XRP Price Recovery: Derivatives Market Slowdown

Table of Contents

The Role of Derivatives Markets in XRP Price Volatility

Understanding XRP Derivatives

XRP derivatives, like futures, options, and swaps, are contracts whose value is derived from the underlying XRP price. These instruments amplify price movements, offering traders leverage to magnify potential profits (and losses). This leverage increases both the upside and downside risk, contributing significantly to XRP's price volatility.

- Major XRP Derivatives Exchanges: Binance, BitMEX (although its future is uncertain), and OKEx are among the platforms offering XRP derivative trading.

- Common Trading Strategies: Traders use derivatives for hedging, speculation, and arbitrage, creating complex interactions that influence the overall XRP market.

- Risks Associated with XRP Derivatives: High leverage significantly increases the risk of substantial losses if the market moves against the trader's position. Understanding margin calls and liquidation is crucial.

Correlation Between Derivatives Volume and XRP Price

Historical data reveals a strong correlation between XRP derivatives trading volume and its price fluctuations. Increased trading volume often coincides with periods of higher price volatility, regardless of whether the price moves up or down.

- Increased Trading Activity & Price Impact: For instance, during periods of intense market speculation, a surge in XRP futures trading frequently led to dramatic price swings, both upward and downward.

- Examples: Examine charts showing the correlation between periods of high derivatives volume on Binance and corresponding spikes in XRP price volatility. A clear visual representation would highlight this relationship.

Recent Slowdown in XRP Derivatives Market Activity

Decreased Trading Volume and Open Interest

Recent data from major XRP derivatives exchanges indicates a noticeable decline in both trading volume and open interest. This slowdown suggests a decrease in overall market activity and a reduction in the number of outstanding derivative contracts.

- Data Sources: Analyzing data from platforms like CoinMarketCap, which tracks derivatives market data, will clearly show this trend.

- Charts Illustrating the Slowdown: Visual representations of trading volume and open interest over time will powerfully demonstrate the decrease in activity.

- Comparison with Previous Periods: Comparing this recent slowdown to previous periods of similar market conditions will provide context and help identify potential causes.

Potential Reasons for the Slowdown

Several factors might contribute to this decreased activity in the XRP derivatives market:

- Regulatory Uncertainty: Ongoing regulatory scrutiny surrounding cryptocurrencies, particularly in relation to Ripple's legal battles, has created uncertainty among investors, reducing their appetite for high-risk derivative trades.

- Market Sentiment Shifts: Changes in overall market sentiment, including bearish trends in the broader crypto market, may have led to reduced trading volume in XRP derivatives.

- Macroeconomic Factors: Global economic uncertainties, such as inflation and interest rate hikes, can influence investor risk tolerance, resulting in less activity in speculative markets like XRP derivatives.

- Lack of Significant Price Catalysts: Without major positive news or developments affecting XRP, investor interest in leveraging their positions through derivatives may wane.

Impact of Slowdown on XRP Price Recovery

Reduced Price Volatility

The reduced activity in the XRP derivatives market may contribute to less price volatility. With fewer leveraged trades amplifying price movements, the price of XRP might become more stable.

- Illustrative Examples: Show how periods of low derivatives volume have historically coincided with periods of lower price volatility for XRP.

- Reduced Leverage Effect: Explain how decreased leverage minimizes the impact of large trades, leading to a calmer price action.

Potential for Consolidation and Future Growth

The slowdown could signify a period of consolidation before a potential future price upswing. This period allows the market to absorb recent events and potentially lay the groundwork for a more sustainable growth trajectory.

- Arguments for This Perspective: Highlight potential positive factors, such as the ongoing Ripple legal case (a positive resolution could be bullish), technological advancements in XRP's utility, and increased adoption.

- Positive Factors: Mention factors that could spur future growth, such as increased institutional adoption and partnerships.

Risks and Uncertainties

Predicting XRP price movements is inherently risky. Focusing solely on the derivatives market provides an incomplete picture.

- Other Influencing Factors: Broader market conditions, regulatory announcements, and technological developments all play significant roles in XRP's price.

- Limitations of this Analysis: Acknowledge the limitations of analyzing only one aspect (derivatives market) of a complex market.

