XRP Price Surge: Ripple SEC Case Update And ETF Speculation

Table of Contents

Ripple SEC Case Update: A Turning Point for XRP?

The Ripple Labs vs. SEC lawsuit has cast a long shadow over XRP, creating uncertainty and impacting its price. The case centers on whether XRP is a security, a classification that carries significant regulatory implications. A favorable ruling for Ripple could drastically alter XRP's regulatory landscape and potentially unlock significant price appreciation. Conversely, an unfavorable outcome could solidify XRP's precarious position and negatively influence its market value.

- Recent court filings and hearings: Recent legal maneuvers have seen both sides present compelling arguments, with the judge seemingly leaning towards a more nuanced interpretation of the "Howey Test," the legal standard used to determine whether an asset is a security.

- Potential outcomes and their impact on XRP's regulatory status: A win for Ripple could lead to increased regulatory clarity and potentially boost mainstream adoption. A loss, however, could stifle growth and limit XRP's accessibility.

- Expert predictions on the timing of a final decision: While no definitive timeline exists, legal experts anticipate a decision within the coming months, although further appeals are possible. This uncertainty itself contributes to market volatility and influences the XRP price.

ETF Speculation: Is XRP on the Verge of Mainstream Adoption?

The emergence of cryptocurrency ETFs is revolutionizing investment access. ETFs offer a regulated and convenient way for investors to gain exposure to cryptocurrencies, thereby increasing liquidity and potentially boosting prices. The prospect of an XRP ETF has ignited significant speculation, with many believing it could be a catalyst for mainstream adoption and substantial price appreciation.

- Benefits of XRP ETFs for investors: ETFs offer diversification benefits, lower transaction costs, and regulatory oversight, making them attractive to institutional and retail investors. An XRP ETF could bring similar advantages to XRP investors.

- Potential challenges in securing regulatory approval for an XRP ETF: Regulatory hurdles remain significant. Securing approval from bodies like the SEC will hinge on demonstrating compliance with existing securities regulations and mitigating investor risks.

- Comparison to other crypto ETFs already available or in development: While Bitcoin and Ethereum ETFs are already available in some markets, the potential launch of an XRP ETF represents a significant milestone for the XRP community, possibly triggering a substantial XRP price surge.

