X's New Financials: Debt Sale Impact And Company Transformation

Table of Contents

The Debt Sale: Details and Rationale

X's debt sale involved the repayment of [Specific amount] in [Type of debt, e.g., high-yield bonds]. The buyers involved were primarily [List key buyers or types of buyers, e.g., a consortium of institutional investors]. This strategic move was driven by X's need to improve its credit rating, reduce interest expenses, and enhance financial flexibility. The company aims to create a more sustainable capital structure that supports its long-term growth objectives.

The key benefits of this debt reduction strategy include:

- Improved creditworthiness: Lowering X's debt-to-equity ratio will lead to access to cheaper capital in the future, enabling more favorable terms on future loans and potentially lowering the cost of borrowing.

- Reduced interest expense: Freeing up cash flow by significantly reducing interest payments allows for reinvestment in research and development, marketing, and other growth initiatives. This improved cash flow will directly impact X's profitability and ability to innovate.

- Enhanced financial stability: A stronger balance sheet reduces the risk of financial distress, providing greater stability and resilience in the face of economic uncertainty. This improved financial health will be reflected in X's financial ratios and overall financial performance.

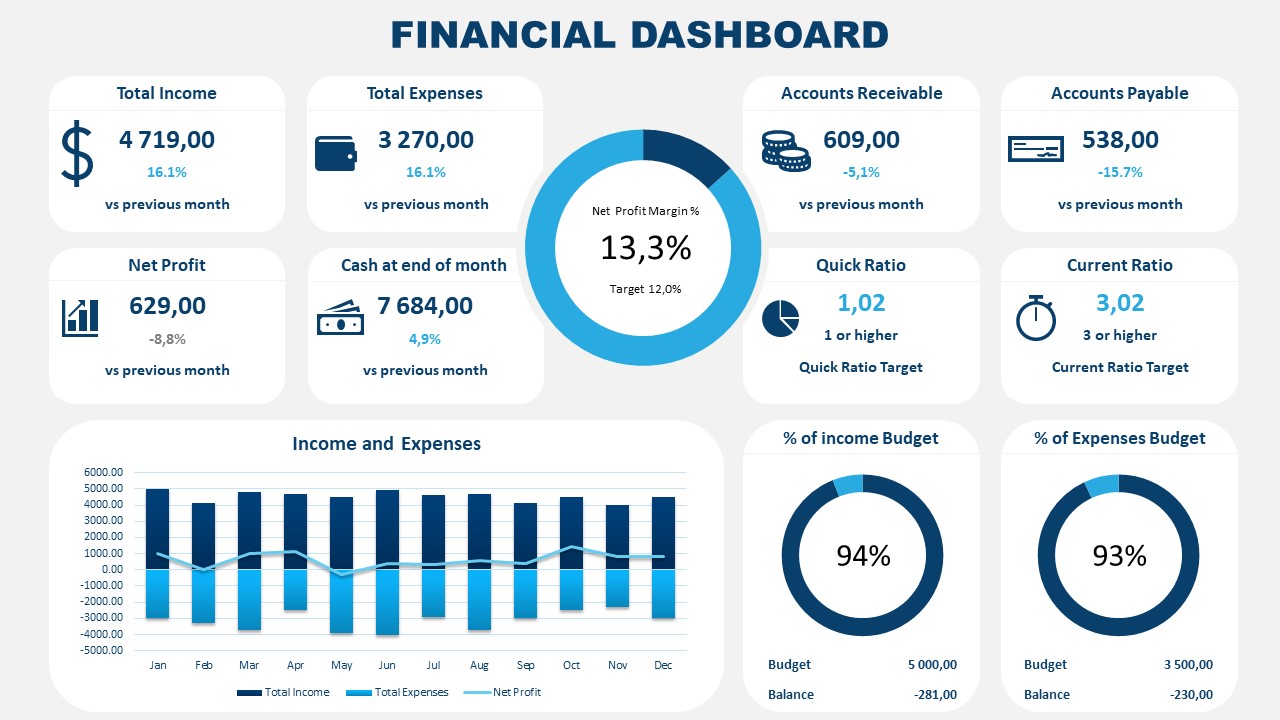

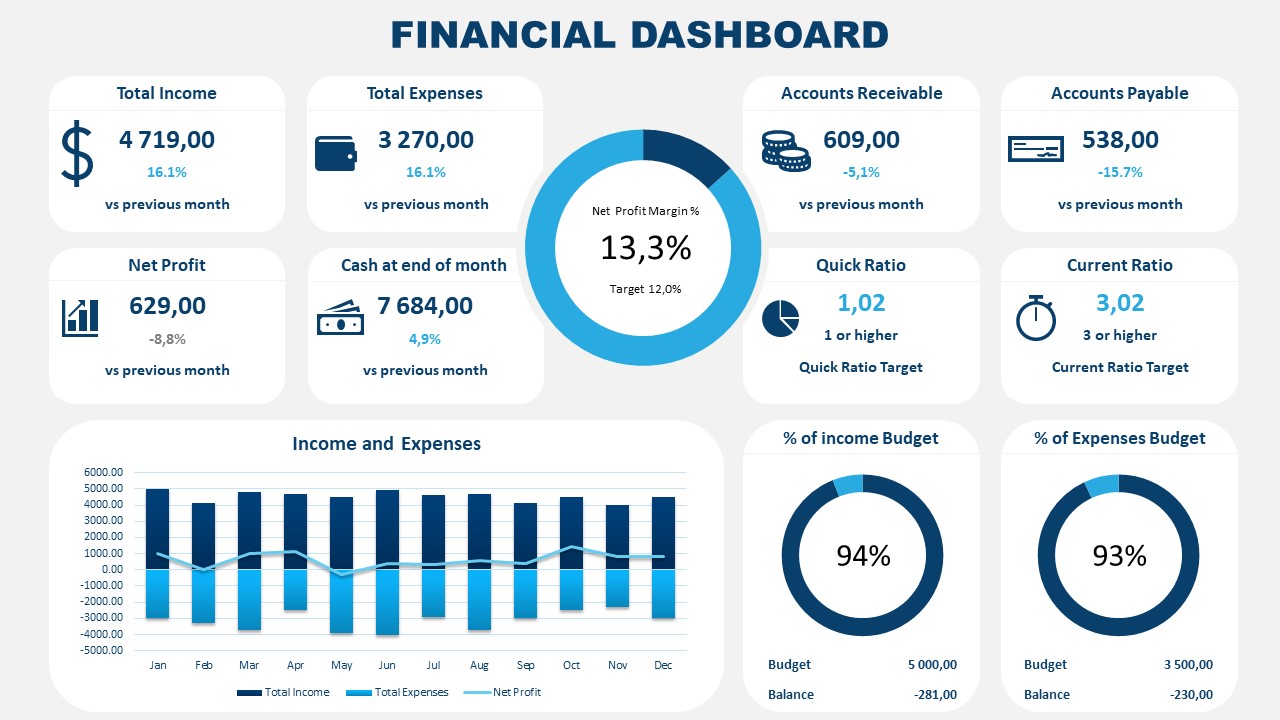

Impact on X's Financial Performance

The immediate impact of X's debt sale is already evident in several key financial metrics. Earnings per share (EPS) are expected to [Increase/Decrease] by approximately [Percentage] due to the reduction in interest expense. The debt-to-equity ratio has significantly improved, falling from [Previous ratio] to [New ratio], indicating a much healthier financial position. While the impact on revenue growth is still unfolding, analysts predict a positive effect in the coming quarters as the company can now focus on strategic growth initiatives rather than solely managing its debt burden.

Further analysis of X's financial performance shows:

- Improved EPS: The reduction in interest expense is a direct driver of increased profitability and higher EPS.

