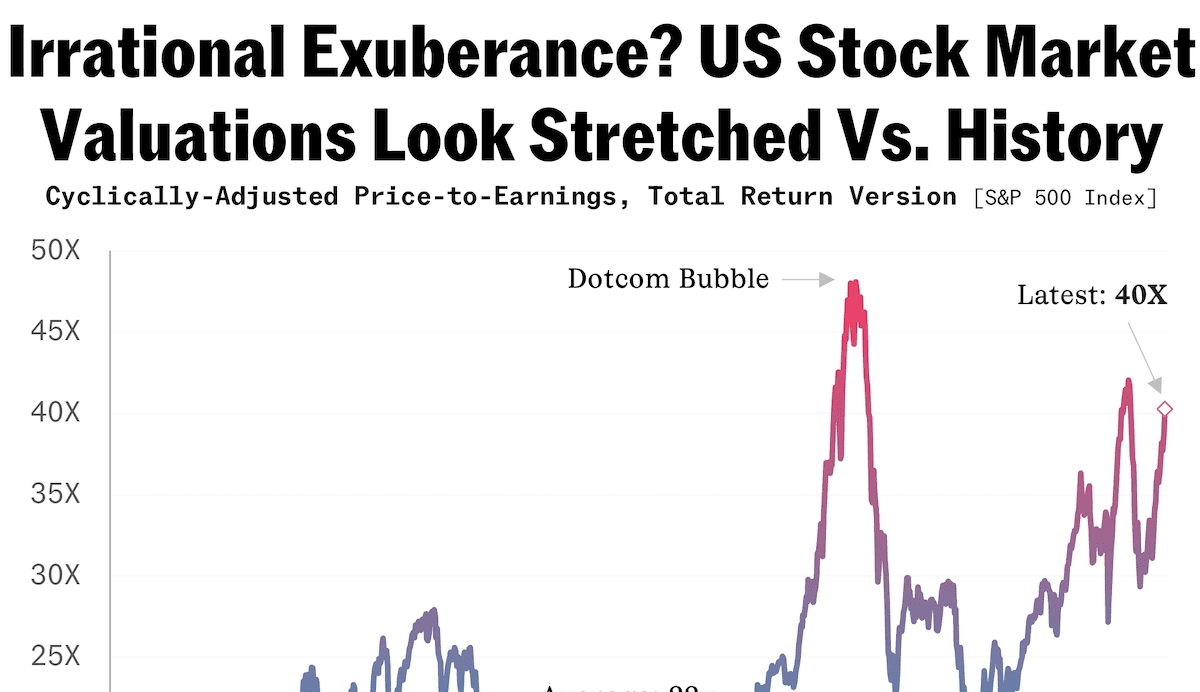

Why Stretched Stock Market Valuations Shouldn't Worry Investors: BofA

Table of Contents

BofA's Rationale for Dismissing Valuation Concerns

BofA's recent reports suggest that current high stock market valuations aren't necessarily a cause for alarm. Their rationale rests on several key pillars, which we will explore in detail:

Low Interest Rates and Their Impact

Historically low interest rates significantly influence stock valuations. Lower rates make borrowing cheaper for companies, boosting investment and ultimately driving earnings growth. This, in turn, can justify higher Price-to-Earnings (P/E) ratios. BofA’s analysis likely points out that current P/E ratios, while elevated compared to historical averages, are reasonable considering the prevailing low-interest-rate environment.

- Data Point: BofA might cite data showing a strong correlation between interest rates and P/E ratios across various market cycles.

- Example: A company with a high P/E ratio might be justified if its projected earnings growth significantly outweighs the cost of borrowing, facilitated by low interest rates.

- Keyword Optimization: Low interest rates, P/E ratios, valuation metrics, stock market valuations, interest rate impact on stock prices.

Strong Corporate Earnings Growth

BofA's analysis likely highlights robust corporate earnings growth as a key factor supporting current valuations. Strong earnings demonstrate the underlying strength of the economy and companies' ability to generate profits, thus validating higher stock prices.

- Data Point: BofA might reference projected earnings growth rates across various sectors, showing healthy expansion despite stretched valuations.

- Example: Strong performance in technology or consumer staples sectors could be used as an example to illustrate overall corporate health.

- Keyword Optimization: Corporate earnings growth, strong earnings, stock market outlook, high valuations, earnings growth projections.

Long-Term Economic Growth Projections

BofA's long-term economic growth projections likely play a significant role in their assessment. A positive economic outlook contributes to higher investor confidence, which, in turn, supports higher stock prices and justifies seemingly stretched valuations.

- Data Point: BofA might cite positive GDP growth forecasts or other economic indicators to support their long-term optimism.

- Example: Projections for infrastructure spending or technological advancements could be presented as drivers of future economic growth.

- Keyword Optimization: Long-term economic growth, economic outlook, stock market predictions, market valuations, economic growth projections.

Addressing Counterarguments: Why Some Investors Might Still Be Concerned

While BofA presents a reassuring perspective, it's crucial to acknowledge the concerns some investors might have about these stretched stock market valuations:

Risk of a Market Correction

The possibility of a market correction is a valid concern. High valuations inherently increase the risk of a price pullback. However, BofA's analysis likely incorporates this risk, potentially suggesting that a correction wouldn't necessarily negate the long-term positive outlook.

- Mitigation Strategy: BofA might suggest diversification as a way to mitigate the risk of a market correction.

