Will Trump's Tax Cuts Pass? The GOP's Divided Future

Table of Contents

Internal GOP Divisions: A Major Hurdle

The Republican party is far from a monolith, and this internal fracturing poses a significant threat to the passage of Trump's tax cuts. Differing opinions on the scope and impact of these cuts create a major hurdle for the legislation.

Conservative vs. Moderate Factions:

A deep ideological chasm separates the conservative and moderate wings of the Republican party regarding tax policy. This division manifests in starkly different approaches to taxation.

- Differing Opinions: Conservatives generally favor significant cuts across the board, including steep reductions in corporate tax rates, arguing this will stimulate economic growth. Moderates, however, express concerns about the potential impact on the national debt and income inequality, advocating for more targeted tax relief.

- Key Figures: Conservative voices like [insert example of a conservative Republican politician] have championed aggressive tax cuts, while more moderate Republicans, such as [insert example of a moderate Republican politician], have expressed reservations.

- Potential Compromises: The potential for compromise lies in finding a middle ground, perhaps through smaller cuts or targeted tax breaks for specific sectors. However, bridging this ideological divide will require significant negotiation and concessions from both sides, a process fraught with uncertainty.

The Role of Lobbying and Special Interests:

Powerful lobbies and special interest groups exert significant influence on the legislative process, potentially shaping the final form of the tax cuts.

- Powerful Lobbies: Groups representing corporations, the financial industry, and real estate developers are actively lobbying for provisions that benefit their interests. Conversely, groups advocating for social justice and economic equality are pushing back against aspects they see as exacerbating inequality.

- Backroom Deals: The potential for backroom deals and quid pro quo arrangements cannot be ignored. These deals could significantly alter the proposed tax cuts, potentially leading to unforeseen consequences.

- Impact on Specific Provisions: Lobbying efforts could influence the final rates for corporate taxes, individual income tax brackets, or specific deductions. Understanding the influence of these lobbies is crucial in predicting the final legislation's outcome.

Public Opinion and Economic Concerns:

Public sentiment and economic forecasts play a crucial role in determining the political viability of Trump's tax cuts. Negative public reaction or gloomy economic projections could significantly impact the legislation's chances of success.

Public Sentiment Towards Tax Cuts:

Public opinion polls reveal a mixed reaction to the proposed tax cuts. While some segments of the population support them, others harbor significant concerns.

- Public Approval/Disapproval: [Insert data from relevant polls showcasing public approval/disapproval rates]. These figures vary considerably depending on the specific provisions and the demographic group surveyed.

- Public Backlash: Specific provisions, such as those benefiting high-income earners or large corporations, may face significant public backlash, potentially influencing lawmakers' votes.

- Influence on Lawmakers: Negative public opinion could put pressure on lawmakers, particularly those facing re-election, to reconsider their support for the tax cuts.

Economic Projections and Potential Impact:

Economic experts offer diverse projections regarding the potential impact of the tax cuts. These divergent views highlight the uncertainties surrounding the legislation's long-term economic consequences.

- Varying Economic Predictions: Some economists predict that the cuts will boost economic growth, leading to job creation and increased investment. Others warn of increased budget deficits and exacerbation of income inequality.

- Impact on Budget Deficits and National Debt: The tax cuts are expected to significantly increase the national debt. The magnitude of this increase is a major point of contention, with differing estimates from various economic models.

- Stimulus vs. Inequality: The debate centers on whether the tax cuts will stimulate sufficient economic growth to offset their cost or whether they will disproportionately benefit the wealthy, widening the gap between rich and poor.

Procedural Challenges in Congress:

Navigating the complexities of the legislative process presents significant challenges to the passage of Trump's tax cuts. The Senate's unique rules and the need for bipartisan support pose considerable hurdles.

Senate Filibuster and Necessary Votes:

The Senate's filibuster rule requires a supermajority (60 votes) to overcome procedural obstacles. This poses a significant challenge for Republicans, who may need Democratic support to pass the legislation.

- Votes Needed: A simple majority (51 votes) is needed to pass the tax cuts in the House, but 60 votes are needed in the Senate to avoid a filibuster.

- Bipartisan Support: The likelihood of achieving bipartisan support is slim, given the deep partisan divisions surrounding the tax cuts. Republicans may need to rely on procedural maneuvers to circumvent the filibuster.

- Republican Strategies: To overcome these challenges, Republicans may employ strategies such as using the budget reconciliation process, which requires only a simple majority. However, this approach limits the scope of changes that can be made.

Negotiations and Potential Amendments:

The legislative process involves negotiations and potential amendments, which can significantly alter the bill's final form. These amendments could either strengthen or weaken the legislation.

- Areas for Compromise: Areas of potential compromise may include modifications to specific tax rates, deductions, or the inclusion of provisions aimed at mitigating the negative economic impacts.

- Impact of Amendments: Amendments could either broaden the scope of tax cuts, possibly making them more appealing to moderate Republicans and even some Democrats, or narrow the scope, potentially making them less effective.

- Effect on Overall Success: The success of the legislation hinges on the ability of Republican leadership to negotiate effectively, build consensus, and manage the amendment process skillfully.

Conclusion:

The future of Trump's tax cuts remains uncertain, dependent on navigating treacherous internal divisions within the GOP, overcoming public concerns, and successfully maneuvering the complex legislative process in Congress. While the Republicans hold power, internal disagreements and potentially negative economic forecasts pose significant threats to the bill's passage. Further analysis of evolving public opinion and legislative developments will be crucial in determining whether these ambitious tax cuts ultimately become law. Stay informed on the latest developments regarding Trump's tax cuts and their potential impact. Understanding the intricacies of Trump's tax cuts and their potential consequences is crucial for informed participation in the ongoing national conversation.

