Why Did Uber Stock Rally Double Digits In April? A Deep Dive

Table of Contents

Stronger-Than-Expected Q1 2024 Earnings Report

Uber's impressive stock rally in April can be largely attributed to its exceptionally strong Q1 2024 earnings report. The results significantly exceeded analyst expectations, boosting investor confidence and driving up the share price.

Revenue Growth and Beat of Analyst Expectations

Uber reported significantly higher revenue than predicted, surpassing analyst consensus estimates by a considerable margin. This growth was fueled by a combination of factors, including:

- Increased Ride-Sharing Demand: A resurgence in post-pandemic travel and commuting led to a notable increase in ride-sharing revenue.

- Booming Delivery Services: Uber Eats continued its strong performance, with increased order volume and higher average order values contributing to substantial revenue growth.

Key financial metrics further solidified the positive narrative:

- Earnings Per Share (EPS): Exceeded expectations by [Insert Percentage or Specific Number]

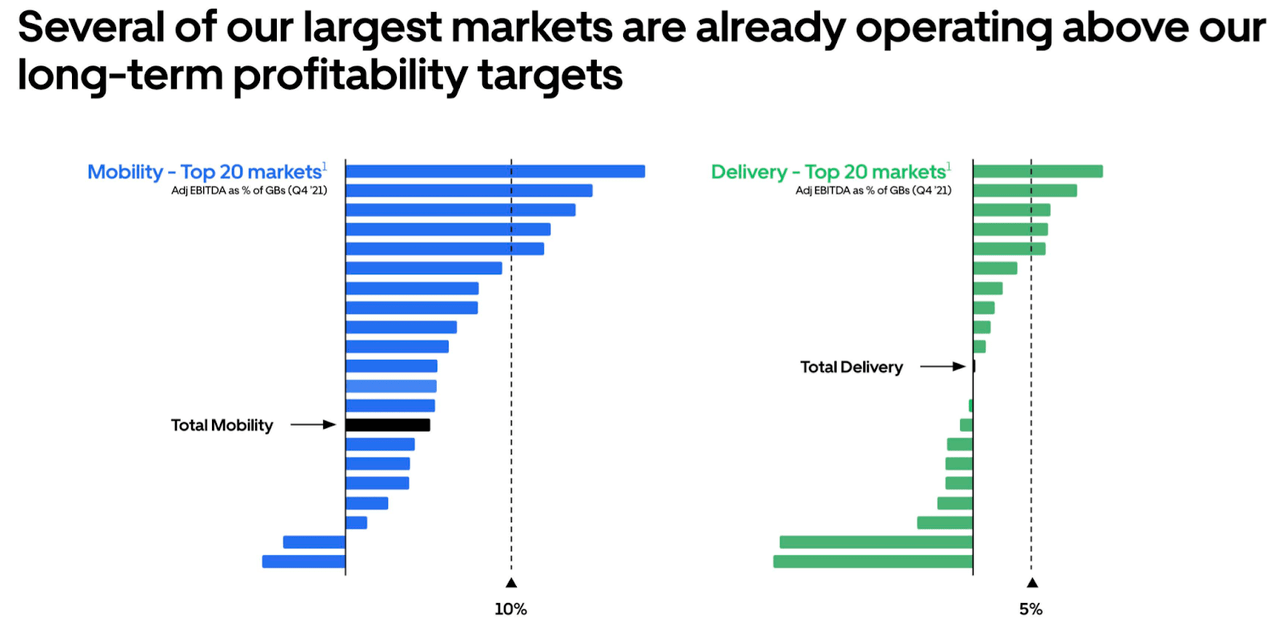

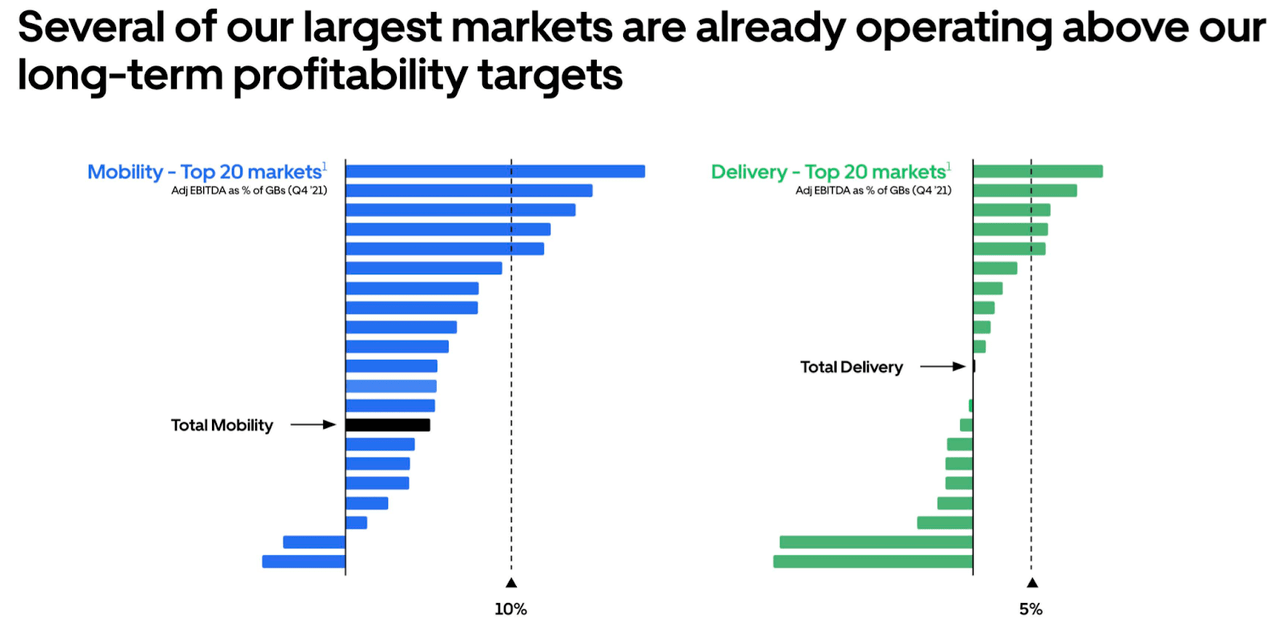

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Showed a significant improvement compared to the same period last year, demonstrating improved profitability.

Improved Operational Efficiency and Cost Management

Beyond revenue growth, Uber also demonstrated significant improvements in operational efficiency and cost management. This played a crucial role in boosting profitability and investor sentiment. Key initiatives included:

- Optimized Driver Acquisition Costs: Uber implemented strategies to reduce the cost of acquiring and retaining drivers, leading to improved margins.

