The U.S. Dollar's Uncertain Future: A Historical Perspective

Table of Contents

The Rise of the U.S. Dollar as the Global Reserve Currency

The U.S. dollar's current status as the world's reserve currency is not an accident; it's the culmination of decades of strategic decisions and geopolitical events.

The Bretton Woods Agreement and its Impact

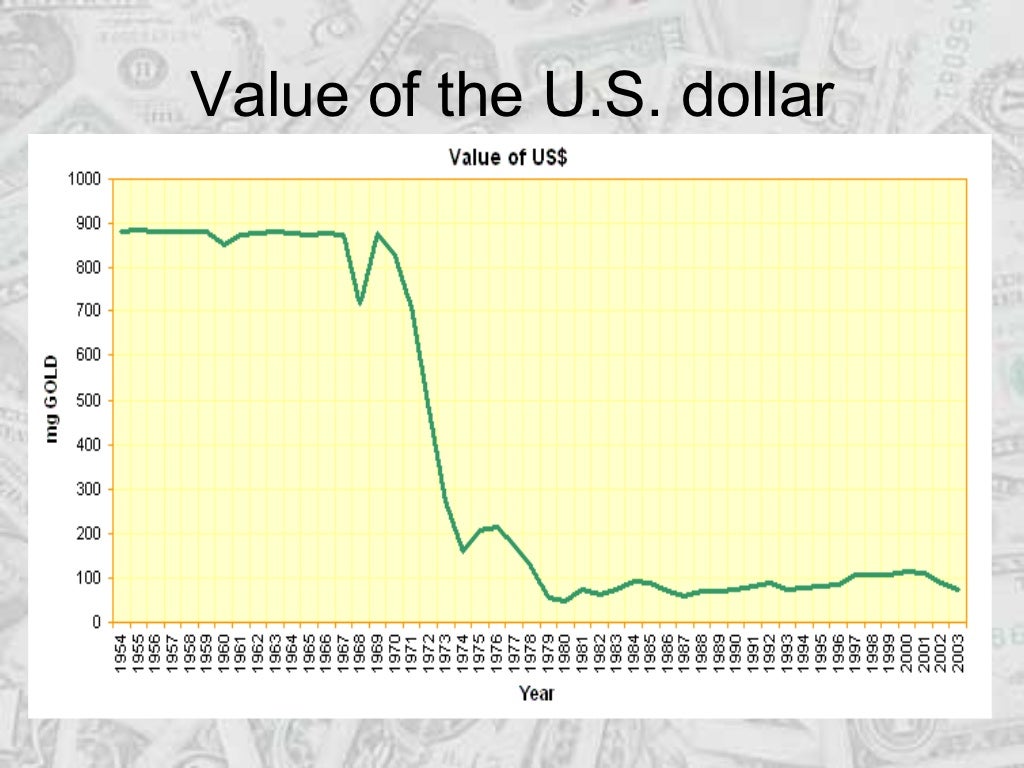

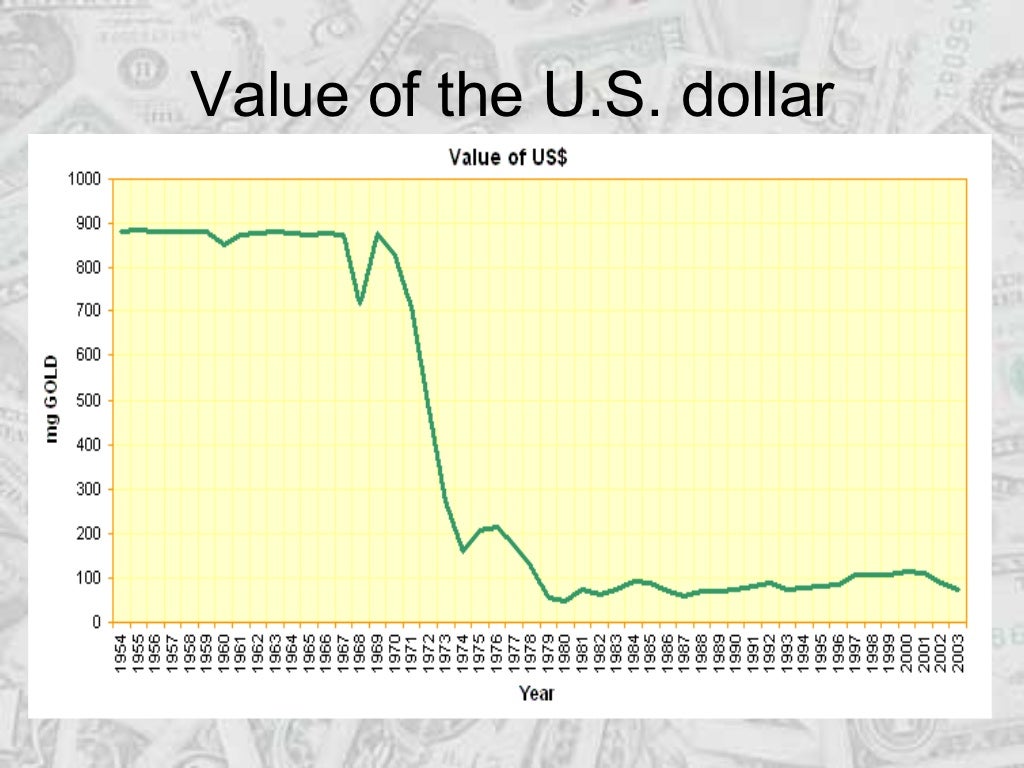

The Bretton Woods Agreement of 1944 was a pivotal moment in the dollar's ascent. This landmark accord established a fixed exchange rate system, tying most currencies to the U.S. dollar, which in turn was pegged to gold.

- Established the International Monetary Fund (IMF) and the World Bank: These institutions played (and continue to play) crucial roles in global financial stability.

- Gave the U.S. dollar a privileged position: The agreement effectively made the dollar the world's primary reserve currency, facilitating international trade and investment.

- Key figures: John Maynard Keynes and Harry Dexter White played crucial roles in shaping the agreement.

The U.S., benefitting from its industrial strength post-World War II, was uniquely positioned to leverage the agreement to establish its economic and financial hegemony. This meant easier access to global markets and cheaper borrowing costs.

Post-Bretton Woods Era and the Petrodollar System

The collapse of the Bretton Woods system in the early 1970s didn't diminish the dollar's dominance. Instead, it paved the way for the petrodollar system, where oil is priced and traded primarily in U.S. dollars.

- Oil pricing in USD: This created a massive demand for dollars globally, further cementing its position as the reserve currency.

- Geopolitical implications: The system intertwined the U.S. dollar with global energy markets, giving the U.S. significant geopolitical leverage.

