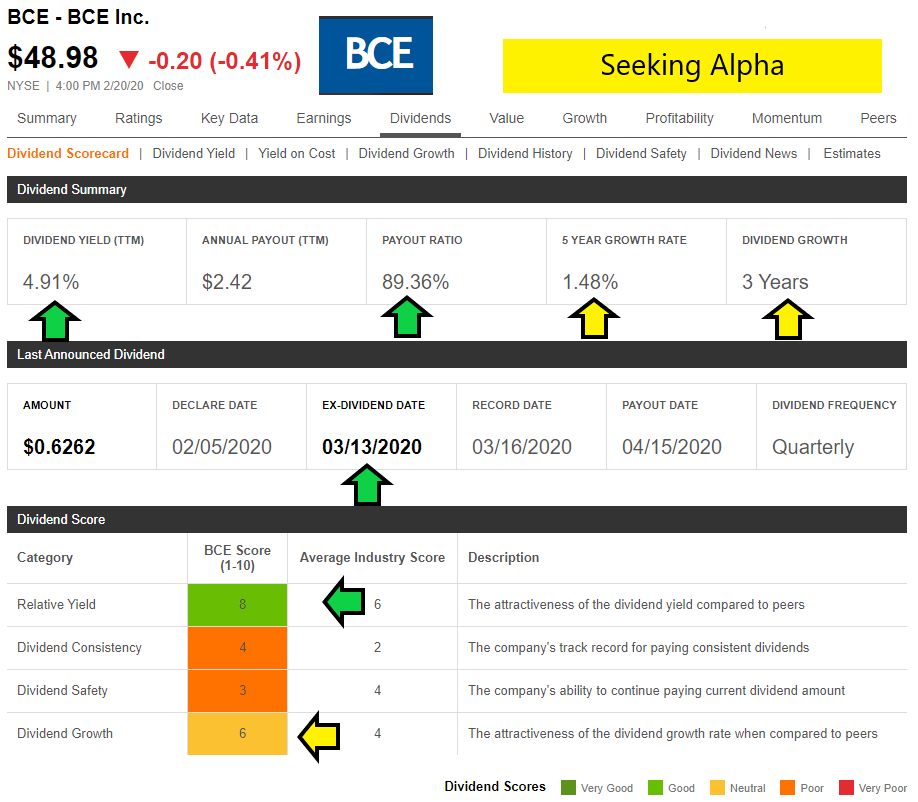

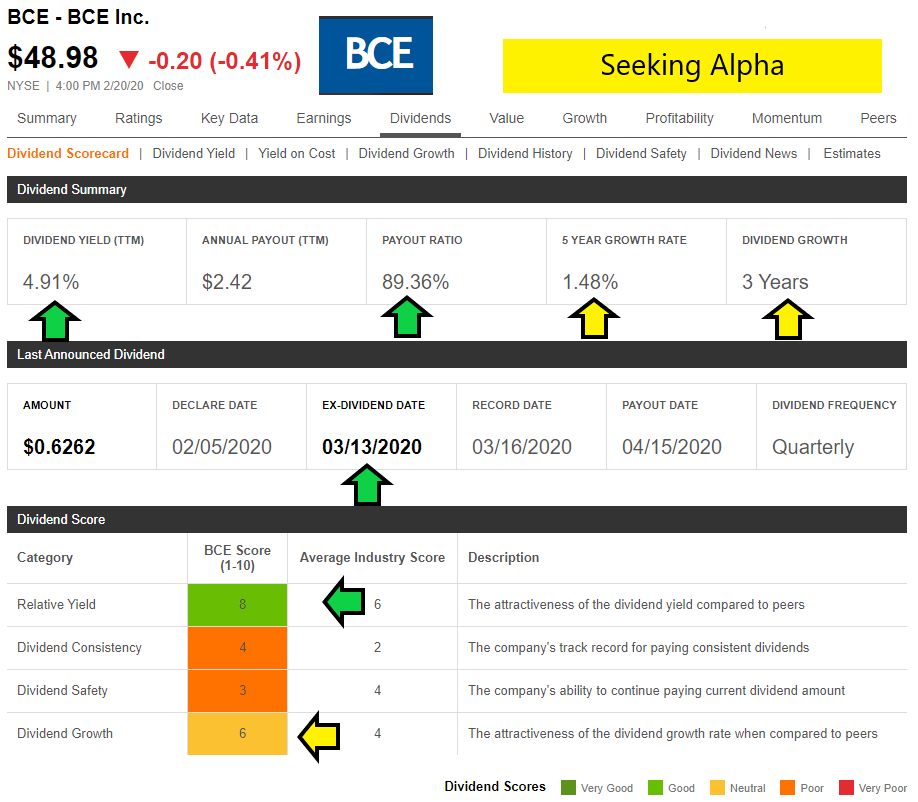

Why Did BCE Inc. Cut Its Dividend? Impact On Investors

Table of Contents

Reasons Behind BCE Inc.'s Dividend Cut

BCE Inc.'s decision to reduce its dividend stems from a confluence of factors, each playing a significant role in the company's strategic shift.

