Will Canadian Tire's Acquisition Of Hudson's Bay Succeed? A Cautious Assessment

Table of Contents

Synergies and Overlap: A Potential Source of Strength or Weakness?

The success of Canadian Tire's acquisition of Hudson's Bay will largely depend on effectively leveraging synergies between the two brands while mitigating potential conflicts. The integration process promises both opportunities and significant hurdles.

Brand Alignment and Target Demographics

Canadian Tire and Hudson's Bay cater to somewhat different, yet overlapping, customer demographics. Canadian Tire focuses on the practical needs of homeowners and outdoor enthusiasts, while Hudson's Bay targets a more fashion-conscious and upscale clientele.

- Overlap: Both brands sell home goods, though at different price points and with varying styles. There's potential overlap in the customer base seeking home furnishings and decor.

- Complementary Offerings: The acquisition could allow Canadian Tire to expand into higher-end home goods and apparel, broadening its appeal and potentially attracting a new customer segment. Conversely, Hudson's Bay could benefit from Canadian Tire's established network and expertise in outdoor and automotive products.

- Integration Challenges: Successfully integrating two such distinct brands with different brand identities and customer perceptions will be a major challenge. Maintaining the unique appeal of each brand while fostering synergy will require careful marketing and branding strategies. Inconsistency in brand messaging or a diluted brand identity could alienate existing customers.

Supply Chain Integration and Operational Efficiency

The combined entity could realize significant cost savings and operational efficiencies through supply chain integration. However, merging two large and complex supply chains is a daunting task.

- Warehouse Consolidation & Logistics: Consolidating warehouses and optimizing logistics could lead to significant cost reductions. However, this requires careful planning and execution to avoid disruptions to the supply chain.

- Redundancies: Identifying and eliminating redundancies in staffing and operations is crucial for maximizing efficiency, but it also carries the risk of job losses and potential employee morale issues.

- Potential Impact on Employment: The integration process might lead to job losses due to redundancies, posing a significant human resources challenge for Canadian Tire. Effective communication and retraining programs will be essential.

Competitive Landscape and Market Reaction

Canadian Tire's acquisition of Hudson's Bay significantly alters the Canadian retail landscape, placing it in direct competition with giants like Walmart and Amazon, as well as other specialty retailers.

Competition from Other Retailers

The combined entity will face stiff competition from established players. Walmart's breadth and price competitiveness, along with Amazon's dominance in online retail, present considerable challenges.

- Competitive Responses: Competitors may respond aggressively to the acquisition, potentially intensifying price wars or launching new initiatives to retain market share.

- Canadian Tire's Strengths and Weaknesses: Canadian Tire's existing strengths in automotive parts, home improvement products, and its strong loyalty program will be critical assets. However, its success in the higher-end apparel and home furnishings market remains to be seen.

Consumer Response and Brand Perception

Consumer perceptions of both brands will be crucial to the acquisition's success. Any negative reactions or concerns need to be proactively addressed.

- Brand Dilution: The risk of brand dilution exists if the distinct identities of Canadian Tire and Hudson's Bay are not carefully preserved.

- Maintaining Brand Identity: It's crucial that Canadian Tire maintains the distinct identities of both brands, carefully balancing synergy with the preservation of unique brand values. Any perceived shift in quality or brand identity could lead to customer dissatisfaction.

Financial Viability and Integration Challenges

The acquisition's financial feasibility and the complexities of integration pose substantial risks.

Financing and Debt

The acquisition will undoubtedly involve significant debt, potentially impacting Canadian Tire's financial health in the long term.

- Acquisition Cost and ROI: The success of the acquisition will depend heavily on the return on investment (ROI) relative to the acquisition cost. Thorough financial modelling and risk assessment are vital.

- Long-Term Financial Sustainability: Maintaining the long-term financial sustainability of the combined entity requires robust financial planning and effective cost management.

Integration Complexity and Execution Risks

Merging two such large and complex organizations presents substantial integration challenges.

- Cultural Differences: Bridging the cultural differences between the two companies will require significant effort and sensitivity.

- IT Systems Integration: Integrating disparate IT systems can be a technically complex and time-consuming process, potentially leading to disruptions in operations.

- Risks of Failed Integration: Failure to integrate effectively could result in significant financial losses and reputational damage. A well-defined integration strategy is crucial to mitigating these risks.

