XRP (Ripple) Investment Strategy: Price Below $3

Table of Contents

Understanding the Current Market Sentiment for XRP

The current XRP market is influenced by several interconnected factors. Analyzing these elements is crucial for formulating a sound XRP investment strategy. Understanding the interplay of these factors will allow you to assess the potential risks and rewards more accurately. Key aspects to consider include:

Keywords: XRP market analysis, Ripple news, regulatory uncertainty, SEC lawsuit, XRP price prediction, market volatility

-

The SEC Lawsuit: The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and market sentiment. A positive resolution could trigger a substantial price increase, while an unfavorable outcome could lead to further decline. Staying updated on the lawsuit's progress is paramount.

-

Regulatory Developments: The regulatory landscape for cryptocurrencies is constantly evolving. Changes in regulations globally, particularly in major markets, can significantly influence XRP's price and adoption. Monitoring regulatory news and announcements is essential.

-

Market Volatility: The cryptocurrency market is inherently volatile. XRP, being an altcoin, is particularly susceptible to price swings driven by broader market trends and investor sentiment. Understanding and managing this volatility is key to successful XRP trading.

-

Ripple's Technology and Partnerships: Ripple's technology, particularly its focus on cross-border payments, continues to attract attention from financial institutions. Successful partnerships and adoption of Ripple's solutions can positively influence XRP's price. Keep an eye on Ripple's announcements and news regarding technological advancements and partnerships.

Risk Assessment and Mitigation for XRP Investments

Investing in cryptocurrencies, including XRP, carries significant risk. The current legal uncertainties surrounding XRP further amplify these risks. Therefore, a robust risk management strategy is vital for any XRP investment.

Keywords: XRP risk management, cryptocurrency risk, diversification, portfolio allocation, stop-loss orders, investment risk tolerance

-

Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across various asset classes, including other cryptocurrencies, stocks, bonds, and real estate, to reduce the overall risk.

-

Stop-Loss Orders: Employ stop-loss orders to automatically sell your XRP if the price falls below a predetermined level. This limits potential losses in case of a significant price drop.

-

Risk Tolerance: Assess your personal risk tolerance. Only invest an amount you are comfortable potentially losing entirely. Avoid investing borrowed money or funds crucial for your immediate needs.

-

Impact of the SEC Lawsuit: The SEC lawsuit outcome has a huge impact on XRP's future. Consider the various potential outcomes and their potential impact on your investment before making any decisions.

Strategic Approaches to Buying XRP Below $3

With XRP trading below $3, investors can consider several strategies for acquiring it. The optimal approach depends on your investment horizon, risk tolerance, and financial goals.

Keywords: XRP buying strategy, dollar-cost averaging (DCA), accumulating XRP, long-term investment, short-term trading, XRP trading strategy

-

Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the price. DCA helps mitigate the risk associated with market volatility. By buying consistently, you reduce the impact of buying high and potentially lower your average purchase price.

-

Lump-Sum Purchases: This involves investing a larger sum of money at once, hoping to capitalize on a perceived undervaluation. This carries higher risk than DCA, but can lead to potentially greater returns if the price subsequently rises.

-

Technical Analysis: Employing technical analysis indicators such as moving averages, relative strength index (RSI), and MACD can help identify potential buying opportunities. However, remember that technical analysis is not foolproof.

-

Long-Term vs. Short-Term: Consider your investment timeline. A long-term investment strategy might be more suitable for those with a higher risk tolerance and a longer time horizon to ride out market fluctuations. Short-term trading requires more active monitoring and carries higher risk.

Long-Term Potential and Future Outlook for XRP

While the current market sentiment may be influenced by short-term factors, the long-term potential of XRP and Ripple's technology remains a key consideration for investors.

Keywords: XRP future price, Ripple technology, adoption rate, blockchain technology, XRP utility, long-term XRP investment

-

Ripple's Partnerships: Ripple's ongoing partnerships with financial institutions globally indicate a growing adoption of its payment solutions. Continued success in this area could significantly boost XRP's utility and price.

-

Adoption Rate: The wider adoption of Ripple's technology by banks and financial institutions is crucial for XRP's long-term growth. Monitor the expansion of RippleNet and its impact on the financial sector.

-

Future Use Cases: Explore the potential expansion of XRP's use cases beyond cross-border payments. New applications and integrations could significantly increase demand and drive price appreciation.

-

Impact of the SEC Lawsuit (Long-Term): While the SEC lawsuit presents short-term uncertainty, consider its potential long-term consequences. A positive resolution could unlock significant price appreciation, but a negative outcome might significantly impact XRP's future.

