Worries Over US Budget Fuel Stock Market Fall

Table of Contents

The Debt Ceiling Debate and its Market Impact

The US government's debt ceiling is a critical issue currently impacting investor sentiment and causing a stock market fall. The debt ceiling represents the legal limit on how much the US government can borrow to meet its existing obligations. The ongoing political debate surrounding raising this limit creates significant uncertainty. Failure to raise the debt ceiling could result in a catastrophic government default, an unprecedented event with potentially devastating consequences for the global economy.

- Increased risk of a government default: A default would severely damage the US's credit rating, increasing borrowing costs and potentially triggering a financial crisis.

- Potential negative impact on credit rating: A downgrade in the US credit rating would ripple through global financial markets, impacting investor confidence and increasing borrowing costs for businesses and consumers.

- Uncertainty leading to decreased investment: The ongoing uncertainty surrounding the debt ceiling discourages investment, as businesses and individuals hesitate to commit capital in a climate of such high risk.

- Examples of past debt ceiling crises and their market effects: Past debt ceiling debates have resulted in periods of market volatility and negative growth. The threat of default itself is enough to unsettle markets, as seen in previous near-misses.

The current situation highlights the critical link between the US budget, political maneuvering, and stock market performance. The uncertainty surrounding the debt ceiling is a major driver of the recent stock market fall.

Government Spending and Inflationary Pressures

Increased government spending plays a significant role in fueling inflationary pressures, which in turn negatively impacts the stock market. When the government spends more than it earns through taxation, it can lead to an increase in the money supply, driving up prices and reducing the purchasing power of the dollar. This inflation erodes investor confidence and diminishes the value of corporate profits.

- Analysis of current inflation rates and projections: Current inflation rates remain elevated, and projections vary, but the trend is a key factor affecting investor sentiment and the stock market.

- The impact of inflation on corporate profits: Rising inflation increases production costs for businesses, potentially squeezing profit margins and decreasing stock valuations.

- How the Federal Reserve might respond to inflationary pressures: The Federal Reserve's response, often involving raising interest rates, further impacts stock market performance, potentially slowing economic growth to combat inflation.

- Examples of historical periods of high inflation and their effect on markets: History shows that sustained high inflation typically leads to lower stock market returns and increased market volatility.

The relationship between government spending, inflation, and the US budget is directly impacting investor confidence and fueling the stock market fall.

Potential Government Shutdown and its Economic Fallout

A potential government shutdown further exacerbates the situation, adding another layer of uncertainty to an already volatile market. A shutdown disrupts essential government services, impacting various sectors of the economy and dampening consumer confidence.

- Disruption to government services: A shutdown disrupts vital services, creating uncertainty and impacting businesses that rely on government contracts or funding.

- Negative impact on consumer confidence: Uncertainty about the government's ability to function effectively decreases consumer confidence, leading to reduced spending and economic slowdown.

- Potential delays in infrastructure projects: Government shutdowns often delay crucial infrastructure projects, hindering economic growth and development.

- Uncertainty and its impact on business investment: Businesses are hesitant to invest in a climate of uncertainty, further exacerbating the economic downturn and contributing to the stock market fall.

The threat of a government shutdown adds to the existing anxieties surrounding the US budget and contributes significantly to the stock market's decline.

Investor Response and Market Strategies

Investors are reacting to the current environment by shifting their strategies to mitigate risk and seek safer assets.

- Increased demand for safe-haven assets (e.g., gold, bonds): Investors are flocking to safe-haven assets perceived as less vulnerable to market fluctuations.

- Shift in investment strategies to reduce risk: Many investors are adopting more conservative strategies, focusing on risk reduction over high returns.

- Potential opportunities for savvy investors: While risky, some investors see potential opportunities in undervalued stocks and sectors less affected by budget concerns.

- Advice for individual investors: Individual investors should consult financial advisors and carefully consider their risk tolerance before making investment decisions.

The current market environment requires a cautious approach and thoughtful risk management.

Conclusion: Navigating the Stock Market Amidst US Budget Worries

The stock market fall is largely attributable to the confluence of several factors related to the US budget: the debt ceiling debate, unsustainable government spending leading to inflationary pressures, and the looming threat of a government shutdown. These factors combine to create significant uncertainty, impacting investor confidence and fueling market volatility. The interplay between the US budget and the stock market is undeniable, creating a challenging environment for investors. The potential long-term implications of these issues are significant, warranting close monitoring and informed decision-making. Stay informed about developments regarding the US budget and its impact on the stock market. Careful monitoring and informed decision-making are crucial to navigate this period of uncertainty and mitigate potential losses in the face of a possible US budget crisis and subsequent stock market fall.