Increased Debt and Capital Expenditures

BCE Inc.'s substantial investment in infrastructure improvements and expansion has resulted in a considerable increase in debt. This debt burden, coupled with high capital expenditures, puts pressure on the company's free cash flow, limiting its ability to maintain the previous dividend payout.

- Increased investment in 5G network infrastructure: The rollout of 5G technology requires massive capital investment, impacting immediate profitability and cash flow available for dividends.

- Acquisition costs for expanding its business: Acquisitions, while potentially beneficial for long-term growth, often involve significant upfront costs that strain financial resources.

- Rising interest rates impacting debt servicing costs: The current economic climate with rising interest rates makes servicing existing debt more expensive, further reducing available cash for dividends. This increased cost of borrowing directly impacts BCE's ability to pay out dividends at the previous level.

Impact of the Pandemic and Economic Uncertainty

The COVID-19 pandemic and the ensuing economic uncertainty created challenges for BCE Inc., impacting its revenue streams and profitability. The effects of the pandemic linger, adding to the complexity of the company's financial situation.

- Decreased demand for certain services: The pandemic led to shifts in consumer behaviour, affecting demand for some of BCE Inc.'s services.

- Challenges in securing new contracts: Economic uncertainty made businesses hesitant to commit to long-term contracts, impacting revenue growth.

- Increased competition in the telecommunications market: The competitive landscape in the telecommunications industry remains fierce, further squeezing profit margins.

Strategic Realignment and Prioritization

The BCE Inc. dividend cut might also reflect a strategic shift prioritizing long-term growth and strengthening the company's core business over immediate shareholder payouts. This suggests a focus on sustainable growth rather than short-term gains.

- Investing in new technologies and services for future expansion: BCE Inc. may be diverting resources to develop new technologies and services, positioning itself for future market leadership.

- Improving operational efficiency and cost management: The dividend cut could signal a commitment to streamlining operations and improving cost efficiency to improve long-term profitability.

- Strengthening its market position and competitiveness: The company may be reinvesting profits to enhance its market position and compete more effectively against rivals.

Impact on Investors: Short-Term and Long-Term Implications

The BCE Inc. dividend cut has significant implications for investors, both immediate and long-term.

Immediate Market Reaction

The announcement of the dividend reduction likely caused a negative market reaction, impacting BCE Inc.'s share price. Investors often view dividend cuts as a negative sign, leading to decreased confidence and potential sell-offs.

- Analysis of share price fluctuations following the announcement: Observing share price movements after the announcement provides insights into investor sentiment.

- Investor sentiment and confidence in the company: The dividend cut might erode investor confidence, requiring the company to rebuild trust through transparent communication and demonstrable progress.

- Comparison to competitor dividend policies and market performance: Comparing BCE Inc.'s actions with its competitors helps understand the relative impact of this decision.

Long-Term Growth Potential

Despite the negative short-term implications, the dividend cut could potentially benefit long-term investors. The reinvestment of previously distributed funds can fuel growth and lead to higher dividends in the future.

- Potential for increased profitability and return on investment: Reinvesting capital into infrastructure and innovation could lead to increased profitability and ultimately higher returns for investors.

- Attracting investors looking for long-term growth potential: The focus on long-term growth may attract investors who prioritize potential future returns over immediate dividend payments.

- Benefits of focused investments in infrastructure and technology: Strategic investments in 5G and other technologies can create a stronger, more competitive company, benefitting shareholders in the long run.

Alternatives and Investor Considerations

Investors need to consider several factors in light of the BCE Inc. dividend cut.

Analyzing the revised dividend policy

Investors should carefully examine the revised dividend policy to assess its alignment with their investment goals and risk tolerance. Understanding the long-term vision is paramount.

- Understanding the rationale behind the change: A thorough understanding of the reasons for the dividend cut is essential for informed decision-making.

- Comparing the revised dividend to other investment options: Investors should compare the revised dividend payout with other investment opportunities to determine its competitiveness.

- Assessing the company’s future financial projections: Reviewing BCE Inc.'s financial forecasts and projections is crucial for evaluating the long-term potential for dividend growth.

Diversifying the investment portfolio

Diversification is crucial for mitigating risk. Spreading investments across different asset classes helps reduce reliance on a single company or sector.

Conclusion

The BCE Inc. dividend cut presents a complex situation with both short-term and long-term implications. While the initial market reaction might be negative, the decision could ultimately benefit the company's long-term financial health and growth prospects. Investors should carefully consider the rationale behind the cut, analyze the revised dividend policy, and assess the company's future outlook before making investment decisions. Understanding the reasons behind the BCE Inc. dividend cut is critical for informed investment choices. Continue monitoring BCE Inc.'s performance and future announcements to make well-informed decisions regarding your investment strategy. Thoroughly research the impact of the BCE Inc. dividend cut to stay informed about its long-term consequences.

