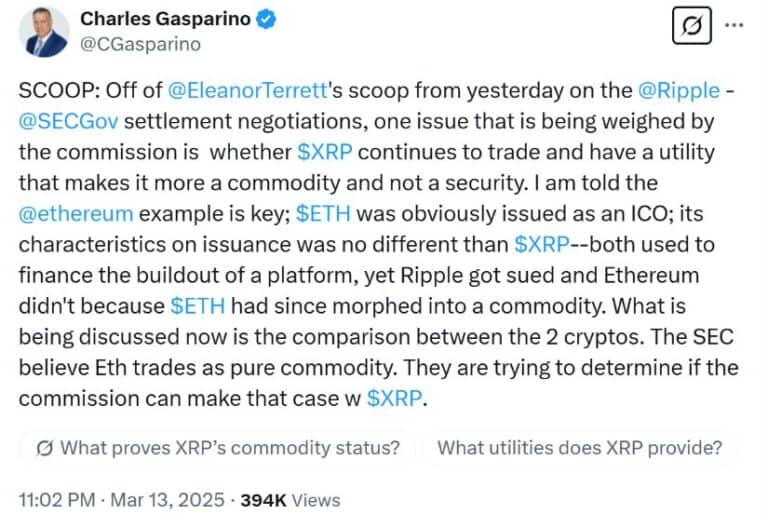

XRP As A Commodity: Potential Outcome Of Ripple-SEC Settlement Talks

Table of Contents

Potential Outcomes of the Ripple-SEC Settlement

The Ripple-SEC case could conclude in several ways, each with drastically different consequences for XRP and its investors.

XRP Classified as a Commodity

This outcome would be incredibly bullish for XRP. Increased regulatory clarity would likely lead to greater adoption by exchanges and institutional investors, who have largely remained hesitant due to the ongoing legal uncertainty. The reduced risk profile would attract a wider range of investors, potentially triggering a significant price appreciation.

- Increased liquidity in the XRP market: More exchanges would list XRP, leading to increased trading volume and tighter spreads.

- Reduced risk for investors: The legal uncertainty surrounding XRP would be eliminated, making it a more attractive investment.

- Greater accessibility for global trading: Reduced regulatory barriers would open up new markets for XRP trading.

XRP Classified as a Security (Partial or Full)

A ruling classifying XRP as a security, either partially or fully, would severely impact XRP's price and trading volume. Restrictions on trading in certain jurisdictions are highly probable, potentially leading to delisting from major exchanges. This scenario carries substantial risk for investors.

- Significant price decline: The market reaction would likely be negative, leading to a considerable drop in XRP's value.

- Reduced investor confidence: The uncertainty and potential legal ramifications would erode trust in XRP.

- Legal ramifications for past XRP investors: Those who acquired XRP before the ruling could face legal challenges depending on the specifics of the ruling.

Settlement with Partial Restrictions

A compromise scenario might see some aspects of XRP's distribution deemed securities, while others are not. This outcome presents significant complexity and uncertainty, likely resulting in a mixed market reaction.

- Gradual increase in price if restrictions are minimal: If the restrictions are limited and manageable, the price could gradually recover.

- Ongoing legal uncertainty and volatility: The lack of complete clarity would likely maintain price volatility.

- Requirement for ongoing compliance: Ripple and other entities involved would need to comply with ongoing regulatory requirements, adding further complexity.

Impact on the XRP Market and Investors

The Ripple-SEC settlement will significantly impact various aspects of the XRP market and its investors.

Price Volatility

The settlement's outcome will dramatically impact XRP's price volatility in the short term. A positive outcome could lead to a significant price surge, while a negative one could cause a sharp decline. Understanding this potential for dramatic price swings is vital for risk management.

Investor Sentiment

A positive settlement leading to commodity classification could restore investor confidence, attracting new investment and potentially driving price appreciation. Conversely, a negative ruling could severely damage investor sentiment, leading to further price drops and decreased market activity.

Regulatory Implications

The ruling will significantly affect how other cryptocurrencies are regulated globally. A clear ruling on XRP's classification could set a precedent for future regulatory decisions concerning other digital assets.

Exchange Listings

The settlement will determine whether exchanges will continue listing XRP. Exchanges might delist XRP if it is classified as a security in their jurisdictions, limiting trading opportunities.

Analyzing the Ripple-SEC Case and its Precedents

Understanding the Ripple-SEC case requires analyzing past legal cases impacting cryptocurrencies. The SEC's argument centers on whether XRP was sold as an unregistered security, focusing on the Howey Test. Ripple's defense emphasizes XRP's decentralized nature and its use as a payment tool.

- Comparison of similar cases: Examining previous SEC actions against other crypto projects provides valuable context.

- Historical price movements following significant regulatory events: Studying past market reactions to regulatory news can offer insights into potential price movements.

- Analysis of legal experts' opinions on the case: Understanding the perspectives of legal professionals helps gauge the possible outcomes.

