Why The Venture Capital Secondary Market Is Booming

Table of Contents

Increased Liquidity Needs for Venture Capital Funds

Venture capital funds face increasing pressure to return capital to their LPs. The traditional venture capital model, with its long investment horizons (often 7-10 years or more), is increasingly challenged by shorter fund lifecycles and heightened LP expectations for quicker returns. This illiquidity in the traditional VC model is a major factor driving the growth of the venture capital secondary market. Funds are turning to the secondary market as a vital tool to manage liquidity and meet their obligations.

- Shorter fund lifecycles and increased LP expectations for returns: LPs are demanding faster returns, putting pressure on GPs to find ways to generate liquidity and distribute profits sooner.

- Need to meet capital calls from other investments: VC funds often have commitments to multiple investments. The secondary market allows them to generate capital to meet these calls without having to liquidate other potentially valuable assets prematurely.

- Opportunities to rebalance portfolios: The secondary market provides a mechanism for GPs to rebalance their portfolios, selling less promising investments to reinvest in more promising opportunities. This allows them to improve the overall performance of their fund.

This need for venture capital liquidity and effective LP capital return mechanisms has propelled the secondary market to the forefront of VC activity. The ability to quickly access capital is increasingly viewed as a critical element of successful fund management.

The Rise of Sophisticated Secondary Market Buyers

The emergence of specialized secondary market funds and the increased participation of institutional investors are significant drivers of the booming VC secondary market. These sophisticated buyers bring substantial capital and advanced investment strategies to the market. Pension funds, sovereign wealth funds, and other large institutional investors are increasingly viewing the secondary market as an attractive source of private equity exposure.

- Growth of dedicated secondary funds with significant capital: Numerous funds have been established specifically to invest in the secondary market, bringing significant capital and expertise to the space.

- Increased participation from institutional investors: These investors seek diversification and exposure to high-growth companies, often inaccessible through traditional channels.

- Sophisticated due diligence and valuation capabilities: These buyers possess the resources and expertise to conduct thorough due diligence and accurate valuations, increasing confidence and liquidity in the market.

The rise of these secondary market buyers, their large capital commitments, and their sophisticated due diligence processes are creating a deeper and more liquid VC secondary market. The increased demand from these players directly fuels market growth.

Growing Demand for Portfolio Diversification Among Limited Partners (LPs)

LPs are increasingly using the secondary market to diversify their VC portfolio holdings. This is driven by a desire to reduce concentration risk and improve overall portfolio performance. Over-reliance on a single fund manager or a concentrated set of investments can expose LPs to significant downside risk. The secondary market offers a solution.

- Reduced reliance on single fund managers: By selling some assets, LPs can diversify their exposure across multiple fund managers and strategies.

- Better risk management through diversification: Diversification reduces overall portfolio volatility and improves risk-adjusted returns.

- Access to a broader range of investments: The secondary market provides access to investments that might not otherwise be available, further enhancing portfolio diversity.

The benefits of LP portfolio diversification are driving demand for secondary market transactions, making it a key element in the broader venture capital ecosystem.

Technological Advancements and Improved Market Transparency

Technological advancements have played a crucial role in improving the efficiency and accessibility of the VC secondary market. Online platforms and data analytics tools have made the process of finding buyers and sellers, conducting due diligence, and facilitating transactions significantly easier.

- Increased transparency in pricing and valuation: Better data and analytics tools enhance price discovery and improve the accuracy of valuations.

- Streamlined transaction processes: Online platforms reduce the time and administrative burden associated with secondary transactions.

- Improved access to information for buyers and sellers: This transparency leads to greater participation and increased liquidity.

The development of VC secondary market platforms and the use of data analytics have created a more efficient and transparent market, making it easier for LPs and GPs to participate.

Conclusion: The Future of the Venture Capital Secondary Market

The booming venture capital secondary market is a direct result of several converging factors: increased liquidity needs among VC funds, the rise of sophisticated secondary market buyers, the growing demand for portfolio diversification among LPs, and significant technological advancements. These factors have profoundly impacted the VC landscape, offering new avenues for liquidity, diversification, and efficient capital allocation. The VC secondary market is poised for continued growth and evolution, driven by ongoing innovation and increasing investor sophistication.

Understanding the dynamics of the venture capital secondary market is crucial for both general partners and limited partners alike. Learn more about how to navigate this rapidly evolving market and leverage its potential for growth. Explore the opportunities presented by secondary market investment and consider its role in your investment strategy. The VC secondary opportunities are numerous, and understanding this market is key to future success in the world of venture capital.