Featured Posts

-

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Gids Naar Succes

May 22, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Gids Naar Succes

May 22, 2025 -

The Funniest White House Moments Trump The Irish Pm And Jd Vances Socks

May 22, 2025

The Funniest White House Moments Trump The Irish Pm And Jd Vances Socks

May 22, 2025 -

Plan Your Trip The Official Peppa Pig Theme Park Texas Guide

May 22, 2025

Plan Your Trip The Official Peppa Pig Theme Park Texas Guide

May 22, 2025 -

Thang 6 Nay Khoi Cong Xay Dung Cau Ma Da Hien Thuc Hoa Ket Noi Dong Nai Binh Phuoc

May 22, 2025

Thang 6 Nay Khoi Cong Xay Dung Cau Ma Da Hien Thuc Hoa Ket Noi Dong Nai Binh Phuoc

May 22, 2025 -

Dutch Central Bank To Investigate Abn Amro For Bonus Practices

May 22, 2025

Dutch Central Bank To Investigate Abn Amro For Bonus Practices

May 22, 2025

Latest Posts

-

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025 -

Used Car Dealership Fire Crews On Scene

May 22, 2025

Used Car Dealership Fire Crews On Scene

May 22, 2025 -

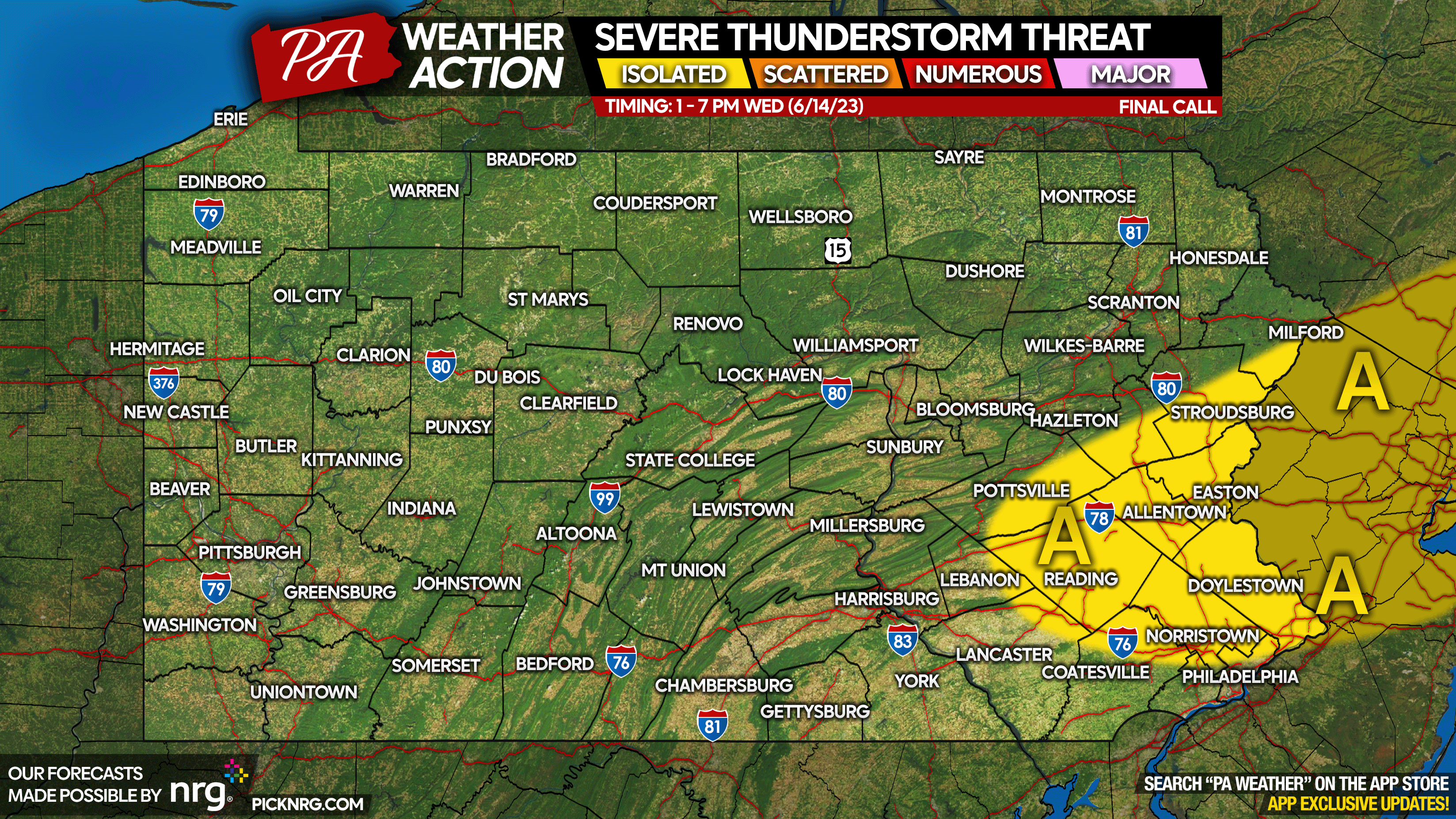

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025