Why Investors Shouldn't Be Concerned About Current Stock Market Valuations (BofA)

Table of Contents

BofA's Perspective on Current Market Valuations

BofA's recent reports present a nuanced view of current stock market valuations. They acknowledge that some valuation metrics, such as the price-to-earnings (P/E) ratio for certain sectors, appear elevated compared to historical averages. However, BofA emphasizes that a singular focus on these metrics can be misleading. Their analysis considers a broader range of factors beyond simple valuation ratios.

-

Key Findings from BofA Reports: BofA's research highlights that while some sectors show high P/E ratios, these are often justified by robust projected earnings growth. Their analysis incorporates price-to-sales ratios, and other forward-looking metrics, providing a more comprehensive assessment. They've also identified specific sectors, such as technology and healthcare, which, while showing higher valuations, are predicted to demonstrate significant future growth, thereby mitigating initial concerns. Specific data points and chart references from BofA reports would ideally be included here, linking to the original sources for added credibility. (Note: Due to the dynamic nature of financial data, specific numbers and links cannot be provided here, but would be essential in a published article).

-

Attractive Sectors: BofA's reports often highlight specific sectors poised for strong growth, even with higher valuations. This information provides investors with opportunities to identify potentially lucrative investments despite broader market concerns about stock market valuations.

Considering Long-Term Growth Potential

Focusing solely on current stock market valuations without considering long-term growth potential is a mistake. A longer-term perspective significantly diminishes the impact of short-term market fluctuations and valuations.

-

Future Earnings Growth: Assessing valuations requires considering projected future earnings growth. Companies with high growth potential may justify higher current valuations as investors anticipate substantial returns in the future.

-

Driving Forces of Future Growth: Technological advancements, economic expansion, and disruptive innovation within industries significantly contribute to future stock price appreciation. Investors should evaluate companies' capacity to adapt to and leverage these trends.

-

The Power of Time: A longer investment horizon significantly reduces the impact of short-term market volatility on overall returns. Short-term fluctuations in stock prices are less relevant when considering a 5, 10, or 20-year investment timeframe.

Understanding the Impact of Interest Rates and Inflation

Current interest rates and inflation significantly influence stock market valuations and investor sentiment.

-

Rising Interest Rates and Valuations: Higher interest rates generally lead to higher discount rates used in valuation models, potentially reducing the present value of future earnings and impacting stock valuations.

-

Inflation and Company Earnings: Inflation affects company earnings. Rising prices can increase production costs, squeezing profit margins. However, companies with pricing power can often pass on increased costs to consumers, mitigating the impact.

-

BofA's Macroeconomic Analysis: BofA's analysis incorporates these macroeconomic factors, providing a more complete picture of the market's valuation. They assess the relative impact of inflation and interest rates on various sectors and industries.

Addressing Specific Valuation Metrics

Several valuation metrics, such as the P/E ratio and PEG ratio, are frequently used to assess stock valuations. However, focusing on a single metric can be deceptive.

-

Justifying High Valuations: High P/E ratios aren't always negative. Rapid growth prospects can justify a higher valuation compared to slower-growing companies.

-

Limitations of Single Metrics: Relying solely on one metric ignores other crucial factors like debt levels, profitability, and future growth potential. A holistic approach is essential.

-

Historical Context: Comparing current valuations to historical averages within a specific economic context provides a more meaningful perspective. Simply comparing current P/E ratios to past averages without accounting for economic changes can be misleading.

Diversification and Risk Management

Diversification and robust risk management strategies are crucial for any investor, regardless of market valuations.

-

Portfolio Diversification: A well-diversified portfolio across various asset classes and sectors reduces the impact of any single stock's underperformance on overall portfolio value.

-

Risk Management Techniques: Employing techniques like dollar-cost averaging, stop-loss orders, and hedging strategies can help mitigate potential losses during market downturns.

-

BofA's Risk Management Advice: BofA likely offers detailed guidance on managing risk within investment portfolios, which investors should consult for personalized strategies.

Conclusion

BofA's analysis suggests that while some stock market valuations appear high, a comprehensive assessment considering long-term growth potential, macroeconomic factors, and a balanced approach to valuation metrics paints a less alarming picture. Focusing on future earnings growth, understanding the impact of interest rates and inflation, and maintaining a diversified portfolio are key to navigating the market successfully.

Don't let current stock market valuations deter your long-term investment strategy. Learn more about BofA's perspective and build a resilient portfolio today! Remember to consult with a qualified financial advisor for personalized advice tailored to your individual financial situation and risk tolerance.

