XRP Price Recovery: Derivatives Market Slows Momentum

Table of Contents

The Recent XRP Price Surge and its Drivers

The recent upward trend in XRP's price has been driven by a confluence of technical and fundamental factors. Understanding these is crucial to interpreting the current slowdown.

Technical Analysis of XRP Price Movement

Technical indicators have provided mixed signals.

- RSI (Relative Strength Index): While showing periods above 50, suggesting bullish momentum, it has recently pulled back, indicating potential exhaustion of the buying pressure.

- MACD (Moving Average Convergence Divergence): The MACD has shown some bullish crossovers, but the momentum appears to be weakening.

- Support and Resistance Levels: XRP has encountered resistance at key price levels, suggesting sellers are stepping in to capitalize on price increases.

- Chart Patterns: While some bullish patterns were briefly observed, recent price action hasn't clearly formed a sustained bullish continuation pattern.

[Insert Chart/Graph visualizing XRP price movements here]

Fundamental Factors Influencing XRP’s Price

Positive news has undeniably contributed to the initial XRP price recovery.

- Ripple Legal Developments: Favorable rulings or settlements in the ongoing SEC lawsuit could significantly boost XRP's price.

- Partnerships and Adoption: Increased adoption by financial institutions and collaborations with other companies could drive demand.

- Technological Advancements: Improvements in XRP's technology or the broader Ripple ecosystem could attract more investors.

However, certain counteracting forces exist:

- Regulatory Uncertainty: Ongoing regulatory scrutiny of cryptocurrencies continues to present headwinds.

- Market Sentiment: The overall bearish sentiment in the broader cryptocurrency market can impact XRP's price.

The Role of the Derivatives Market in Slowing Momentum

The derivatives market, specifically the trading of XRP futures and options, has played a significant role in dampening the XRP price recovery's momentum.

Understanding XRP Derivatives Trading Volume

High trading volume in XRP derivatives often signals investor hesitancy or profit-taking.

- Futures Volume: [Insert Data on XRP Futures Trading Volume]. A recent decrease in volume suggests reduced speculative activity.

- Options Volume: [Insert Data on XRP Options Trading Volume]. High option volume, particularly in put options (bets on price decline), can contribute to price pressure.

- Other Derivatives: The activity in other XRP derivative products should also be considered for a complete picture.

This data suggests that despite price gains, many investors are hedging their bets or taking profits, thus preventing a more substantial price surge.

Open Interest and its Implications for XRP Price

Open interest, the total number of outstanding derivative contracts, provides insights into market sentiment.

- Open Interest Trends: [Insert Data on Open Interest Trends]. A declining open interest, even amidst a price rise, can be a bearish signal, suggesting less confidence in future price increases.

- Implications: Decreased open interest implies fewer investors are actively betting on future price movements, hindering a sustained recovery.

Hedging Activities and Their Impact on XRP Price Volatility

Institutional investors often employ hedging strategies to mitigate risk.

- Hedging Strategies: Institutional investors might be using derivatives to hedge their XRP holdings, limiting upward price movement.

- Impact on Volatility: This hedging activity can contribute to price stagnation or even slight decreases, slowing down the overall XRP price recovery.

Future Outlook for XRP Price and Market Sentiment

Predicting the future price of XRP is challenging, but analyzing market sentiment and potential catalysts is essential.

Analyzing Market Sentiment towards XRP

Gauging market sentiment requires a multifaceted approach.

- Social Media Sentiment: [Analyze social media sentiment – is it generally bullish, bearish, or neutral?].

- News Articles and Expert Opinions: [Summarize prevailing opinions from news and expert analysis].

Currently, market sentiment appears to be cautiously optimistic, but the lack of significant bullish momentum suggests hesitation.

Potential Scenarios for XRP Price in the Coming Months

Several scenarios are possible:

- Optimistic Scenario: Positive legal developments and increased adoption could trigger a new price surge.

- Neutral Scenario: The price consolidates within a range, with limited upward or downward movement.

- Pessimistic Scenario: Negative news or a broader market downturn could lead to a price decline.

Based on current market conditions and technical analysis, a price range of $[Lower Bound] to $[Upper Bound] seems plausible in the coming months. However, significant volatility remains possible.

Conclusion: XRP Price Recovery – A Cautious Outlook

The XRP price recovery, while evident, is facing considerable headwinds. The derivatives market plays a crucial role, with high trading volumes and decreasing open interest suggesting that despite positive fundamental factors, investor confidence isn't fully translating into sustained upward price momentum. While potential catalysts for further gains exist, a cautious outlook is warranted. The interplay between technical indicators, fundamental developments, and derivatives market activity will ultimately dictate the trajectory of the XRP price recovery. Stay tuned for further updates on the XRP price recovery and the evolving role of the derivatives market. Continue monitoring key indicators like trading volume, open interest, and market sentiment to make informed decisions regarding your XRP investments. Further research into XRP price prediction and XRP market analysis is highly recommended.

