Opportunistic Investments: Brookfield's Response To Market Dislocation

Table of Contents

Brookfield's Opportunistic Investment Strategy

Brookfield's success in opportunistic investments is not accidental; it's a result of a carefully crafted and consistently applied strategy. This strategy hinges on three core pillars: identifying undervalued assets, meticulous risk management, and proactive value creation through active management.

Identifying Undervalued Assets

Brookfield's ability to pinpoint mispriced assets during market stress is a key differentiator. This isn't a matter of luck but a systematic process:

- Deep fundamental analysis: Brookfield goes beyond surface-level valuations, conducting thorough due diligence to understand the underlying value of an asset. This includes detailed financial modeling, market research, and on-the-ground assessments.

- Long-term perspective: Unlike many investors focused on short-term gains, Brookfield takes a long-term view, focusing on the intrinsic value of an asset and its potential for appreciation over years, even decades. This allows them to weather short-term market fluctuations.

- Proprietary research: Brookfield leverages its extensive global network and in-house expertise to gain insights unavailable to other investors. This includes access to exclusive data, relationships with key industry players, and a deep understanding of local market dynamics.

- Example: During the 2008 financial crisis, Brookfield identified numerous distressed real estate properties significantly undervalued by the market. Their deep understanding of the underlying real estate fundamentals allowed them to acquire these assets at prices far below their intrinsic value.

Risk Management and Due Diligence

A conservative approach to risk management is crucial to Brookfield's success in opportunistic investments. Their strategy involves:

- Stress testing: Brookfield rigorously analyzes potential scenarios, including worst-case scenarios, to assess downside risks and ensure the resilience of their investments.

- Conservative leverage: While utilizing debt to amplify returns, Brookfield maintains a conservative leverage ratio, minimizing the impact of potential market downturns.

- Diversification: Brookfield spreads its investments across various asset classes (real estate, infrastructure, renewable energy) and geographies, reducing the overall portfolio risk.

- Example: Before acquiring infrastructure assets, Brookfield undertakes extensive due diligence, including detailed engineering assessments, regulatory reviews, and operational audits, to mitigate potential risks.

Value Creation Through Active Management

Brookfield doesn't simply buy and hold; it actively manages its assets to enhance value. This active management approach includes:

- Operational improvements: Brookfield streamlines processes, increases efficiency, and reduces operational costs to improve profitability.

- Capital improvements: Investing in upgrades and renovations to enhance the quality and value of its assets.

- Strategic repositioning: Adapting assets to changing market conditions, identifying new uses, or repositioning them to appeal to a wider range of customers.

- Example: In its real estate portfolio, Brookfield has implemented numerous energy efficiency measures, reducing operating costs and enhancing the sustainability profile of its properties.

Case Studies of Successful Opportunistic Investments

Brookfield's track record speaks for itself. Here are a few examples demonstrating the power of their opportunistic investment strategy:

Real Estate Acquisitions During the 2008 Financial Crisis

During the 2008 financial crisis, Brookfield capitalized on the distressed real estate market, acquiring a significant portfolio of high-quality properties at deeply discounted prices. One notable example involved the acquisition of a large multi-family residential portfolio in several major US cities. By leveraging their deep understanding of the market and employing active management strategies, Brookfield significantly increased the value of this portfolio, realizing substantial returns within a few years. While specific financial figures are often kept confidential, reports suggest returns far exceeding the market average during that period.

Infrastructure Investments in Emerging Markets

Brookfield has successfully deployed capital in emerging markets, focusing on essential infrastructure projects. One example is their investment in a large-scale toll road project in South America. This project faced challenges related to regulatory hurdles and local market volatility, but Brookfield's extensive due diligence and local expertise mitigated these risks, resulting in long-term, stable returns. The project, while initially facing headwinds, has since become a cornerstone of Brookfield's infrastructure portfolio.

Renewable Energy Portfolio Development

Brookfield has made significant investments in renewable energy projects globally, recognizing their long-term growth potential and contribution to ESG (Environmental, Social, and Governance) goals. Their portfolio includes wind farms, solar power plants, and hydroelectric facilities. These investments offer not only strong financial returns but also contribute to a more sustainable future, aligning with increasing investor demand for ESG-conscious investments.

Lessons Learned and Future Outlook for Opportunistic Investments

Brookfield's success with opportunistic investments offers valuable lessons for other investors.

Adaptability and Innovation

Brookfield consistently adapts to changing market conditions and embraces innovative investment strategies. Their ability to identify emerging trends and adapt their approach is a key factor in their long-term success.

The Importance of Long-Term Vision

Long-term thinking is crucial in opportunistic investing. Brookfield's patient approach allows them to weather short-term market volatility and capitalize on long-term value creation opportunities.

Future Opportunities

Brookfield sees significant opportunities for future opportunistic investments in sectors like technology, healthcare, and sustainable infrastructure. These sectors are expected to experience significant growth in the coming years, presenting attractive investment opportunities for firms with Brookfield's expertise and risk management capabilities.