Conclusion

The Ripple-SEC settlement will undoubtedly be a pivotal moment for the cryptocurrency market, particularly for XRP. The classification of XRP as a commodity or security carries massive implications for its price, trading volume, and overall future. Whether the result is bullish or bearish, understanding the potential outcomes is crucial for investors navigating the complexities of this evolving regulatory landscape. Stay informed on the latest developments in the Ripple-SEC case and analyze the potential impact on your XRP investment strategy. Keep researching XRP as a commodity and its potential to stay ahead of the curve.

Featured Posts

-

Fortnite Item Shop Update A Disappointment For Many Fans

May 02, 2025

Fortnite Item Shop Update A Disappointment For Many Fans

May 02, 2025 -

Bharty Hkwmt Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Shdyd Ahtjaj

May 02, 2025

Bharty Hkwmt Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Shdyd Ahtjaj

May 02, 2025 -

Loyle Carner New Album Glastonbury Festival And Reflections On Fatherhood

May 02, 2025

Loyle Carner New Album Glastonbury Festival And Reflections On Fatherhood

May 02, 2025 -

Ponant Agent Program Earn 1 500 Flight Credit Selling Paul Gauguin Cruises

May 02, 2025

Ponant Agent Program Earn 1 500 Flight Credit Selling Paul Gauguin Cruises

May 02, 2025 -

Bbcs Celebrity Traitors Hit By Star Withdrawals

May 02, 2025

Bbcs Celebrity Traitors Hit By Star Withdrawals

May 02, 2025

Latest Posts

-

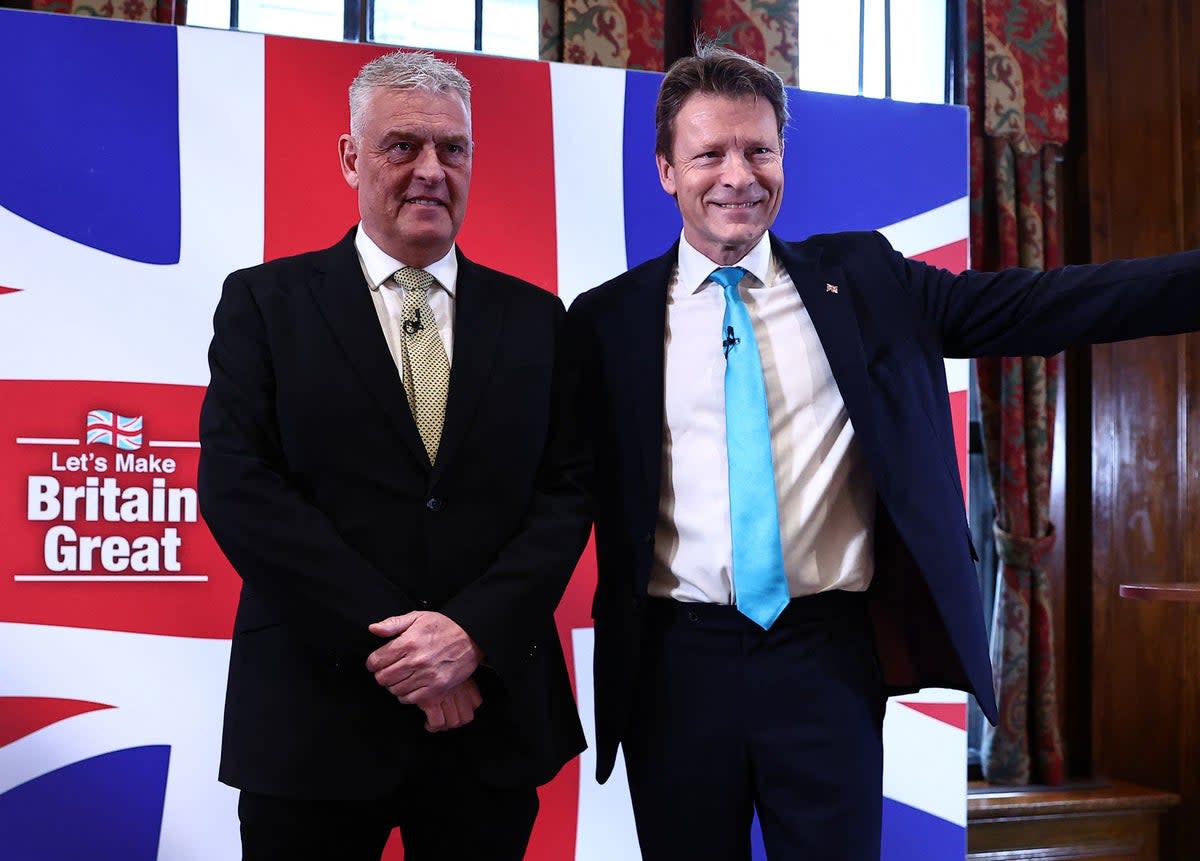

Lee Anderson Celebrates Major Political Win With Councillor Defection

May 03, 2025

Lee Anderson Celebrates Major Political Win With Councillor Defection

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025 -

Drone Attack On Ship Carrying Aid To Gaza Ngo Statement

May 03, 2025

Drone Attack On Ship Carrying Aid To Gaza Ngo Statement

May 03, 2025 -

Activist Aid Ship To Gaza Hit By Drone Strikes Ngo

May 03, 2025

Activist Aid Ship To Gaza Hit By Drone Strikes Ngo

May 03, 2025