XRP Investment Analysis: Assessing The 400% Price Increase

Table of Contents

Factors Contributing to the 400% XRP Price Increase

Several interconnected factors contributed to XRP's impressive price rally. Understanding these elements is crucial for any thorough XRP investment analysis.

Ripple's Legal Victory

The partial victory for Ripple Labs in its lawsuit against the Securities and Exchange Commission (SEC) significantly impacted XRP's price. The court's ruling, declaring that XRP sales on exchanges did not constitute unregistered securities offerings, boosted investor sentiment and market confidence. This positive legal development reduced regulatory uncertainty, a major concern for many investors previously hesitant to engage with XRP. However, it's crucial to note that the legal battle isn't entirely over, and future appeals could still influence XRP's price.

- Increased trading volume: The news spurred a massive influx of trading activity, pushing the price upwards.

- Positive media coverage: Favorable news coverage amplified the positive sentiment surrounding XRP, attracting more investors.

- Reduced regulatory uncertainty: The partial victory lessened the regulatory overhang, making XRP a more attractive investment for risk-averse investors.

Increased Institutional Adoption

Beyond the legal win, growing institutional interest in XRP played a significant role in its price surge. Several factors contributed to this increased adoption:

- Growing use in cross-border payments: XRP's speed and low transaction costs make it attractive for facilitating international payments, a key area of focus for Ripple.

- Integration into payment platforms: Ripple's technology is increasingly integrated into various financial platforms, expanding XRP's utility and reach.

- Strategic partnerships: Ripple continues to forge strategic partnerships with financial institutions globally, further boosting XRP's credibility and adoption. Examples include collaborations with major banks and payment providers.

Market Speculation and FOMO (Fear Of Missing Out)

The rapid price increase wasn't solely driven by fundamentals. Market speculation and FOMO played a significant role. Social media chatter and news articles amplified the price movement, creating a self-fulfilling prophecy. Retail investors, fearing they would miss out on potential gains, flocked to the market, further driving up demand and price. This speculative buying, however, also increases the risk of a market correction.

- Social media trends: Positive sentiment and hype on platforms like Twitter and Reddit contributed to increased buying pressure.

- News articles: Extensive media coverage of the Ripple lawsuit and XRP's price surge fueled further speculation.

- Increased trading volume from retail investors: A surge in trading activity from retail investors amplified the price movement.

Analyzing the Sustainability of the XRP Price Increase

Determining the long-term sustainability of XRP's price increase requires a careful analysis of both technical and fundamental factors.

Technical Analysis

Technical analysis of XRP's price charts reveals some insights, but it's crucial to remember that it is not foolproof. Examining indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and identifying chart patterns like head and shoulders or triangles can provide clues about potential future price movements. High trading volume accompanying the price increase suggests strong momentum, but this momentum could be unsustainable if fueled primarily by speculation.

Fundamental Analysis

A comprehensive XRP investment analysis must also consider fundamental factors. XRP's value proposition rests on its utility in facilitating cross-border payments. Ripple's technology, characterized by its speed, scalability, and low transaction fees, provides a competitive advantage. However, the competitive landscape is dynamic, with other cryptocurrencies and payment solutions vying for market share. A thorough assessment of Ripple's business model, partnerships, and overall market position is essential.

Risk Assessment

Investing in XRP involves significant risk. Regulatory uncertainty, though lessened by the Ripple court decision, still exists. The cryptocurrency market is inherently volatile, subject to sudden and unpredictable price swings. Technological risks, including potential security vulnerabilities, also exist. Diversification is crucial for managing risk. Investors should allocate only a portion of their portfolio to XRP, and never invest more than they can afford to lose.

- Regulatory risks: Future legal challenges or changes in regulations could negatively impact XRP's price.

- Market volatility: The cryptocurrency market is known for its high volatility, leading to potentially significant losses.

- Technological risks: Technological advancements or security breaches could negatively impact XRP's functionality.

- Security risks: Holding XRP on exchanges or in poorly secured wallets exposes investors to security risks.

Conclusion

The 400% price surge in XRP is a complex event driven by a confluence of factors, including Ripple's legal victory, increased institutional adoption, and market speculation. While the sustainability of this price increase remains uncertain, a thorough XRP investment analysis requires a balanced assessment of both technical and fundamental factors, coupled with a keen awareness of inherent risks. Investors should conduct their own due diligence and consider their risk tolerance before making any investment decisions. Remember, thorough research is key before engaging in any XRP investment analysis and remember that past performance is not indicative of future results.

Featured Posts

-

Rihannas Surprise Pregnancy Reveal At The Met Gala

May 07, 2025

Rihannas Surprise Pregnancy Reveal At The Met Gala

May 07, 2025 -

Jenna Ortega And Glen Powells Film What We Know So Far

May 07, 2025

Jenna Ortega And Glen Powells Film What We Know So Far

May 07, 2025 -

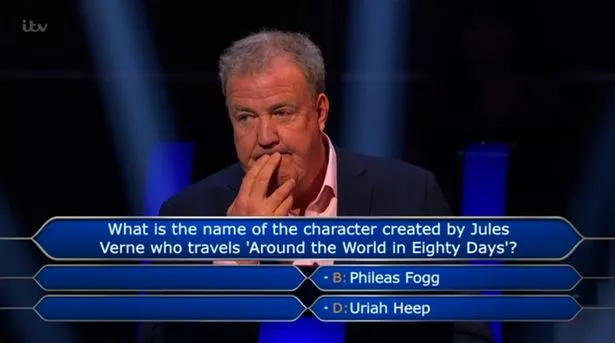

Who Wants To Be A Millionaire Fan Outrage Contestant Wastes Lifelines On Simple Question

