1,500% Bitcoin Growth: Fact Or Fiction? Examining The Prediction

Table of Contents

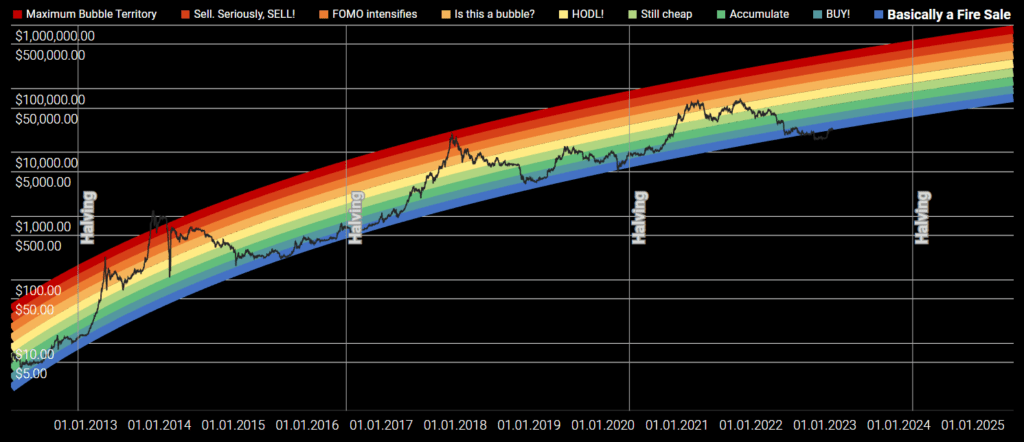

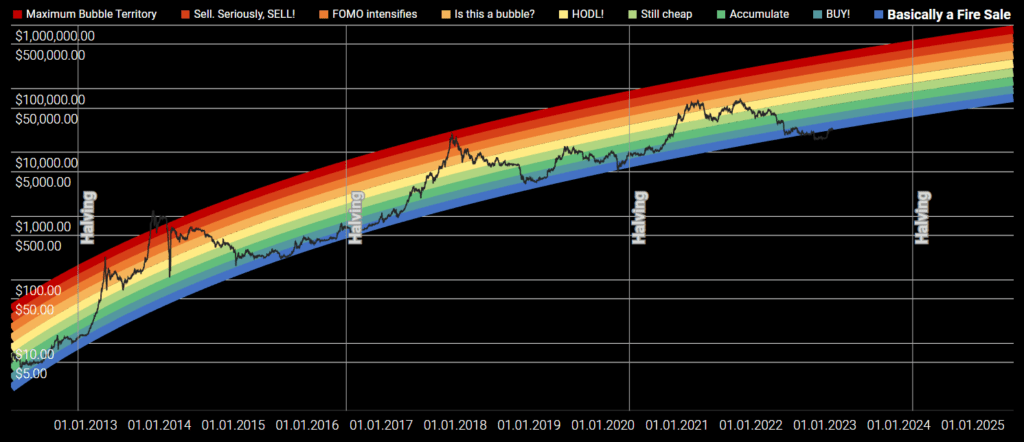

Historical Bitcoin Price Volatility and Growth

Bitcoin's history is a rollercoaster of dramatic price swings, showcasing both incredible gains and devastating losses. Understanding this volatility is key to evaluating any Bitcoin growth prediction, including the ambitious 1,500% figure. Analyzing Bitcoin price history reveals distinct phases of growth and decline:

-

2010-2013 Early Growth Phase: Bitcoin's early years saw slow but steady growth, driven by early adopters and increasing awareness. The price rose from mere cents to hundreds of dollars, establishing it as a viable alternative currency.

-

2017 Bull Run and Subsequent Crash: This period witnessed an explosive rise in Bitcoin's price, reaching nearly $20,000 before a sharp correction. This dramatic Bitcoin price history showcased the inherent risk and volatility associated with the cryptocurrency. This period highlighted the importance of careful Bitcoin price prediction analysis.

-

2020-2021 Growth Cycle: Following a period of consolidation, Bitcoin experienced another significant price surge, fueled by institutional investment and increased mainstream adoption. This demonstrated the growing acceptance of Bitcoin as a store of value and an investment asset.

-

Current Market Conditions and Trends: Currently, the Bitcoin market exhibits considerable volatility, influenced by various macroeconomic factors and regulatory developments. Analyzing current trends is crucial for informed Bitcoin price prediction.

