Why Stretched Stock Market Valuations Are Not A Cause For Investor Alarm (BofA)

Table of Contents

The Limitations of Traditional Valuation Metrics

Traditional valuation metrics, while useful, often fail to capture the complexities of the modern market. Over-reliance on a single metric can lead to inaccurate conclusions and uninformed decisions.

The P/E Ratio's Shortcomings

The Price-to-Earnings (P/E) ratio, a widely used valuation metric, has significant limitations.

- Varying Accounting Practices: Different companies utilize different accounting methods, making direct P/E comparisons misleading. A company with aggressive accounting practices might appear cheaper than a more conservative counterpart.

- Industry Differences: P/E ratios vary significantly across industries. Comparing the P/E ratio of a high-growth tech company to a mature utility company is inherently flawed.

- Impact of Economic Cycles: Economic cycles greatly influence earnings, affecting P/E ratios. High P/E ratios during periods of low interest rates should be viewed differently than during periods of high inflation.

- Alternative Metrics: Other metrics like the Price/Earnings to Growth (PEG) ratio offer a more nuanced view by incorporating growth rates into the valuation, providing a more comprehensive analysis. However, even these metrics have their limitations and should be considered alongside other factors.

Ignoring the Impact of Low Interest Rates

Historically low interest rates significantly influence stock valuations. These low rates impact investor behavior and market dynamics.

- Reduced Discount Rate: Low interest rates reduce the discount rate used in present value calculations. This means future earnings are discounted less heavily, leading to higher present values and thus, higher valuations.

- Rising Interest Rates: While low interest rates inflate valuations, a rise in interest rates can have the opposite effect, potentially leading to lower valuations and impacting stock prices negatively. Investors need to be aware of this interplay.

The Role of Technological Innovation and Growth Potential

Current valuations, while seemingly high, are often justified by the immense potential for future earnings growth fueled by technological advancements.

Disruptive Technologies and Future Earnings

Revolutionary technologies are reshaping industries and driving significant future earnings potential.

- Artificial Intelligence (AI): AI is rapidly transforming various sectors, promising increased efficiency and profitability for businesses that adopt it.

- Biotechnology: Advances in biotechnology are leading to groundbreaking medical treatments and diagnostics, resulting in substantial revenue growth for companies in this sector.

- Other Disruptive Technologies: The potential for exponential growth from other emerging technologies like blockchain, renewable energy, and advanced materials cannot be ignored when evaluating current market valuations.

The Shifting Economic Landscape

Globalization, emerging markets, and changing consumer behaviors all contribute to higher growth potential.

- Globalization: Increased global interconnectedness opens new markets and opportunities for businesses.

- Emerging Markets: Rapid economic growth in developing countries provides massive opportunities for investment and expansion.

- Changing Consumer Behavior: Shifts in consumer preferences and spending habits create new demand and drive innovation within various industries. For example, the rise of e-commerce and the demand for sustainable products have reshaped entire markets.

BofA's Specific Arguments and Supporting Data

BofA's research supports the idea that current stretched stock market valuations are not necessarily alarming. Their analysis considers factors beyond traditional valuation metrics.

Key Findings from BofA Research

BofA's reports (specific report links should be inserted here if available) highlight several key points: [Insert specific data points and charts/graphs from BofA research here, clearly citing sources]. For example, they might emphasize the long-term growth potential of specific sectors, highlighting the positive impact of technological advancements on future earnings. They may also present data that compares current valuations to historical valuations within the context of prevailing interest rate environments.

BofA's Investment Strategies

Based on their analysis, BofA likely suggests a long-term investment strategy focused on diversification and growth opportunities in innovative sectors.

- Diversification: BofA likely advocates for a diversified portfolio across different asset classes and sectors to mitigate risk.

- Long-Term Investing: Given the long-term growth potential identified, they would probably encourage investors to focus on long-term returns rather than short-term market fluctuations. Holding onto high-growth stocks with significant future earnings potential despite apparent short-term "stretched stock market valuations" is a key strategic element.

