XRP News: SEC Commodity Classification And Regulatory Uncertainty

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP

The SEC alleges that Ripple conducted an unregistered securities offering of XRP, violating federal securities laws. Their argument rests on the claim that XRP sales constituted an investment contract, where investors purchased XRP with the expectation of profit generated primarily through Ripple's efforts. The SEC's key allegations against Ripple Labs include:

- Unregistered securities offering: The SEC contends that Ripple's distribution of XRP to institutional and individual investors constituted an unregistered securities offering, bypassing crucial investor protection mechanisms.

- Violation of federal securities laws: Ripple is accused of violating Section 5 of the Securities Act of 1933, which requires registration of securities offerings before public sale.

- Potential penalties and fines: If the SEC prevails, Ripple could face substantial penalties, fines, and potentially even criminal charges.

- Impact on XRP price and trading volume: The ongoing litigation has significantly impacted XRP's price volatility and trading volume, creating a climate of uncertainty for investors.

Understanding the "Howey Test" and its Application to XRP

The SEC's case hinges on the "Howey Test," a legal framework used to determine whether an asset qualifies as a security. The Howey Test comprises four elements:

- Investment of money: Did investors provide capital?

- Common enterprise: Was there a common investment scheme?

- Expectation of profits: Did investors anticipate profits primarily from the efforts of others?

- Solely from the efforts of others: Was the profit derived from the efforts of a promoter or third party rather than the investor's own efforts?

The SEC argues that XRP satisfies all four prongs of the Howey Test, claiming investors purchased XRP expecting profits derived primarily from Ripple's efforts to increase XRP's value and adoption. Ripple, however, counters that XRP functions as a currency, not a security, and that it's primarily used for transactions on its network. They argue that the decentralized nature of XRP and its widespread usage negate the "efforts of others" element of the Howey Test.

Regulatory Uncertainty and its Impact on XRP Investors and Exchanges

The uncertainty surrounding XRP's regulatory status creates significant challenges for investors and exchanges. This uncertainty impacts:

- Holding, buying, and selling XRP: Investors face considerable risk in holding, buying, or selling XRP due to the potential for further regulatory action or significant price fluctuations.

- Delisting from exchanges: Several exchanges have delisted or restricted trading of XRP to mitigate potential legal risks.

- Trading restrictions: Trading restrictions on XRP vary across different exchanges, further complicating the situation for investors.

- Investor risk and uncertainty: The ongoing legal battle has resulted in significant investor anxiety and uncertainty about the future of XRP.

- Impact on XRP's market capitalization: The uncertainty has negatively affected XRP's market capitalization and overall standing in the cryptocurrency market.

Potential Outcomes of the Ripple Case and their Implications for the Future of XRP

Several outcomes are possible in the Ripple vs. SEC lawsuit:

- SEC victory: A SEC victory could severely damage Ripple, potentially leading to significant fines, restrictions on XRP operations, and a further decline in XRP's price. It could also set a precedent for the regulation of other cryptocurrencies.

- Ripple victory: A Ripple victory would likely boost XRP's price and potentially influence future cryptocurrency regulations, suggesting a more favorable regulatory environment for cryptocurrencies.

- Settlement: A settlement between Ripple and the SEC is also possible, with terms that could significantly impact XRP's future. The terms of a settlement would likely influence future market behavior and regulatory interpretations.

- Long-term implications for XRP adoption and usage: The outcome of the case will undoubtedly shape the long-term adoption and usage of XRP, impacting its role in the payment processing sector and broader crypto market.

Conclusion: Staying Informed on XRP News and Regulatory Developments

The SEC's classification of XRP as a security and the ongoing regulatory uncertainty surrounding it present significant challenges for investors. Understanding the SEC's case against Ripple, the application of the Howey Test, and the potential outcomes of the lawsuit is crucial for navigating this complex situation. Staying informed about XRP regulatory updates, the SEC's XRP classification, and the future of XRP regulation is paramount. Keep abreast of the latest XRP news and navigate the complexities of the SEC commodity classification by regularly checking for updates from reputable news sources and legal experts.

