100 Days Of Uncertainty: Assessing The U.S. Dollar's Trajectory

Table of Contents

Inflation's Grip on the U.S. Dollar

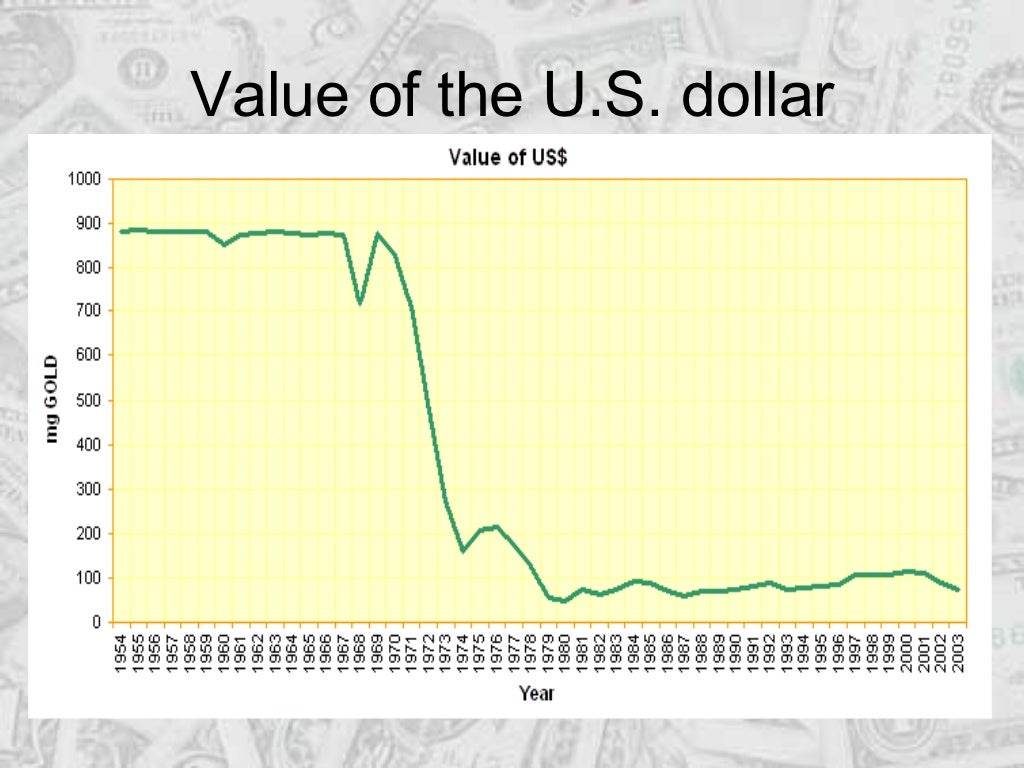

The current inflation rate in the United States is a major driver of uncertainty surrounding the dollar's value. High inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors. The relationship between inflation and currency value is inverse; as inflation rises, the currency typically weakens.

- Current Inflationary Pressures: The Consumer Price Index (CPI) remains a key indicator to watch. Sustained high CPI readings signal persistent inflationary pressure, potentially weakening the dollar.

- Future Inflation Scenarios: Several scenarios are possible. A sustained high inflation rate could significantly weaken the dollar. Conversely, a rapid decrease in inflation could strengthen it. A plateauing of inflation might lead to sideways movement in the dollar's value.

- Impact on Purchasing Power: High inflation directly reduces the purchasing power of the dollar, both domestically and internationally. This impacts consumer spending and investment decisions. Keywords: inflation, US inflation rate, purchasing power, inflationary pressure, CPI

The Federal Reserve's Policy Influence

The Federal Reserve (Fed) plays a crucial role in shaping the dollar's trajectory through its monetary policy decisions. Recent interest rate hikes aim to curb inflation, but this also affects the dollar's value.

- Interest Rate Hikes and Cuts: Higher interest rates generally attract foreign investment, increasing demand for the dollar and strengthening its value. Conversely, interest rate cuts can weaken the dollar.

- Quantitative Easing (QE): The Fed's use of QE (printing money to stimulate the economy) can devalue the dollar in the long run.

- Fed Communication: The Fed's communication strategy significantly impacts market sentiment. Clear and consistent communication can help stabilize the markets, while ambiguous statements can increase volatility. Keywords: Federal Reserve, interest rates, monetary policy, quantitative easing, rate hikes

Geopolitical Events and Global Economic Factors

Geopolitical events and global economic conditions significantly impact the U.S. dollar's value. Global uncertainty often drives investors toward the safety of the dollar, increasing its demand.

- Geopolitical Risk: Events like the war in Ukraine create global uncertainty, boosting the dollar's safe-haven appeal.

- Global Economic Growth: Strong global economic growth increases demand for all currencies, including the dollar. Conversely, a global economic slowdown can weaken the dollar.

- Major Currency Interactions: The Euro, Yen, and British Pound, among others, all play a significant role in shaping the dollar's exchange rates. Strength in these currencies can relatively weaken the dollar. Keywords: geopolitical risk, global economy, currency exchange rates, Euro, Yen, British Pound, global trade

Analyzing Market Sentiment and Investor Behavior

Investor confidence and speculation heavily influence the foreign exchange market and the dollar's value. Positive sentiment strengthens the dollar, while negative sentiment weakens it.

- Investor Confidence: Positive economic news and political stability generally boost investor confidence, strengthening the dollar.

- Foreign Exchange Market Trends: Analyzing trends in currency trading helps predict future movements. For example, a consistent upward trend suggests bullish sentiment.