Market Sentiment and Technical Analysis of XRP Price

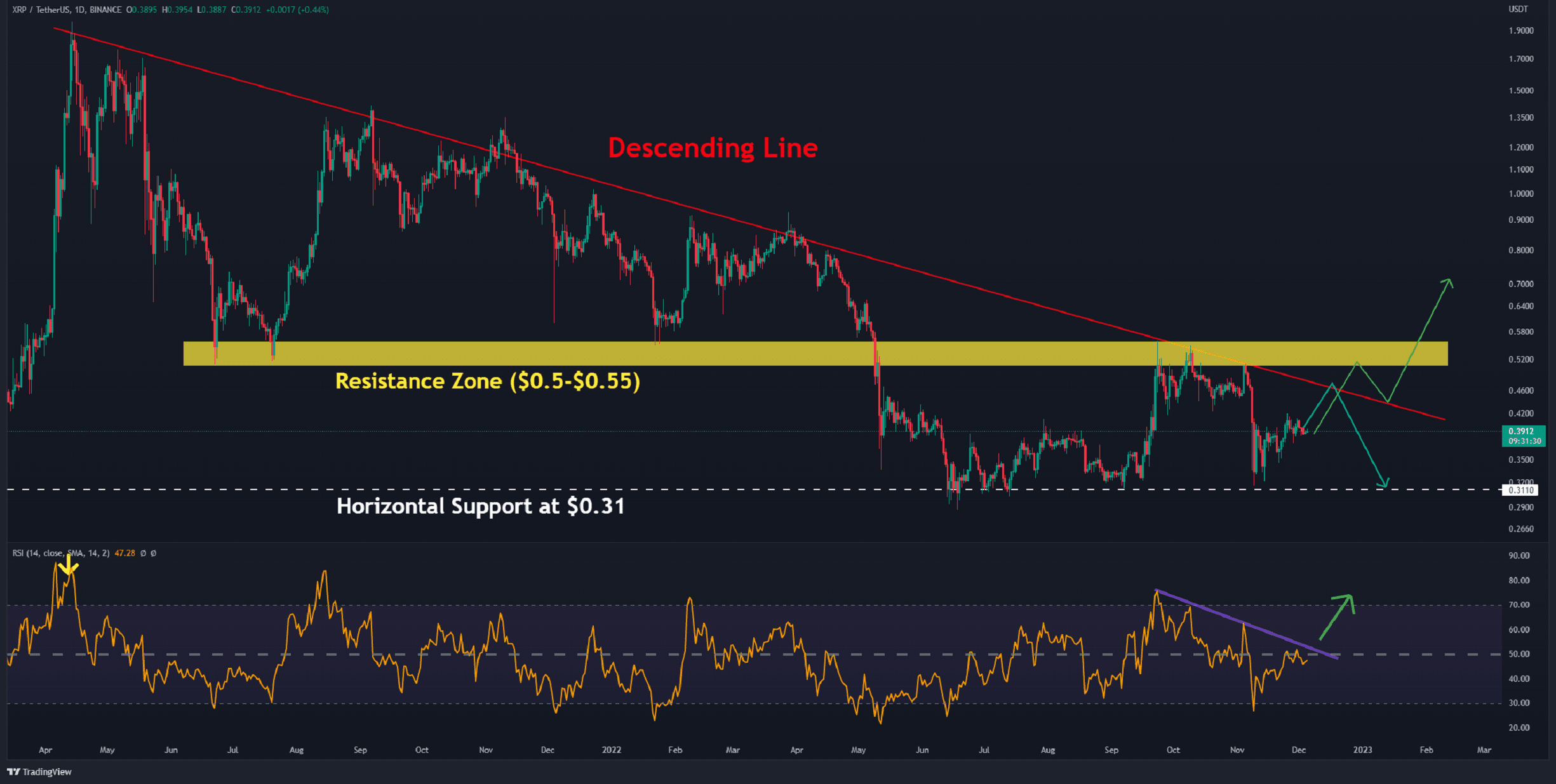

Analyzing market sentiment and employing technical analysis provide valuable insights into XRP's price movements. Positive news coverage, enthusiastic social media discussions, and a generally bullish crypto market often translate into higher prices. Conversely, negative sentiment can quickly lead to price corrections. Technical indicators, such as support and resistance levels and trading volume, can help identify potential price trends.

- Key technical indicators and their significance: Indicators like Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands can signal overbought or oversold conditions, helping traders anticipate price reversals.

- Current support and resistance levels for XRP: Identifying these levels helps gauge potential price ranges and provides insights into potential buying or selling pressure.

- Short-term and long-term price predictions (with appropriate disclaimers): It's crucial to remember that cryptocurrency price predictions are inherently speculative. However, considering the confluence of factors discussed above, a cautious optimism for XRP's long-term potential seems warranted. Disclaimer: This analysis is not financial advice.

Conclusion: Navigating the XRP Future — Investment Strategies and Outlook

The XRP price surge is undeniably linked to the evolving Ripple SEC case and the exciting prospect of XRP ETFs. A favorable court ruling and the successful launch of an ETF could significantly impact XRP's price, potentially leading to substantial gains. However, investors must acknowledge inherent risks, including regulatory uncertainty and market volatility. A balanced approach, considering both opportunities and risks, is essential.

Stay updated on the XRP price, monitor the Ripple SEC case developments, and consider the potential of XRP ETFs. By remaining informed and employing a thoughtful investment strategy, you can navigate the complex landscape of the cryptocurrency market and potentially capitalize on the exciting opportunities presented by XRP. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to the XRP price, the Ripple SEC case, or XRP ETFs.

Featured Posts

-

Prince Williams Scottish Homelessness Initiative A Warm Embrace With Gail Porter

May 01, 2025

Prince Williams Scottish Homelessness Initiative A Warm Embrace With Gail Porter

May 01, 2025 -

Former Wkrn Anchors Nikki Burdine And Neil Orne Announce New Ventures

May 01, 2025

Former Wkrn Anchors Nikki Burdine And Neil Orne Announce New Ventures

May 01, 2025 -

Assam Cms Crackdown On Non Nrc Aadhaar Holders

May 01, 2025

Assam Cms Crackdown On Non Nrc Aadhaar Holders

May 01, 2025 -

Anti Muslim Plots In Bangladesh Nrc Urges Immediate Action

May 01, 2025

Anti Muslim Plots In Bangladesh Nrc Urges Immediate Action

May 01, 2025 -

Michael Jordans Life A Quick Overview

May 01, 2025

Michael Jordans Life A Quick Overview

May 01, 2025

Latest Posts

-

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025 -

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025 -

Dallas Icon Passes Away At The Age Of 100

May 01, 2025

Dallas Icon Passes Away At The Age Of 100

May 01, 2025 -

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025 -

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025