- Vulnerabilities: The system's reliance on oil demand and the stability of the U.S. economy makes it vulnerable to shifts in global energy markets and internal U.S. economic shocks. Diversification away from the dollar in oil transactions is a potential long-term threat.

The Dollar's Strength and Global Influence

The advantages of holding U.S. dollars are numerous, contributing to its enduring appeal:

- Liquidity: The dollar is the most liquid currency in the world, facilitating easy transactions.

- Safety: Many perceive the U.S. financial system as relatively stable and secure, making the dollar a safe haven asset.

- International trade: A significant portion of international trade invoices are denominated in U.S. dollars.

- Central bank reserves: Central banks around the world hold substantial dollar reserves, reinforcing the currency's importance. This, in turn, supports the US economy by providing a stable source of foreign capital.

Challenges to the U.S. Dollar's Dominance

Despite its historical strength, the U.S. dollar faces several formidable challenges to its dominance.

The Rise of Competing Currencies

The emergence of strong rival currencies like the Euro and the Chinese Yuan presents a significant challenge to the dollar's hegemony.

- Euro: The Euro’s strength comes from the unified European economy, although internal economic divergences remain a challenge.

- Chinese Yuan: China's growing economic influence is pushing for greater international use of the Yuan, though significant obstacles remain, including capital controls and a less transparent financial system.

- Global implications: The rise of competing currencies could lead to a multipolar monetary system, reducing the dollar's dominance and potentially impacting global trade and finance.

Increasing U.S. National Debt and Budget Deficits

The U.S.'s soaring national debt and persistent budget deficits pose a direct threat to the dollar's value.

