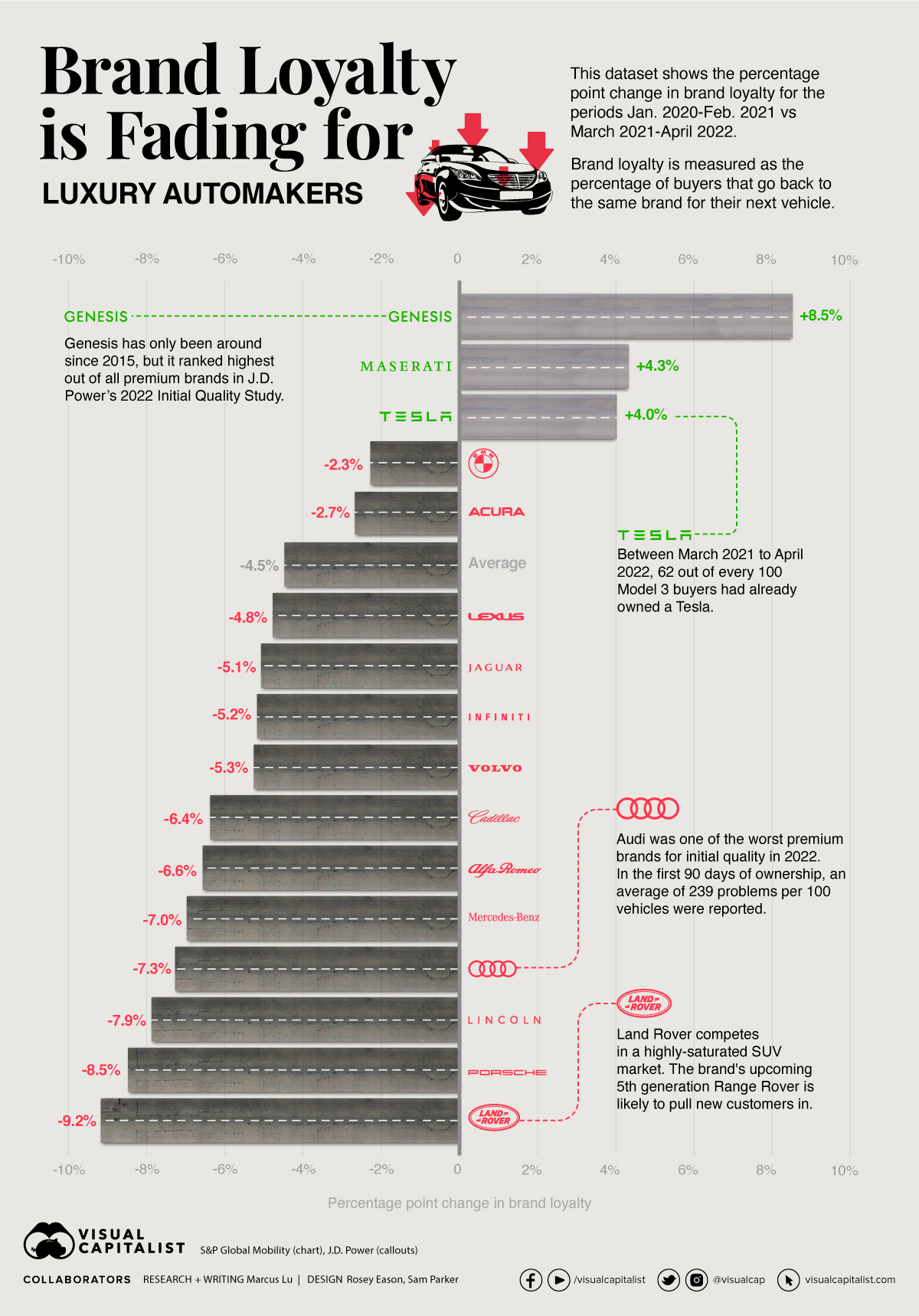

The China Factor Why Luxury Automakers Face Headwinds In The Chinese Market

May 18, 2025

The China Factor Why Luxury Automakers Face Headwinds In The Chinese Market

May 18, 2025 -

Can Conforto Emulate Hernandezs Success With The Dodgers

May 18, 2025

Can Conforto Emulate Hernandezs Success With The Dodgers

May 18, 2025 -

The Truth About Kanye Wests Access To His Children

May 18, 2025

The Truth About Kanye Wests Access To His Children

May 18, 2025 -

Gambling On Natural Disasters The Troubling Trend Of Betting On The Los Angeles Wildfires

May 18, 2025

Gambling On Natural Disasters The Troubling Trend Of Betting On The Los Angeles Wildfires

May 18, 2025

Latest Posts

-

Amanda Bynes And Taran Killam A Look Back At Their Relationship

May 18, 2025

Amanda Bynes And Taran Killam A Look Back At Their Relationship

May 18, 2025 -

Amanda Bynes Only Fans Debut A Major Caveat Explained

May 18, 2025

Amanda Bynes Only Fans Debut A Major Caveat Explained

May 18, 2025 -

Drake Bells Controversial Comparison Amanda Bynes And Friends Rachel

May 18, 2025

Drake Bells Controversial Comparison Amanda Bynes And Friends Rachel

May 18, 2025 -

Michael Confortos Path To Redemption Overcoming Early Spring Slump

May 18, 2025

Michael Confortos Path To Redemption Overcoming Early Spring Slump

May 18, 2025 -

Understanding Amanda Bynes Journey Through Public Challenges

May 18, 2025

Understanding Amanda Bynes Journey Through Public Challenges

May 18, 2025