- Reduced Marketing Expenses: Targeted marketing campaigns and improved user engagement strategies resulted in lower marketing costs while maintaining growth.

These efficiency gains directly impacted Uber's bottom line, contributing significantly to the better-than-expected earnings report and the subsequent stock rally.

Positive Market Sentiment and Investor Confidence

The April stock rally wasn't solely driven by Uber's internal performance; positive market sentiment and renewed investor confidence played a significant role.

Overall Positive Market Conditions

The overall stock market climate in April 2024 was relatively positive, with several positive economic indicators contributing to investor optimism. This broader market strength created a favorable environment for tech stocks like Uber to thrive.

Improved Investor Perception of Uber's Long-Term Growth Potential

Beyond the positive market backdrop, investors showed renewed faith in Uber's long-term growth potential. This shift in perception was driven by several factors:

- Positive Analyst Upgrades: Several prominent financial analysts upgraded their ratings and price targets for Uber stock, reflecting growing confidence in the company's future prospects.

- Strategic Initiatives: Uber's ongoing investments in new technologies and expansion into new markets demonstrated its commitment to long-term growth.

These factors helped to alleviate previous investor concerns about Uber's profitability and sustainability, contributing significantly to the double-digit stock surge.

Strategic Initiatives and New Business Opportunities

Uber's strategic initiatives and exploration of new business opportunities also contributed to the positive investor sentiment and the April stock rally.