Featured Posts

-

Understanding The Big Rig Rock Report 3 12 97 1 Double Q Data

May 23, 2025

Understanding The Big Rig Rock Report 3 12 97 1 Double Q Data

May 23, 2025 -

Grand Ole Oprys Historic London Show Royal Albert Hall Broadcast Details

May 23, 2025

Grand Ole Oprys Historic London Show Royal Albert Hall Broadcast Details

May 23, 2025 -

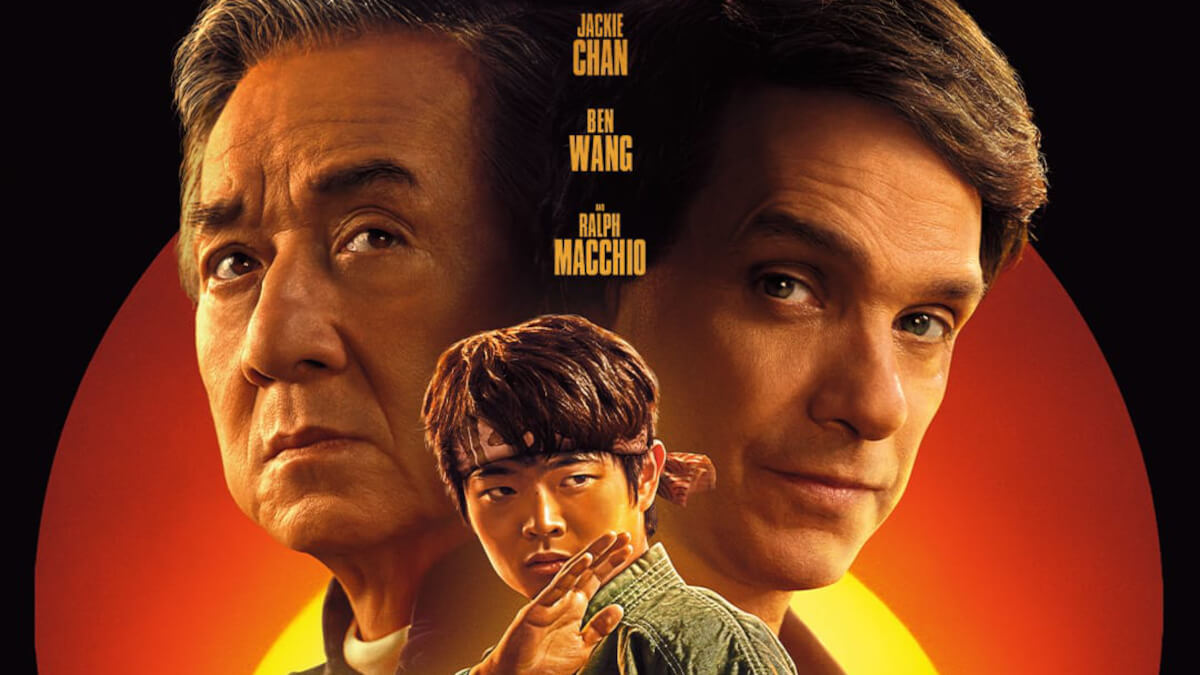

The Return Of Ralph Macchio Karate Kid 6 And Potential Film Revivals

May 23, 2025

The Return Of Ralph Macchio Karate Kid 6 And Potential Film Revivals

May 23, 2025 -

Big Rig Rock Report 3 12 Laser 101 7 A Comprehensive Guide

May 23, 2025

Big Rig Rock Report 3 12 Laser 101 7 A Comprehensive Guide

May 23, 2025 -

Increased Bt Profits A Result Of Johnson Mattheys Strategic Move

May 23, 2025

Increased Bt Profits A Result Of Johnson Mattheys Strategic Move

May 23, 2025

Latest Posts

-

Did Eric Andre Turn Down Kieran Culkin For A Role

May 23, 2025

Did Eric Andre Turn Down Kieran Culkin For A Role

May 23, 2025 -

Revenirea Lui Andrew Tate Din Dubai O Noua Provocare

May 23, 2025

Revenirea Lui Andrew Tate Din Dubai O Noua Provocare

May 23, 2025 -

Pivdenniy Mist Detali Remontu Pidryadniki Ta Finansuvannya

May 23, 2025

Pivdenniy Mist Detali Remontu Pidryadniki Ta Finansuvannya

May 23, 2025 -

Eric Andre Rejected Kieran Culkin For A Real Pain Role

May 23, 2025

Eric Andre Rejected Kieran Culkin For A Real Pain Role

May 23, 2025 -

Remont Pivdennogo Mostu Khto Yak Ta Skilki Koshtuye

May 23, 2025

Remont Pivdennogo Mostu Khto Yak Ta Skilki Koshtuye

May 23, 2025