Why Investors Should Remain Calm Despite High Stock Market Valuations (BofA)

Table of Contents

Understanding the Current High Valuations

Factors Contributing to High Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these elements is crucial for developing a well-informed investment strategy:

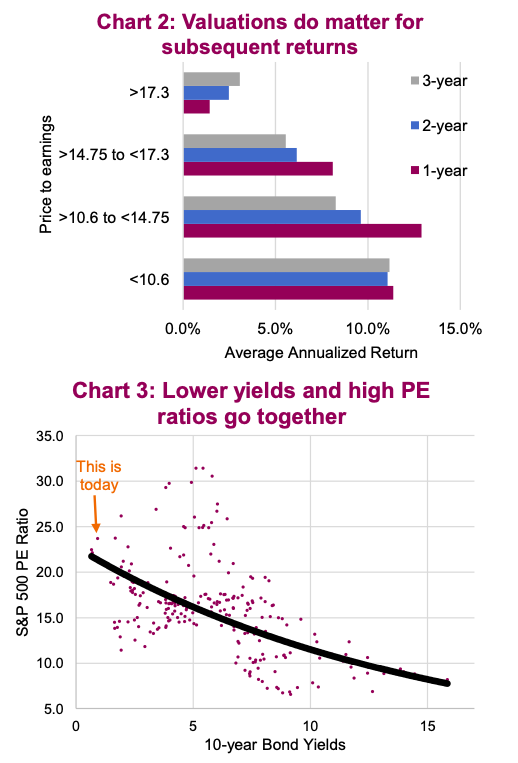

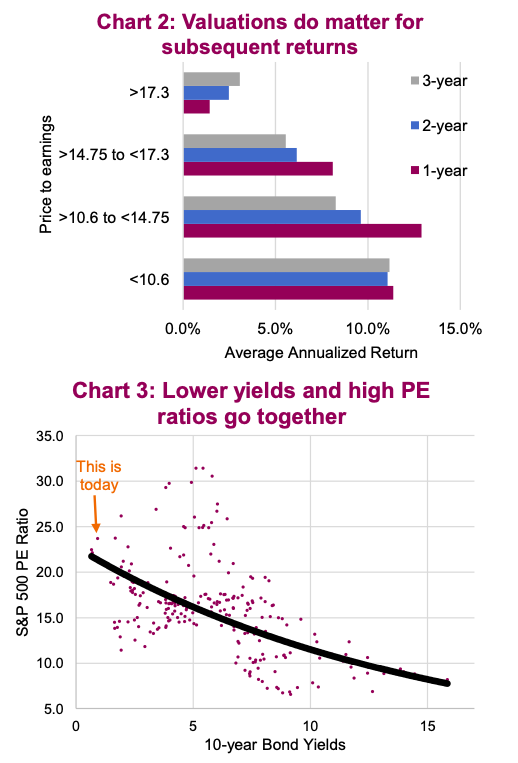

- Low Interest Rates: Historically low interest rates have made borrowing cheaper, fueling corporate investment and increasing demand for equities as a relatively higher-yielding asset class. This increased demand pushes prices upwards, contributing to higher valuations.

- Strong Corporate Earnings (in select sectors): While some sectors struggle, others, like technology and certain consumer staples, have experienced robust earnings growth. This positive performance boosts investor confidence and supports higher stock prices. The tech sector, in particular, has seen significant growth fueled by innovations in artificial intelligence and cloud computing.

- Inflationary Pressures: While inflation erodes purchasing power, it can also, paradoxically, lead to higher valuations in certain sectors. Companies able to pass increased costs onto consumers might see profits remain relatively strong, driving investor interest.

- Quantitative Easing (QE) Policies: Past quantitative easing programs injected significant liquidity into the market, driving up asset prices, including stocks. The lingering effects of these policies continue to influence valuations.

