XRP Price Prediction: Should You Invest Below $3?

Table of Contents

XRP, or Ripple, is a cryptocurrency designed to facilitate seamless cross-border payments. Operating within the Ripple ecosystem, it boasts a significant market capitalization and holds a considerable position amongst other cryptocurrencies. However, its price trajectory is far from predictable, influenced by a complex interplay of technical and fundamental factors. This article aims to dissect these factors and offer insights into whether a sub-$3 entry point represents a sound investment strategy.

Analyzing Current Market Conditions for XRP

Technical Analysis of XRP's Chart

Technical analysis provides valuable insights into potential price movements. By examining historical data, we can identify trends and predict future behavior. Key indicators help us gauge the momentum and potential direction of XRP's price.

- Support and Resistance Levels: Identifying key support and resistance levels on the XRP chart can help us anticipate potential price reversals or breakouts. A sustained break above a resistance level can signal bullish momentum, while a fall below a support level might indicate bearish pressure.

- Trading Volume: High trading volume accompanying price movements often confirms the strength of those movements. Low volume, on the other hand, can suggest a lack of conviction and a potential for price reversal.

- Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can help identify the overall trend. A bullish trend is typically signaled when the shorter-term moving average crosses above the longer-term moving average.

(Insert chart showing XRP's price with support/resistance levels, moving averages, RSI, MACD, and Bollinger Bands)

Other technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands provide additional insights into momentum and potential overbought or oversold conditions.

Fundamental Analysis of Ripple and XRP

Fundamental analysis focuses on the underlying value of XRP. This includes considering Ripple's ongoing legal battles, its partnerships, and the technological advancements within its ecosystem.

- Ripple's Legal Case with the SEC: The outcome of Ripple's legal battle with the Securities and Exchange Commission (SEC) significantly impacts XRP's price. A favorable ruling could lead to a price surge, while an unfavorable outcome could trigger a decline.

- Partnerships and Adoption: Ripple's partnerships with financial institutions are crucial for XRP's adoption. Wider adoption in cross-border payments strengthens XRP's utility and potentially increases its value.

- Technological Advancements: Continuous improvements in Ripple's technology, such as increased transaction speed and efficiency, enhance XRP's appeal and potential for future growth.

Factors Influencing Future XRP Price

Adoption and Utility of XRP

The increasing use of XRP in cross-border payments is a key factor influencing its future price. Wider adoption by financial institutions and businesses could significantly boost demand and drive price appreciation.

- Real-world use cases: Examples of businesses leveraging XRP for efficient and cost-effective international payments demonstrate its practical utility.

- Institutional adoption: Increased participation from institutional investors can lead to higher liquidity and price stability.

Regulatory Landscape and its Impact on XRP Price

The regulatory environment for cryptocurrencies is constantly evolving, and this uncertainty significantly impacts XRP's price.

- Regulatory clarity: Clearer regulations could potentially lead to increased investor confidence and higher prices.

- Varying regulatory approaches: Different regulatory approaches across jurisdictions can create uncertainty and volatility in XRP's price.

Market Sentiment and Speculation

Market sentiment and speculation play a crucial role in XRP's price volatility. News events, social media trends, and the actions of large investors significantly influence investor behavior.

- News and social media: Positive news often triggers price increases, while negative news can lead to price drops.

- Whale activity: Large holders ("whales") can significantly impact XRP's price through their buying and selling activities.

Risk Assessment: Investing in XRP Below $3

Potential Rewards and Risks

Investing in XRP below $3 presents both substantial rewards and considerable risks. The potential for high returns is undeniable, but volatility is inherent in cryptocurrency investments.

- High-reward, high-risk scenario: A successful resolution to Ripple's legal case and increased adoption could lead to substantial price appreciation.

- Downside potential: Negative regulatory developments or a decline in market sentiment could lead to significant price drops.

- Diversification: It's crucial to diversify your investment portfolio to mitigate risk.

Diversification Strategies

Diversification is a fundamental principle of sound investment management. Don't put all your eggs in one basket.

- Asset allocation: Spread your investments across different asset classes, including stocks, bonds, and other cryptocurrencies.

- Risk management: Develop a risk management plan that defines your investment goals and risk tolerance.

Conclusion: XRP Price Prediction: Should You Invest Below $3? – A Final Verdict

Predicting XRP's price with certainty is impossible. However, by analyzing current market conditions, assessing future influencing factors, and understanding the inherent risks, we can make a more informed decision. The potential for growth is substantial, driven by the utility of XRP in cross-border payments and the potential for increased adoption. However, the ongoing legal challenges and regulatory uncertainty introduce considerable risk. Whether investing in XRP below $3 is a viable option depends entirely on your risk tolerance and investment goals.

Before investing in XRP or any other cryptocurrency, conduct thorough research, consider professional financial advice, and understand the potential for both significant gains and substantial losses. Consider exploring different XRP investment strategies, studying XRP price forecasts, and asking yourself: Should you buy XRP? Ultimately, the decision rests with you.