Featured Posts

-

Avrupa Daki Ortakliklarimiz Is Birliginin Gelecegi

May 02, 2025

Avrupa Daki Ortakliklarimiz Is Birliginin Gelecegi

May 02, 2025 -

Remembering Poppy Atkinson A United And Bayern Munich Tribute

May 02, 2025

Remembering Poppy Atkinson A United And Bayern Munich Tribute

May 02, 2025 -

Priscilla Pointer Dead At 100 Remembering The Dallas And Hollywood Actress

May 02, 2025

Priscilla Pointer Dead At 100 Remembering The Dallas And Hollywood Actress

May 02, 2025 -

Beijings Economic Vulnerability The Unseen Costs Of The Trade War With America

May 02, 2025

Beijings Economic Vulnerability The Unseen Costs Of The Trade War With America

May 02, 2025 -

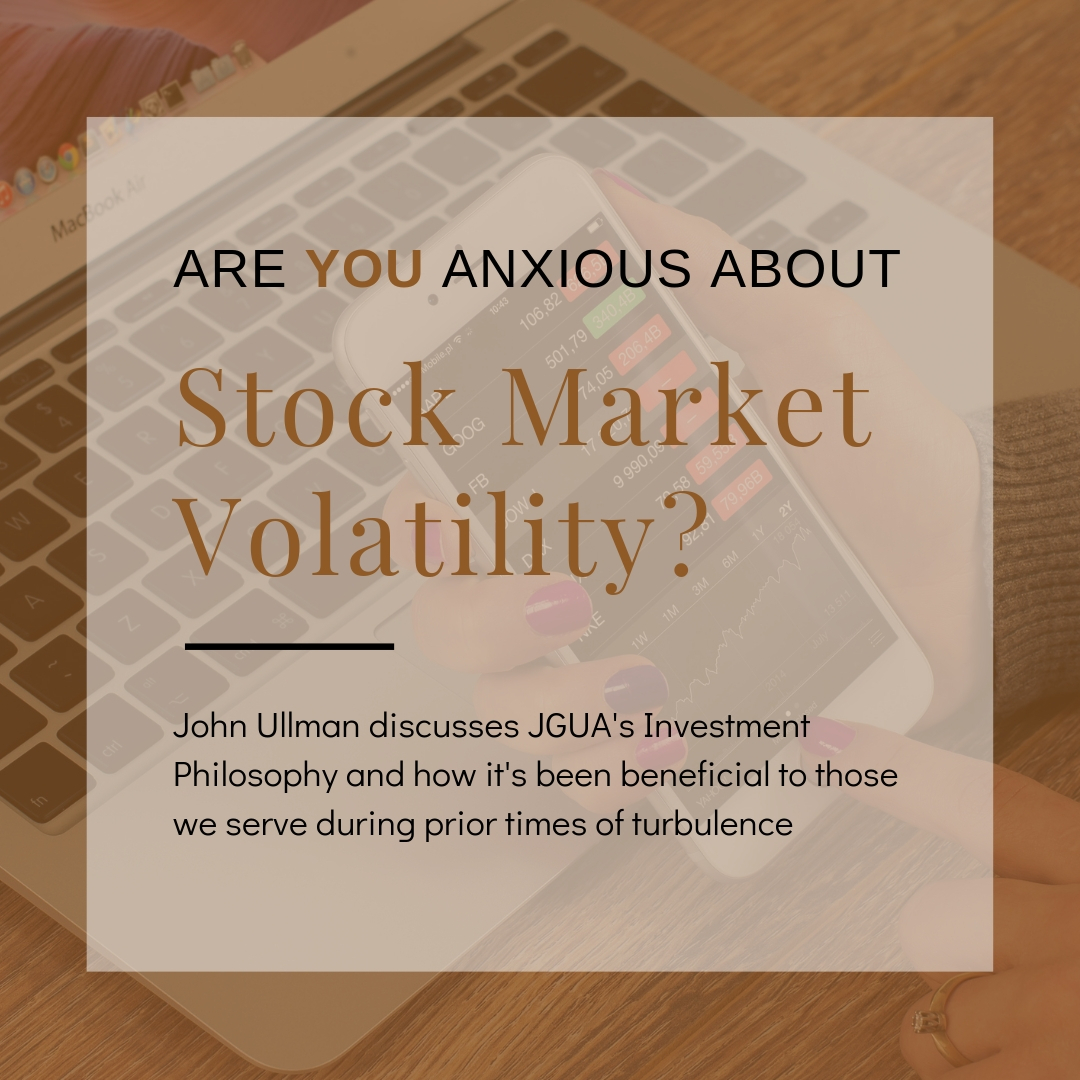

Ukraine And U S Forge Economic Partnership On Rare Earth Minerals

May 02, 2025

Ukraine And U S Forge Economic Partnership On Rare Earth Minerals

May 02, 2025

Latest Posts

-

Unlawful Harassment Allegations Against Ex Mp Rupert Lowe A Reform Shares Investigation

May 02, 2025

Unlawful Harassment Allegations Against Ex Mp Rupert Lowe A Reform Shares Investigation

May 02, 2025 -

L Avvertimento Di Medvedev Missili Arma Nucleare E La Percezione Della Russofobia In Europa

May 02, 2025

L Avvertimento Di Medvedev Missili Arma Nucleare E La Percezione Della Russofobia In Europa

May 02, 2025 -

Investigation Launched Into Allegations Against Mp Rupert Lowe

May 02, 2025

Investigation Launched Into Allegations Against Mp Rupert Lowe

May 02, 2025 -

Rupert Lowe Report Details Credible Evidence Of Unlawful Harassment

May 02, 2025

Rupert Lowe Report Details Credible Evidence Of Unlawful Harassment

May 02, 2025 -

Medvedev La Terapia Della Russofobia E L Impiego Di Missili Anche Nucleari

May 02, 2025

Medvedev La Terapia Della Russofobia E L Impiego Di Missili Anche Nucleari

May 02, 2025