Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

Higher Initial Interest Rates

One of the most significant deterrents to 10-year mortgages in Canada is the typically higher initial interest rate compared to shorter-term options like 5-year mortgages or even variable-rate mortgages. This difference can be substantial, significantly impacting the overall cost of borrowing and making them a less attractive proposition for many Canadians. Understanding the nuances of Canadian mortgage interest rates is crucial.

-

Higher upfront costs: The increased initial interest rate translates to higher monthly payments from the outset. This can be a particularly challenging hurdle for first-time homebuyers with limited savings and a smaller budget for down payments.

-

Interest rate fluctuation unpredictability: Predicting interest rate fluctuations over a decade is extremely difficult. While a fixed-rate mortgage offers predictability, you're locked into that rate, even if rates fall significantly during the 10-year period. Variable-rate mortgages offer flexibility but come with their own risk.

-

Daunted by the long-term commitment: The sheer financial commitment involved in a 10-year mortgage can feel daunting. It requires a high degree of financial confidence and a strong belief in the ability to maintain consistent payments over an extended period, even with potential unforeseen circumstances.

Risk of Locked-In Rates

A key aspect of a 10-year mortgage is the inherent risk associated with locking into a specific interest rate for a decade. This means you're committed to that rate regardless of how market conditions evolve. If interest rates drop considerably during that 10-year period, you miss out on the opportunity to refinance your mortgage at a lower rate and potentially save a significant amount of money. This is a major consideration for many Canadians who prefer to have more control over their mortgage payments.

-

Substantial prepayment penalties: Breaking a 10-year mortgage early, for example, due to unforeseen circumstances, often incurs substantial prepayment penalties. These penalties can be significant, wiping out potential savings from refinancing.

-

Dynamic Canadian housing market: The Canadian housing market is known for its dynamism and volatility. Locking into a 10-year mortgage represents a considerable commitment in a market subject to cyclical changes and external influences.

-

Uncertainty of future finances: Life is unpredictable. Unexpected job losses, illness, or other financial hardships can strain household budgets. The rigid nature of a 10-year mortgage offers little room for manoeuvre if such unforeseen events occur.

Limited Flexibility and Life Changes

Life is full of surprises and unexpected changes. A 10-year mortgage offers relatively limited flexibility to adapt to these changes, a major factor influencing its lack of popularity. The rigidity of a long-term commitment can be a significant drawback for many Canadians.

-

Financial hardship: Job loss or unexpected major expenses can make maintaining consistent monthly mortgage payments challenging.

-

Relocation: Relocating for work often necessitates selling a property, which usually triggers prepayment penalties on a 10-year mortgage.

-

Changing family needs: Life events such as marriage, divorce, the birth of children, or other family growth can substantially alter housing needs, making a long-term mortgage less suitable.

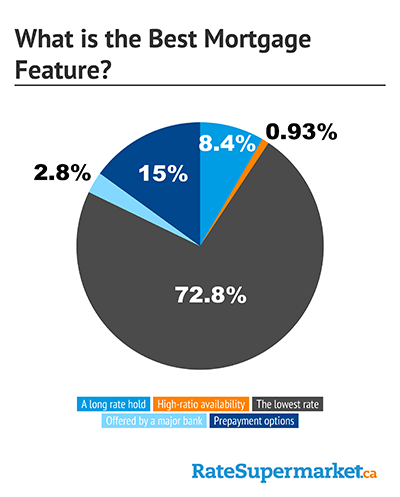

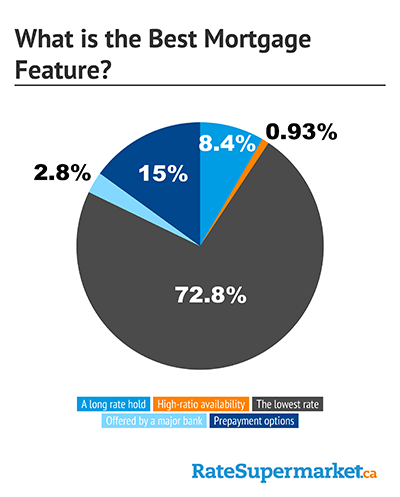

Preference for Shorter-Term Mortgages

Many Canadians prefer the shorter-term flexibility offered by 5-year mortgages. This preference stems partly from the cyclical nature of the Canadian mortgage market and the opportunities these shorter terms present for rate adjustments and refinancing. The ability to reassess and readjust their mortgage strategy every five years provides significant comfort and control.

Conclusion

While a 10-year mortgage in Canada offers the potential benefit of lower monthly payments, several factors contribute to its relatively low popularity. Higher initial interest rates, the significant risk of locked-in rates, and the lack of flexibility compared to shorter-term options like 5-year mortgages are crucial considerations. Canadians frequently prioritize the adaptability of shorter-term mortgages, allowing them to navigate the changing economic landscape and adapt to life's unexpected turns. Carefully weighing your individual risk tolerance, long-term financial goals, and potential life changes is essential when choosing a mortgage term. Are you ready to explore the best mortgage options for your unique situation? Contact a mortgage broker today to discuss your needs and find a solution beyond a simple 10-year mortgage in Canada.

Featured Posts

-

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 05, 2025

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 05, 2025 -

Kentucky Derby 2025 Unpacking The Potential Race Pace

May 05, 2025

Kentucky Derby 2025 Unpacking The Potential Race Pace

May 05, 2025 -

Ruth Buzzi A Celebration Of The Life And Career Of A Comedy Icon

May 05, 2025

Ruth Buzzi A Celebration Of The Life And Career Of A Comedy Icon

May 05, 2025 -

Capitals 2025 Playoffs Push New Initiatives Unveiled By Vanda Pharmaceuticals

May 05, 2025

Capitals 2025 Playoffs Push New Initiatives Unveiled By Vanda Pharmaceuticals

May 05, 2025 -

Premiere Fashion Face Off Blake Lively And Anna Kendricks Understated Style

May 05, 2025

Premiere Fashion Face Off Blake Lively And Anna Kendricks Understated Style

May 05, 2025

Latest Posts

-

Analyzing Fleetwood Macs Top Singles Why They Remain Popular

May 05, 2025

Analyzing Fleetwood Macs Top Singles Why They Remain Popular

May 05, 2025 -

How Fleetwood Mac Achieved A Top Selling Album Without Releasing New Music

May 05, 2025

How Fleetwood Mac Achieved A Top Selling Album Without Releasing New Music

May 05, 2025 -

Fleetwood Mac Chart Topping Singles And Their Lasting Legacy

May 05, 2025

Fleetwood Mac Chart Topping Singles And Their Lasting Legacy

May 05, 2025 -

Fleetwood Macs Biggest Hits A Testament To Enduring Popularity

May 05, 2025

Fleetwood Macs Biggest Hits A Testament To Enduring Popularity

May 05, 2025 -

Fleetwood Macs Unexpected Us Chart Success A Hit Album Without New Music

May 05, 2025

Fleetwood Macs Unexpected Us Chart Success A Hit Album Without New Music

May 05, 2025