Will A Minority Government Weaken The Canadian Dollar?

Table of Contents

Political Instability and Investor Confidence

Political uncertainty is a major factor influencing investor confidence and, subsequently, the Canadian dollar. The inherent instability of minority governments, characterized by frequent elections, potential for policy gridlock, and unpredictable legislative agendas, can significantly deter foreign investment and potentially lead to capital flight. This uncertainty creates a risk premium, driving up the cost of borrowing and potentially weakening the currency.

- Increased political risk premiums: Investors demand higher returns to compensate for the added risk associated with political instability, directly impacting the exchange rate. A higher risk premium translates to a weaker Canadian dollar.

- Reduced foreign direct investment: Uncertainty surrounding future policies discourages foreign companies from committing capital to Canadian ventures. This reduced investment inflow weakens the demand for the Canadian dollar.

- Potential for capital flight: Investors may move their assets to countries perceived as politically more stable, leading to a decrease in the demand for, and thus the value of, the Canadian dollar.

- Currency volatility: The fluctuating investor sentiment resulting from political instability creates volatility in the Canadian dollar's exchange rate, making it difficult to predict its future value.

Impact on Fiscal and Monetary Policy

A minority government's ability to effectively implement fiscal and monetary policies is often constrained by the need for compromise and consensus-building with other parties. This can lead to delays, watered-down policies, and ultimately, a less effective response to economic challenges.

- Difficulty in passing budgets and implementing fiscal stimulus: Negotiating budgetary allocations and securing support for fiscal stimulus packages can be significantly more challenging, hindering economic growth and potentially impacting the Canadian dollar negatively.

- Potential for increased budget deficits: Political compromises may lead to increased government spending or reduced revenue generation, resulting in larger budget deficits and potentially higher national debt. This could negatively impact investor confidence and the currency.

- Limited ability to control inflation through monetary policy: The Bank of Canada's independence and its ability to control inflation might be indirectly affected by a minority government's economic priorities and political pressures.

- Uncertainty regarding the Bank of Canada's independence and policy direction: Political interference or the perception of potential interference can erode confidence in the central bank's ability to manage monetary policy effectively, leading to currency instability.

Economic Growth and the Canadian Dollar

A strong correlation exists between economic growth and currency strength. A thriving economy, with increasing GDP and positive trade balances, usually supports a stronger currency. A minority government's ability to foster economic growth will therefore significantly impact the Canadian dollar's performance.

- Slower economic growth: The potential for policy gridlock and delayed policy implementation in a minority government scenario could lead to slower economic growth, potentially weakening the Canadian dollar.

- Impact on Canada's trade balance and export competitiveness: Uncertainty and policy instability can hurt Canada's ability to compete internationally, impacting the trade balance and the Canadian dollar.