May 07, 2025

Who Wants To Be A Millionaire Fan Outrage Contestant Wastes Lifelines On Simple Question

May 07, 2025 -

Analyzing The 2025 Nhl Draft Lottery Impact On The Utah Hockey Club

May 07, 2025

Analyzing The 2025 Nhl Draft Lottery Impact On The Utah Hockey Club

May 07, 2025 -

Chinese Stock Market Shows Strength After Recent Setback Us Talks And Data In Focus

May 07, 2025

Chinese Stock Market Shows Strength After Recent Setback Us Talks And Data In Focus

May 07, 2025

Latest Posts

-

Neymar En Prelista De Brasil Regreso Ante Argentina

May 08, 2025

Neymar En Prelista De Brasil Regreso Ante Argentina

May 08, 2025 -

Sergio Hernandez Rumbo Al Flamengo Como Entrenador

May 08, 2025

Sergio Hernandez Rumbo Al Flamengo Como Entrenador

May 08, 2025 -

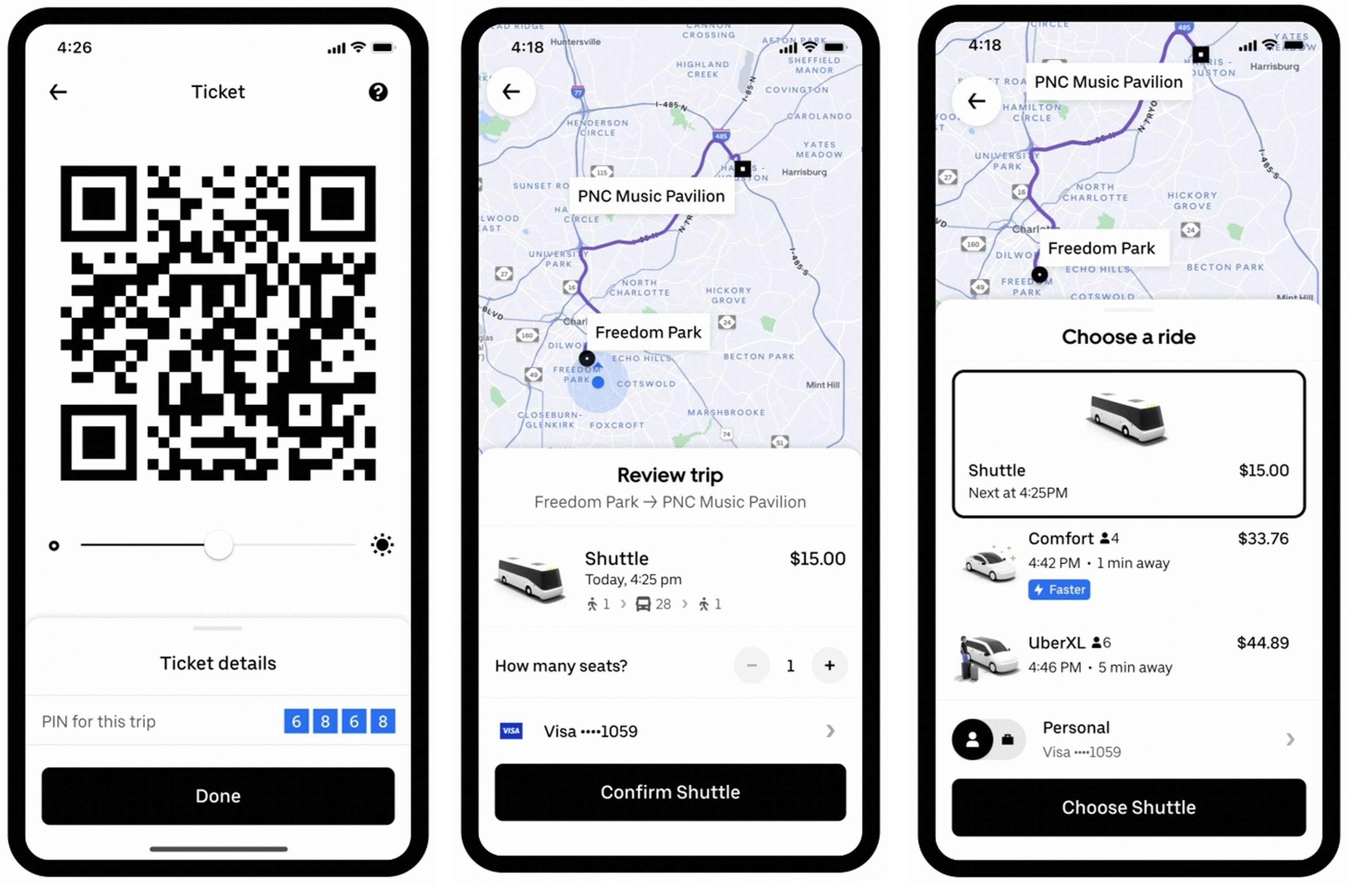

New Uber Shuttle Option Offers Fans Cheap Rides From United Center

May 08, 2025

New Uber Shuttle Option Offers Fans Cheap Rides From United Center

May 08, 2025 -

El Flamengo Presenta A Sergio Hernandez Como Su Nuevo Dt

May 08, 2025

El Flamengo Presenta A Sergio Hernandez Como Su Nuevo Dt

May 08, 2025 -

5 Uber Shuttle Service Now Available For United Center Events

May 08, 2025

5 Uber Shuttle Service Now Available For United Center Events

May 08, 2025