- Market Scenarios: Three main scenarios exist: bullish (dollar strengthens), bearish (dollar weakens), and sideways (dollar's value fluctuates within a range). Keywords: market sentiment, investor confidence, foreign exchange market, currency trading, speculation

Predicting the U.S. Dollar's Trajectory: A 100-Day Outlook

Based on the factors discussed above, predicting the dollar's trajectory over the next 100 days is challenging. However, several plausible scenarios exist:

- Best-Case Scenario: Inflation cools rapidly, the Fed maintains a steady interest rate, geopolitical tensions ease, and global economic growth remains robust. This could lead to a moderate strengthening of the dollar.

- Worst-Case Scenario: Inflation remains stubbornly high, the Fed aggressively raises interest rates, geopolitical risks escalate, and a global economic slowdown occurs. This could lead to a significant weakening of the dollar.

- Most Likely Scenario: A combination of factors will likely result in moderate volatility, with the dollar fluctuating within a relatively narrow range. Keywords: dollar forecast, currency prediction, market outlook, economic forecast, risk assessment

Conclusion: Navigating the Uncertainty: Your Next Steps with the U.S. Dollar

The U.S. dollar's trajectory over the next 100 days will depend heavily on inflation, Federal Reserve policy, geopolitical events, and global economic conditions. While predicting the future with certainty is impossible, understanding these key factors is crucial. Staying informed about economic news and market trends is paramount. Before making any investment decisions involving the U.S. dollar or currency trading, consult with a qualified financial advisor. Subscribe to our newsletter for ongoing analysis of the dollar trajectory and stay ahead of the curve. We hope this analysis provides a clearer understanding of the factors influencing the US dollar and its potential movements. Remember, responsible financial planning is key when navigating currency forecast and economic uncertainty.

Featured Posts

-

Signs Your Silent Divorce Is Already Happening

Apr 28, 2025

Signs Your Silent Divorce Is Already Happening

Apr 28, 2025 -

Starbucks Workers Reject Companys Guaranteed Raise Offer

Apr 28, 2025

Starbucks Workers Reject Companys Guaranteed Raise Offer

Apr 28, 2025 -

The U S Dollars Uncertain Future A Historical Perspective

Apr 28, 2025

The U S Dollars Uncertain Future A Historical Perspective

Apr 28, 2025 -

5 Key Dos And Don Ts To Succeed In The Private Credit Industry

Apr 28, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Industry

Apr 28, 2025 -

Chinas Tariff Exemptions Impact On Us Goods

Apr 28, 2025

Chinas Tariff Exemptions Impact On Us Goods

Apr 28, 2025

Latest Posts

-

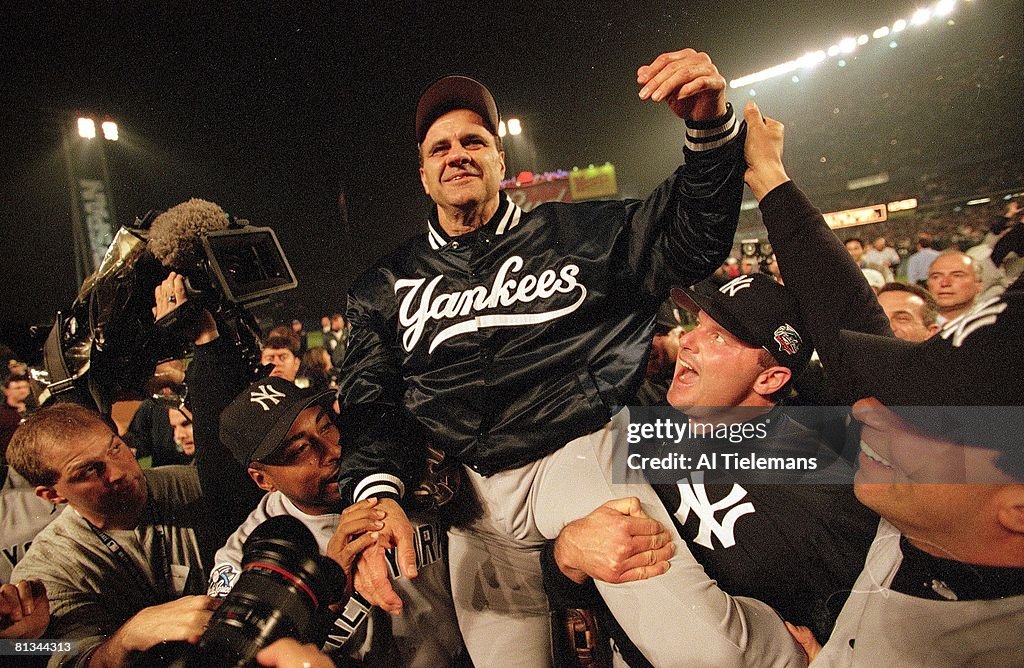

The 2000 New York Yankees Joe Torre Andy Pettitte And A Memorable Season

Apr 28, 2025

The 2000 New York Yankees Joe Torre Andy Pettitte And A Memorable Season

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

Blue Jays Defeat Yankees Devin Williams Relief Appearance Crumbles

Apr 28, 2025

Blue Jays Defeat Yankees Devin Williams Relief Appearance Crumbles

Apr 28, 2025 -

Rodons Strong Performance Prevents Astros Sweep Of Yankees

Apr 28, 2025

Rodons Strong Performance Prevents Astros Sweep Of Yankees

Apr 28, 2025 -

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025