Why Is Novo Nordisk's Ozempic Losing Market Share In Weight Loss?

Table of Contents

Increased Competition from Newer GLP-1 Receptor Agonists

The weight loss medication market is becoming increasingly crowded. Ozempic's initial success has spurred the development and release of several competitor drugs, significantly impacting its market dominance. The most notable challenger is Wegovy, also developed by Novo Nordisk, but offering a higher dosage specifically targeted for weight loss. However, the most significant threat arguably comes from Eli Lilly's Mounjaro, a dual GLP-1 and GIP receptor agonist, boasting potentially superior efficacy and a different mechanism of action.

- Wegovy's higher dosage: Wegovy, unlike Ozempic which is also approved for type 2 diabetes management, is specifically designed for weight loss and offers a higher dosage range, leading to potentially greater weight reduction in some patients.

- Mounjaro's dual mechanism: Mounjaro's unique dual action on both GLP-1 and GIP receptors may lead to improved weight loss outcomes and a potentially better side effect profile compared to Ozempic.

- Emerging competitors: The pipeline for new GLP-1 receptor agonists and other weight loss medications is robust, with several new drugs entering or expected to enter the market soon, intensifying the competition further. This increased competition is directly correlated with the data showing Ozempic losing market share.

The emergence of these alternatives with potentially superior efficacy or better side effect profiles is a major driver behind the shifting market dynamics. Precise market share figures fluctuate, but reports indicate a noticeable decrease in Ozempic's dominance.

Rising Costs and Accessibility Issues of Ozempic

Ozempic's high price point is a significant barrier to access for many patients. The cost of treatment, coupled with inconsistent insurance coverage, leaves many individuals unable to afford this medication. This affordability issue isn't merely about the out-of-pocket expense; many patients face significant hurdles in navigating insurance approvals and prior authorizations. Furthermore, supply chain issues and high demand have contributed to shortages, making it difficult for patients to even obtain Ozempic even if they can afford it.

- Pricing disparities: Ozempic's cost significantly exceeds that of some competitors, making it less attractive to budget-conscious patients or those relying on insurance coverage.

- Insurance coverage limitations: Many insurance plans impose restrictions on Ozempic coverage, requiring patients to jump through hoops or pay substantial co-pays, further limiting access.

- Supply constraints: The high demand and occasional shortages have led to delays and difficulties in accessing Ozempic, pushing patients towards more readily available alternatives.

These accessibility challenges directly affect Ozempic's market share, leading patients to seek out more affordable or easily accessible options.

Growing Awareness and Concerns about Side Effects

While Ozempic is generally considered safe, reports of side effects like nausea, vomiting, constipation, and pancreatitis have contributed to public concern. Increased media coverage of these adverse events has heightened awareness, influencing patient perceptions and potentially impacting treatment choices. While rare, the potential for serious side effects can sway patients towards medications perceived as having a lower risk profile.

- Common side effects: Nausea, vomiting, and constipation are frequently reported side effects that can negatively impact patient adherence and satisfaction.

- Serious side effects: While less frequent, the potential for more serious side effects like pancreatitis raises concerns and may drive patients toward perceived safer options.

- Media influence: Negative media coverage and social media discussions can significantly impact public perception and patient decisions regarding medication choice.

This increased awareness of potential side effects, even if statistically uncommon, significantly contributes to Ozempic losing market share.

The Role of Marketing and Public Relations

The marketing strategies employed by Novo Nordisk for Ozempic, compared to those of competitors, play a significant role in shaping market perception. While Ozempic's initial marketing campaign enjoyed considerable success, negative press surrounding its use, especially regarding off-label weight loss use, could have impacted public trust and brand image. The rise of social media has amplified both positive and negative narratives surrounding Ozempic and other GLP-1 receptor agonists, influencing patient choices and impacting market trends.