Conclusion: Assessing the Future of Canadian Tire's Acquisition of Hudson's Bay

Canadian Tire's acquisition of Hudson's Bay presents both exciting opportunities and significant risks. While potential synergies exist in terms of supply chain efficiencies and expanded product offerings, the challenges of integrating two distinct brands, navigating a competitive landscape, and managing substantial debt cannot be overlooked. The success of this ambitious undertaking hinges on effective brand management, careful integration planning, and a strong response to competitive pressures. The long-term viability of this acquisition remains uncertain and will depend heavily on the execution of the integration strategy.

We encourage you to share your thoughts and predictions on Canadian Tire's acquisition of Hudson's Bay. Leave a comment below or join the conversation on social media to share your perspective on this transformative event in the Canadian retail industry. What are your predictions for the future of this ambitious merger?

Featured Posts

-

Restauration De Notre Dame De Poitiers Le Departement S Engage

May 19, 2025

Restauration De Notre Dame De Poitiers Le Departement S Engage

May 19, 2025 -

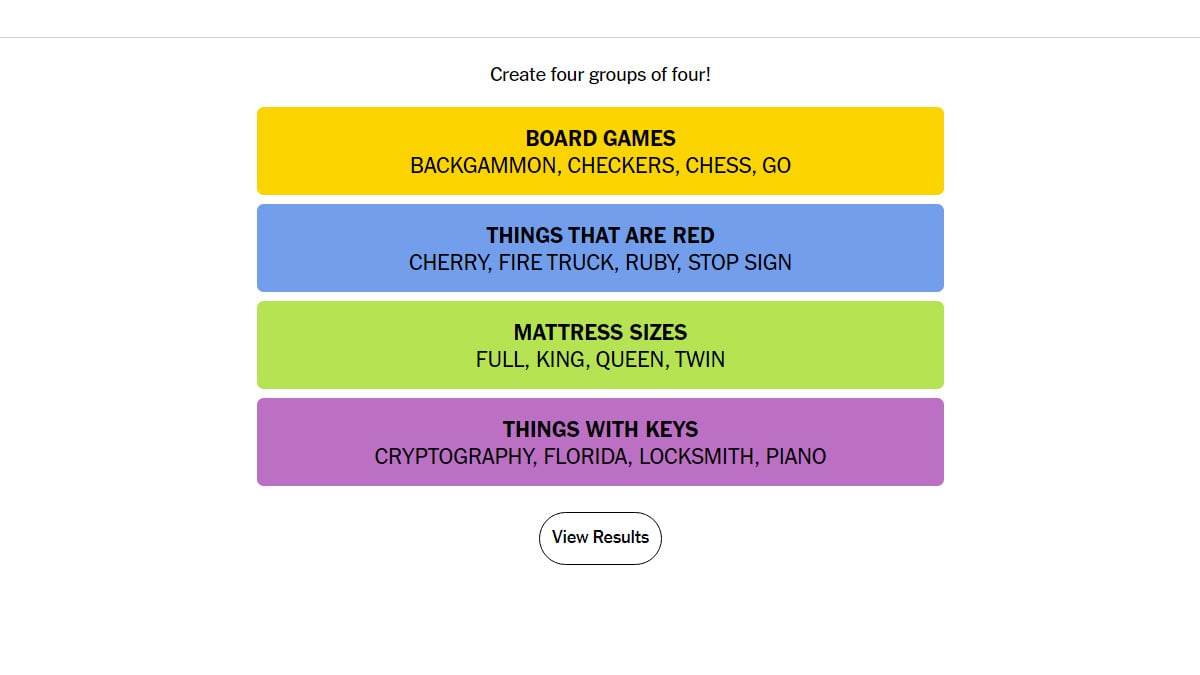

Todays Nyt Connections Puzzle 697 May 8 Hints And Solutions

May 19, 2025

Todays Nyt Connections Puzzle 697 May 8 Hints And Solutions

May 19, 2025 -

Cellcom Network Outage Lengthy Recovery Expected For Voice And Text Services

May 19, 2025

Cellcom Network Outage Lengthy Recovery Expected For Voice And Text Services

May 19, 2025 -

Ukraine Under Siege Russias Largest Drone Assault

May 19, 2025

Ukraine Under Siege Russias Largest Drone Assault

May 19, 2025 -

Nyt Connections Puzzle Answers For March 17th Puzzle 645

May 19, 2025