Conclusion

While the current stock market exhibits high valuations, interpreting them solely through traditional metrics like the P/E ratio provides an incomplete picture. Factors such as historically low interest rates, rapid technological innovation, and the potential for long-term growth in various sectors all need to be considered. BofA's research emphasizes this broader perspective, suggesting that high valuations may not be as alarming as widely perceived. Investors should adopt a balanced approach, focusing on long-term growth, diversification, and thorough research to inform their investment decisions, rather than being solely driven by concerns about stretched stock market valuations. For a more comprehensive understanding, review BofA's research reports and market analyses [insert link to relevant BofA resources here]. Remember to consult with a financial advisor to tailor an investment strategy that best suits your personal financial goals and risk tolerance.

Featured Posts

-

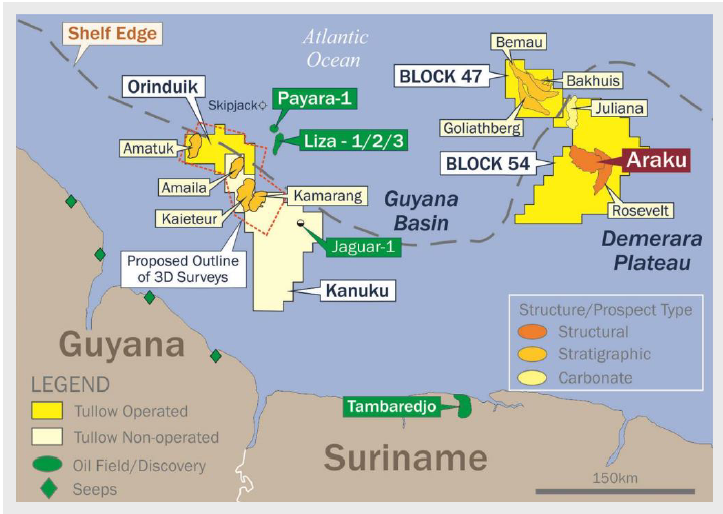

Is Black Gold Within Reach Uruguays Focus On Offshore Drilling

May 12, 2025

Is Black Gold Within Reach Uruguays Focus On Offshore Drilling

May 12, 2025 -

Hl Yjmehma Alhb Twm Krwz Wana Dy Armas Farq Alsnwat Wtbyet Alelaqt

May 12, 2025

Hl Yjmehma Alhb Twm Krwz Wana Dy Armas Farq Alsnwat Wtbyet Alelaqt

May 12, 2025 -

Mtv Cribs A Tour Of Extravagant Homes

May 12, 2025

Mtv Cribs A Tour Of Extravagant Homes

May 12, 2025 -

Trump Administrations Pursuit Of Cheap Oil Impact On The Domestic Energy Industry

May 12, 2025

Trump Administrations Pursuit Of Cheap Oil Impact On The Domestic Energy Industry

May 12, 2025 -

Nuits Saint Georges Philippe Candeloro Et Chantal Ladesou A La Vente Des Vins

May 12, 2025

Nuits Saint Georges Philippe Candeloro Et Chantal Ladesou A La Vente Des Vins

May 12, 2025

Latest Posts

-

From Kamala Harris Influencer To Congressional Candidate A Gen Z Story

May 13, 2025

From Kamala Harris Influencer To Congressional Candidate A Gen Z Story

May 13, 2025 -

Remembering Lost Loved Ones Recent Local Obituaries

May 13, 2025

Remembering Lost Loved Ones Recent Local Obituaries

May 13, 2025 -

Community Outrage Local Residents Demonstrate Against Trumps State Of The Union

May 13, 2025

Community Outrage Local Residents Demonstrate Against Trumps State Of The Union

May 13, 2025 -

Large Scale Search For Missing Elderly Hiker In Peninsula Hills Continues

May 13, 2025

Large Scale Search For Missing Elderly Hiker In Peninsula Hills Continues

May 13, 2025 -

Obituaries Saying Goodbye To Our Neighbors And Friends

May 13, 2025

Obituaries Saying Goodbye To Our Neighbors And Friends

May 13, 2025