Will These 2 Stocks Outperform Palantir Within 3 Years? A Prediction

Table of Contents

Analyzing Palantir's Current Market Position and Future Projections

Palantir's Strengths:

Palantir boasts several key strengths contributing to its current market position and future growth potential. Its success hinges on:

-

Strong government contracts and growing commercial sector presence: Palantir has secured substantial contracts with government agencies, providing a stable revenue stream. Simultaneously, its expansion into the commercial sector demonstrates a diversified approach, reducing reliance on any single client. Examples include its partnerships with major financial institutions and healthcare providers. This diversification significantly impacts Palantir stock price and long-term stability.

-

Cutting-edge data analytics technology: Palantir's Foundry platform offers sophisticated data integration and analysis capabilities, attracting clients seeking advanced solutions. Recent technological advancements, such as improved AI integration and enhanced data visualization tools, position Palantir favorably against competitors. This ongoing innovation contributes to Palantir revenue and overall growth.

-

Potential for expansion into new markets: Palantir's technology is adaptable and applicable across various sectors. Future expansion into emerging markets like renewable energy and supply chain management presents considerable growth opportunities, further impacting Palantir stock price and long-term prospects.

Palantir's Weaknesses & Risks:

Despite its strengths, Palantir faces challenges that could affect its future performance and Palantir stock prediction:

-

High valuation compared to competitors: Palantir's current valuation is significantly higher than some competitors, making it vulnerable to market corrections and investor sentiment shifts. This high Palantir valuation creates a risk of decreased stock performance.

-

Dependence on large government contracts: While government contracts provide stability, over-reliance on them exposes Palantir to potential political and budgetary changes that could negatively influence Palantir revenue.

-

Competition from established tech giants: Companies like Microsoft and Google offer competing data analytics solutions, posing a significant challenge to Palantir's market share and future growth. This strong Palantir competition necessitates continuous innovation and market adaptation.

Competitor 1: Snowflake – A Deep Dive

Snowflake's Strengths and Potential for Growth:

Snowflake (SNOW) is a major player in the cloud data warehousing space, presenting a strong challenge to Palantir. Its strengths include:

-

Focus on cloud-based data warehousing: Snowflake's core offering is a scalable and cost-effective cloud-based data warehouse, directly addressing a growing market need. This focus differentiates Snowflake from Palantir, providing unique market appeal.

-

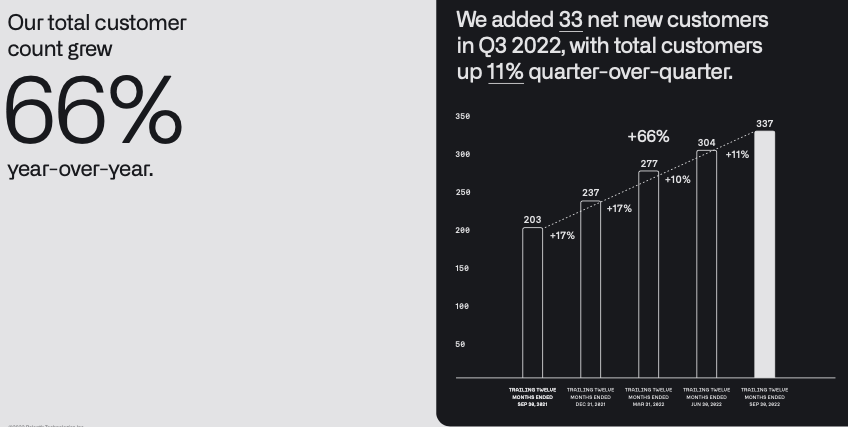

Strong financial performance and growth trajectory: Snowflake has shown impressive revenue growth and increasing market share, indicating strong financial health and future growth potential. Analyzing Snowflake financials reveals a company poised for continued expansion.

-

Competitive advantages over Palantir: Snowflake's ease of use and scalability often make it a more attractive solution for businesses needing flexible data management, posing a competitive threat to Palantir's more complex platform.