Nyt Connections Puzzle Answers For March 17th Puzzle 645

May 19, 2025

Latest Posts

-

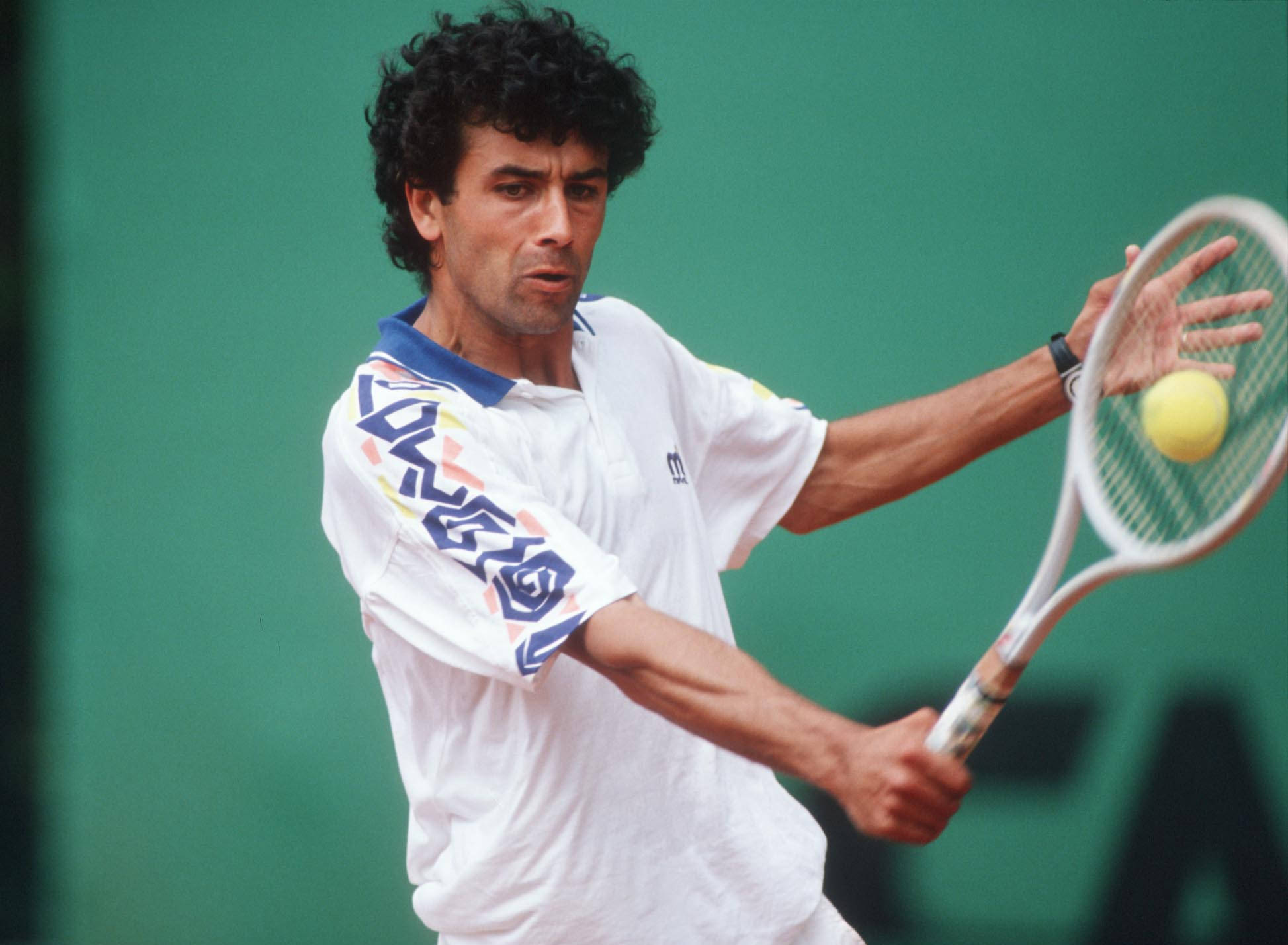

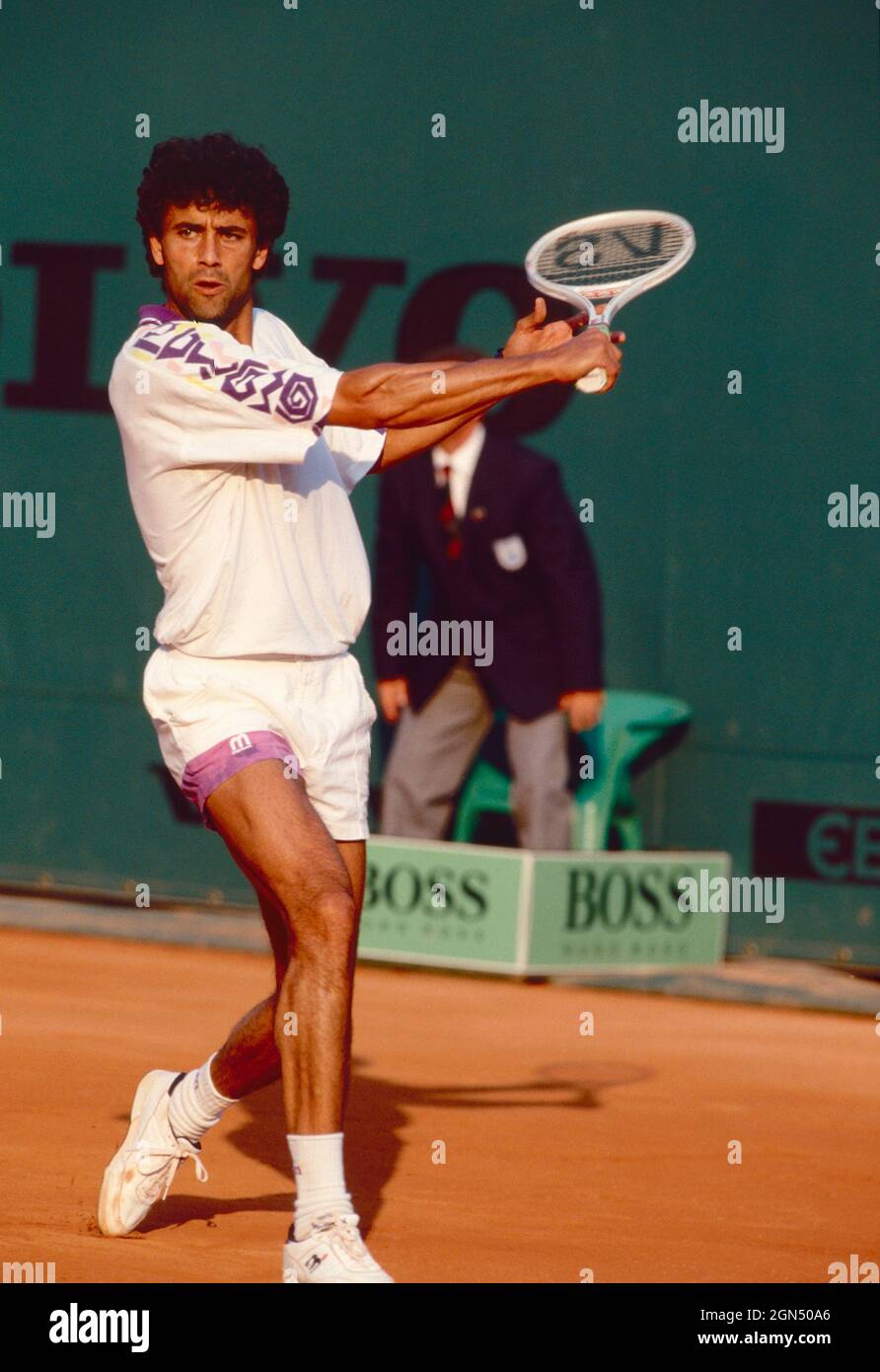

Muere Juan Aguilera El Tenis Espanol Esta De Luto

May 19, 2025

Muere Juan Aguilera El Tenis Espanol Esta De Luto

May 19, 2025 -

Juan Aguilera Recordando Al Primer Espanol En Triunfar En Un Masters 1000

May 19, 2025

Juan Aguilera Recordando Al Primer Espanol En Triunfar En Un Masters 1000

May 19, 2025 -

Adios A Juan Aguilera Leyenda Espanola Del Tenis Masters 1000

May 19, 2025

Adios A Juan Aguilera Leyenda Espanola Del Tenis Masters 1000

May 19, 2025 -

Juan Aguilera Recordando Al Campeon Espanol De Masters 1000

May 19, 2025

Juan Aguilera Recordando Al Campeon Espanol De Masters 1000

May 19, 2025 -

Fallecimiento De Juan Aguilera Leyenda Del Tenis Espanol

May 19, 2025

Fallecimiento De Juan Aguilera Leyenda Del Tenis Espanol

May 19, 2025