Expansion into New Markets and Services

Uber continues to expand its geographic reach and diversify its service offerings. This expansion into new markets and service verticals provides multiple avenues for future growth and revenue generation. Examples include: [Insert specific examples of new markets or services launched].

Technological Advancements and Innovations

Uber's ongoing investment in technological advancements is also a key driver of its success. Improvements in:

- AI-powered dispatch systems: Optimized routing and driver allocation, leading to faster delivery times and increased efficiency.

- Enhanced app features: Improved user experience and increased customer engagement, leading to higher usage and retention rates.

These technological innovations contribute to a more efficient and user-friendly experience, fostering growth and strengthening Uber's competitive advantage.

Conclusion

The double-digit rally in Uber stock during April 2024 was a result of a confluence of factors. The stronger-than-expected Q1 2024 earnings report, fueled by revenue growth and improved operational efficiency, played a pivotal role. Simultaneously, positive market sentiment, a renewed belief in Uber's long-term growth potential, and the company’s strategic initiatives all contributed to this significant surge. Understanding these factors is crucial for investors seeking to analyze Uber's stock performance and its potential for future growth. To stay informed about future developments and opportunities related to Uber stock and other similar growth stocks, continue to research market trends and company performance. Further analysis of Uber stock and its performance is recommended to inform your investment decisions.

