Why The Fed Is Lagging Behind On Interest Rate Cuts

Table of Contents

Persistent Inflation as a Primary Obstacle

The Fed operates under a dual mandate: price stability and maximum employment. Persistent inflation directly undermines price stability, making aggressive interest rate cuts a risky proposition. High inflation erodes purchasing power, impacting consumer confidence and spending. The Fed's cautious approach stems from a desire to avoid repeating past mistakes where premature rate cuts fueled inflationary spirals, leading to even greater economic instability later.

- High inflation erodes purchasing power: Reducing interest rates too quickly could reignite inflation, potentially leading to a repeat of the stagflationary periods of the 1970s.

- Avoiding past mistakes: The Fed is acutely aware of the potential consequences of acting too hastily and is prioritizing a measured approach to avoid repeating past errors in monetary policy.

- Data-driven decision-making: The Fed is meticulously monitoring key inflation indicators like the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index before making significant changes to interest rates. These data points provide crucial insights into the effectiveness of current policies.

The risk of "sticky inflation," where inflation becomes entrenched and resistant to typical monetary policy adjustments, further complicates the situation. This necessitates a more cautious and sustained approach to interest rate management.

Concerns About a Potential Wage-Price Spiral

A wage-price spiral is a dangerous feedback loop where rising wages lead to higher production costs, which in turn fuels further inflation, leading to further wage demands, and so on. This creates a self-perpetuating cycle of increasing prices and wages, making it difficult to control inflation.

- Rising wages and production costs: Increased labor costs translate to higher prices for goods and services, thus contributing to persistent inflation.

- Monitoring wage growth: The Fed is closely scrutinizing wage growth data, such as the Employment Cost Index (ECI), to gauge the potential for a wage-price spiral.

- Exacerbating wage demands: Premature interest rate cuts could potentially embolden workers to demand even higher wages, further intensifying inflationary pressures.

Beyond interest rate adjustments, the Fed may utilize other tools to combat a potential wage-price spiral. These may include communication strategies aimed at managing inflation expectations.

Uncertain Economic Outlook and Geopolitical Risks

Predicting future economic performance is inherently complex, and the current environment presents significant challenges. Global factors add layers of uncertainty to the Fed's decision-making process.

- Global uncertainties: The ongoing war in Ukraine, persistent supply chain disruptions, and other geopolitical risks introduce significant volatility into the global economy and impact the US economy.

- External factors: The Fed must account for these external factors, many of which are beyond its direct control, when determining monetary policy. This necessitates a flexible and adaptable approach.

- Data analysis and uncertainty: While data analysis is crucial, the inherent uncertainty necessitates a measured approach to interest rate changes, avoiding potentially destabilizing abrupt shifts.

Geopolitical risks directly influence inflation and growth expectations. For example, supply chain disruptions contribute to higher prices, while geopolitical instability can dampen investor confidence and reduce economic activity.

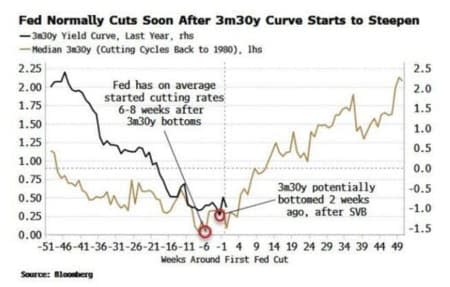

The Lag Effect of Monetary Policy

Monetary policy changes, including interest rate adjustments, don't have an immediate impact on the economy. There's a significant time lag between policy implementation and its effect on inflation and economic activity.

- Delayed impact: Interest rate cuts do not instantly translate into lower inflation or increased economic growth.

- Considering past rate hikes: The Fed must carefully weigh the delayed impact of previous interest rate hikes before implementing cuts, ensuring that the effects of previous policies are fully accounted for.

- Careful timing: This inherent lag necessitates careful timing and a data-driven approach to ensure that policy adjustments are made at the optimal moment.

Predicting the optimal timing for interest rate adjustments is incredibly challenging, given the complexities of the economic environment and the potential for unforeseen events.

Conclusion: Understanding the Fed's Cautious Approach to Interest Rate Cuts

The Fed's perceived slowness in cutting interest rates is driven by several interconnected factors: persistent inflation, concerns about a wage-price spiral, an uncertain economic outlook clouded by geopolitical risks, and the inherent lag effect of monetary policy. Balancing price stability and maximum employment in this complex economic environment presents a considerable challenge. The situation remains fluid, requiring continuous monitoring of economic indicators and a flexible approach to monetary policy.

Stay informed about the Fed's policy decisions and the evolving economic landscape to better understand the dynamics of interest rate cuts and their impact on your investments and financial planning. For more information, visit the Federal Reserve website [link to Federal Reserve website].

Featured Posts

-

Dijon Cite De La Gastronomie L Etablissement Epicure Et Les Responsabilites De La Ville

May 09, 2025

Dijon Cite De La Gastronomie L Etablissement Epicure Et Les Responsabilites De La Ville

May 09, 2025 -

The Actor Playing David In High Potential Episode 13 An Analysis Of The Casting Choice

May 09, 2025

The Actor Playing David In High Potential Episode 13 An Analysis Of The Casting Choice

May 09, 2025 -

Uk Visa Crackdown Stricter Rules For Work And Student Visas

May 09, 2025

Uk Visa Crackdown Stricter Rules For Work And Student Visas

May 09, 2025 -

Dijon Agresssion Au Lac Kir Enquete En Cours Apres Trois Victimes

May 09, 2025

Dijon Agresssion Au Lac Kir Enquete En Cours Apres Trois Victimes

May 09, 2025 -

Nyt Spelling Bee Puzzle April 4 2025 Find The Pangram

May 09, 2025

Nyt Spelling Bee Puzzle April 4 2025 Find The Pangram

May 09, 2025