Will Climate Risk Affect My Ability To Buy A Home?

Table of Contents

Rising Insurance Premiums and Uninsurability

Properties located in high-risk areas are facing a stark reality: significantly higher homeowner's insurance premiums, or even complete uninsurability. This is a direct consequence of the increasing frequency and severity of extreme weather events. Insurance companies are reassessing risk profiles and adjusting premiums accordingly, leading to dramatic increases for those in vulnerable locations.

- Increased frequency and severity of extreme weather events: Hurricanes, floods, and wildfires are becoming more powerful and more common, resulting in billions of dollars in damage each year.

- Insurance companies reassessing risk and adjusting premiums accordingly: Insurance providers are factoring in climate risk data, leading to higher premiums for homes in high-risk zones. In some cases, they may refuse to offer coverage altogether.

- Difficulty obtaining mortgages for properties in high-risk zones due to uninsurability: Many mortgage lenders require homeowners insurance as a condition for loan approval. If a property is uninsurable, securing a mortgage becomes nearly impossible.

- Examples of specific areas experiencing this issue: Coastal communities facing rising sea levels and increased storm surges, areas prone to wildfires in the western United States, and floodplains across the country are prime examples. Researching specific climate risk for your target area is critical.

Property Value Depreciation Due to Climate Risk

Climate change isn't just affecting insurance; it's impacting property values themselves. Properties in areas prone to flooding, wildfires, or extreme heat are becoming less attractive to buyers. This reduced demand directly translates to lower property values, posing a significant risk to potential homebuyers and investors.

- Reduced demand for homes in areas prone to flooding, wildfires, or extreme heat: Buyers are increasingly hesitant to purchase homes in areas with a high risk of climate-related damage.

- Disclosure requirements for sellers regarding climate-related risks: Many jurisdictions now mandate sellers to disclose known climate-related risks associated with their properties.

- Long-term devaluation of properties in vulnerable locations: Properties in high-risk areas are likely to experience continued devaluation over time as climate change intensifies.

- Impact on future resale value: The future resale value of a property in a climate-vulnerable area is significantly uncertain and likely lower than a comparable property in a safer location.

Government Regulations and Building Codes

Government regulations and building codes are playing an increasingly important role in mitigating climate risks and shaping the home-buying process. We're seeing stricter building codes in high-risk areas, increased scrutiny of building permits, and government initiatives to incentivize climate-resilient construction.

- Stricter building codes in high-risk areas: New construction in floodplains or fire-prone zones often faces stricter building codes designed to enhance resilience.

- Increased scrutiny of building permits in floodplains or fire-prone zones: The permitting process is more rigorous in high-risk areas, leading to potential delays and added costs.

- Government initiatives to incentivize climate-resilient construction: Many governments offer tax credits or rebates to encourage the construction of climate-resilient homes.

- Potential for stricter zoning regulations in vulnerable areas: Zoning regulations may become more restrictive in areas deemed highly vulnerable to climate-related hazards.

Accessing Climate Risk Information for Home Buyers

Understanding climate risk is essential for informed home buying. Fortunately, several resources can help you assess the potential hazards associated with a specific location.

- Utilizing online tools and resources: FEMA flood maps, wildfire risk maps, and other online resources provide valuable information about climate hazards.

- Consulting with real estate agents specializing in climate-risk assessment: Experienced real estate professionals can offer insights into local climate risks and guide you through the process.

- Reviewing local government reports and planning documents: Local governments often publish reports and planning documents that outline climate risks within their jurisdictions.

- Engaging environmental consultants for property-specific assessments: For a comprehensive evaluation, consider engaging an environmental consultant to conduct a property-specific climate risk assessment.

Conclusion

Climate risk is undeniably a significant factor shaping the home-buying process. It influences insurance costs, property values, and government regulations, making thorough due diligence absolutely crucial. Understanding the potential impact of climate change on your investment is not just prudent; it’s essential. To protect your investment and make informed decisions about climate risk, proactively research climate risks in your desired locations before making a purchase. Utilize the resources mentioned above to assess climate risk and make informed decisions about your future home. Don't let climate change blindside your dream of homeownership; understand climate risks in home buying to ensure a secure and stable future.