Conclusion: Navigating the XRP Price Recovery Landscape

The relationship between XRP price, derivatives market activity, and the recent slowdown is complex. While reduced derivatives trading may lead to less volatility, it doesn't guarantee a sustained price recovery. Other factors significantly influence XRP's future price trajectory. Stay informed about the evolving landscape of the XRP price recovery and the role of the derivatives market. Consider developing a robust XRP investment strategy based on thorough research and a diversified approach. Keep an eye on XRP price prediction analysis from reliable sources to navigate this dynamic market effectively.

Featured Posts

-

Counting Crows Slip Into The Rain Lyrics History And Cultural Significance

May 08, 2025

Counting Crows Slip Into The Rain Lyrics History And Cultural Significance

May 08, 2025 -

Predicting The Arsenal Vs Psg Champions League Semi Final

May 08, 2025

Predicting The Arsenal Vs Psg Champions League Semi Final

May 08, 2025 -

The Planet Star Wars Has Hidden For 48 Years Will We Finally See It

May 08, 2025

The Planet Star Wars Has Hidden For 48 Years Will We Finally See It

May 08, 2025 -

6 Million Awarded In Soulja Boy Sexual Assault Lawsuit

May 08, 2025

6 Million Awarded In Soulja Boy Sexual Assault Lawsuit

May 08, 2025 -

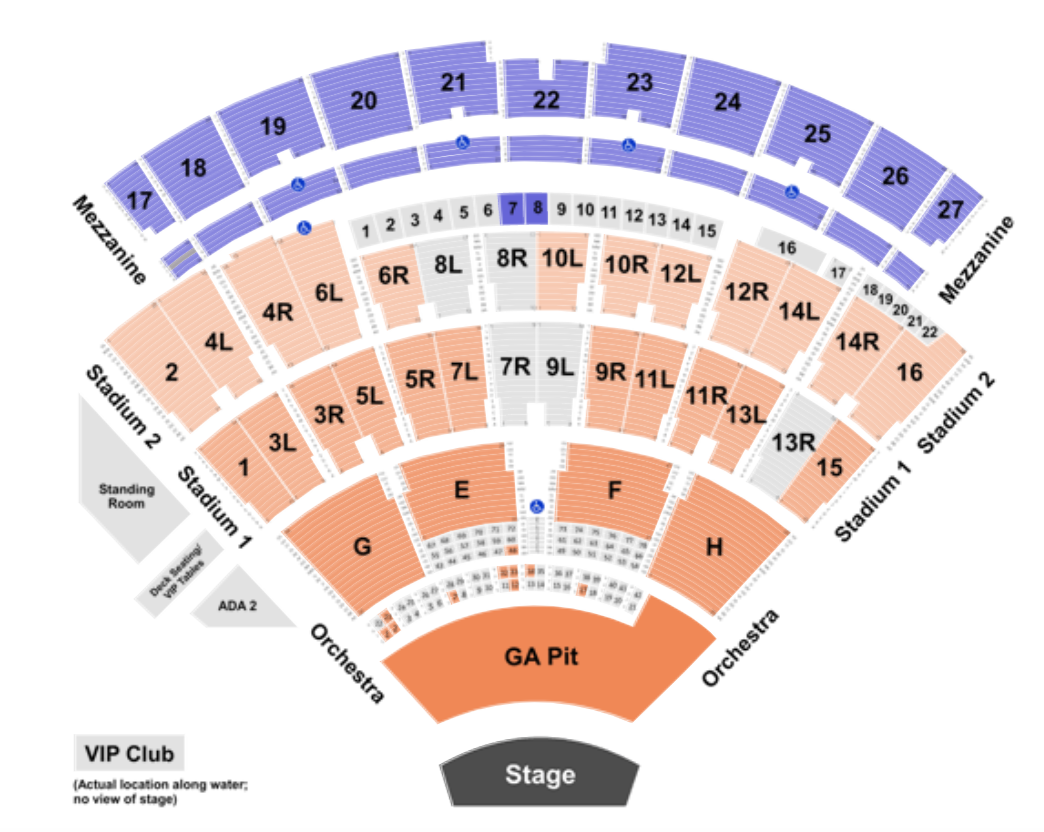

Cyndi Lauper And Counting Crows Jones Beach Concert Details

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Details

May 08, 2025