Will A Minority Government Weaken The Canadian Dollar? Expert Opinion

Table of Contents

The Canadian political landscape frequently features minority governments. This raises a crucial question for investors and citizens: Will a minority government weaken the Canadian dollar (CAD)? This article examines expert opinions and analyzes the potential effects of political instability on the CAD's value. We'll delve into the potential for increased market volatility, impacts on foreign investment, and differing expert predictions to provide a comprehensive overview.

Political Instability and Economic Uncertainty

Minority governments often lead to increased political uncertainty, significantly impacting investor confidence and potentially driving up volatility in both the Canadian stock market and the CAD exchange rate. This uncertainty stems from the inherent fragility of minority governments, their reliance on opposition support for crucial legislation, and the potential for frequent elections.

Increased Volatility in the Markets

The inherent instability of a minority government can translate to increased volatility in financial markets. Investors, wary of unpredictable policy changes and potential gridlock, may become hesitant, leading to market fluctuations.

- Examples: Past minority governments in Canada have shown instances of increased market volatility, particularly surrounding budget debates and key policy announcements.

- Delayed Policy Decisions: The need for consensus-building and potential compromises can lead to delays in implementing crucial economic policies, impacting business planning and investment decisions.

- Data: While precise statistical correlations are difficult to isolate, historical data indicates a tendency towards increased market volatility during periods of minority government, especially in sectors sensitive to government policy.

Difficulty Passing Key Economic Legislation

A minority government faces significant hurdles in passing budgets and other essential economic legislation. The need to negotiate with opposition parties can lead to compromises, amendments, or even complete blocks, potentially hindering economic growth.

- Examples: Legislation related to taxation, infrastructure spending, and trade agreements could face delays or be significantly altered during negotiations.

- Risk of Gridlock: The potential for parliamentary gridlock can create uncertainty, discouraging both domestic and foreign investment.

- Impact on CAD: Delayed or watered-down economic legislation can negatively impact investor confidence, potentially leading to a weakening of the Canadian dollar.

Impact on Foreign Investment

Political uncertainty significantly affects foreign investment, a key driver of the CAD's strength. The inherent instability associated with a minority government can deter foreign investors, potentially leading to capital flight and a weakening of the currency.

Reduced Investor Confidence

Foreign investors seek stability and predictability. The prospect of frequent elections, potential policy reversals, and legislative gridlock under a minority government can significantly reduce investor confidence.

- Reasons for Hesitation: Uncertainty about the long-term political landscape makes long-term investment strategies riskier, leading investors to seek alternative, more stable markets.

- Capital Flight: If investor confidence plummets, capital may flow out of Canada, putting downward pressure on the Canadian dollar.

- International Comparisons: Studies have shown a correlation between political instability and reduced foreign direct investment in various countries.

Currency Speculation

The potential for sudden policy shifts under a minority government creates an environment ripe for currency speculation. Speculators may bet against the CAD, anticipating a decline in its value due to political uncertainty.

- Speculator Reactions: Currency speculators actively monitor political developments, and increased uncertainty can trigger bets against the Canadian dollar.

- Mechanics of Speculation: Speculators use various financial instruments to profit from anticipated currency fluctuations, potentially exacerbating downward pressure on the CAD.

- Impact: This speculative activity can amplify the impact of political uncertainty, further weakening the Canadian dollar.

Expert Opinions and Diverging Views

Expert opinions on the potential impact of a minority government on the Canadian dollar vary widely. While some economists express concerns about increased volatility and potential negative effects, others believe the CAD's resilience and diversification of the Canadian economy will mitigate any significant impact.

Economists' Perspectives

Leading economists offer diverse perspectives on the potential effects of a minority government on the Canadian dollar.

- Pessimistic Views: Some economists highlight the risks of increased political uncertainty and its potential to negatively impact investor confidence and weaken the CAD.

- Optimistic Views: Other economists emphasize the resilience of the Canadian economy and the ability of the Bank of Canada to manage potential shocks.

- Source Examples: [Link to relevant economic analysis and reports].

Financial Analysts' Predictions

Financial analysts offer varying predictions regarding the Canadian dollar's performance under a minority government. These predictions often depend on specific assumptions about the government's policy priorities and the overall global economic climate.

- Exchange Rate Forecasts: Analysts' forecasts may range from a modest weakening of the CAD to relatively stable performance, depending on their assumptions.

- Underlying Assumptions: These assumptions should be carefully considered when evaluating these predictions, as they can significantly impact the outcome.

- Source Examples: [Link to relevant financial analysis and forecasts].

Conclusion

The impact of a minority government on the Canadian dollar remains a complex and uncertain issue. While the potential for increased market volatility, reduced foreign investment, and currency speculation exists, the resilience of the Canadian economy and the Bank of Canada's ability to manage potential shocks are also significant factors. Expert opinions diverge, highlighting the need for careful monitoring of the political and economic landscape.

Call to Action: Stay informed about the Canadian political landscape and its potential impact on the Canadian dollar. Follow our blog for further updates on minority government and its effects on the CAD. Consider diversifying your investments to mitigate risks associated with political uncertainty.

Featured Posts

-

What To Expect From The New Cruise Ships Of 2025

Apr 30, 2025

What To Expect From The New Cruise Ships Of 2025

Apr 30, 2025 -

Il Risarcimento Di Becciu Oltre Il Danno La Beffa Per Gli Accusatori

Apr 30, 2025

Il Risarcimento Di Becciu Oltre Il Danno La Beffa Per Gli Accusatori

Apr 30, 2025 -

Schneider Electric And Vignan University Partner For Center Of Excellence In Vijayawada

Apr 30, 2025

Schneider Electric And Vignan University Partner For Center Of Excellence In Vijayawada

Apr 30, 2025 -

Multi Million Dollar Nfl Heists Chilean Migrants Face Charges

Apr 30, 2025

Multi Million Dollar Nfl Heists Chilean Migrants Face Charges

Apr 30, 2025 -

Ups And Figure Ai Humanoid Robot Deployment Partnership

Apr 30, 2025

Ups And Figure Ai Humanoid Robot Deployment Partnership

Apr 30, 2025

Latest Posts

-

Germany Spd Coalition Agreement Campaign Ahead Of Crucial Party Vote

Apr 30, 2025

Germany Spd Coalition Agreement Campaign Ahead Of Crucial Party Vote

Apr 30, 2025 -

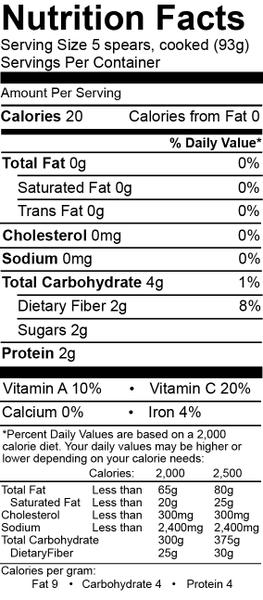

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025 -

Asparagus A Nutrient Rich Vegetable And Its Health Benefits

Apr 30, 2025

Asparagus A Nutrient Rich Vegetable And Its Health Benefits

Apr 30, 2025 -

Asparagus Nutrition How This Vegetable Supports Your Health

Apr 30, 2025

Asparagus Nutrition How This Vegetable Supports Your Health

Apr 30, 2025 -

The Health Benefits Of Asparagus A Comprehensive Guide

Apr 30, 2025

The Health Benefits Of Asparagus A Comprehensive Guide

Apr 30, 2025