Featured Posts

-

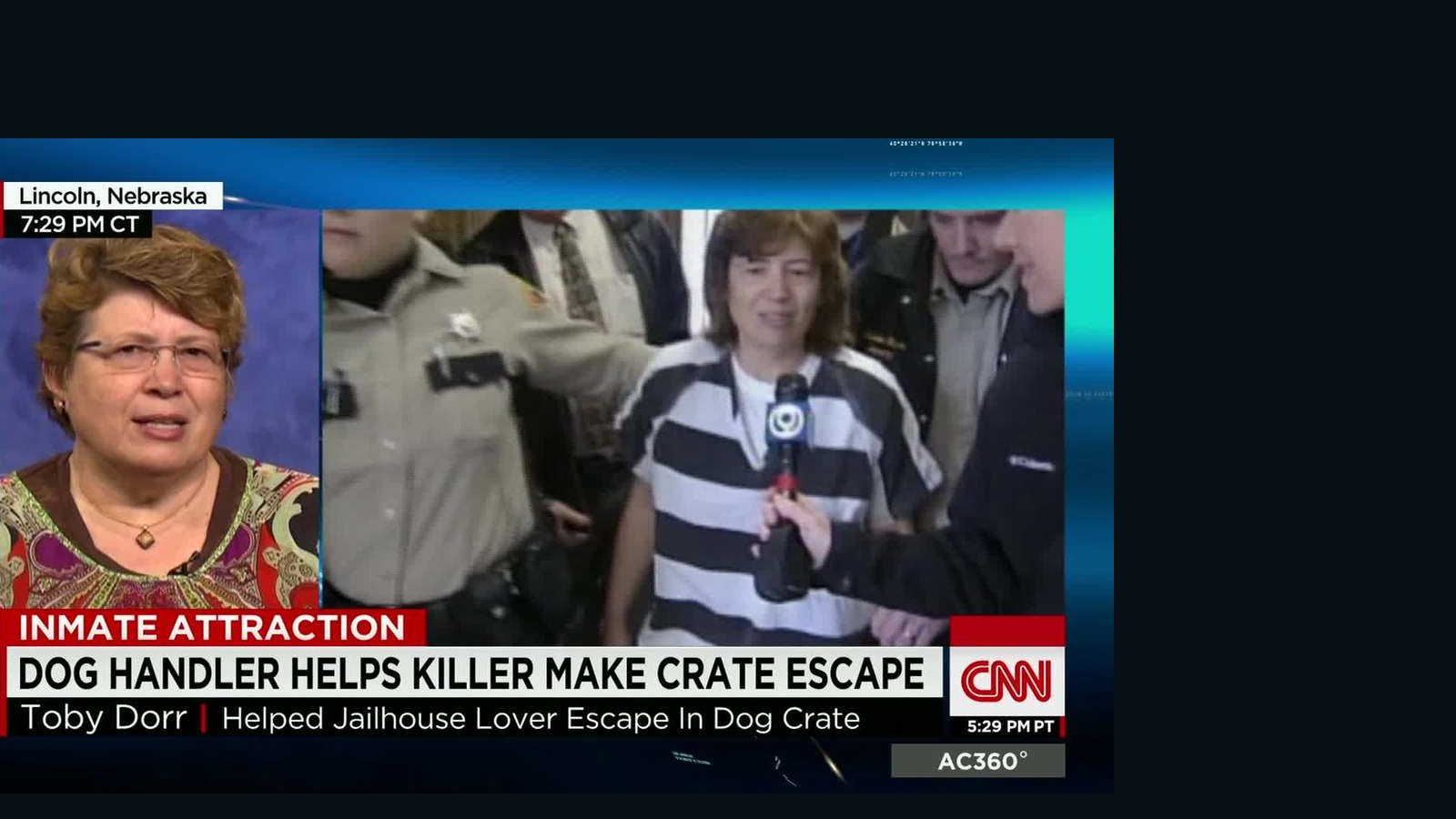

New Orleans Jail Escape Cnn Releases Dramatic Video Footage

May 18, 2025

New Orleans Jail Escape Cnn Releases Dramatic Video Footage

May 18, 2025 -

Astmrar Nar Alsrae Dwr Htb Alhrb Fy Italt Amd Alnzae

May 18, 2025

Astmrar Nar Alsrae Dwr Htb Alhrb Fy Italt Amd Alnzae

May 18, 2025 -

Shrek 5 Official Original Cast Back With Zendaya

May 18, 2025

Shrek 5 Official Original Cast Back With Zendaya

May 18, 2025 -

Kane Uest I Pokhorony Instruktsiya Ot Pashi Tekhnikom

May 18, 2025

Kane Uest I Pokhorony Instruktsiya Ot Pashi Tekhnikom

May 18, 2025 -