- Debt and inflation: High national debt can lead to inflation, eroding the purchasing power of the dollar.

- Investor confidence: Large debt levels can erode investor confidence in the U.S. economy, potentially leading to capital flight.

- Solutions: Fiscal discipline and long-term economic reforms are crucial to address the national debt and mitigate its impact on the dollar.

Geopolitical Instability and its Impact on the Dollar

Geopolitical events can significantly affect the dollar's value, often leading to increased volatility.

- Global uncertainty: Periods of heightened global uncertainty often drive investors towards the perceived safety of the dollar, temporarily boosting its value.

- However: Prolonged instability can erode confidence in the U.S. and its economy, leading to a long-term weakening of the dollar.

- Examples: The ongoing war in Ukraine, trade tensions with China, and other geopolitical events can significantly impact the value and stability of the dollar.

Potential Future Scenarios for the U.S. Dollar

Projecting the future of the U.S. dollar involves considering several distinct possibilities.

Continued Dominance

The dollar could maintain its dominance under certain conditions:

- Strong U.S. economy: Continued economic growth and stability would reinforce the dollar’s appeal.

- Geopolitical stability: A relatively stable global geopolitical environment would maintain investor confidence.

- Lack of viable alternatives: The absence of a compelling alternative reserve currency would ensure the dollar's continued dominance.

Gradual Decline

A more likely scenario is a gradual decline in the dollar's global share.

- Rise of competitors: The continued rise of the Euro and Yuan, along with other potential currencies, would gradually erode the dollar's share of global reserves.

- Economic weakness: Persistent U.S. economic weakness, high inflation, and large budget deficits could accelerate the dollar's decline.

- Geopolitical shifts: Significant geopolitical changes could accelerate the shift away from the dollar.

Sudden Collapse

While less probable, a sudden collapse of the dollar is theoretically possible, though extremely unlikely. This would require an unprecedented confluence of negative factors including a major financial crisis, a catastrophic loss of confidence in the U.S. economy, and the emergence of a vastly superior alternative. The consequences of such a collapse would be severe and globally disruptive.

Conclusion: The Future of the U.S. Dollar – A Call to Action

The future of the U.S. dollar is far from certain. While it has historically enjoyed an unparalleled position as the world's reserve currency, several challenges threaten its continued dominance. Understanding the historical context of the dollar's rise and the emerging forces that could reshape its future is crucial for investors, policymakers, and anyone interested in the global economy. The rise of competing currencies, the U.S. national debt, and geopolitical instability all pose significant risks. Staying informed about developments affecting the U.S. dollar and continuing to research the future of the U.S. dollar and its global implications is paramount.

