Why You Can't Find Dasani Bottled Water In The United Kingdom

Table of Contents

Dasani's Initial UK Launch and Subsequent Withdrawal

Dasani's initial launch in the UK market was ambitious, but ultimately disastrous. The brand, known for its purified water profile in the US, failed to resonate with UK consumers. The initial marketing campaign, focused on a purified water concept that didn't align with UK tastes, proved ineffective. Media coverage quickly turned negative, highlighting the perceived bland taste and the comparatively high price point compared to well-established local alternatives.

- Initial marketing campaign failures: The messaging failed to connect with UK consumers' preferences.

- Negative public reaction to taste and branding: Many found the water tasteless and the branding unappealing.

- Highlighted the cost of importing vs. local brands: Dasani's imported status resulted in a higher price, making it less competitive.

- Lack of strong UK distribution network: Initial distribution was patchy, limiting availability and brand visibility.

The combination of these factors led to disappointing sales figures and, eventually, Dasani's withdrawal from the UK market. The brand's failure serves as a cautionary tale for international companies entering new markets without fully understanding local consumer preferences and logistical complexities.

The Role of Consumer Preferences in the UK Beverage Market

The UK bottled water market is dominated by established brands that cater specifically to UK consumer preferences. British consumers exhibit a strong preference for water sourced locally or from within Europe, often with specific mineral content and taste profiles. These preferences differ significantly from those in the US, where purified water is more common.

- Popularity of UK sourced spring water: Many consumers value the provenance and perceived purity of UK spring water.

- Preference for specific mineral content profiles: Certain mineral contents are favoured, impacting taste and perceived health benefits.

- Brand loyalty amongst UK consumers: Established brands enjoy strong loyalty, making it difficult for newcomers to gain a foothold.

- The influence of local marketing and advertising: Successful UK brands invest heavily in targeted marketing campaigns resonating with local consumers.

This ingrained preference for locally sourced and distinct-tasting water created a significant hurdle for Dasani, which offered a product not aligned with these tastes. The established brands benefited from strong consumer loyalty and deeply embedded distribution networks.

Distribution and Logistics Challenges for International Brands

Importing and distributing beverages internationally is a complex and costly undertaking. Dasani faced significant challenges in this area, contributing to its ultimate failure in the UK market.

- Import duties and taxes: These added significantly to the cost of importing Dasani into the UK.

- Transportation costs and efficiency: Transporting bottled water over long distances is expensive and requires careful logistical planning.

- Establishing retailer relationships: Securing shelf space in UK supermarkets is competitive and requires significant investment.

- Cold chain maintenance for bottled water: Maintaining the proper temperature during transportation and storage is crucial for quality and shelf life.

These logistical hurdles, coupled with the already high cost of importing, made Dasani less competitive against locally sourced and produced bottled water.

Competition from Established UK Bottled Water Brands

The UK bottled water market is intensely competitive, with several powerful brands holding significant market share. These brands have cultivated strong consumer relationships and efficiently established distribution networks.

- List of major UK bottled water brands: Brands like Highland Spring, Buxton, and Volvic enjoy widespread popularity.

- Comparison of pricing strategies: Established brands often offer competitive pricing strategies compared to imported water.

- Analysis of market share data: Established brands hold a considerable portion of the UK bottled water market share.

- Discussion of successful marketing campaigns: Successful marketing ensures continued consumer loyalty and new customer acquisition.

These established brands posed a significant challenge to Dasani, which struggled to compete on price, distribution, and brand recognition.

Conclusion

The absence of Dasani bottled water in the UK is a compelling case study in the challenges faced by international brands entering new markets. A combination of negative initial reception, strong competition from established brands, distinct UK consumer preferences, and significant logistical hurdles contributed to its failure. Understanding these factors is crucial for any international beverage company aiming to succeed in the UK market. If you're looking for a refreshing bottled water alternative in the UK, explore the wide array of high-quality, locally sourced brands readily available. Finding a great bottled water alternative in the UK is easy; numerous excellent choices exist to satisfy your thirst.

Featured Posts

-

Dodgers Minor League Standouts Evan Phillips Sean Paul Linan Eduardo Quintero

May 15, 2025

Dodgers Minor League Standouts Evan Phillips Sean Paul Linan Eduardo Quintero

May 15, 2025 -

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 15, 2025

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 15, 2025 -

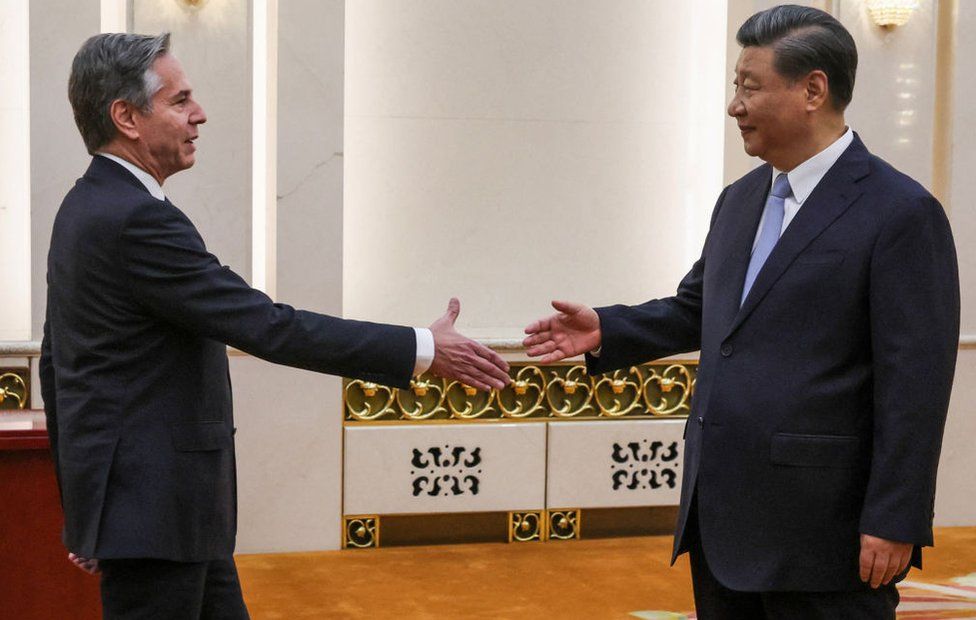

Who Blinked First Resolving The Us China Trade Standoff

May 15, 2025

Who Blinked First Resolving The Us China Trade Standoff

May 15, 2025 -

Npos Aanpak Van Grensoverschrijdend Gedrag Maatregelen En Verbeterpunten

May 15, 2025

Npos Aanpak Van Grensoverschrijdend Gedrag Maatregelen En Verbeterpunten

May 15, 2025 -

High Value Sales Of Kid Cudi Personal Items At Recent Auction

May 15, 2025

High Value Sales Of Kid Cudi Personal Items At Recent Auction

May 15, 2025