- Strengthened balance sheet: The lower debt-to-equity ratio demonstrates a more robust and less risky financial structure. This makes the company a more attractive investment.

- Increased financial flexibility: This allows for strategic investments, acquisitions, and new product development, fueling future growth.

Short-Term vs. Long-Term Implications

While the short-term impact of the debt sale focuses primarily on improved financial metrics and reduced risk, the long-term implications are even more significant. X's transformation strategy relies heavily on this financial restructuring to pave the way for sustainable growth and expansion. The potential risks involve unforeseen challenges in implementing the new strategy, but the opportunities for long-term growth outweigh these concerns. The sustainability of this new financial strategy hinges on the success of X's broader transformation plans and consistent execution of its new business model. The ability of X to adapt to market changes and maintain its improved financial position will determine the overall success of the restructuring.

X's Company Transformation Strategy

X's company transformation involves a multifaceted strategy focused on [Clearly outline X's transformation strategy, e.g., innovation, market expansion, operational efficiency]. The debt sale is a crucial component of this strategy, providing the financial flexibility needed to implement ambitious plans.

The key elements of X's transformation strategy include:

- Investment in R&D: X plans to allocate a significant portion of its freed-up cash flow to research and development of innovative products and services to ensure its future competitiveness.

- Market expansion: The company intends to penetrate new markets and expand its customer base through targeted marketing campaigns and strategic partnerships.

- Operational restructuring: X aims to enhance internal operational efficiency to improve margins and drive long-term profitability. This might involve streamlining processes, leveraging technology, or optimizing supply chain management.

Conclusion

This analysis of X's new financials demonstrates that the recent debt sale is a pivotal step in the company's transformation. By reducing debt and improving its financial position, X is strategically positioning itself for sustainable growth and future success. The changes in financial performance, along with the company's outlined transformation strategy, suggest a promising outlook for X.

Call to Action: Stay informed about X's progress and its ongoing company transformation. Follow X's financial reports and news to understand the lasting impact of this debt sale on its future success and financial stability. Continue to track X's financials for further insights into their strategic initiatives and the overall success of their debt reduction and company transformation strategy.

Featured Posts

-

Willie Nelson Celebrates His Roadies Legacy In Upcoming Documentary

Apr 29, 2025

Willie Nelson Celebrates His Roadies Legacy In Upcoming Documentary

Apr 29, 2025 -

A Geographic Analysis Of The Countrys Top Emerging Business Markets

Apr 29, 2025

A Geographic Analysis Of The Countrys Top Emerging Business Markets

Apr 29, 2025 -

Nyt Spelling Bee March 15 2025 Pangram And Word List

Apr 29, 2025

Nyt Spelling Bee March 15 2025 Pangram And Word List

Apr 29, 2025 -

Ais Limited Thinking A Realistic Assessment Of Artificial Intelligences Cognitive Abilities

Apr 29, 2025

Ais Limited Thinking A Realistic Assessment Of Artificial Intelligences Cognitive Abilities

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Latest Posts

-

Is Channing Tatum Dating 25 Year Old Inka Williams

Apr 30, 2025

Is Channing Tatum Dating 25 Year Old Inka Williams

Apr 30, 2025 -

Schneider Electric And Vignan University Partner For Center Of Excellence In Vijayawada

Apr 30, 2025

Schneider Electric And Vignan University Partner For Center Of Excellence In Vijayawada

Apr 30, 2025 -

Marchs Dance Roster Directors And Dancers New Positions

Apr 30, 2025

Marchs Dance Roster Directors And Dancers New Positions

Apr 30, 2025 -

Channing Tatum Moves On Date Night With Inka Williams After Zoe Kravitz Breakup

Apr 30, 2025

Channing Tatum Moves On Date Night With Inka Williams After Zoe Kravitz Breakup

Apr 30, 2025 -

Channing Tatums Aussie Girlfriends Sydney Trip Concludes

Apr 30, 2025

Channing Tatums Aussie Girlfriends Sydney Trip Concludes

Apr 30, 2025