Analyzing Bitcoin's price history, including the significant peaks and troughs, provides valuable context when evaluating future Bitcoin growth predictions. Understanding this volatility is critical for responsible investment in Bitcoin. The unpredictable nature of Bitcoin volatility necessitates careful consideration before basing investment decisions on any single Bitcoin price prediction. Charts and graphs visualizing this historical Bitcoin price data would further illuminate the volatile nature of this asset.

Factors Influencing Potential Bitcoin Growth

Several key factors influence Bitcoin's potential for growth, impacting the validity of any Bitcoin growth prediction. These factors interact in complex ways, making accurate predictions challenging.

-

Inflation's effect on Bitcoin as a hedge: Many investors view Bitcoin as a hedge against inflation, leading to increased demand during periods of economic uncertainty. This demand can drive up the price.

-

Regulatory clarity and its impact on market confidence: Clear and consistent regulations can boost investor confidence, leading to greater adoption and price stability. Conversely, unclear or unfavorable regulations can negatively impact the market.

-

Institutional adoption and its influence on price stability: Increased adoption by institutional investors like hedge funds and corporations lends credibility to Bitcoin and can contribute to price stability and growth.

-

Technological advancements within the Bitcoin ecosystem: Improvements in scalability, security, and usability can enhance Bitcoin's appeal and attract new users and investors.

The interplay of these macroeconomic factors, regulatory developments, and technological advancements creates a complex environment, which makes precise Bitcoin growth predictions difficult. Accurate Bitcoin investment strategies require consideration of these varied influences.

Assessing the 1,500% Bitcoin Growth Prediction's Plausibility

Assessing the credibility of the 1,500% Bitcoin growth prediction requires a critical examination of its source and underlying assumptions.

-

Evaluation of prediction methodologies (fundamental analysis, technical analysis, etc.): Understanding the methodology used is crucial. Is it based on sound fundamental analysis, technical analysis, or merely speculation?

-

Risks associated with such a dramatic price increase: Such a significant price increase would likely be accompanied by increased volatility and risk. A sudden correction could result in substantial losses.

-

Black swan events and their potential impact: Unforeseen events, such as a major regulatory crackdown or a significant security breach, could dramatically impact Bitcoin's price, rendering any prediction inaccurate.

-

Comparison with previous predictions and their accuracy: Analyzing the accuracy of past Bitcoin price predictions provides valuable insight into the limitations of forecasting in this highly volatile market.

The plausibility of a 1,500% Bitcoin growth prediction hinges on a confluence of positive factors, while ignoring the inherent risks and potential for unforeseen events. Therefore, a conservative approach to Bitcoin price analysis is advisable.

Alternative Scenarios and Realistic Expectations for Bitcoin Growth

While a 1,500% surge is possible, it's crucial to consider alternative scenarios and manage expectations accordingly.

-

Conservative growth projections: A more conservative approach might predict moderate, steady growth based on increased adoption and market maturation.

-

Moderate growth projections: This scenario acknowledges Bitcoin's volatility and factors in potential setbacks while still anticipating positive growth.

-

Risk management strategies for Bitcoin investors: Diversification, dollar-cost averaging, and setting stop-loss orders are essential risk management strategies for Bitcoin investors.

-

Diversification within a cryptocurrency portfolio: Holding multiple cryptocurrencies can reduce risk compared to solely investing in Bitcoin.

Realistic Bitcoin growth expectations must account for the inherent volatility and unpredictable nature of the cryptocurrency market. A balanced Bitcoin investment strategy involves acknowledging both the potential for substantial growth and the significant risks involved.

Conclusion

The 1,500% Bitcoin growth prediction, while enticing, is highly speculative. While Bitcoin's potential for growth is significant, the inherent volatility and influence of various factors make such a dramatic prediction difficult to substantiate. Thorough research, careful risk assessment, and a diversified investment strategy are crucial before making any investment decisions related to Bitcoin. Before committing to any investment based on a Bitcoin growth prediction, conduct further research to make informed choices aligned with your risk tolerance. Remember, responsible investment decisions are based on a comprehensive understanding of the market, not solely on a single Bitcoin growth prediction.

Featured Posts

-

110 Return Predicted Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Return Predicted Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

The Long Walk A Stephen King Adaptation Gets Its First Trailer

May 08, 2025

The Long Walk A Stephen King Adaptation Gets Its First Trailer

May 08, 2025 -

Spk Nin Kripto Para Piyasalarina Dair Son Aciklamasi Detayli Analiz

May 08, 2025

Spk Nin Kripto Para Piyasalarina Dair Son Aciklamasi Detayli Analiz

May 08, 2025 -

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025 -

Are High Stock Market Valuations A Concern Bof A Weighs In

May 08, 2025

Are High Stock Market Valuations A Concern Bof A Weighs In

May 08, 2025