'Liberation Day' Tariffs And Stock Market Volatility: A Comprehensive Overview

Table of Contents

Historical Context of Liberation Day Tariffs

Liberation Day tariffs, implemented [Insert Year/Date of Implementation], represent a significant historical event with lasting consequences for global trade. Understanding their historical context is vital to grasping their impact on stock market fluctuations.

The Initial Impact

The announcement of Liberation Day tariffs immediately sent shockwaves through global financial markets. The initial reaction was largely negative, as investors reacted to the uncertainty and potential disruptions to established trade relationships.

- Dow Jones Industrial Average: Experienced a [Percentage]% drop in the days following the announcement.

- NASDAQ Composite: Suffered a [Percentage]% decline, reflecting concerns about the impact on technology companies reliant on global supply chains.

- Other relevant indices: [Mention other affected indices and their performance].

- Economic Indicators: GDP growth forecasts were revised downward, and inflation concerns increased due to potential price hikes on imported goods.

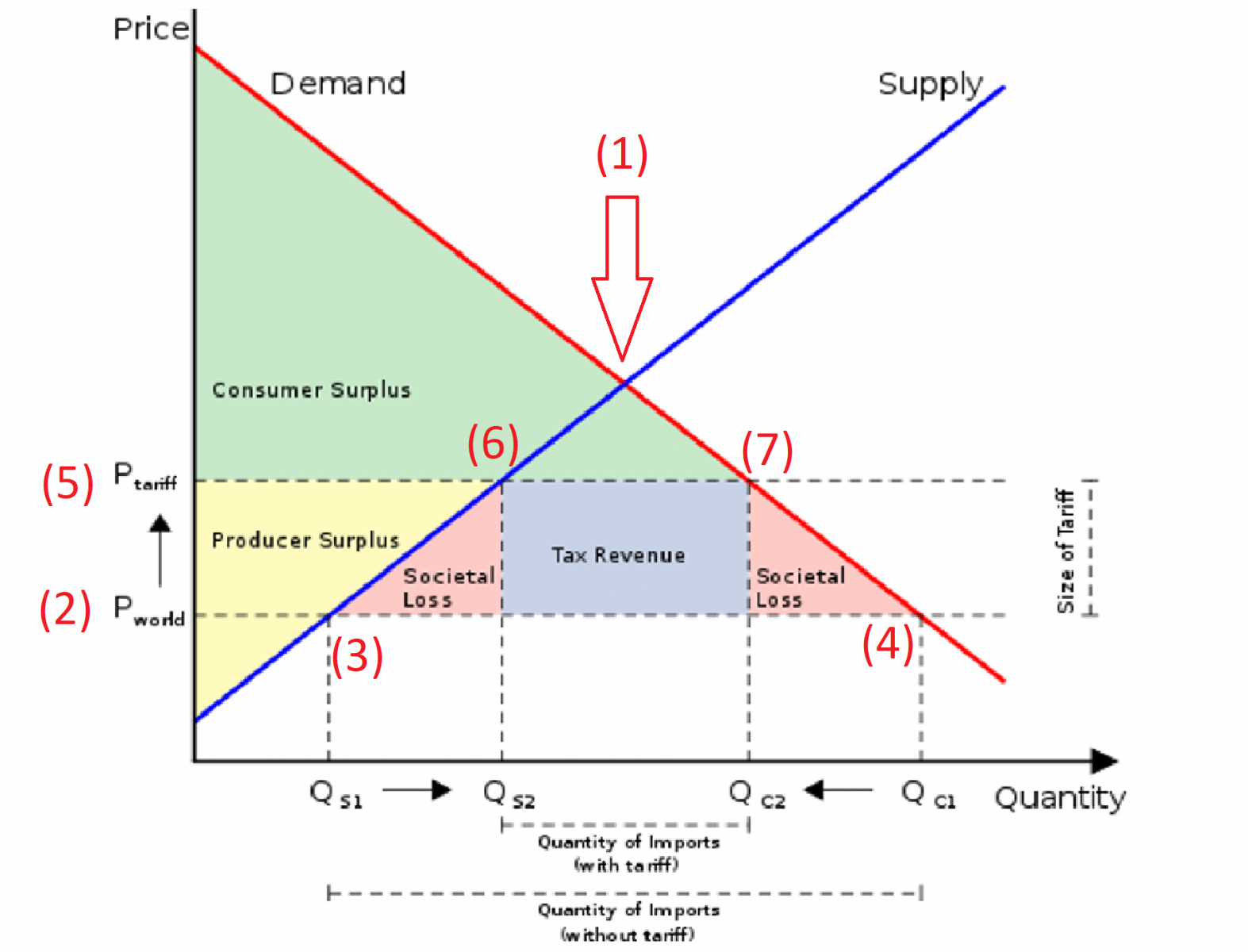

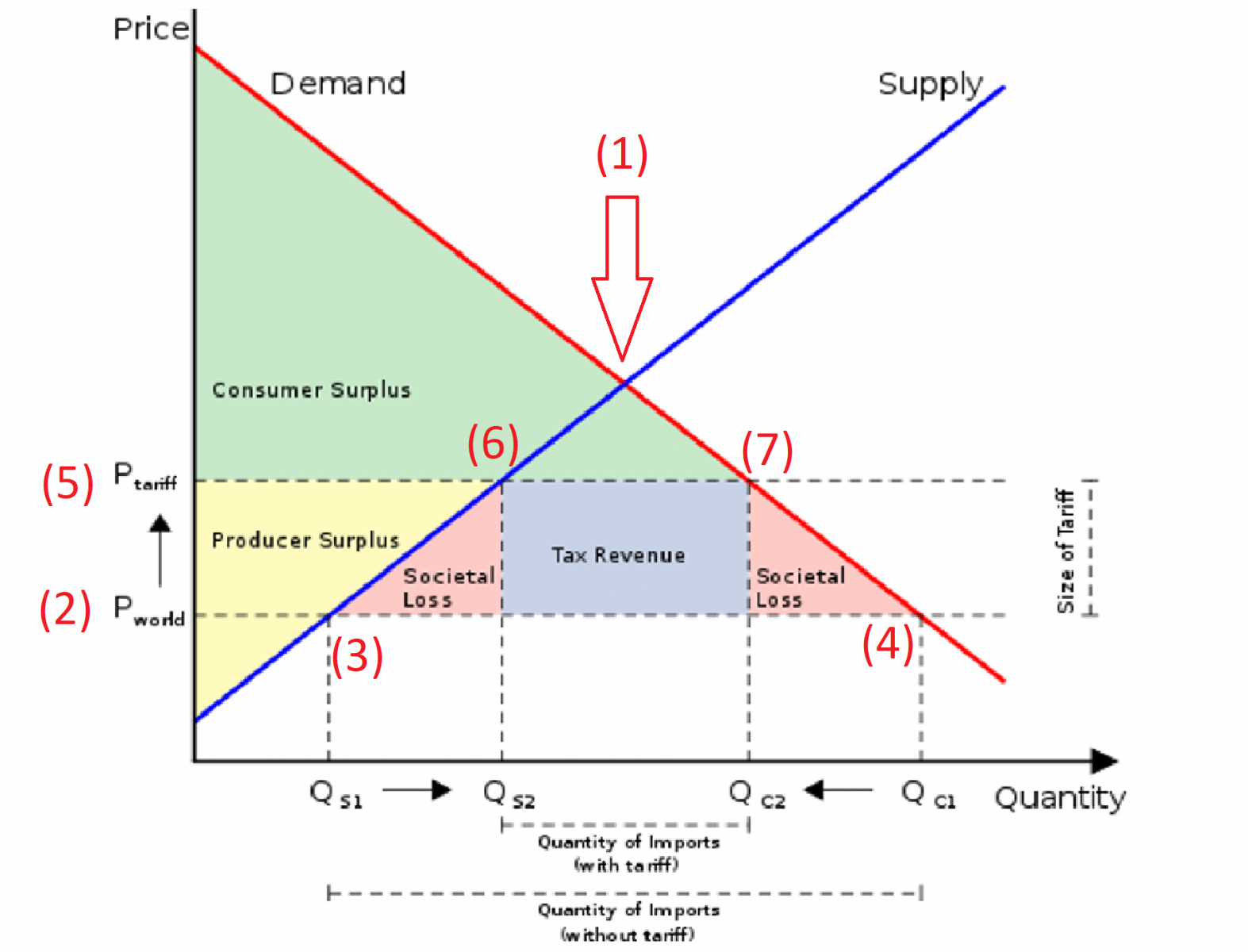

Long-Term Effects on Global Trade

The long-term effects of Liberation Day tariffs extended beyond the initial market shock. These tariffs fundamentally reshaped global trade relationships, leading to:

- Shifts in Global Supply Chains: Companies scrambled to diversify their sourcing, relocating production facilities and establishing new supply chains to mitigate the impact of tariffs.

