Will The Fed Hold Rates? Analyzing Economic Pressures On Monetary Policy

Table of Contents

Inflationary Pressures and the Fed's Response

The current inflation rate significantly deviates from the Fed's target of 2%, fueling concerns about its persistence. Several factors contribute to this elevated inflation: supply chain disruptions stemming from the pandemic and the war in Ukraine, soaring energy prices, and robust consumer demand. To combat this, the Fed employs various tools, primarily raising interest rates (a series of Fed interest rate hikes) and implementing quantitative tightening (reducing its balance sheet).

- Impact on Consumer Spending and Business Investment: Higher interest rates increase borrowing costs, potentially cooling down consumer spending and reducing business investment.

- Analysis of Inflation Data (CPI, PPI): Close monitoring of the Consumer Price Index (CPI) and Producer Price Index (PPI) is crucial for assessing the effectiveness of the Fed's actions and informing future policy decisions regarding Fed interest rate hikes.

- Potential Risks of Aggressive Rate Hikes: Aggressive interest rate hikes risk triggering a recession by severely dampening economic activity. Finding the right balance is the Fed's considerable challenge.

Economic Growth and the Risk of Recession

Current economic growth indicators paint a mixed picture. While the unemployment rate remains relatively low, GDP growth has slowed considerably. The relationship between interest rate hikes and economic slowdown is complex; while rate hikes aim to curb inflation, they also increase borrowing costs, potentially hindering economic expansion. The possibility of a recession looms large, further complicating the Fed's decision-making process concerning future Fed interest rate hikes.

- Examination of Leading Economic Indicators: Leading economic indicators, such as manufacturing activity and consumer confidence, provide valuable insights into the direction of the economy and the potential for a recession.

- Soft Landing vs. Hard Landing: The Fed aims for a "soft landing"—slowing economic growth enough to curb inflation without triggering a recession. However, a "hard landing," or a significant recession, remains a distinct possibility.

- Impact on Different Economic Sectors: Interest rate hikes impact different economic sectors differently. Interest-sensitive sectors, such as housing and automobiles, are particularly vulnerable.

Global Economic Factors and Their Influence on the Fed

The US economy is deeply intertwined with the global economy. Geopolitical instability, such as the war in Ukraine, significantly impacts global supply chains and energy prices, feeding into US inflation. Furthermore, monetary policies of other central banks influence the Fed's decisions. A coordinated global effort to combat inflation is crucial, but divergent economic realities often hinder such coordination.

- Impact of the War in Ukraine: The war in Ukraine has exacerbated existing supply chain issues and driven up energy prices worldwide, placing upward pressure on inflation globally, including in the US.

- Influence of Other Central Banks: The actions of central banks in other major economies, such as the European Central Bank and the Bank of Japan, have a ripple effect on the US economy and the Fed's policy decisions.

- Potential Spillover Effects: Global economic shocks, like financial crises or major recessions in other countries, can have significant spillover effects on the US economy.

