110% Return Predicted: Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

The BlackRock ETF: Unveiling the Investment Vehicle

While we cannot disclose the specific ticker symbol of the ETF due to regulatory concerns and to avoid giving unqualified financial advice, let's discuss the general characteristics of the type of BlackRock ETF attracting high-net-worth investors. Imagine an ETF focused on a rapidly growing sector with significant disruptive potential. BlackRock offers a wide range of ETFs targeting various sectors and investment strategies, many of which are designed for sophisticated investors. You can explore their offerings on the BlackRock website [link to BlackRock website].

- Specific investment strategy: This hypothetical ETF might focus on a high-growth sector like renewable energy, artificial intelligence, or biotechnology. It could employ a concentrated strategy, investing in a select number of promising companies within that sector. This strategy aims for higher returns, but also carries higher risk.

- Risk assessment: The potential for a 110% return is significant, but it's crucial to acknowledge the inherent risks. Market volatility, regulatory changes, and unforeseen technological disruptions could all negatively impact performance. This is not a guaranteed return.

- Expense ratio and management fees: The expense ratio, reflecting the ETF's management fees, is a crucial factor to consider. Lower expense ratios can contribute to higher overall returns.

The 110% Return Prediction: Analyzing the Rationale

The 110% return prediction is not a guaranteed outcome, but rather a projection based on several factors. It's important to understand the assumptions behind this projection.

- Market forecasts supporting the prediction: Analysts might point to robust growth projections in the target sector, anticipating exponential market expansion. This could be driven by government policies, technological advancements, or shifting consumer preferences.

- Expert opinions and analysis from financial professionals: Financial models and projections from reputable sources could underpin the prediction. However, it's vital to critically evaluate the underlying assumptions of these analyses.

- Historical data and comparable performance of similar ETFs: While past performance is not indicative of future results, analyzing similar ETFs with a similar investment strategy could offer some insight into potential returns.

- Assumptions and potential limitations of the prediction: The 110% return prediction likely relies on various assumptions about future market conditions, technological advancements, and regulatory environments. Changes in any of these factors could significantly impact the actual returns.

Why Billionaires Are Betting Big

Billionaires are known for their sophisticated investment strategies. This hypothetical BlackRock ETF likely appeals to them for several reasons:

- Sophisticated investment strategies employed by billionaires: High-net-worth individuals often employ complex investment strategies to maximize returns and manage risk. This ETF might fit into such a broader strategy.

- Diversification benefits within their existing portfolios: Even billionaires diversify their investments. This ETF could provide exposure to a specific sector not adequately represented in their existing portfolios.

- Potential for tax efficiency: Certain investment structures might offer tax advantages, making this ETF particularly attractive for high-income individuals.

- Alignment with long-term investment goals: Billionaires often adopt long-term investment horizons, making high-growth, potentially high-risk investments like this ETF potentially appealing.

Risks and Considerations: A Balanced Perspective

Investing in any ETF carries risks. It's crucial to understand these risks before investing:

- Market volatility and potential for losses: Market fluctuations can significantly impact an ETF's value, leading to potential losses, even if the long-term outlook is positive.

- Geopolitical risks and their potential impact: Global events can influence market trends and affect the performance of any investment, including this ETF.

- Concentration risk (if applicable): A concentrated investment strategy, focusing on a smaller number of companies, increases the risk of substantial losses if those companies underperform.

- Importance of individual risk tolerance and investment horizon: Only invest what you can afford to lose and only after careful consideration of your personal risk tolerance and investment time horizon.

How to Access the BlackRock ETF: A Step-by-Step Guide

Investing in ETFs typically requires a brokerage account.

- Brokerage account requirements: You will need to open a brokerage account with a reputable firm.

- Minimum investment amounts: Minimum investment amounts vary across brokerage platforms and ETFs.

- Trading commissions and fees: Brokerage commissions and fees should be factored into the overall investment cost.

- Links to relevant brokerage platforms: [Links to reputable brokerage platforms]. (Note: This requires a specific ETF, which was not provided and we cannot ethically recommend specific products.)

Conclusion

Billionaires are reportedly attracted to this hypothetical BlackRock ETF due to its potential for significant returns, driven by its focus on a high-growth sector and a potentially lucrative investment strategy. The predicted 110% return is a projection, not a guarantee, and it's vital to understand the associated risks, including market volatility and concentration risk. Remember, past performance is not indicative of future results.

Are you interested in exploring this potentially lucrative investment opportunity? Learn more about BlackRock ETFs and their potential for significant returns by [link to BlackRock website]. Don't miss out on this opportunity to potentially benefit from sophisticated investment strategies. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Investing wisely in BlackRock ETFs could be your key to unlocking exceptional returns. Always remember to diversify your investments and never invest more than you can afford to lose.

Featured Posts

-

Opportunistic Investments Brookfields Response To Market Dislocation

May 08, 2025

Opportunistic Investments Brookfields Response To Market Dislocation

May 08, 2025 -

Flamengo Derrota Gremio Com Show De Arrascaeta No Brasileirao

May 08, 2025

Flamengo Derrota Gremio Com Show De Arrascaeta No Brasileirao

May 08, 2025 -

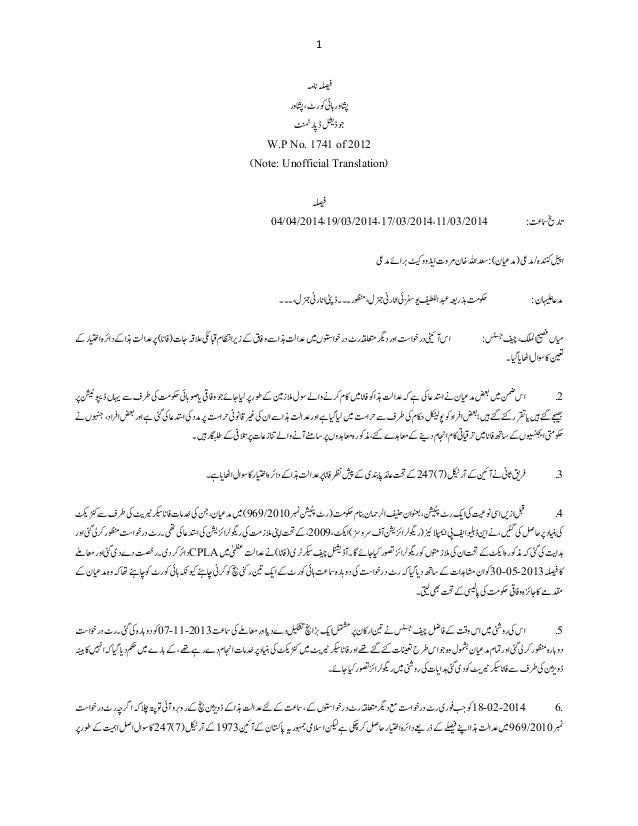

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Kw Khtm Krne Ka Fyslh

May 08, 2025

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Kw Khtm Krne Ka Fyslh

May 08, 2025 -

Artetas Arsenal Future Questioned Following Collymores Remarks

May 08, 2025

Artetas Arsenal Future Questioned Following Collymores Remarks

May 08, 2025 -

Watch Thunder Vs Trail Blazers Game Details Tv Listings And Live Stream Links March 7

May 08, 2025

Watch Thunder Vs Trail Blazers Game Details Tv Listings And Live Stream Links March 7

May 08, 2025