Featured Posts

-

Bangladeshinfo Com A Reliable Source For Information About Bangladesh

May 21, 2025

Bangladeshinfo Com A Reliable Source For Information About Bangladesh

May 21, 2025 -

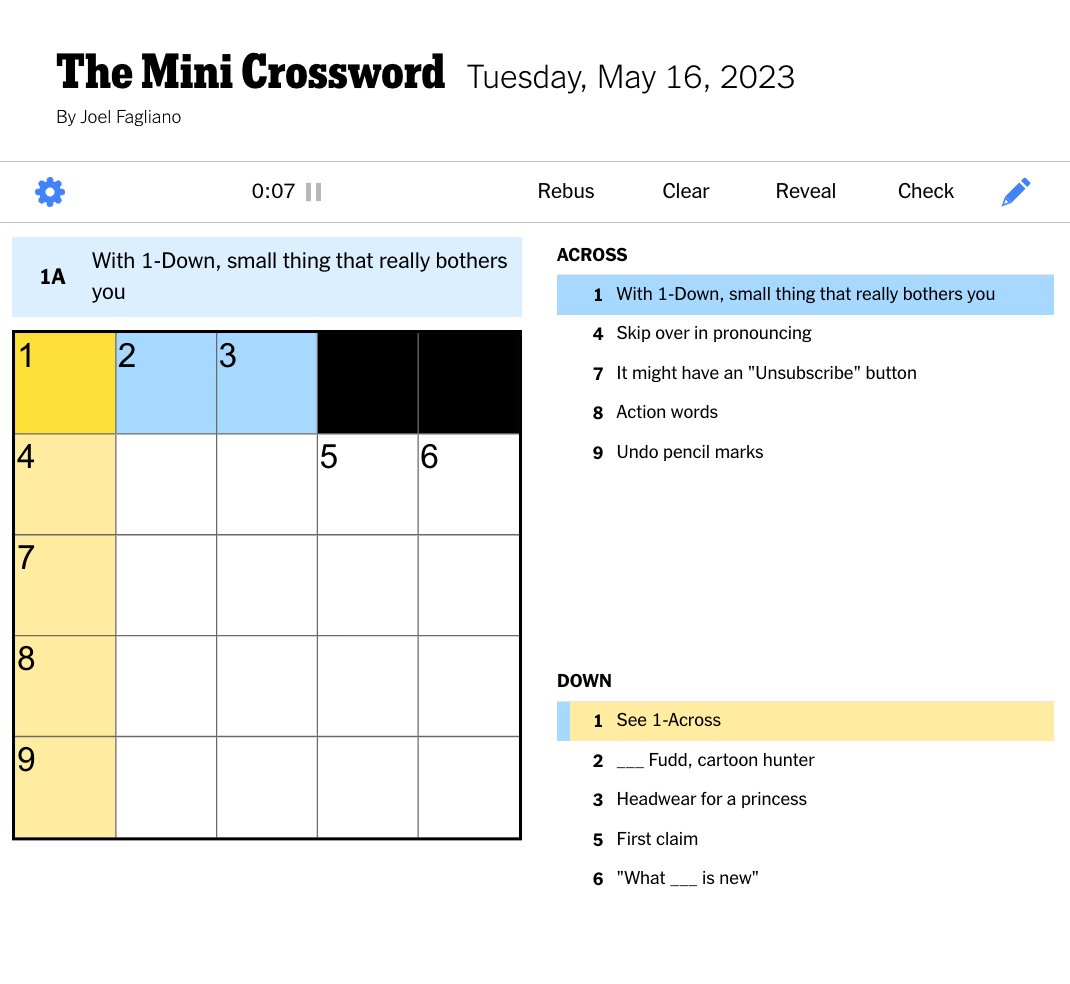

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025 -

Sofrep News Houthi Missile Attack On Israel Russias Action Against Amnesty International

May 21, 2025

Sofrep News Houthi Missile Attack On Israel Russias Action Against Amnesty International

May 21, 2025 -

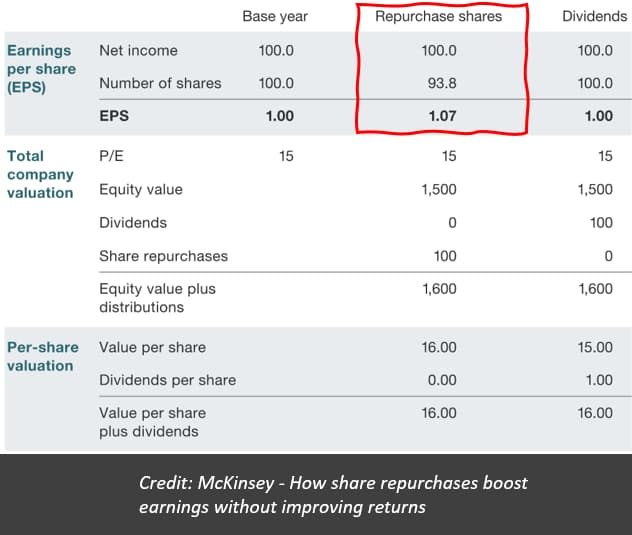

Ryanairs Growth Outlook Tariff Conflicts And Planned Share Repurchases

May 21, 2025

Ryanairs Growth Outlook Tariff Conflicts And Planned Share Repurchases

May 21, 2025 -

The Versatile Cassis Blackcurrant From Cocktails To Cuisine

May 21, 2025

The Versatile Cassis Blackcurrant From Cocktails To Cuisine

May 21, 2025

Latest Posts

-

Suomi Mm Karsinnoissa Huuhkajien Valmennuksen Uudistus

May 21, 2025

Suomi Mm Karsinnoissa Huuhkajien Valmennuksen Uudistus

May 21, 2025 -

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 21, 2025

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 21, 2025 -

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 21, 2025

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 21, 2025 -

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

May 21, 2025

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

May 21, 2025 -

Yllaetysvalinnat Friisin Avauskokoonpanoon Kamaran Ja Pukin Sijaan Toiset

May 21, 2025

Yllaetysvalinnat Friisin Avauskokoonpanoon Kamaran Ja Pukin Sijaan Toiset

May 21, 2025