Featured Posts

-

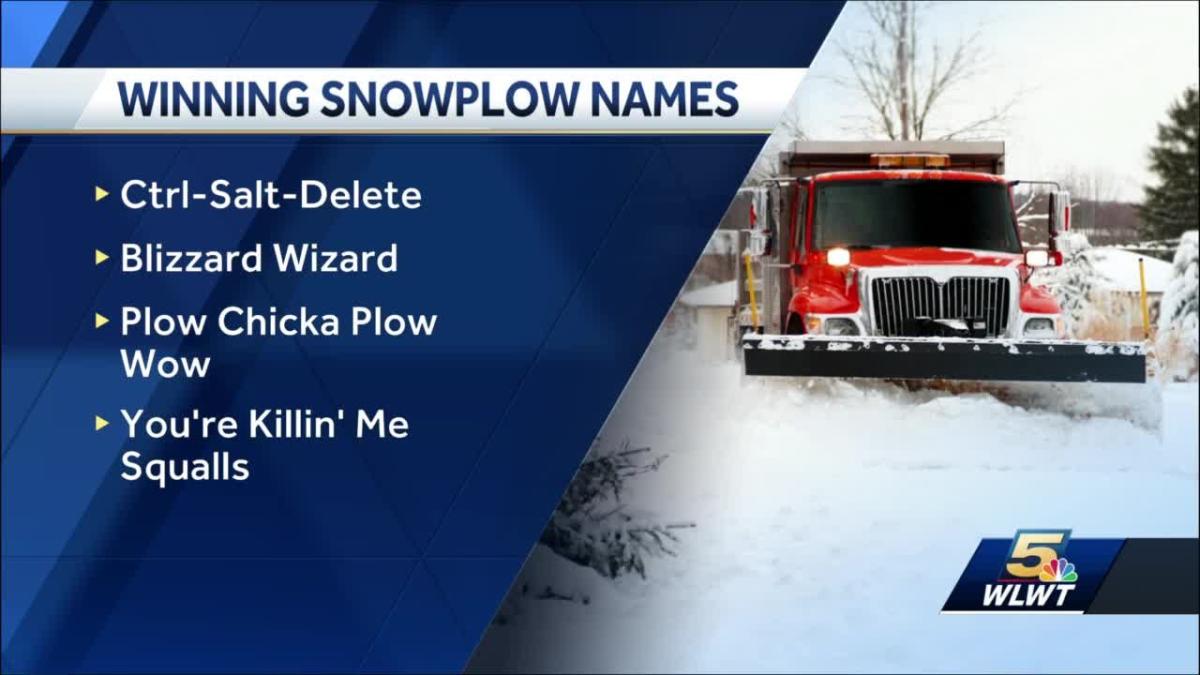

Minnesota Snow Plow Name Winners Announced

Apr 29, 2025

Minnesota Snow Plow Name Winners Announced

Apr 29, 2025 -

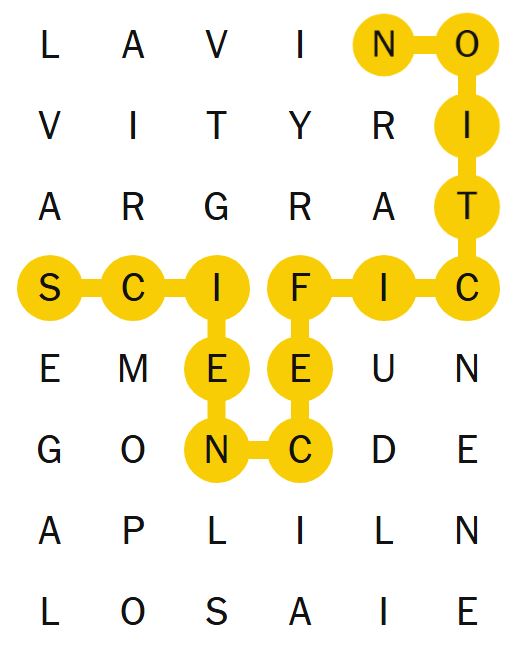

Unlock The Nyt Spelling Bee April 3 2025 Answers And Pangram

Apr 29, 2025

Unlock The Nyt Spelling Bee April 3 2025 Answers And Pangram

Apr 29, 2025 -

China Approves Hengrui Pharmas Hong Kong Share Sale

Apr 29, 2025

China Approves Hengrui Pharmas Hong Kong Share Sale

Apr 29, 2025 -

How You Tube Caters To The Needs Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Needs Of Older Viewers

Apr 29, 2025 -

Relief In Sight Louisville Postal Union Announces End To Mail Delays

Apr 29, 2025

Relief In Sight Louisville Postal Union Announces End To Mail Delays

Apr 29, 2025

Latest Posts

-

Convicted Cardinal Claims Entitlement To Papal Conclave Vote

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Papal Conclave Vote

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025 -

Cardinal Becciu Case Further Investigations Needed Following New Revelations

Apr 29, 2025

Cardinal Becciu Case Further Investigations Needed Following New Revelations

Apr 29, 2025 -

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025 -

You Tubes Growing Senior Audience Understanding The Trends

Apr 29, 2025

You Tubes Growing Senior Audience Understanding The Trends

Apr 29, 2025