Featured Posts

-

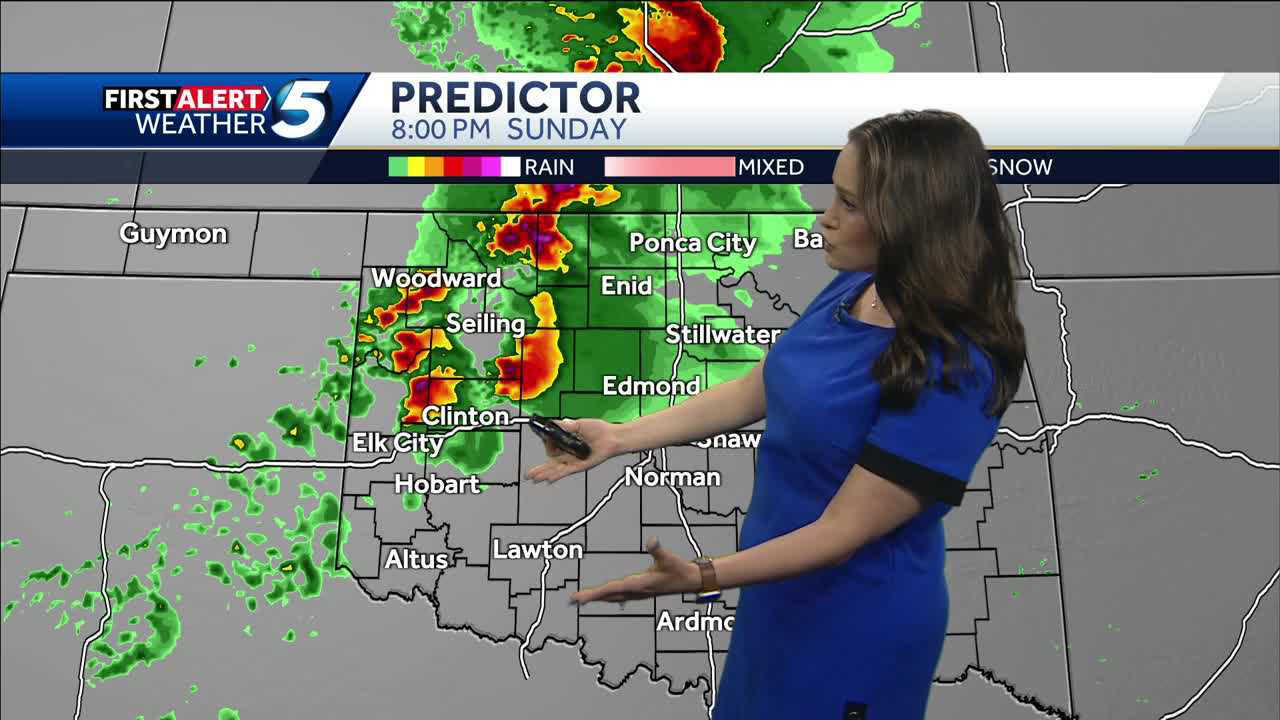

Severe Weather Timeline Strong Winds Impacting Oklahoma

May 02, 2025

Severe Weather Timeline Strong Winds Impacting Oklahoma

May 02, 2025 -

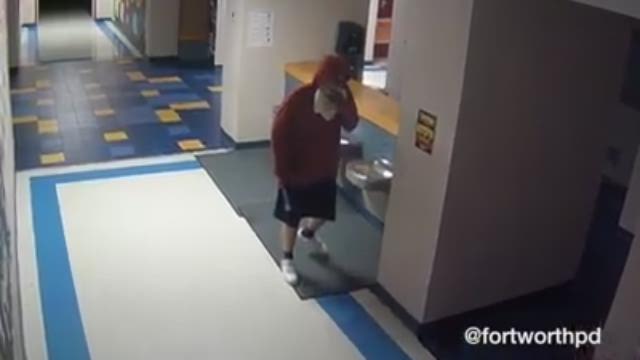

Consequences Of Fragmenting The Keller School District

May 02, 2025

Consequences Of Fragmenting The Keller School District

May 02, 2025 -

Hans Resignation Paving The Way For A South Korean Presidential Run

May 02, 2025

Hans Resignation Paving The Way For A South Korean Presidential Run

May 02, 2025 -

Indias Rail Network Expands To Kashmir Inaugural Train Details

May 02, 2025

Indias Rail Network Expands To Kashmir Inaugural Train Details

May 02, 2025 -

Endonezya Ve Tuerkiye Stratejik Ortaklik Anlasmalarinin Detaylari

May 02, 2025

Endonezya Ve Tuerkiye Stratejik Ortaklik Anlasmalarinin Detaylari

May 02, 2025

Latest Posts

-

Sydney Harbour Activity Concerns Rise Over Growing Number Of Chinese Vessels

May 03, 2025

Sydney Harbour Activity Concerns Rise Over Growing Number Of Chinese Vessels

May 03, 2025 -

Hjwm Israyyly Ela Sfynt Astwl Alhryt Tfasyl Jdydt En Alhsar Ela Ghzt

May 03, 2025

Hjwm Israyyly Ela Sfynt Astwl Alhryt Tfasyl Jdydt En Alhsar Ela Ghzt

May 03, 2025 -

Chinese Ships Near Sydney Increased Presence Prompts Australian Concerns

May 03, 2025

Chinese Ships Near Sydney Increased Presence Prompts Australian Concerns

May 03, 2025 -

Australian Officials Respond To Growing Number Of Chinese Ships Spotted Near Sydney

May 03, 2025

Australian Officials Respond To Growing Number Of Chinese Ships Spotted Near Sydney

May 03, 2025 -

Increased Chinese Ship Sightings Near Sydney A Growing Trend

May 03, 2025

Increased Chinese Ship Sightings Near Sydney A Growing Trend

May 03, 2025