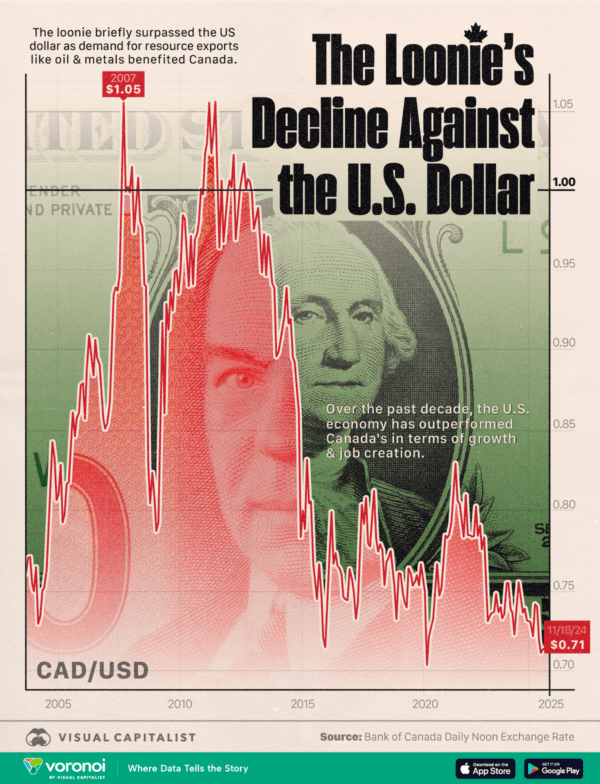

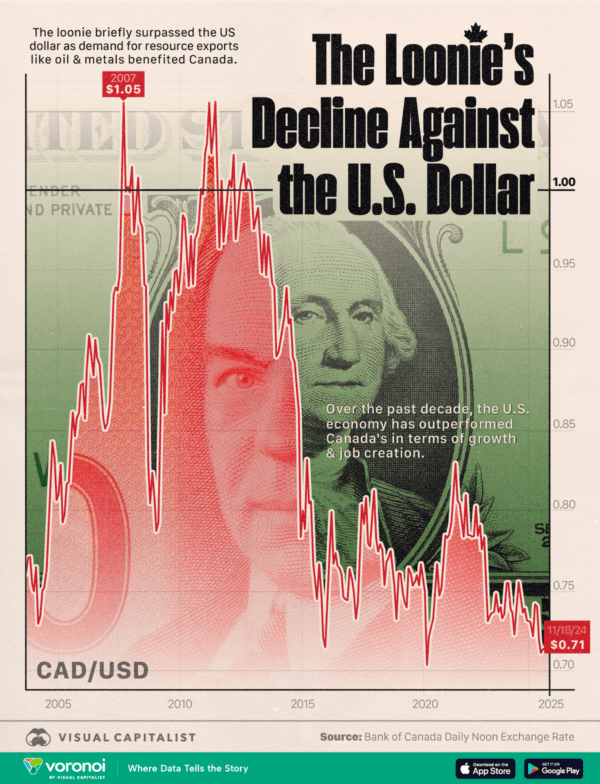

- Fluctuations in commodity prices and their effects on the Canadian dollar: Canada's resource-based economy makes its currency highly sensitive to commodity price fluctuations. A minority government's approach to resource management could indirectly influence these prices and the Canadian dollar.

- The overall economic outlook impacting investor perception and currency value: A pessimistic economic outlook due to political uncertainty will naturally lead to a weaker Canadian dollar.

The Role of Commodity Prices

Fluctuations in commodity prices, particularly oil and natural gas, are crucial drivers of the Canadian dollar. Canada's reliance on these exports means that changes in global commodity markets directly impact the country's trade balance and currency value. A minority government's policies regarding resource extraction, environmental regulations, and energy infrastructure projects can significantly influence commodity prices and thus the Canadian dollar. For instance, uncertainty surrounding pipeline approvals can negatively affect oil prices and consequently the Canadian dollar. Similarly, policies impacting the mining sector can affect the prices of other commodities like gold and metals, impacting Canadian exports and the currency.

Conclusion

The potential impact of a minority government on the Canadian dollar is multifaceted. Political instability erodes investor confidence, hindering foreign investment and potentially leading to capital flight. The challenges in implementing consistent fiscal and monetary policies can hamper economic growth and contribute to currency volatility. Furthermore, the impact on commodity prices and the overall economic outlook significantly influence the Canadian dollar's value. While a direct causal link between a minority government and a weaker Canadian dollar isn't guaranteed, the inherent uncertainties significantly increase the risk and contribute to fluctuations in the currency exchange rate.

Understanding the potential implications of a minority government on the Canadian dollar is crucial for investors and businesses alike. Stay informed about Canadian political developments and their potential impact on the Canadian economy and the Canadian dollar to make informed financial decisions. Continue learning about the potential effects of a minority government on the Canadian dollar and its implications for your financial planning.

Featured Posts

-

Vaticano Ultime Notizie Sul Processo 8xmille E Il Fratello Di Becciu

May 01, 2025

Vaticano Ultime Notizie Sul Processo 8xmille E Il Fratello Di Becciu

May 01, 2025 -

Essential Wayne Gretzky Fast Facts A Quick Overview

May 01, 2025

Essential Wayne Gretzky Fast Facts A Quick Overview

May 01, 2025 -

Ripple Xrp From 0 003 To Today A Millionaire Maker

May 01, 2025

Ripple Xrp From 0 003 To Today A Millionaire Maker

May 01, 2025 -

Michael Jordan Fast Facts For Basketball Fans

May 01, 2025

Michael Jordan Fast Facts For Basketball Fans

May 01, 2025 -

Six Nations 2024 France Triumphs England Dominates Scotland And Ireland Struggle

May 01, 2025

Six Nations 2024 France Triumphs England Dominates Scotland And Ireland Struggle

May 01, 2025

Latest Posts

-

Processo Becciu Appello 22 Settembre Ricerca Della Giustizia

May 01, 2025

Processo Becciu Appello 22 Settembre Ricerca Della Giustizia

May 01, 2025 -

Becciu Il 22 Settembre Inizia L Appello La Sua Dichiarazione Di Innocenza

May 01, 2025

Becciu Il 22 Settembre Inizia L Appello La Sua Dichiarazione Di Innocenza

May 01, 2025 -

Il Cardinale Becciu Risponde Analisi Delle Chat Segrete E Del Processo

May 01, 2025

Il Cardinale Becciu Risponde Analisi Delle Chat Segrete E Del Processo

May 01, 2025 -

Processo Becciu Data Appello 22 Settembre Aspettando La Verita

May 01, 2025

Processo Becciu Data Appello 22 Settembre Aspettando La Verita

May 01, 2025 -

Caso Becciu Chat Segrete Complotto E La Difesa Del Cardinale

May 01, 2025

Caso Becciu Chat Segrete Complotto E La Difesa Del Cardinale

May 01, 2025