Why Is BigBear.ai (BBAI) Stock Falling In 2025?

Table of Contents

Macroeconomic Factors Impacting BBAI Stock Performance

The broader economic landscape of 2025 significantly influences the performance of tech stocks, including BBAI. A potential recession, persistent inflation, and aggressive interest rate hikes by central banks create a challenging environment for growth stocks. These factors directly impact BBAI stock in several ways:

-

Rising Interest Rates: Higher interest rates increase borrowing costs for companies, reducing investment capital and impacting profit margins. This makes growth stocks like BBAI, which often rely on future earnings projections, less attractive to investors.

-

Reduced Risk Appetite: In a volatile market, investors tend to shift their focus towards safer, more established investments. This reduces the demand for riskier growth stocks like BBAI, leading to a price decline.

-

Competition for Capital: Established tech giants often have easier access to capital, outcompeting smaller companies like BBAI for funding and resources. This intensifies the pressure on BBAI's performance and stock valuation.

-

Overall Market Downturn: A general downturn in the technology sector, irrespective of individual company performance, can negatively affect BBAI's stock price through a ripple effect.

Company-Specific Challenges Affecting BBAI Stock Price

Beyond macroeconomic factors, several internal challenges might be contributing to BBAI's stock price decline. These include:

-

Missed Earnings Expectations: Failing to meet or exceed projected revenue and earnings targets erodes investor confidence and can trigger sell-offs.

-

Increased Competition: The AI market is highly competitive. The emergence of stronger competitors or disruptive technologies could negatively impact BBAI's market share and growth prospects.

-

Scaling Challenges: Difficulty in scaling operations, product development, or customer acquisition can hinder growth and negatively affect the BBAI stock forecast.

-

Financial Stability Concerns: Any concerns regarding the long-term financial health of BBAI, such as high debt levels or unsustainable cash burn, can negatively impact investor sentiment.

-

Regulatory Hurdles: Potential regulatory investigations or lawsuits related to data privacy, intellectual property, or anti-trust issues can severely damage a company's reputation and stock price.

-

Lack of Innovation: Failure to introduce innovative products or services could lead to stagnation and decreased investor interest, impacting the BBAI stock price prediction.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a crucial role in shaping BBAI's stock price. Negative news cycles can amplify concerns and trigger sell-offs.

-

Negative News and Analyst Downgrades: Negative news coverage, analyst downgrades, or negative social media sentiment can quickly spread fear and uncertainty among investors, pushing the BBAI stock price down.

-

Profit-Taking and Fear: Investors might sell their BBAI stock to lock in profits or to avoid further potential losses, contributing to downward pressure on the price.

-

Short Selling: Short selling, where investors bet against a stock's future performance, can further exacerbate price declines, creating a self-fulfilling prophecy.

-

Shifting Investor Focus: As the AI market evolves, investors might shift their attention and capital towards other more promising AI companies or related sectors.

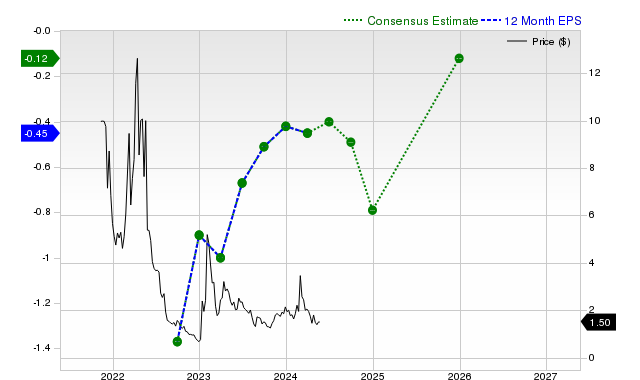

Analyzing BBAI's Financial Performance and Future Outlook

A thorough examination of BBAI's financial statements is crucial to understanding its current situation and future prospects. Key metrics to consider include:

-

Revenue Growth: Is BBAI's revenue growing steadily, or is it experiencing a decline compared to previous years? This is a key indicator of the company's overall health.

-

Profitability and Margins: Analyzing profitability and margins helps assess BBAI's efficiency and ability to generate profits from its operations.

-

Debt Levels and Financial Stability: High debt levels can indicate financial instability and risk, deterring potential investors.

-

Cash Flow and Liquidity: Strong cash flow and liquidity are essential for sustained growth and navigating economic uncertainties.

-

Competitor Analysis: Comparing BBAI's performance and financial position to its main competitors is vital for evaluating its competitive advantage.

-

Long-Term Growth Prospects: Industry analysis and future market projections provide insights into BBAI's long-term growth potential.

Conclusion: Navigating the BBAI Stock Market in 2025 and Beyond

The decline in BigBear.ai (BBAI) stock price in 2025 is likely a complex interplay of macroeconomic headwinds, company-specific challenges, and fluctuating investor sentiment. While the challenges are significant, it's crucial to remember that BBAI operates in a rapidly evolving and potentially lucrative market. Before making any investment decisions regarding BBAI stock, or any AI stock for that matter, thorough due diligence and a careful analysis of the BBAI stock forecast are paramount. Consider the factors outlined above, conduct your own research, and stay updated on market trends to make informed investment choices. Continue your research on BigBear.ai (BBAI) stock, and consider exploring resources that provide comprehensive BBAI stock price predictions and forecasts to assist in your investment strategy. Remember, responsible investment requires careful consideration and a balanced perspective.

Featured Posts

-

Kaellmanin Nousu Maalivireestae Huuhkajiin

May 20, 2025

Kaellmanin Nousu Maalivireestae Huuhkajiin

May 20, 2025 -

Protect Your Rights Big Bear Ai Bbai Investors Urged To Contact Gross Law Firm

May 20, 2025

Protect Your Rights Big Bear Ai Bbai Investors Urged To Contact Gross Law Firm

May 20, 2025 -

Nyt Mini Crossword Clues And Answers March 20 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 20 2025

May 20, 2025 -

Femicide Causes Trends And Prevention Strategies

May 20, 2025

Femicide Causes Trends And Prevention Strategies

May 20, 2025 -

The Logitech Forever Mouse A Realistic Look At Long Term Product Design

May 20, 2025

The Logitech Forever Mouse A Realistic Look At Long Term Product Design

May 20, 2025