- Market Sentiment and Investor Behavior: Investor psychology plays a powerful role. Optimism and a fear of missing out (FOMO) can drive prices beyond what might be considered fundamentally justified. Conversely, periods of pessimism can lead to sharp market corrections.

Differentiating between Valuation and Price

It's crucial to distinguish between the intrinsic value of a company (its actual worth based on fundamentals) and its market price (what the stock is currently trading at). High market valuations don't automatically equate to an impending crash. Market prices can fluctuate significantly due to short-term sentiment, while intrinsic value remains relatively more stable. Think of it like this: a valuable piece of art might be temporarily undervalued in a sluggish art market, but its intrinsic value doesn't change. Similarly, high valuations don't always mean an asset is overvalued in the long run.

The Long-Term Investment Perspective

Historical Market Cycles and Recoveries

Markets are cyclical. History is replete with examples of market corrections and subsequent recoveries. The dot-com bubble burst, the 2008 financial crisis, and even the recent COVID-19 market downturn all serve as reminders that volatility is inherent in the investment landscape. However, each downturn has eventually been followed by significant rebounds. Analyzing historical charts visually underscores this cyclical nature and offers valuable context for navigating current uncertainty. (Include a relevant chart or graph here)

The Power of Time in the Market

Time is your greatest ally in long-term investing. Trying to time the market – buying low and selling high – is notoriously difficult, even for professional investors. A long-term strategy allows you to ride out market fluctuations, benefitting from the compounding effect of returns over time. Data consistently shows that investors who remain invested throughout market cycles tend to achieve significantly higher returns than those who frequently trade based on short-term market signals. (Include data points supporting long-term investment benefits here, e.g., average annual returns over various time horizons)

Mitigating Risk in a High-Valuation Market

Diversification Strategies

Diversification is paramount in managing risk. Don't put all your eggs in one basket. Spread your investments across various asset classes, including stocks, bonds, real estate, and potentially other alternatives. A well-diversified portfolio can help cushion the blow of potential losses in any single asset class. For instance, holding a mix of large-cap and small-cap stocks, along with government and corporate bonds, can offer a more resilient portfolio.

Strategic Asset Allocation

Strategic asset allocation involves tailoring your investment portfolio to align with your individual risk tolerance and long-term financial goals. A younger investor with a longer time horizon might tolerate more risk and invest a larger proportion of their portfolio in equities. Conversely, an investor closer to retirement may opt for a more conservative approach with a higher allocation to fixed-income securities. This personalized approach is crucial for managing risk effectively and achieving your financial objectives. Remember that seeking advice from a qualified financial advisor is always recommended before making significant investment decisions.

Conclusion

High stock market valuations are a cause for consideration, not panic. History shows that market cycles are normal, and focusing on long-term investment strategies remains crucial. By understanding the factors contributing to current valuations, differentiating between price and value, and employing sound risk management strategies like diversification and strategic asset allocation, investors can navigate these challenging times effectively. Maintain your calm investment strategy amidst high stock market valuations. Learn more about [link to relevant resource on long-term investing or risk management].

Featured Posts

-

Nyt Mini Crossword Answers For Saturday April 19th Complete Solutions

May 31, 2025

Nyt Mini Crossword Answers For Saturday April 19th Complete Solutions

May 31, 2025 -

Canadian Wildfires Unprecedented Evacuations And Transborder Smoke Impact

May 31, 2025

Canadian Wildfires Unprecedented Evacuations And Transborder Smoke Impact

May 31, 2025 -

Discovering A Banksy Your Action Plan

May 31, 2025

Discovering A Banksy Your Action Plan

May 31, 2025 -

Germanys Accommodation Offer Two Weeks Free For New Residents

May 31, 2025

Germanys Accommodation Offer Two Weeks Free For New Residents

May 31, 2025 -

Glastonbury Resale Tickets 2024 Everything You Need To Know

May 31, 2025

Glastonbury Resale Tickets 2024 Everything You Need To Know

May 31, 2025