Conclusion

Brookfield's success with opportunistic investments demonstrates the potential for significant returns during periods of market dislocation. Their disciplined approach, focused on rigorous due diligence, active management, and a long-term perspective, sets them apart. By identifying undervalued assets and employing effective risk management strategies, they consistently create value even amidst uncertainty. To learn more about how to capitalize on similar market opportunities, explore alternative investment strategies and consider working with firms specializing in opportunistic investments. Understanding and utilizing strategies like Brookfield's can help you navigate market volatility and potentially achieve substantial returns through strategic opportunistic investments.

Featured Posts

-

Rogue Comic Preview Ka Zar Faces Danger In Savage Land 2

May 08, 2025

Rogue Comic Preview Ka Zar Faces Danger In Savage Land 2

May 08, 2025 -

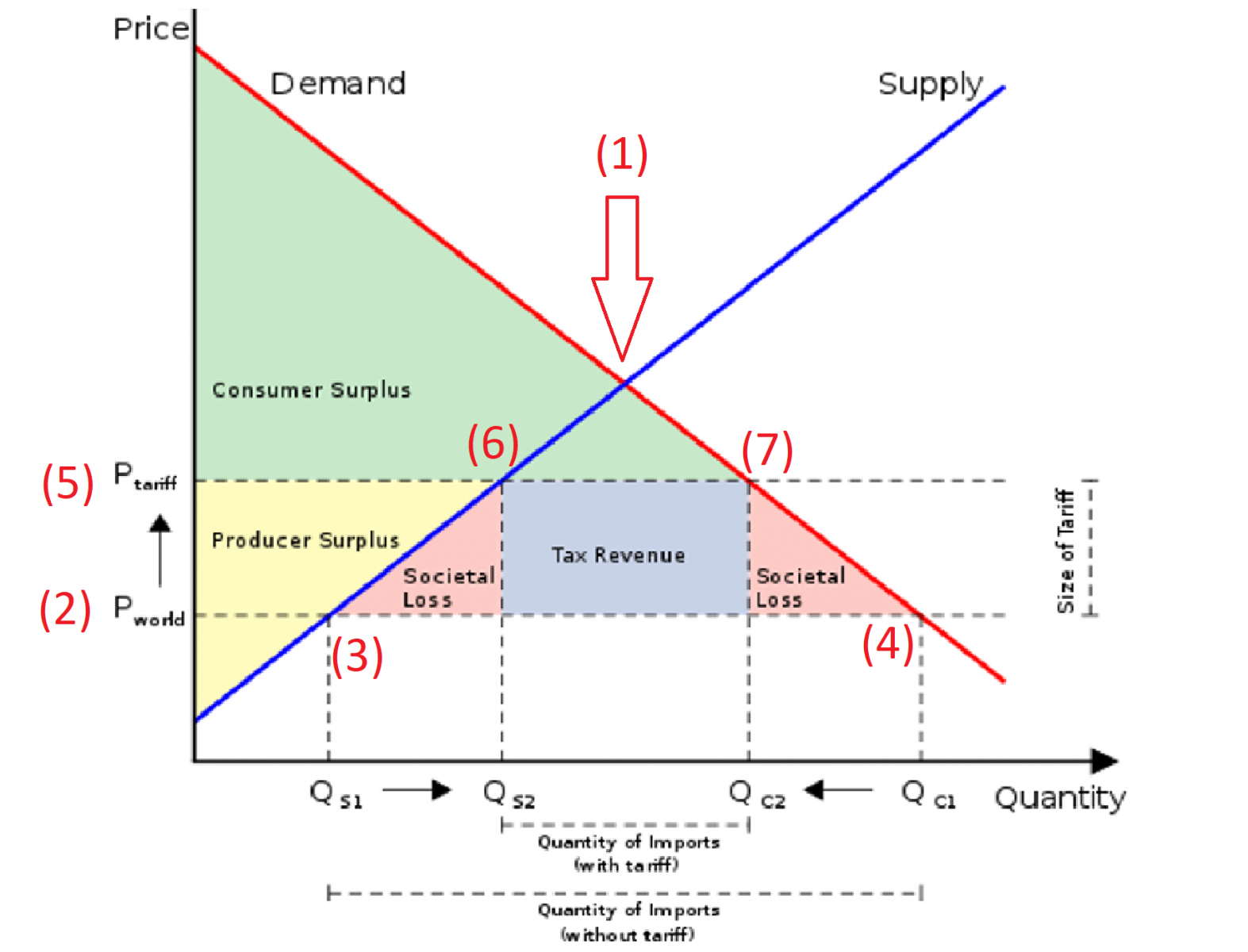

Liberation Day Tariffs And Stock Market Volatility A Comprehensive Overview

May 08, 2025

Liberation Day Tariffs And Stock Market Volatility A Comprehensive Overview

May 08, 2025 -

Best Streaming Services To Watch La Angels Baseball In 2025 No Cable

May 08, 2025

Best Streaming Services To Watch La Angels Baseball In 2025 No Cable

May 08, 2025 -

Dwp Letter Missing Potential 6 828 Loss Explained

May 08, 2025

Dwp Letter Missing Potential 6 828 Loss Explained

May 08, 2025 -

Investing In The Future Identifying The Countrys Top Business Growth Areas

May 08, 2025

Investing In The Future Identifying The Countrys Top Business Growth Areas

May 08, 2025