Featured Posts

-

2000 Yankees Season Diary The Comeback That Wasnt

May 07, 2025

2000 Yankees Season Diary The Comeback That Wasnt

May 07, 2025 -

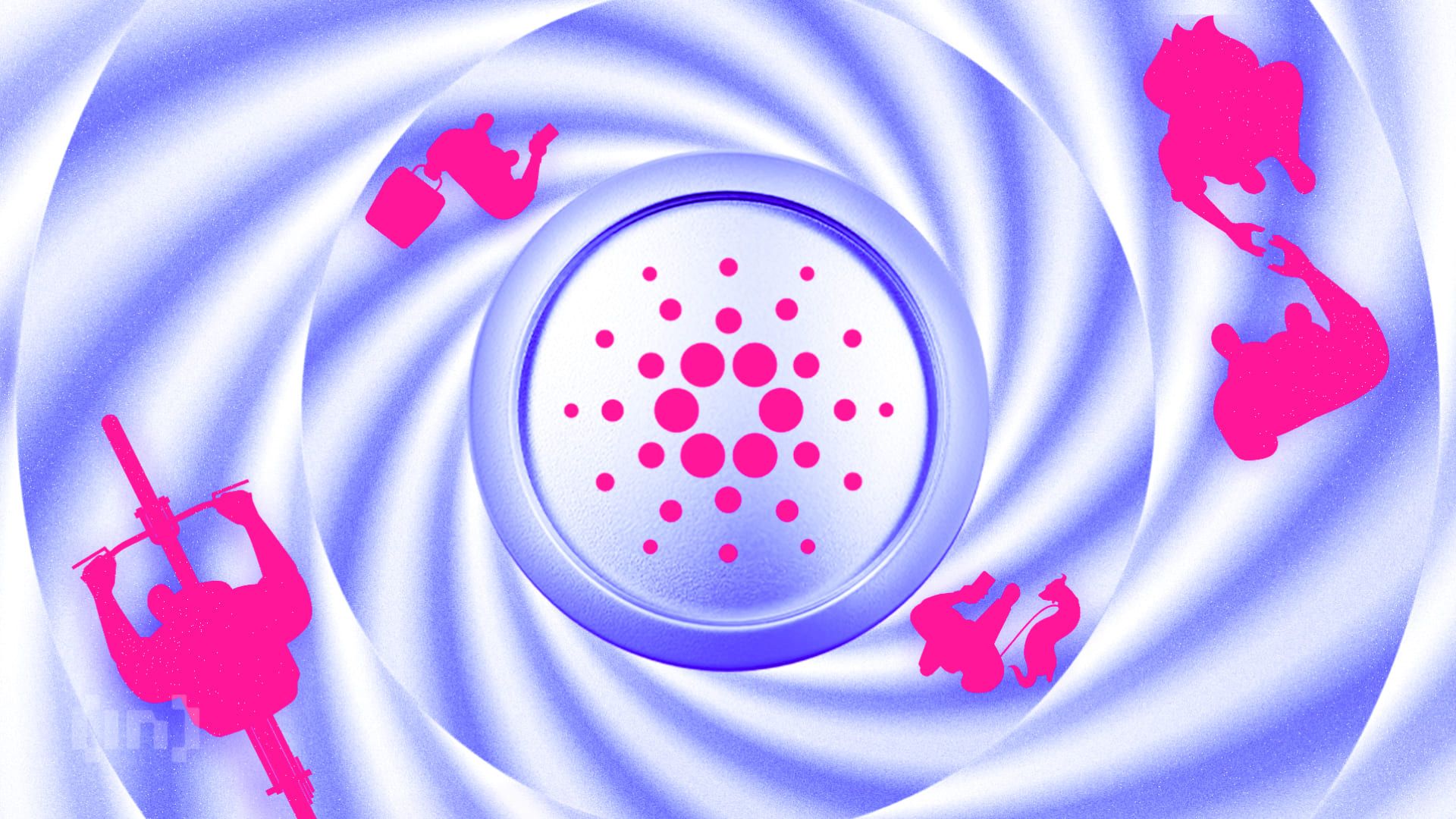

Check Daily Lotto Results For Sunday May 4 2025

May 07, 2025

Check Daily Lotto Results For Sunday May 4 2025

May 07, 2025 -

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 07, 2025

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 07, 2025 -

E Bay Faces Legal Action Over Banned Chemicals Listed Under Section 230

May 07, 2025

E Bay Faces Legal Action Over Banned Chemicals Listed Under Section 230

May 07, 2025 -

Los Angeles 2028 Las Reflexiones De Simone Biles Sobre Su Participacion

May 07, 2025

Los Angeles 2028 Las Reflexiones De Simone Biles Sobre Su Participacion

May 07, 2025