- Marketing campaign comparisons: A comparative analysis of marketing strategies between Ozempic and its competitors reveals differences in messaging, focus, and target audience.

- Media impact: Both positive and negative media coverage surrounding Ozempic has influenced the public perception of the medication.

- Social media's influence: Social media platforms provide a powerful channel for both positive and negative patient experiences, shaping perceptions and informing purchasing decisions.

Conclusion: Understanding the Shifting Landscape of Weight Loss Medications

Ozempic's decline in market share is a complex issue stemming from a confluence of factors: increased competition from more effective or more accessible alternatives, high costs and limited access, growing concerns about side effects, and the impact of marketing and public perception. Understanding these intertwined elements is crucial for navigating the evolving landscape of weight loss medications. To make informed decisions about weight loss treatment, patients should stay updated on the latest developments and consult with their healthcare providers to determine the best treatment options for their individual needs, considering both Ozempic and other GLP-1 agonists, like Wegovy and Mounjaro, alongside their potential benefits and risks. Further research into GLP-1 agonists and the broader field of weight loss treatments is encouraged.

Featured Posts

-

Us Ban On Foreign Officials Retaliation For Social Media Censorship

May 30, 2025

Us Ban On Foreign Officials Retaliation For Social Media Censorship

May 30, 2025 -