Featured Posts

-

Death Of Dallas And Carrie Icon Daughter Amy Irvings Heartfelt Tribute

May 01, 2025

Death Of Dallas And Carrie Icon Daughter Amy Irvings Heartfelt Tribute

May 01, 2025 -

Enexis Slim Opladen In Noord Nederland Buiten De Piekuren

May 01, 2025

Enexis Slim Opladen In Noord Nederland Buiten De Piekuren

May 01, 2025 -

Frances Six Nations Triumph Mauvakas Mistakes And Lions Implications

May 01, 2025

Frances Six Nations Triumph Mauvakas Mistakes And Lions Implications

May 01, 2025 -

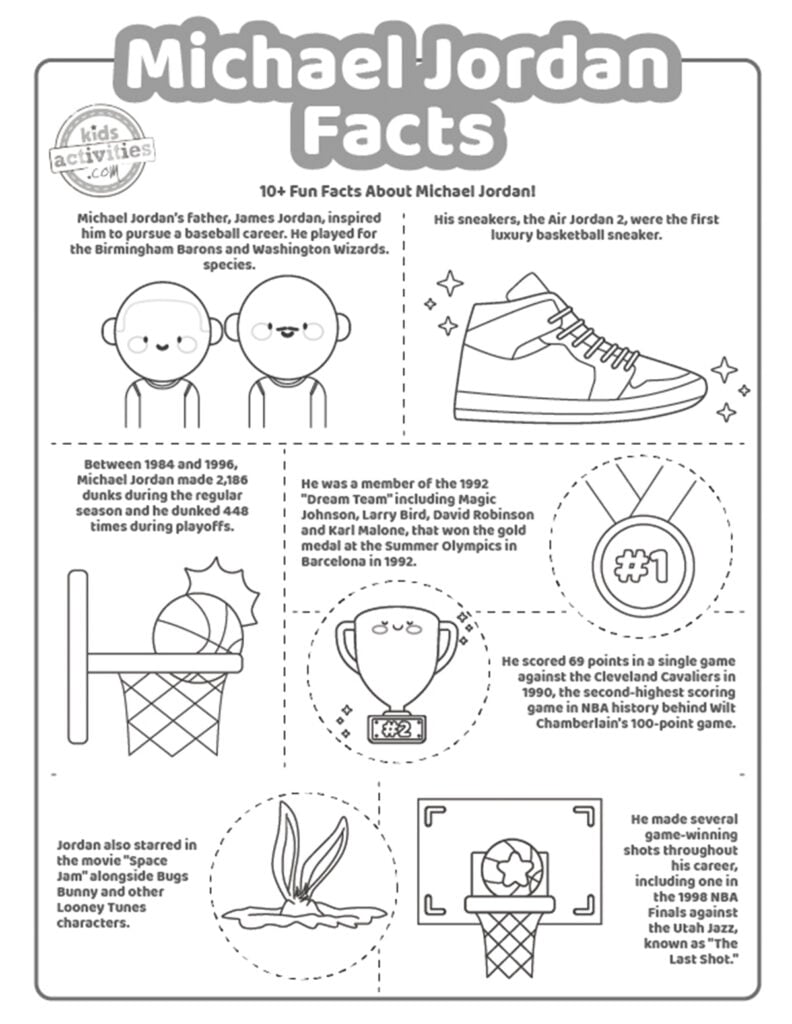

Understanding Michael Jordan Through Fast Facts

May 01, 2025

Understanding Michael Jordan Through Fast Facts

May 01, 2025 -

Difficult Economy Threatens Popular Indigenous Arts Festival

May 01, 2025

Difficult Economy Threatens Popular Indigenous Arts Festival

May 01, 2025

Latest Posts

-

Legendary Dallas Star Dies At Age 100

May 01, 2025

Legendary Dallas Star Dies At Age 100

May 01, 2025 -

Dallas Star Passes Away At 100

May 01, 2025

Dallas Star Passes Away At 100

May 01, 2025 -

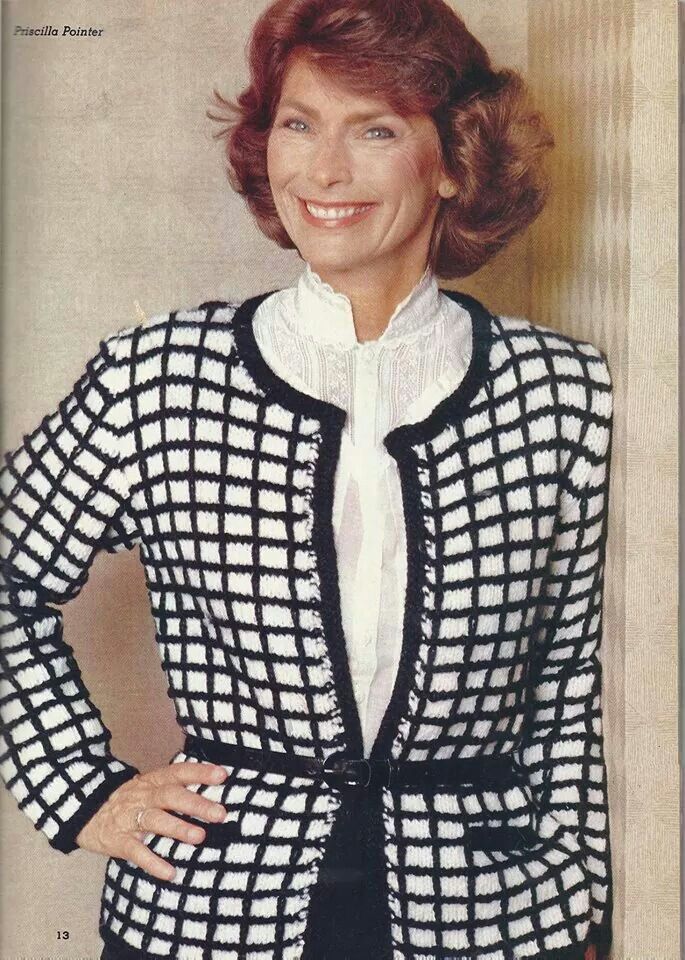

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025 -

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025 -

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025