Will Mortgage Rates Under 3% Boost Canada's Housing Market?

Table of Contents

Historical Context: Low Mortgage Rates and Housing Market Activity

Historically, low mortgage rates in Canada have correlated strongly with increased housing market activity. Periods of low interest rates have often fueled home sales, driven up prices, and, consequently, impacted affordability. Examining past trends offers valuable insights into the potential effects of mortgage rates under 3%.

- 2000-2008: This period saw sustained low mortgage rates, leading to a significant boom in the Canadian housing market. Home sales surged, and prices appreciated considerably, particularly in major urban centers.

- Rate Increases and Market Cooling: Conversely, periods of interest rate increases, such as those seen in the early 2000s and more recently, have resulted in market cooling, with decreased sales and slower price growth.

- Statistical Evidence: Data from the Canadian Real Estate Association (CREA) and other sources clearly demonstrate the historical link between low mortgage rates and increased housing market activity. Analyzing these historical trends helps us better predict potential future scenarios. For instance, examining the average number of homes sold per year during previous low-rate periods can provide a valuable benchmark.

The Current Economic Landscape: Beyond Interest Rates

While mortgage rates under 3% are undeniably attractive to potential homebuyers, several other economic factors are shaping the Canadian housing market. Focusing solely on interest rates provides an incomplete picture. The current economic landscape presents a complex interplay of forces.

- Inflation's Impact on Affordability: High inflation erodes purchasing power, making homes less affordable despite lower mortgage rates. The rising cost of living needs to be considered alongside potential reductions in interest rates.

- Government Policies: Government policies like stress tests (designed to ensure borrowers can handle higher interest rates) and foreign buyer taxes significantly influence market dynamics. These measures aim to cool the market and prevent overheating, potentially counteracting the effects of low mortgage rates.

- Supply Chain Issues and New Housing Construction: Ongoing supply chain disruptions continue to constrain new housing construction, limiting supply and keeping prices elevated even with lower borrowing costs. The shortage of available housing remains a critical factor.

- Immigration's Role in Housing Demand: Canada's immigration targets significantly impact housing demand. The influx of new residents increases competition for existing homes and further contributes to the existing housing shortage.

Potential Scenarios: Sub-3% Rates and Their Impacts

Predicting the precise impact of mortgage rates under 3% requires considering various scenarios. The interplay of different factors makes accurate forecasting challenging.

- Scenario 1: Moderate Increase in Buyer Activity, Stable Prices: Lower rates might stimulate modest increases in buyer activity, but other market constraints (limited supply, high inflation) could prevent significant price surges.

- Scenario 2: Significant Price Increases, Potential Market Overheating: If low mortgage rates combine with strong buyer demand and limited supply, we could see significant price increases and a potential return to a highly competitive market, possibly leading to market overheating.

- Scenario 3: Limited Impact Due to Other Market Constraints: The influence of other economic factors (inflation, government policies) might outweigh the effect of lower mortgage rates, resulting in a limited impact on overall market activity.

Regional Variations: A Diverse Market

It's crucial to remember that the Canadian housing market isn't uniform. Different regions experience unique economic conditions and local market dynamics.

- High-Demand Urban Centers (Toronto, Vancouver): In these high-demand areas, even sub-3% rates might not significantly alter the already highly competitive landscape. Prices remain high due to limited supply and strong demand.

- Smaller Cities and Rural Areas: Lower mortgage rates might have a more pronounced effect in smaller cities and rural areas where market dynamics are less influenced by factors like limited supply and high demand.

- Regional Differences in Supply and Demand: Regional variations in housing supply and demand will continue to shape the market. Areas with significant housing shortages will likely see less impact from lower interest rates than areas with greater housing supply.