New Us Solar Tariffs Hit Malaysia And Three Other Countries

May 30, 2025

New Us Solar Tariffs Hit Malaysia And Three Other Countries

May 30, 2025 -

Agassi Recuerda A Rios Su Principal Rival Sudamericano

May 30, 2025

Agassi Recuerda A Rios Su Principal Rival Sudamericano

May 30, 2025 -

French Open 2025 Knee Injury Ends Ruuds Run Borges Secures Victory

May 30, 2025

French Open 2025 Knee Injury Ends Ruuds Run Borges Secures Victory

May 30, 2025 -

How To See Gorillaz Play Albums In Full In London A Guide To Getting Tickets

May 30, 2025

How To See Gorillaz Play Albums In Full In London A Guide To Getting Tickets

May 30, 2025

Latest Posts

-

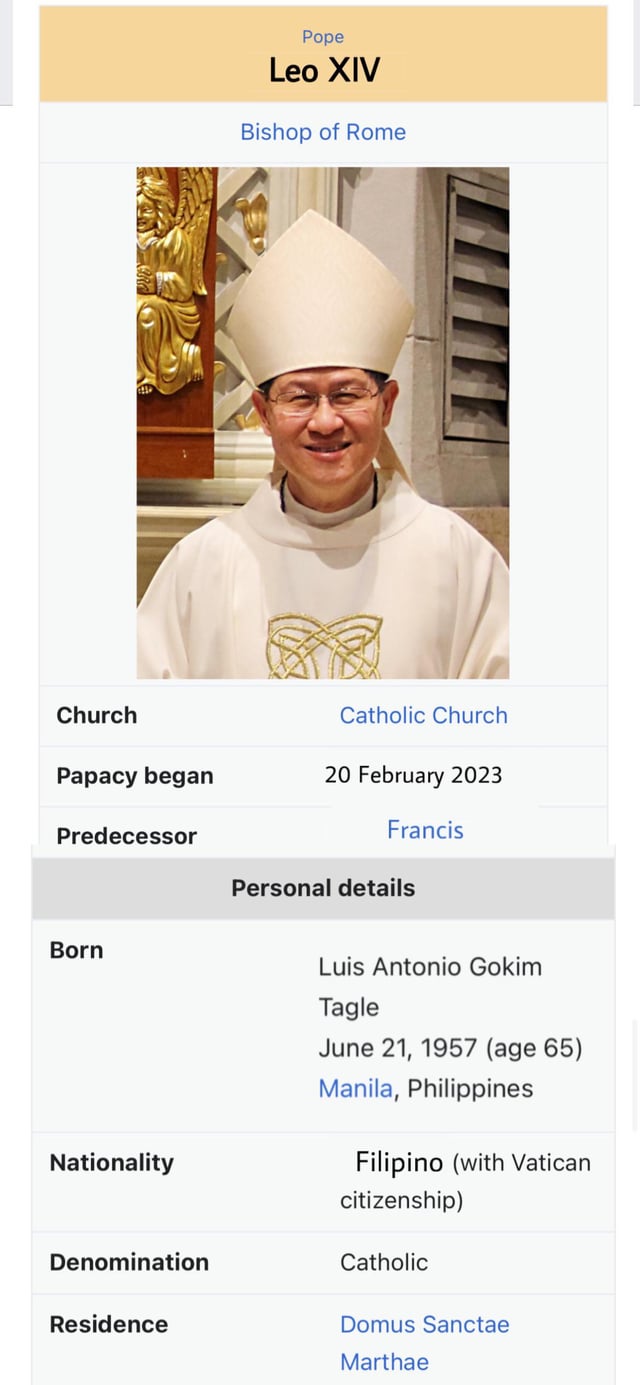

Vatican City To Host Giro D Italia Cyclists Pope Leo Xivs Planned Greeting

May 31, 2025

Vatican City To Host Giro D Italia Cyclists Pope Leo Xivs Planned Greeting

May 31, 2025 -

Arese Borromeo Fotografie Del Neorealismo In Ladri Di Biciclette

May 31, 2025

Arese Borromeo Fotografie Del Neorealismo In Ladri Di Biciclette

May 31, 2025 -

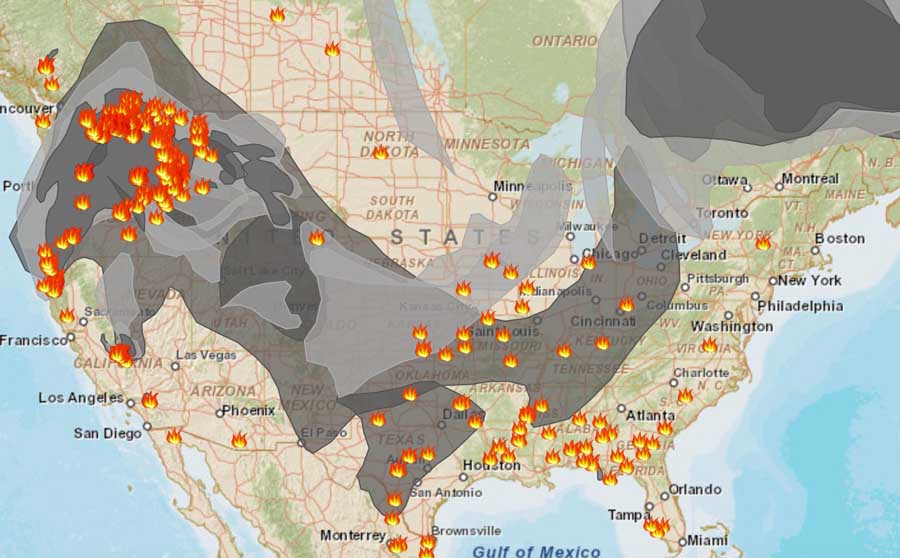

Wildfire Smoke Impact New York Citys 3 C Temperature Decrease And Elevated Air Pollutants

May 31, 2025

Wildfire Smoke Impact New York Citys 3 C Temperature Decrease And Elevated Air Pollutants

May 31, 2025 -

Pope Leo Xivs Vatican Greeting A Historic Moment For Giro D Italia Cyclists

May 31, 2025

Pope Leo Xivs Vatican Greeting A Historic Moment For Giro D Italia Cyclists

May 31, 2025 -

How To Watch The Giro D Italia 2025 For Free Live Stream Options

May 31, 2025

How To Watch The Giro D Italia 2025 For Free Live Stream Options

May 31, 2025