Snl I Ermineia Toy Maik Magiers Os Ilon Mask

May 18, 2025

Snl I Ermineia Toy Maik Magiers Os Ilon Mask

May 18, 2025

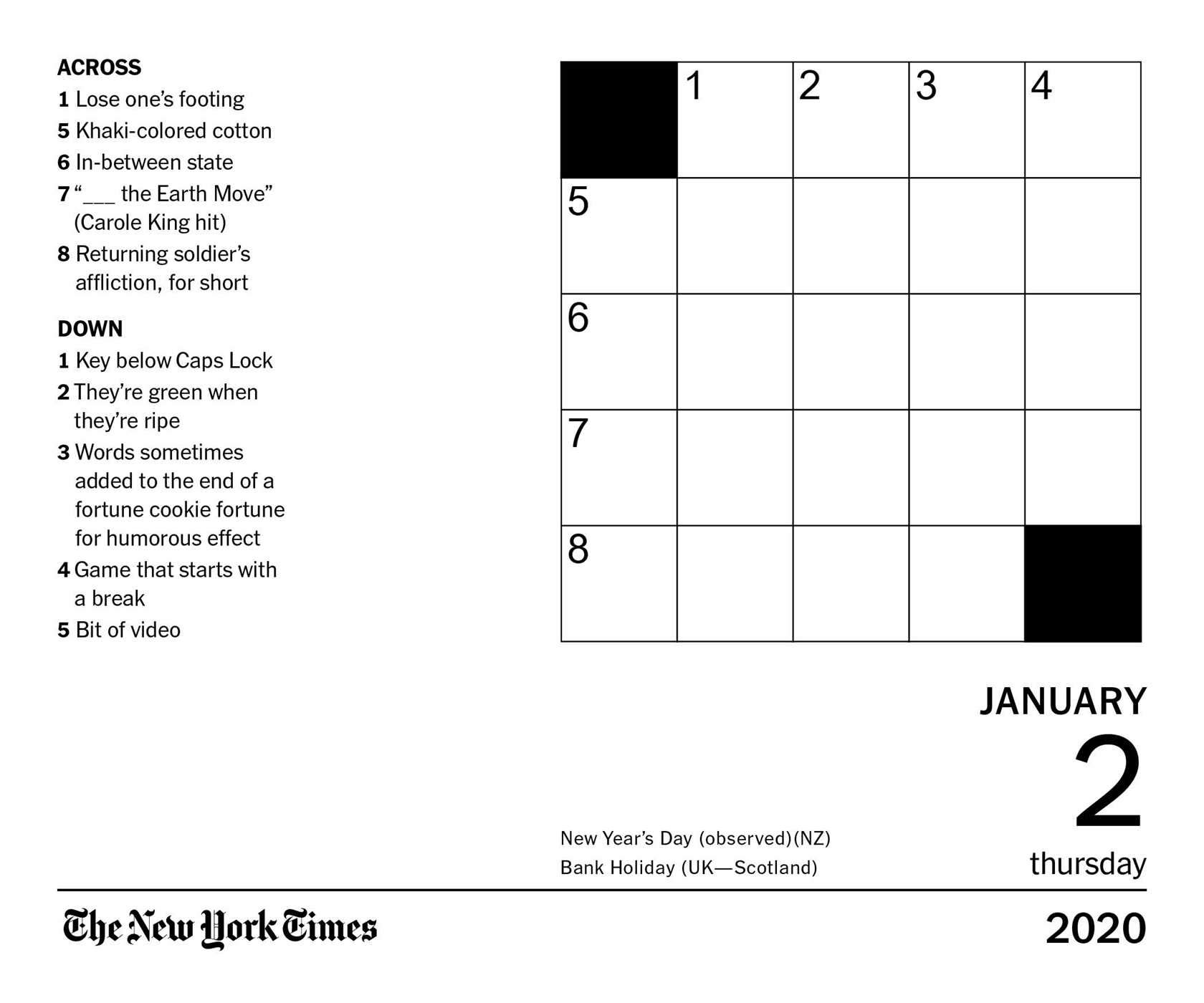

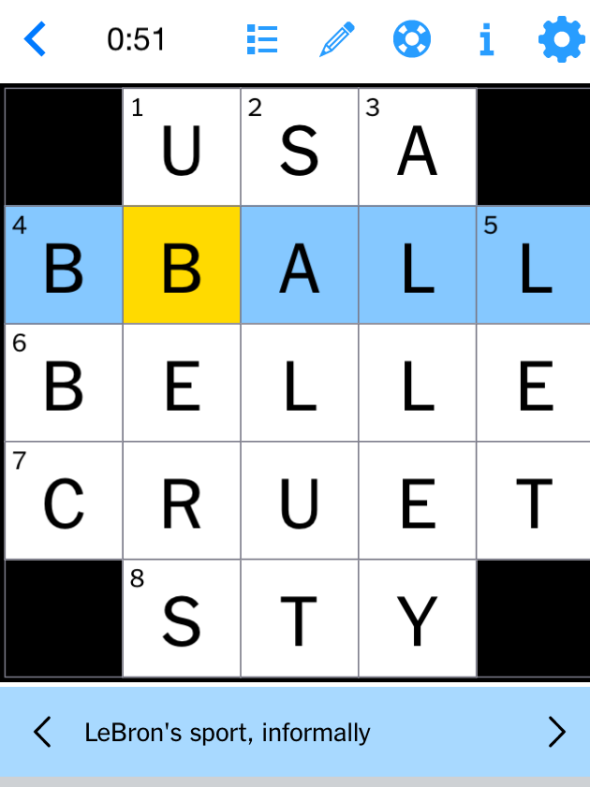

Nyt Mini Crossword February 27 2025 Complete Solutions

Nyt Mini Crossword February 27 2025 Complete Solutions

Nyt Mini Crossword Answers For February 27 2025

Nyt Mini Crossword Answers For February 27 2025

Nyt Mini Crossword Today Hints And Answers For February 26 2025

Nyt Mini Crossword Today Hints And Answers For February 26 2025

Nyt Mini Crossword Today February 27 2025 Hints And Answers

Nyt Mini Crossword Today February 27 2025 Hints And Answers