Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

The Importance of Context: Understanding Current Market Conditions

To accurately assess the implications of high stock market valuations, we must move beyond simplistic interpretations. A comprehensive understanding of the current market conditions is crucial.

Beyond Price-to-Earnings Ratios: A Broader Look at Valuation Metrics

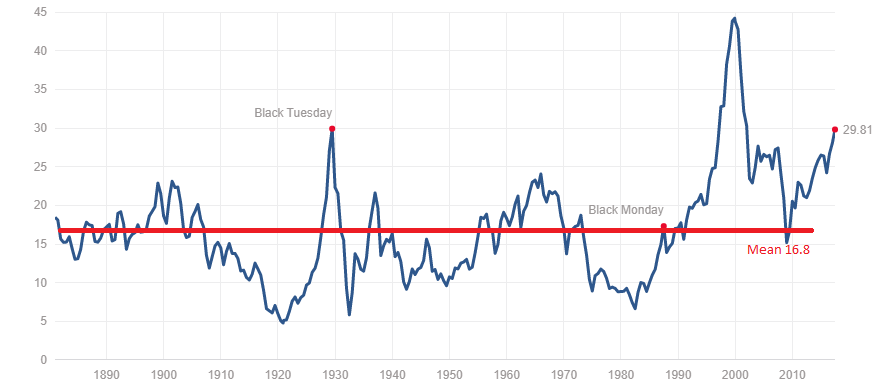

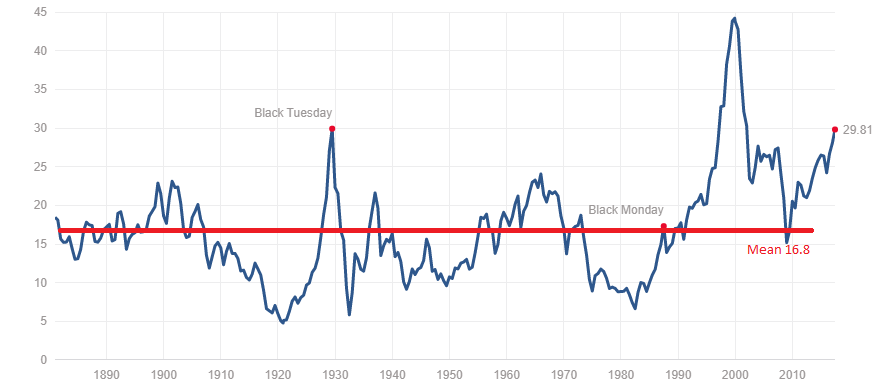

Relying solely on the Price-to-Earnings ratio (P/E) to judge market valuations can be misleading. While P/E is a commonly used metric, a more holistic approach involves considering other valuation ratios.

- Price-to-Sales (P/S): This ratio compares a company's market capitalization to its revenue, offering a perspective less susceptible to manipulation of earnings.

- Price-to-Book (P/B): This ratio assesses the market value relative to the net asset value of a company, providing insights into the intrinsic value.

- Price/Earnings to Growth (PEG): This ratio considers the relationship between P/E and the company's expected earnings growth rate, offering a more nuanced evaluation.

BofA's analysts often incorporate these multiple valuation metrics in their assessment, acknowledging that relying on a single ratio can lead to inaccurate conclusions about overall market health. Factors such as interest rates, inflation, and economic growth significantly influence these ratios, impacting the perceived "high" valuation. A comprehensive analysis considers the interplay of these macroeconomic forces.

The Role of Interest Rates and Inflation in Valuations

Interest rates and inflation are key drivers of stock valuations. High interest rates typically lead to lower valuations, as investors demand higher returns to compensate for the increased borrowing costs. Inflation, on the other hand, can erode the purchasing power of future earnings, impacting valuations negatively.

- BofA's Interest Rate Outlook: BofA's analysis of the current interest rate environment is crucial to understanding its impact on valuations. Their projections and interpretations of central bank policies are key to predicting future market movement.

- Inflation's Influence: BofA's assessment of inflationary pressures and their projected trajectory is crucial to determining whether current valuations reflect genuine overvaluation or are justified by future growth prospects in an inflationary environment.

BofA's detailed analysis considers how current interest rate policies and inflationary pressures might affect future earnings and, consequently, valuations. Their research often accounts for expected future earnings growth, providing a more forward-looking perspective on the sustainability of current valuations.

BofA's Perspective on Long-Term Growth Potential

While acknowledging the high valuations, BofA's analysts maintain a positive long-term outlook. Their strategy focuses on identifying companies with sustainable growth potential, even within this elevated valuation environment.

Identifying Strong Companies with Sustainable Growth

BofA employs robust strategies to pinpoint companies with strong fundamentals capable of delivering long-term growth. Their approach goes beyond simply looking at current valuations.

- Focus on Quality: BofA's analysts prioritize companies with strong competitive advantages, high-quality management, and innovative business models. They delve deep into qualitative factors alongside quantitative data.

- Sector-Specific Opportunities: BofA identifies promising sectors with strong growth prospects, even within a high-valuation market. They might highlight sectors less susceptible to economic downturns or those poised for significant technological advancements.