Conclusion

The prospect of mortgage rates under 3% is undeniably attractive, but its impact on the Canadian housing market is far from straightforward. Several factors beyond interest rates—including inflation, government policies, supply chain constraints, and regional variations—play crucial roles. The relationship between mortgage rates under 3% and market activity is complex and multifaceted. While lower rates could potentially stimulate buyer activity, other economic headwinds may mitigate the effect. Understanding this complex interplay is crucial for navigating the Canadian housing market. Stay informed about current mortgage rates and market trends to make informed decisions. To find the best mortgage rates available, check out [link to relevant resource, e.g., a mortgage rate comparison tool].

Featured Posts

-

Mental Health Awareness Week Join A Dog Walk In Didcot

May 13, 2025

Mental Health Awareness Week Join A Dog Walk In Didcot

May 13, 2025 -

Tory Lanez And 50 Cents Furious Reaction To A Ap Rocky Bet Inquiry

May 13, 2025

Tory Lanez And 50 Cents Furious Reaction To A Ap Rocky Bet Inquiry

May 13, 2025 -

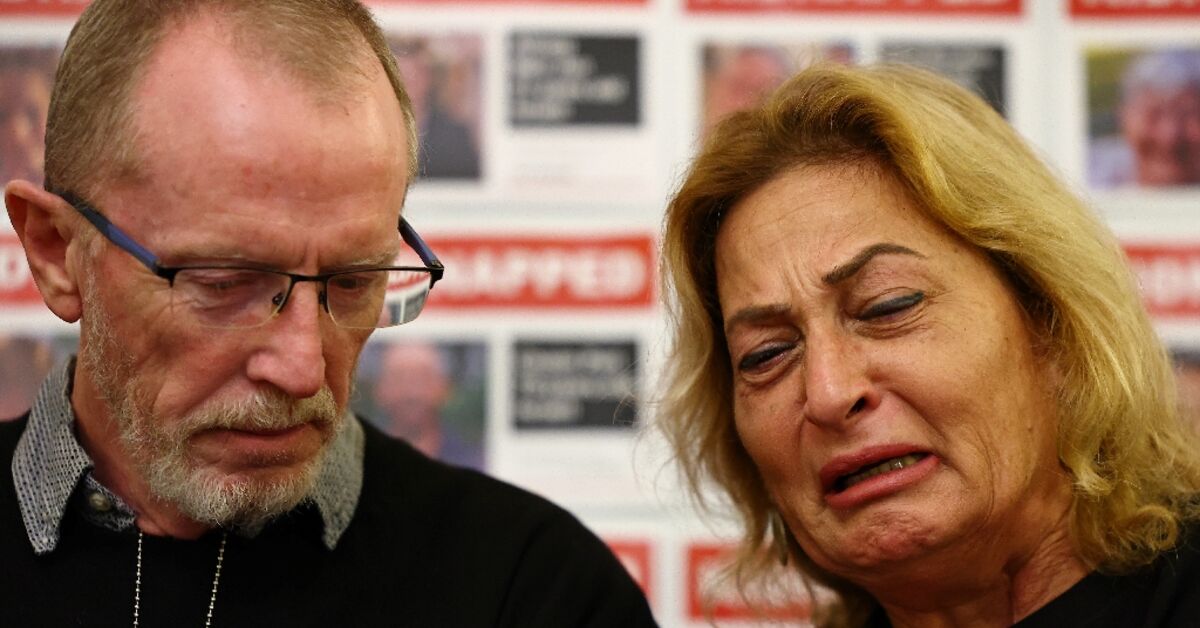

Families Of Gaza Hostages Face Lingering Nightmare

May 13, 2025

Families Of Gaza Hostages Face Lingering Nightmare

May 13, 2025 -

Jelena Ostapenkos Stunning Stuttgart Open Victory Over Aryna Sabalenka

May 13, 2025

Jelena Ostapenkos Stunning Stuttgart Open Victory Over Aryna Sabalenka

May 13, 2025 -

Espns Nba Draft Lottery Coverage Overhaul A Detailed Look

May 13, 2025

Espns Nba Draft Lottery Coverage Overhaul A Detailed Look

May 13, 2025