Latest Posts

-

Pierce County Historic Homes Transformation Into A Park

May 08, 2025

Pierce County Historic Homes Transformation Into A Park

May 08, 2025 -

Demolition Of Historic Pierce County Home To Create Public Park

May 08, 2025

Demolition Of Historic Pierce County Home To Create Public Park

May 08, 2025 -

160 Year Old Pierce County Home To Make Way For New Park

May 08, 2025

160 Year Old Pierce County Home To Make Way For New Park

May 08, 2025 -

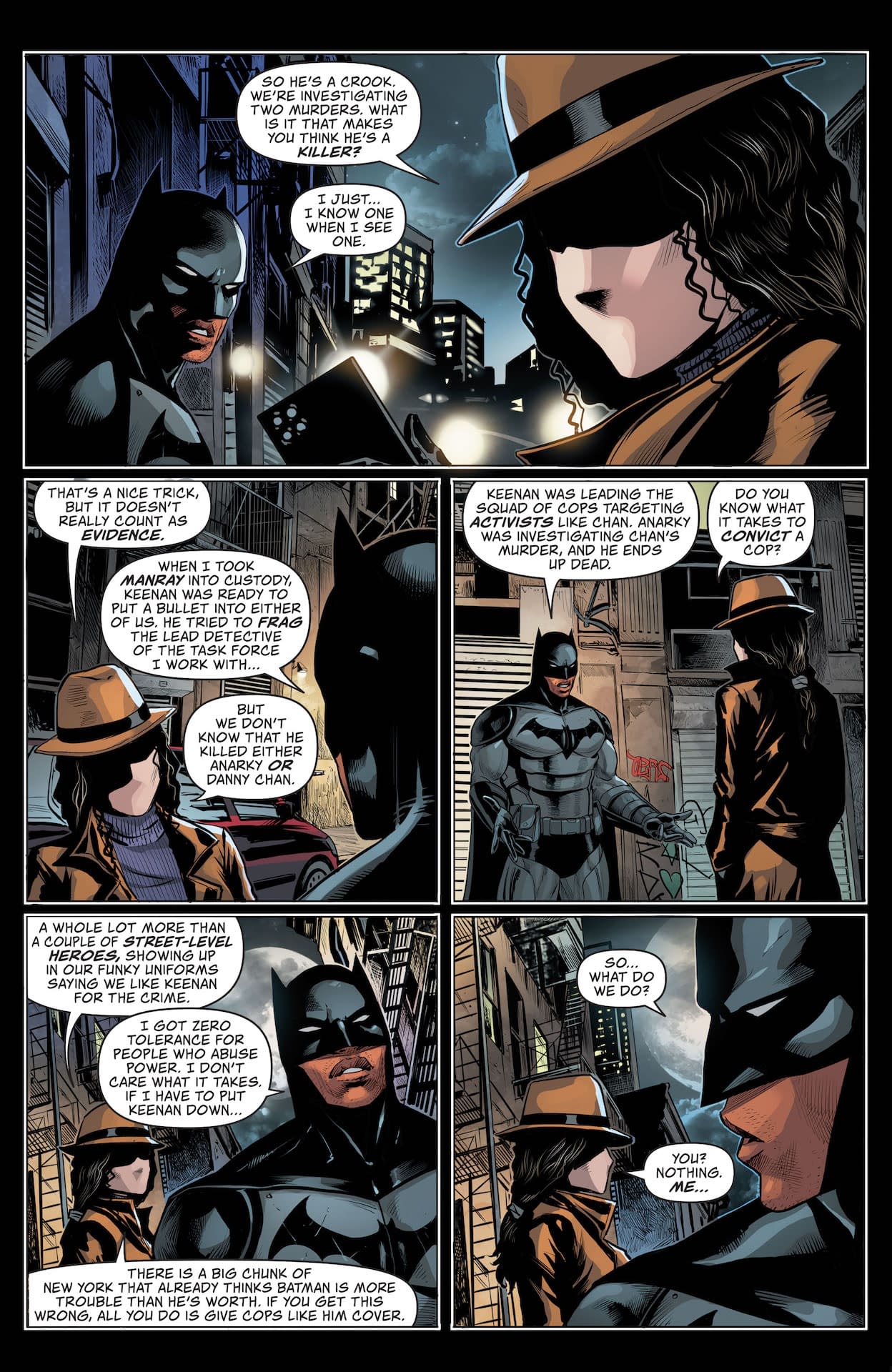

Dcs Batman A Brand New Beginning With Issue 1 And Costume Redesign

May 08, 2025

Dcs Batman A Brand New Beginning With Issue 1 And Costume Redesign

May 08, 2025 -

Dc Comics Batman Gets A Reboot New 1 And Updated Suit

May 08, 2025

Dc Comics Batman Gets A Reboot New 1 And Updated Suit

May 08, 2025