BofA's investment criteria extend beyond short-term profitability, focusing on companies with proven track records of innovation, adaptability, and a sustainable competitive edge.

The Power of Long-Term Investing in High-Valuation Markets

High stock market valuations are less concerning for long-term investors who can ride out market fluctuations. The power of compounding returns over extended periods significantly diminishes the impact of short-term volatility.

- Historical Data: BofA's research often incorporates historical data to demonstrate the benefits of long-term investing, even during periods of high valuations. This data underscores the importance of patience and a long-term perspective.

- Compounding Returns: The longer the investment horizon, the more potent the effects of compounding become, minimizing the significance of market timing.

BofA emphasizes that consistent, disciplined investing over the long term is a far more effective strategy than trying to time the market based on short-term valuations.

Managing Risk in a High-Valuation Market: BofA's Strategies

Navigating a high-valuation market necessitates a robust risk management strategy. BofA provides recommendations to mitigate potential downsides.

Diversification and Portfolio Allocation

Diversification is paramount in managing risks associated with high valuations. BofA advises a carefully constructed portfolio across various asset classes and sectors.

- Asset Allocation: BofA recommends strategic asset allocation across stocks, bonds, and potentially alternative investments to reduce overall portfolio volatility.

- Sector Diversification: Concentrating investments in a single sector amplifies risk. BofA's strategies encourage diversification across various sectors to reduce exposure to specific market downturns.

A well-diversified portfolio cushions the impact of potential losses in one sector or asset class.

Active vs. Passive Management in a High Valuation Environment

BofA recognizes the roles of both active and passive management strategies within a high-valuation market.

- Active Management: Active management offers the potential for outperformance in specific sectors or through strategic stock selection, capitalizing on market inefficiencies.

- Passive Management: Passive management, via index funds, provides broad market exposure, mitigating the risk of underperforming due to poor individual stock selection.

The choice between active and passive management depends on individual risk tolerance and investment goals. BofA's guidance helps investors determine the most suitable approach given their circumstances.

Conclusion: Don't Fear High Stock Market Valuations – Invest Strategically

While high stock market valuations present legitimate concerns, a comprehensive analysis reveals that fear should not dictate investment decisions. By considering various valuation metrics, assessing long-term growth potential, and implementing robust risk management strategies, investors can identify opportunities. BofA's perspective highlights the importance of a long-term outlook, diversification, and a nuanced understanding of market conditions. Remember, focusing solely on the "high stock market valuations" narrative can be misleading. Instead, adopt a strategic, long-term investment approach informed by comprehensive research and professional advice. Consult with a financial advisor to develop a personalized strategy tailored to your risk tolerance and financial goals. Informed and strategic investment approaches can help you effectively navigate high-valuation markets and achieve your long-term financial objectives.

Featured Posts

-

Riana Skritiyat Iztochnik Na Vdkhnovenie Za Khitovete Na Ed Shiyrn

May 07, 2025

Riana Skritiyat Iztochnik Na Vdkhnovenie Za Khitovete Na Ed Shiyrn

May 07, 2025 -

Sejour Au Lioran Onet Le Chateau Un Choix Ideal

May 07, 2025

Sejour Au Lioran Onet Le Chateau Un Choix Ideal

May 07, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

May 07, 2025

Understanding The Value Of Middle Management In Todays Workplace

May 07, 2025 -

Karate Kid Legends Trailer Family Honor Tradition And Legacy

May 07, 2025

Karate Kid Legends Trailer Family Honor Tradition And Legacy

May 07, 2025 -

Jacek Harlukowicz Najwiekszy Zasieg W 2024 Roku 5 Publikacji Onetu

May 07, 2025

Jacek Harlukowicz Najwiekszy Zasieg W 2024 Roku 5 Publikacji Onetu

May 07, 2025

Latest Posts

-

London Bound Jenna Ortega And Glen Powell Star In Upcoming Fantasy Film

May 07, 2025

London Bound Jenna Ortega And Glen Powell Star In Upcoming Fantasy Film

May 07, 2025 -

Jenna Ortega And Glen Powell New Fantasy Film To Begin Filming In London

May 07, 2025

Jenna Ortega And Glen Powell New Fantasy Film To Begin Filming In London

May 07, 2025 -

Mercredi Jenna Ortega Et Lady Gaga Un Duo Inattendu Sur Le Plateau

May 07, 2025

Mercredi Jenna Ortega Et Lady Gaga Un Duo Inattendu Sur Le Plateau

May 07, 2025 -

Le Tournage De Mercredi La Rencontre Memorable Entre Jenna Ortega Et Lady Gaga

May 07, 2025

Le Tournage De Mercredi La Rencontre Memorable Entre Jenna Ortega Et Lady Gaga

May 07, 2025 -

Jenna Ortega Raconte Son Experience Avec Lady Gaga Sur Le Tournage De Mercredi

May 07, 2025

Jenna Ortega Raconte Son Experience Avec Lady Gaga Sur Le Tournage De Mercredi

May 07, 2025