Featured Posts

-

Celebrity Chefs Fishermans Stew Wins Over Eva Longoria

Apr 28, 2025

Celebrity Chefs Fishermans Stew Wins Over Eva Longoria

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Surge In Costs

Apr 28, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Surge In Costs

Apr 28, 2025 -

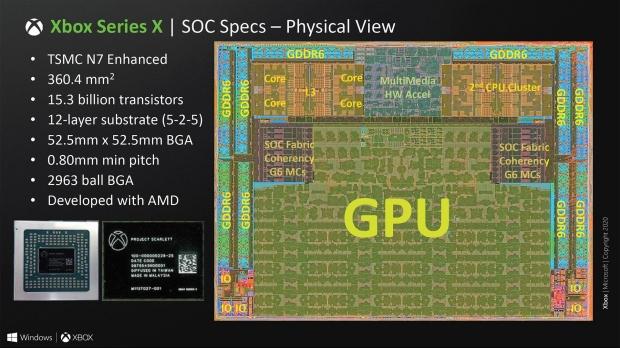

Gpu Costs A Deep Dive Into The Recent Price Hikes

Apr 28, 2025

Gpu Costs A Deep Dive Into The Recent Price Hikes

Apr 28, 2025 -

Silent Divorce Subtle Signs Your Relationship Is Failing

Apr 28, 2025

Silent Divorce Subtle Signs Your Relationship Is Failing

Apr 28, 2025 -

Why Are Gpu Prices Skyrocketing Again

Apr 28, 2025

Why Are Gpu Prices Skyrocketing Again

Apr 28, 2025

Latest Posts

-

Blue Jays Defeat Yankees Devin Williams Relief Appearance Crumbles

Apr 28, 2025

Blue Jays Defeat Yankees Devin Williams Relief Appearance Crumbles

Apr 28, 2025 -

Rodons Strong Performance Prevents Astros Sweep Of Yankees

Apr 28, 2025

Rodons Strong Performance Prevents Astros Sweep Of Yankees

Apr 28, 2025 -

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025 -

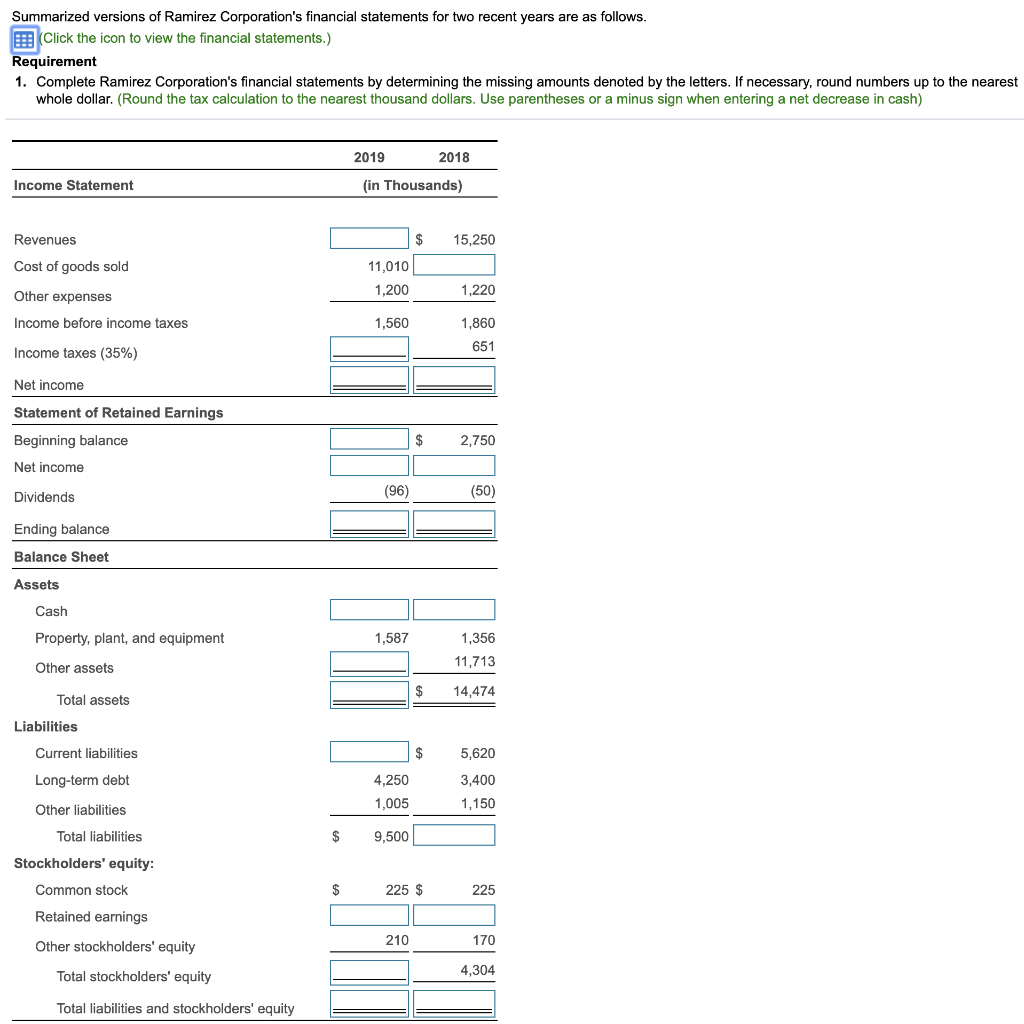

Decoding Musks X Debt Sale A Financial Deep Dive

Apr 28, 2025

Decoding Musks X Debt Sale A Financial Deep Dive

Apr 28, 2025 -

X Corporations Financial Transformation Insights From The Recent Debt Sale

Apr 28, 2025

X Corporations Financial Transformation Insights From The Recent Debt Sale

Apr 28, 2025