Conclusion

Investing in XRP below $3 requires a cautious yet strategic approach. By carefully considering market sentiment, implementing robust risk management techniques, choosing a suitable buying strategy, and assessing the long-term potential of Ripple's technology, investors can make more informed decisions. Remember to conduct your own thorough research and, if needed, consult a financial advisor before making any investment decisions. Don't miss the opportunity to refine your XRP (Ripple) investment strategy, even with the price currently below $3.

Featured Posts

-

The Mental Health Crisis In Ghana Exploring The Insufficient Psychiatrist To Patient Ratio

May 02, 2025

The Mental Health Crisis In Ghana Exploring The Insufficient Psychiatrist To Patient Ratio

May 02, 2025 -

Tribute To Dallas And Carrie Star Amy Irvings Moving Words

May 02, 2025

Tribute To Dallas And Carrie Star Amy Irvings Moving Words

May 02, 2025 -

Social Media Frenzy Kashmir Cat Owners On High Alert

May 02, 2025

Social Media Frenzy Kashmir Cat Owners On High Alert

May 02, 2025 -

Plan Your Next Foodie Adventure A Windstar Cruise Experience

May 02, 2025

Plan Your Next Foodie Adventure A Windstar Cruise Experience

May 02, 2025 -

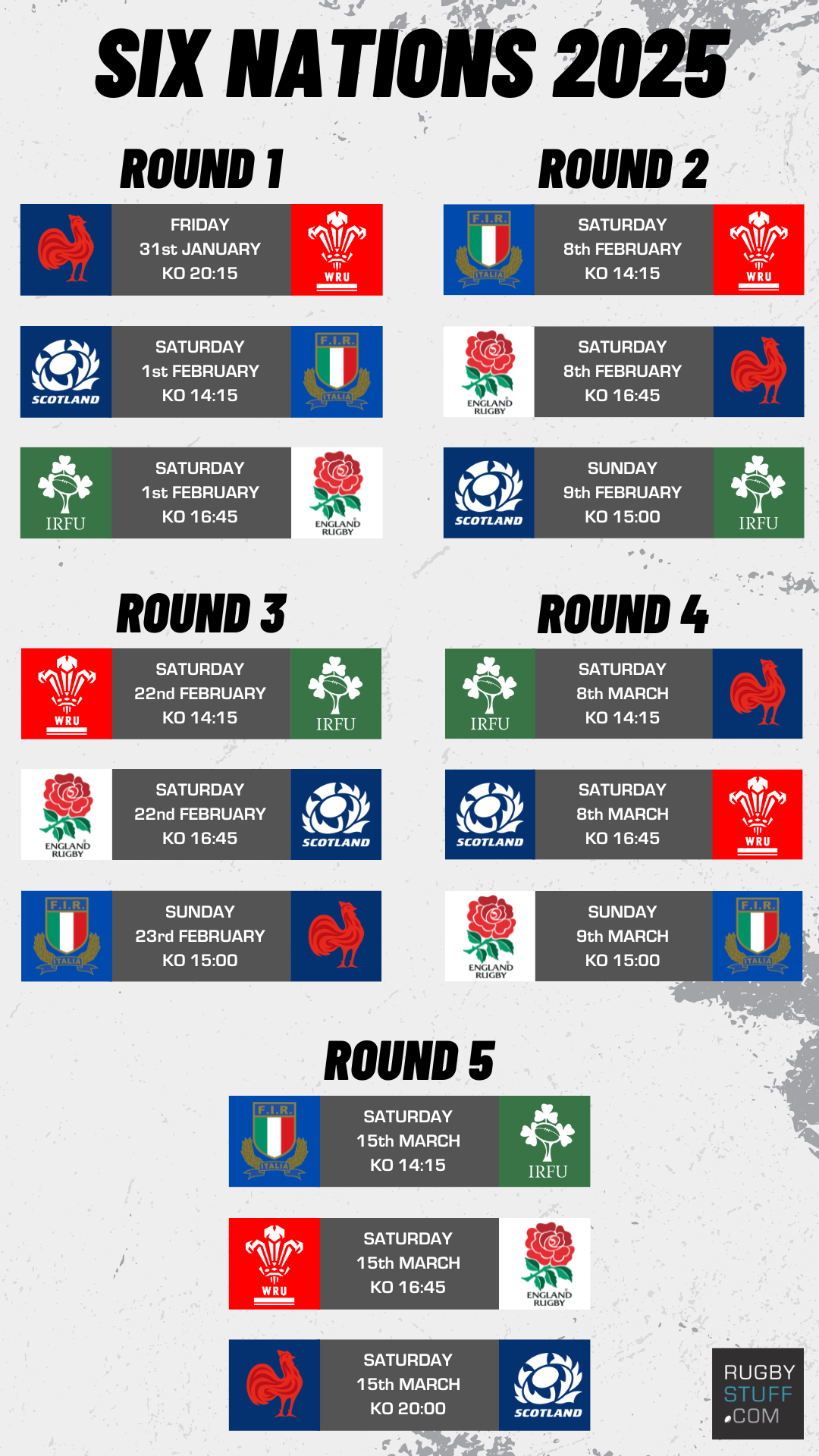

Scotland In The Six Nations 2025 Overachievers Or Underperformers

May 02, 2025

Scotland In The Six Nations 2025 Overachievers Or Underperformers

May 02, 2025

Latest Posts

-

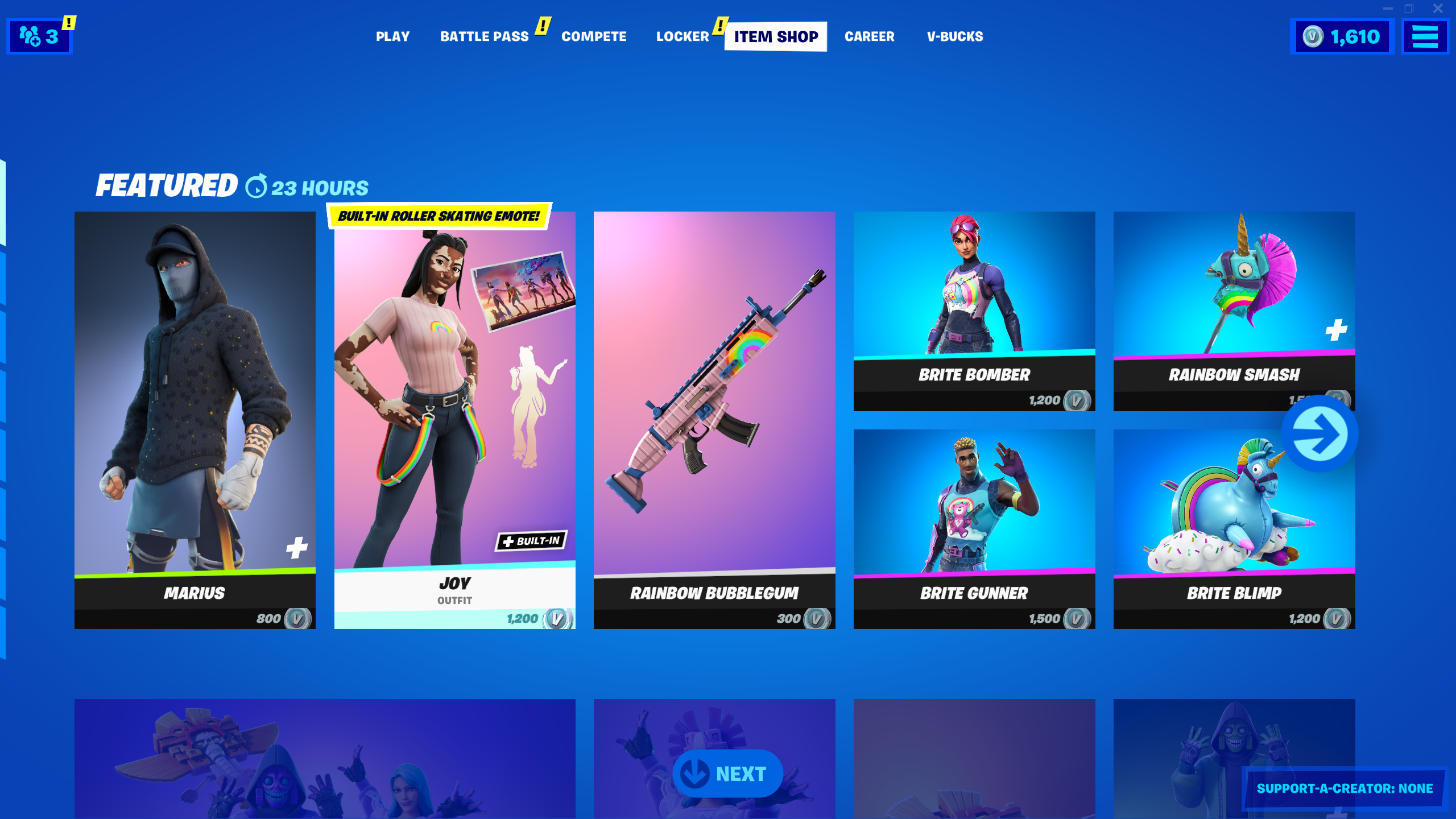

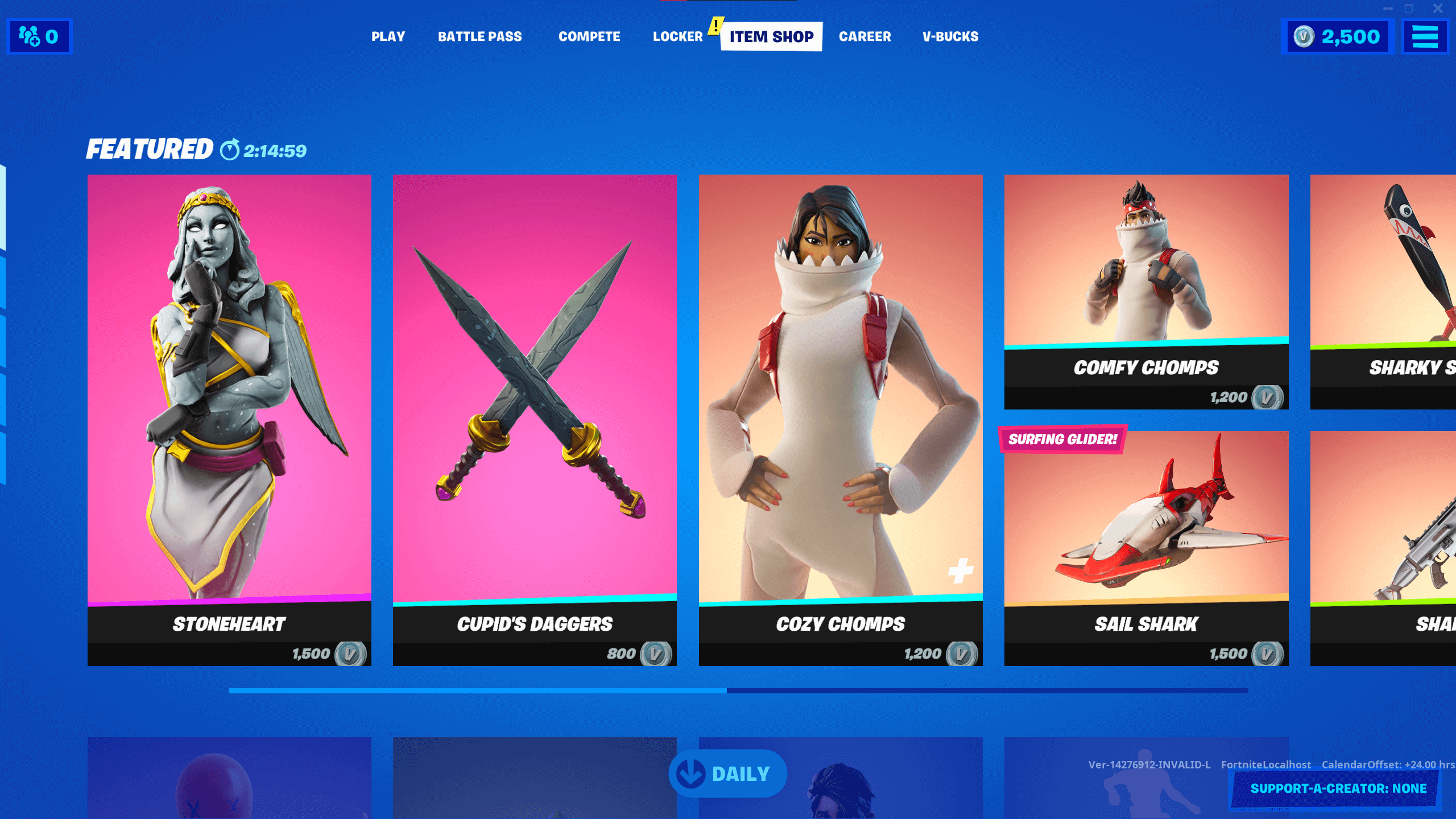

Free Captain America Fortnite Skins Limited Time Item Shop Offer

May 02, 2025

Free Captain America Fortnite Skins Limited Time Item Shop Offer

May 02, 2025 -

Fortnites Item Shop Free Captain America Items For A Limited Time

May 02, 2025

Fortnites Item Shop Free Captain America Items For A Limited Time

May 02, 2025 -

The Walking Deads Negan Jeffrey Dean Morgans Fortnite Journey

May 02, 2025

The Walking Deads Negan Jeffrey Dean Morgans Fortnite Journey

May 02, 2025 -

Fortnite Predicting The Return Of Exclusive Skins

May 02, 2025

Fortnite Predicting The Return Of Exclusive Skins

May 02, 2025 -

From The Walking Dead To Fortnite Jeffrey Dean Morgans Negan Experience

May 02, 2025

From The Walking Dead To Fortnite Jeffrey Dean Morgans Negan Experience

May 02, 2025