- Impact on Specific Industries: Sectors heavily reliant on imports, such as [mention specific examples, e.g., consumer electronics, textiles], were particularly affected, experiencing price increases and reduced competitiveness.

- Retaliatory Tariffs: Other countries responded with retaliatory tariffs, escalating trade tensions and further destabilizing global markets. This tit-for-tat tariff war created a complex and unpredictable trade environment.

Understanding Stock Market Volatility During Liberation Day Periods

Stock market volatility during periods influenced by Liberation Day tariffs is driven by several interconnected factors.

Factors Contributing to Volatility

The uncertainty surrounding Liberation Day tariffs creates a volatile market environment primarily due to:

- Investor Sentiment and Speculation: Investor confidence is highly sensitive to news and developments regarding these tariffs, leading to rapid shifts in market sentiment and increased speculation.

- News and Media Coverage: The media plays a significant role in shaping investor perceptions and driving market reactions. Negative news coverage can exacerbate volatility.

- Geopolitical Factors: The geopolitical implications of Liberation Day tariffs, including strained international relations and potential trade wars, contribute significantly to market uncertainty.

Predicting and Mitigating Volatility

Predicting and mitigating volatility related to Liberation Day tariffs requires a multifaceted approach:

- Technical Analysis: Studying chart patterns and market indicators can help identify potential trends and turning points.

- Fundamental Analysis: Evaluating the financial health and future prospects of companies can aid in making informed investment decisions.

- Hedging Strategies: Utilizing hedging techniques, like options trading, can help protect against potential losses.

- Diversification: Spreading investments across various asset classes and sectors reduces exposure to risk from any single event or sector.

- Risk Management: Implementing robust risk management strategies is crucial for navigating volatile markets.

Investor Strategies for Navigating Liberation Day Tariff Uncertainty

Investors can employ various strategies to navigate the uncertainty created by Liberation Day tariffs.

Defensive Investment Strategies

During periods of high volatility, a defensive investment approach is often prudent:

- Cash and Government Bonds: Holding a portion of the portfolio in cash or low-risk government bonds can provide stability and liquidity.

- Defensive Stocks: Investing in companies with stable earnings and low volatility, such as consumer staples, utilities, or healthcare companies, can help mitigate losses.

Opportunities for Profit

For risk-tolerant investors, Liberation Day tariffs can also present profit opportunities:

- Import Substitution: Companies that benefit from import substitution (producing domestically what was previously imported) may experience increased demand and growth.

- Value Investing: Identifying undervalued companies that are temporarily affected by market downturns can yield significant returns in the long run.

Conclusion

Liberation Day tariffs have a demonstrably significant impact on stock market volatility. Understanding the historical context, predicting market movements, and employing effective investment strategies are crucial for navigating this complex landscape. By analyzing the factors contributing to volatility and utilizing diverse investment approaches, investors can better manage risk and potentially capitalize on market opportunities. Continue researching the economic impact of Liberation Day tariffs and adapt your investment strategies accordingly. Careful planning and a nuanced understanding of market dynamics are key to successfully navigating the challenges and opportunities presented by Liberation Day tariffs and their effect on stock market volatility.

Featured Posts

-

Dogecoin Shiba Inu And Sui Price Surge Understanding The Reasons Behind The Rally

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Understanding The Reasons Behind The Rally

May 08, 2025 -

Daily Lotto Friday April 18th 2025 Results

May 08, 2025

Daily Lotto Friday April 18th 2025 Results

May 08, 2025 -

Is 2025 Stephen Kings Best Year Despite A Potential Monkey Flop

May 08, 2025

Is 2025 Stephen Kings Best Year Despite A Potential Monkey Flop

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Kw Khraj Eqydt 12 Wyn Brsy Ky Tqrybat

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Kw Khraj Eqydt 12 Wyn Brsy Ky Tqrybat

May 08, 2025 -

Wall Street Predicts 110 Surge Is This Black Rock Etf The Next Big Investment

May 08, 2025

Wall Street Predicts 110 Surge Is This Black Rock Etf The Next Big Investment

May 08, 2025