Will Resuming Trump Tariffs Cripple Europe's Trade?

Table of Contents

Historical Context: The Trump Administration's Trade Wars

The Trump administration's protectionist trade policies significantly impacted global trade, particularly the relationship between the US and the EU. The imposition of tariffs, often framed as measures to protect American industries, led to a period of escalating trade tensions and a full-blown trade war. These tariffs particularly targeted European industries such as steel and aluminum.

- Specific examples of tariffs imposed and their consequences: In 2018, the Trump administration imposed a 25% tariff on steel imports and a 10% tariff on aluminum imports from the EU, citing national security concerns. This resulted in immediate price increases for European manufacturers and retaliatory tariffs from the EU on various American goods, impacting sectors like agricultural products and whiskey. [Link to relevant news article on steel/aluminum tariffs]

- The retaliatory measures taken by the EU: The EU responded with its own tariffs on a range of US products, including Harley-Davidson motorcycles and bourbon whiskey, aiming to counter the negative effects of American tariffs and protect its domestic industries. [Link to EU press release on retaliatory measures]

- The overall economic impact of the trade war on both sides: The trade war resulted in reduced trade volumes between the US and the EU, impacting economic growth on both sides of the Atlantic. Studies from various organizations, like the Peterson Institute for International Economics, highlighted significant negative economic consequences for both the US and EU economies. [Link to relevant economic study on the impact of the trade war]

Potential Impacts of Resumed Tariffs on Key European Sectors

The reintroduction of Trump-era tariffs would likely have severe consequences across various key European sectors. The impact would be felt across the board, from manufacturing to agriculture. The disruption of established trade flows and increased prices for consumers would create a ripple effect across the European economy.

- Impact on specific industries (e.g., German car manufacturers, French wine producers): German car manufacturers, heavily reliant on US exports, would face significant challenges. Similarly, French wine producers could see a sharp decline in sales to the US market due to increased tariffs. The agricultural sector as a whole would also face major challenges.

- Potential job losses and economic downturn: Increased production costs resulting from tariffs would likely lead to job losses in several sectors, potentially triggering a wider economic downturn in Europe. The automotive industry, in particular, could experience significant job displacement.

- Increased prices for consumers: The increased cost of imported goods due to tariffs would inevitably lead to higher prices for European consumers, impacting their purchasing power and potentially reducing overall consumption.

The Automotive Industry: A Case Study

The automotive industry serves as a prime example of a sector highly vulnerable to renewed tariffs. The close integration of European and US automotive supply chains makes it particularly susceptible to disruption.

- Discuss the interconnectedness of the European and US automotive supply chains: Many European car manufacturers have significant production facilities in the US and rely on parts sourced from both regions. Tariffs would disrupt this complex network.

- Analyze potential price increases and reduced competitiveness: Tariffs would inflate the prices of both imported and domestically produced cars in both the US and EU, reducing competitiveness in the global market.

- Explore the possibility of factory closures and job displacement: Facing increased costs and reduced competitiveness, car manufacturers could be forced to consider factory closures and lay-offs, leading to significant job losses.

Geopolitical Implications and Alternative Trade Partnerships

The reimposition of Trump-era tariffs would severely strain EU-US relations, potentially pushing the transatlantic partnership toward further fragmentation. This would necessitate the EU exploring alternative trade partnerships to mitigate the negative impact.

- Analyze the potential shift in global trade dynamics: Renewed trade tensions between the US and EU could reshape global trade dynamics, potentially accelerating the shift towards regional trade agreements and away from a globalized system.

- Assess the viability of alternative trade agreements: The EU might intensify efforts to forge stronger trade ties with other regions, including Asia and Africa, to diversify its trade relationships and reduce its reliance on the US market. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and similar agreements could become increasingly important.

- Discuss the long-term strategic implications for the EU: A renewed trade war could force the EU to rethink its long-term trade strategy, potentially leading to a more protectionist approach in some sectors and a greater focus on strategic autonomy.

Conclusion

The potential resumption of Trump-era tariffs presents a serious threat to European trade. The devastating effects would be felt across numerous sectors, from the automotive industry to agriculture, leading to job losses, economic downturn, and increased prices for consumers. The geopolitical implications are equally significant, potentially straining transatlantic relations and necessitating a reassessment of the EU's trade strategy, including the pursuit of alternative partnerships. Understanding the potential ramifications of "Trump tariffs" is crucial for businesses and policymakers. Staying informed about developments in transatlantic trade relations is vital to mitigate the risks associated with these potentially crippling tariffs. Further research and monitoring of trade policy are essential for navigating this uncertain landscape.

Featured Posts

-

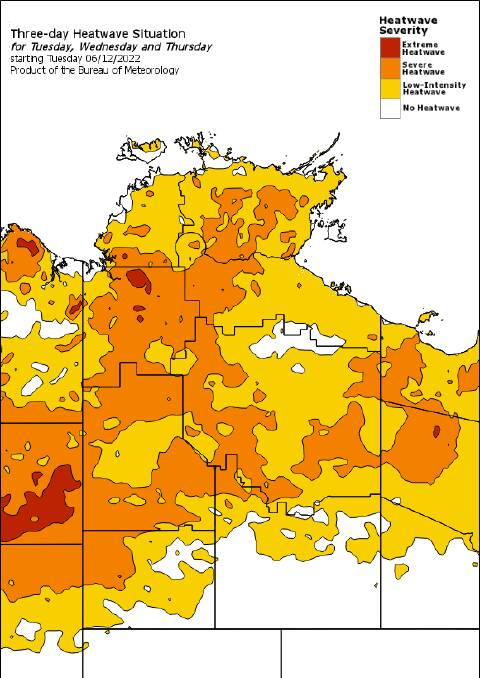

Noida And Ghaziabad Heatwave Warning Advisory For Outdoor Workers

May 13, 2025

Noida And Ghaziabad Heatwave Warning Advisory For Outdoor Workers

May 13, 2025 -

Nba Draft Lottery Espns Coverage Shake Up Explained

May 13, 2025

Nba Draft Lottery Espns Coverage Shake Up Explained

May 13, 2025 -

Doom The Dark Ages Limited Edition Xbox Controller Amazon Sale

May 13, 2025

Doom The Dark Ages Limited Edition Xbox Controller Amazon Sale

May 13, 2025 -

Romski Muzikanti V Prekmurju Tradicija In Igranje

May 13, 2025

Romski Muzikanti V Prekmurju Tradicija In Igranje

May 13, 2025 -

Confirmed Sam Elliott To Appear In Landman Season 2 Report Details

May 13, 2025

Confirmed Sam Elliott To Appear In Landman Season 2 Report Details

May 13, 2025