- Keyword Optimization: Market correction, stock market risk, downside risk, valuation risks, market volatility.

Inflationary Pressures

Inflationary pressures can erode corporate profits and impact stock valuations. BofA's analysis likely incorporates inflation projections and assesses their potential impact on earnings growth.

- Mitigation Strategy: BofA might suggest investing in companies with strong pricing power to mitigate inflation's impact.

- Keyword Optimization: Inflation, inflationary pressures, interest rate hikes, stock market inflation, inflation hedging strategies.

Geopolitical Uncertainties

Geopolitical uncertainties can introduce volatility into the market. BofA's analysis likely accounts for these factors, assessing their potential impact on the overall economic outlook and stock valuations.

- Mitigation Strategy: BofA might recommend a cautious approach, suggesting investors maintain a diversified portfolio and closely monitor geopolitical developments.

- Keyword Optimization: Geopolitical risks, global uncertainty, market volatility, stock market stability, geopolitical impact on markets.

BofA's Investment Recommendations (if applicable)

While specific investment recommendations might vary depending on the BofA report, their overall perspective likely encourages a balanced approach. This might involve maintaining a diversified portfolio, focusing on companies with strong fundamentals and long-term growth potential, and strategically utilizing asset allocation to mitigate risk. Consult with a financial advisor for personalized recommendations.

Conclusion: Navigating Stretched Stock Market Valuations – A BofA Perspective

BofA's analysis suggests that while current stock market valuations appear high, they are not necessarily a cause for immediate alarm. Factors such as historically low interest rates, strong corporate earnings growth, and positive long-term economic growth projections support their perspective. However, potential risks such as market corrections, inflationary pressures, and geopolitical uncertainties should be considered. Don't let concerns about stretched stock market valuations paralyze your investment strategy. Carefully consider BofA's perspective and make informed decisions, potentially consulting with a financial advisor to tailor your investment approach to your risk tolerance and financial goals. Remember to conduct your own thorough research before making any investment decisions based on any single analyst's perspective.

Featured Posts

-

Snls Marcello Hernandez A Suitcase Full Of Laughs Dog Included

May 18, 2025

Snls Marcello Hernandez A Suitcase Full Of Laughs Dog Included

May 18, 2025 -

The Burning Tower A 9 11 Survivors Story Netflix Documentary

May 18, 2025

The Burning Tower A 9 11 Survivors Story Netflix Documentary

May 18, 2025 -

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 18, 2025

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 18, 2025 -

Exploring The Rich Mining Past Of Boulder Countys Switzerland Trail

May 18, 2025

Exploring The Rich Mining Past Of Boulder Countys Switzerland Trail

May 18, 2025 -

Alex Fines Birthday Cassie Reveals Gender Of Third Child

May 18, 2025

Alex Fines Birthday Cassie Reveals Gender Of Third Child

May 18, 2025

Latest Posts

-

Stephen Miller Eyed For National Security Advisor Role Amidst Waltz Speculation

May 18, 2025

Stephen Miller Eyed For National Security Advisor Role Amidst Waltz Speculation

May 18, 2025 -

Understanding The Dying For Sex Clasp Michelle Williams Perspective

May 18, 2025

Understanding The Dying For Sex Clasp Michelle Williams Perspective

May 18, 2025 -

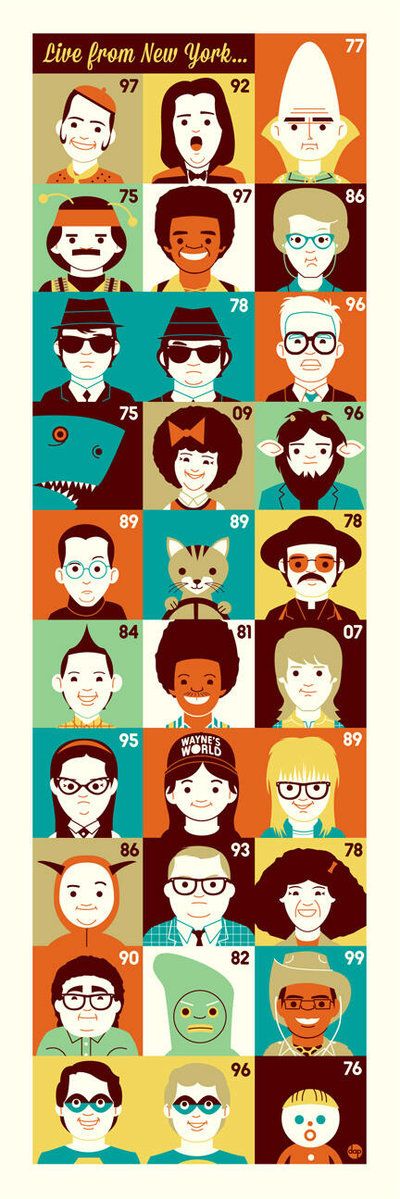

Snls Signal Group Chat Sketch Features Mikey Madison And Government Officials

May 18, 2025

Snls Signal Group Chat Sketch Features Mikey Madison And Government Officials

May 18, 2025 -

Snl Spoofs Signal Leak With Mikey Madison Texting Government Officials

May 18, 2025

Snl Spoofs Signal Leak With Mikey Madison Texting Government Officials

May 18, 2025 -

Michelle Williams Clarifies Dying For Sex Scene With Marcello Hernandez

May 18, 2025

Michelle Williams Clarifies Dying For Sex Scene With Marcello Hernandez

May 18, 2025