Featured Posts

-

Mortgage Rates Below 3 Can They Revive Canadas Housing Market

May 13, 2025

Mortgage Rates Below 3 Can They Revive Canadas Housing Market

May 13, 2025 -

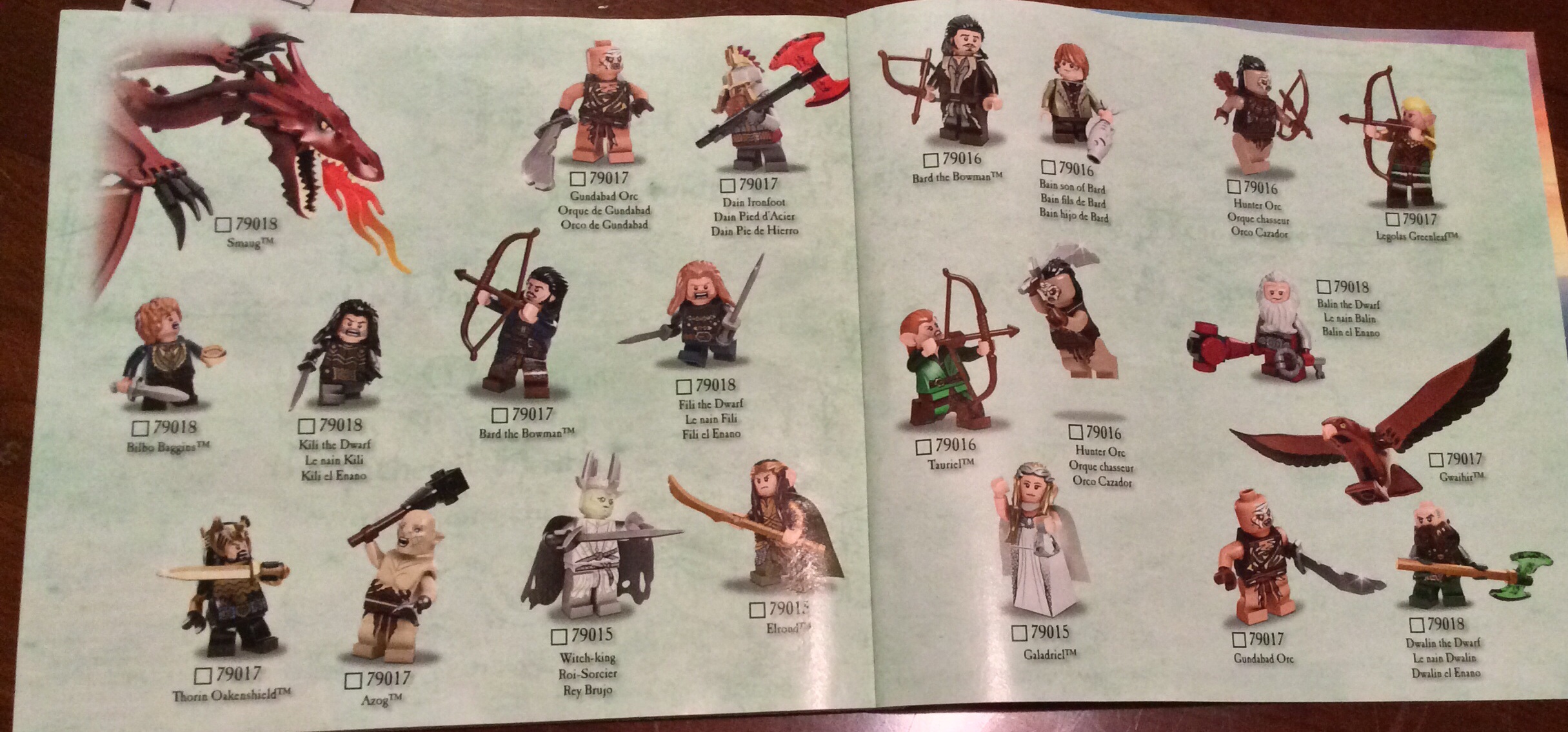

The Hobbit The Battle Of The Five Armies Characters Plot And Legacy

May 13, 2025

The Hobbit The Battle Of The Five Armies Characters Plot And Legacy

May 13, 2025 -

Airdrie And Coatbridge 41 Clubs Second Gibraltar Twin Club Visit

May 13, 2025

Airdrie And Coatbridge 41 Clubs Second Gibraltar Twin Club Visit

May 13, 2025 -

Sabadell In Talks With Unicaja Investors Potential Merger On The Horizon

May 13, 2025

Sabadell In Talks With Unicaja Investors Potential Merger On The Horizon

May 13, 2025 -

Zovnishnist Ta Potochne Mistseperebuvannya Oleksiya Poroshenka

May 13, 2025

Zovnishnist Ta Potochne Mistseperebuvannya Oleksiya Poroshenka

May 13, 2025