Snowflake's Weaknesses and Challenges:

Despite Snowflake's strengths, it also faces some challenges:

-

Dependence on cloud providers: Snowflake relies on major cloud providers like AWS, Azure, and GCP. Changes in these providers’ pricing or service availability could impact Snowflake's operations. This dependence presents a significant Snowflake risk.

-

Intense competition: The cloud data warehousing market is highly competitive, with established players and emerging startups vying for market share. This intense Snowflake competition requires continuous innovation and strategic adaptation.

Competitor 2: Databricks – A Comparative Analysis

Databricks' Strengths and Growth Potential:

Databricks is another significant competitor, leveraging its unique strengths:

-

Unique selling proposition and market differentiation: Databricks' unified analytics platform combines data warehousing, data lakes, and machine learning capabilities, offering a comprehensive solution for data management and analysis. This distinctive approach differentiates Databricks from both Palantir and Snowflake.

-

Growth opportunities and strategic partnerships: Databricks' open-source roots and strategic partnerships with various tech companies position it for expansion into different market segments and geographies. This strategic approach allows for a wider reach and increased growth potential.

-

Financial strength and stability: Databricks has secured significant funding and demonstrates strong financial performance, underpinning its long-term viability and growth potential. Examining Databricks stock performance reveals a strong and stable company.

Databricks' Weaknesses and Challenges:

However, Databricks also faces potential hurdles:

-

Complexity and learning curve: Databricks' platform can be complex for users unfamiliar with its architecture and functionalities, potentially hindering adoption by smaller businesses. This complexity presents a significant Databricks challenge.

-

Competition from established players: Similar to Snowflake, Databricks faces competition from large tech companies, demanding continuous innovation and adaptability to maintain market position. Analyzing the Databricks competition landscape reveals the need for constant strategy refinement.

Predictive Analysis and Conclusion

Comparing Palantir, Snowflake, and Databricks, we see distinct advantages and disadvantages for each. While Palantir benefits from strong government contracts and cutting-edge technology, its high valuation and dependence on large contracts present risks. Snowflake and Databricks offer compelling alternatives, particularly for cloud-based solutions and unified analytics platforms respectively. Considering their growth trajectories and market positions, our Palantir stock prediction suggests that both Snowflake and Databricks have a higher probability of outperforming Palantir in terms of stock price appreciation over the next three years. This prediction is based on their strong market position, robust financial performance, and the growing demand for their specific services within the evolving tech landscape.

Conclusion

In summary, this analysis highlighted the strengths and weaknesses of Palantir and its competitors, Snowflake and Databricks. Based on current market trends and projected growth, our Palantir stock prediction leans towards Snowflake and Databricks outperforming Palantir within the next three years. This, however, is just a prediction and is not financial advice. To formulate your own informed Palantir stock prediction, thoroughly research each company, examining their financial statements, market positioning, and competitive landscape. Remember to consult with a qualified financial advisor before making any investment decisions. Remember, developing a sound investment strategy requires careful consideration of various factors affecting Palantir stock prediction and the broader market.

Featured Posts

-

Elon Musks Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025

Elon Musks Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025 -

Should You Invest In Palantir Before May 5th A Comprehensive Overview

May 10, 2025

Should You Invest In Palantir Before May 5th A Comprehensive Overview

May 10, 2025 -

Roberts Shares Experience Of Being Confused For Former Gop House Leader

May 10, 2025

Roberts Shares Experience Of Being Confused For Former Gop House Leader

May 10, 2025 -

To Buy Palantir Stock Or Not Considering The May 5th Deadline

May 10, 2025

To Buy Palantir Stock Or Not Considering The May 5th Deadline

May 10, 2025 -

Eleven Years On High Potentials Enduring Influence On Psych Spiritual Growth

May 10, 2025

Eleven Years On High Potentials Enduring Influence On Psych Spiritual Growth

May 10, 2025