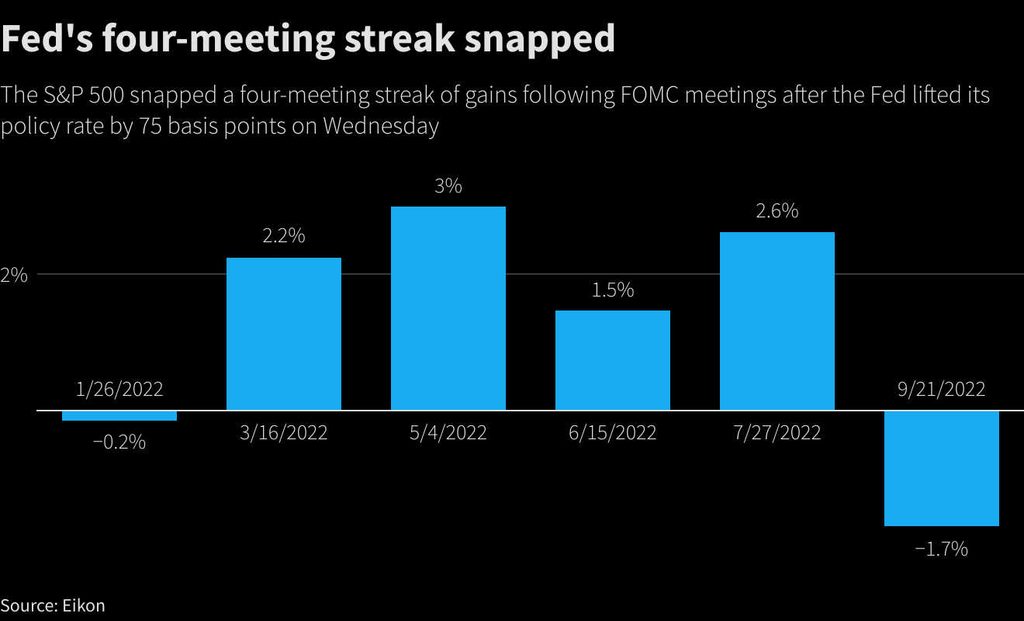

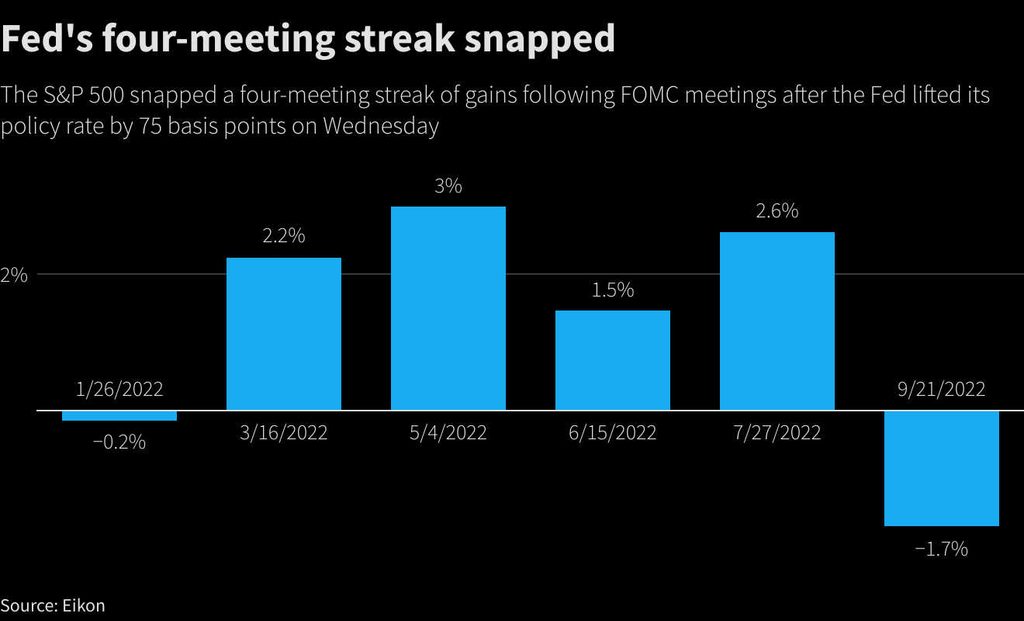

Market Reactions and Investor Sentiment

Market reactions to previous Fed announcements regarding Fed interest rate hikes provide valuable insights into future expectations. Investor sentiment, reflected in stock market movements, bond yields, and currency exchange rates, significantly influences the Fed's decision-making. A sharp market downturn could prompt the Fed to adjust its policy stance.

- Impact on the Stock Market: Interest rate hikes generally negatively impact the stock market in the short term, as higher borrowing costs reduce corporate profits and investor confidence.

- Analysis of Bond Yields: Bond yields move inversely to bond prices. Rising interest rates typically lead to higher bond yields, reflecting increased risk-free returns.

- Influence on the Fed's Decision-Making: While the Fed aims for independence, it is keenly aware of market reactions and investor sentiment, which can influence its decisions.

Conclusion: The Future of Interest Rates – Will the Fed Hold Rates?

The decision of whether the Fed will hold rates or further adjust them hinges on a complex interplay of factors: persistent inflationary pressures, slowing economic growth, global economic uncertainty, and market reactions. While a "soft landing" remains the desired outcome, the path ahead is fraught with uncertainty. The possibility of further rate hikes, a pause, or even potential rate cuts all remain plausible scenarios. The Fed's decisions will continue to shape the economic landscape for months to come. To stay updated on the Fed's interest rate decisions, monitor the evolving interest rate outlook, and learn more about the Fed's monetary policy, be sure to subscribe to our newsletter, follow us on social media, and continue exploring our insightful articles.

Featured Posts

-

Mangsa Tragedi Putra Heights Terima Bantuan Daripada 10 Adn Pas Selangor

May 09, 2025

Mangsa Tragedi Putra Heights Terima Bantuan Daripada 10 Adn Pas Selangor

May 09, 2025 -

Dijon Rue Michel Servet Explication D Un Accident Impliquant Un Vehicule Et Un Mur

May 09, 2025

Dijon Rue Michel Servet Explication D Un Accident Impliquant Un Vehicule Et Un Mur

May 09, 2025 -

Ambitions Ecologistes Pour Les Municipales De Dijon En 2026

May 09, 2025

Ambitions Ecologistes Pour Les Municipales De Dijon En 2026

May 09, 2025 -

Is Jayson Tatum Underappreciated Colin Cowherds Consistent Critique Examined

May 09, 2025

Is Jayson Tatum Underappreciated Colin Cowherds Consistent Critique Examined

May 09, 2025 -

Nyt Strands Today April 6 2025 Clues And Hints

May 09, 2025

Nyt Strands Today April 6 2025 Clues And Hints

May 09, 2025