X Corporation's Financial Transformation: Insights From The Recent Debt Sale

Table of Contents

Details of the Debt Sale

The Sale's Structure and Terms

X Corporation successfully executed a debt sale involving the issuance of senior unsecured notes. The sale raised a total of $500 million, a substantial injection of capital into the company. These notes carry a 5-year maturity date and a fixed interest rate of 4.5%, reflecting the current market conditions for similar corporate bonds. The sale also included certain covenants, standard for this type of debt instrument, designed to protect the interests of investors.

- Senior Unsecured Notes: This signifies that these notes rank higher in the capital structure than subordinated debt, offering investors greater security.

- 5-Year Maturity: This relatively short maturity period allows X Corporation to refinance at a later date, taking advantage of potential changes in interest rates.

- 4.5% Interest Rate: This competitive interest rate showcases X Corporation's strong creditworthiness, attracting significant investor interest.

- Credit Rating Agencies: Moody's and S&P both affirmed X Corporation's investment-grade credit rating following the debt sale, indicating investor confidence in the company's financial stability.

Investor Response and Market Impact

The debt sale was significantly oversubscribed, indicating strong investor confidence in X Corporation's future prospects and the attractiveness of the terms offered. Demand came from a broad range of institutional investors, including mutual funds, pension funds, and insurance companies. The successful completion of the debt sale positively impacted X Corporation's stock price, reflecting the improved financial position and reduced financial risk.

- Oversubscribed Offering: The high demand for the notes suggests strong belief in X Corporation's ability to meet its debt obligations.

- Strong Institutional Investor Participation: This validates X Corporation's financial stability and attractiveness as an investment.

- Positive Impact on Stock Price: The successful debt sale signaled reduced financial risk, leading to a boost in investor confidence and share price.

- Bond Yield Implications: The relatively low interest rate achieved indicates a favorable market perception of X Corporation's creditworthiness, resulting in lower borrowing costs.

Strategic Rationale Behind the Debt Sale

Debt Restructuring and Refinancing

A primary objective of the debt sale was to refinance existing higher-cost debt. By replacing older, more expensive debt obligations with the new notes, X Corporation significantly reduced its overall interest expense. This freed up valuable cash flow for reinvestment in growth initiatives and improved its long-term financial flexibility.

- Reduction in Interest Expense: The lower interest rate on the new notes resulted in substantial annual savings on interest payments.

- Debt Maturity Extension: While the new notes have a 5-year maturity, this offers a longer time horizon compared to some existing debt, reducing short-term refinancing pressures.

- Improved Financial Flexibility: The reduction in debt burden and interest expense grants X Corporation greater flexibility to pursue strategic opportunities and weather unexpected economic downturns.

Funding for Strategic Initiatives

The proceeds from the debt sale will primarily fund key strategic initiatives designed to accelerate X Corporation's growth and enhance its competitive position. These initiatives include expansion into new international markets, significant investments in research and development, and potentially, strategic acquisitions.

- Market Expansion: Investing in new markets will expand X Corporation’s customer base and revenue streams.

- R&D Investment: Increased R&D spending will fuel innovation, leading to the development of new products and services.

- Strategic Acquisitions: Acquiring complementary businesses could enhance X Corporation's market share and technological capabilities.

Long-Term Implications for X Corporation

Improved Financial Health and Stability

The successful debt sale has demonstrably improved X Corporation's financial health and stability. Key financial ratios, such as the debt-to-equity ratio and the interest coverage ratio, have improved significantly, reflecting a stronger balance sheet and enhanced creditworthiness. This improved financial position enhances X Corporation’s access to future financing opportunities and reduces its vulnerability to economic fluctuations.

- Debt-to-Equity Ratio: This ratio, measuring the proportion of debt financing compared to equity, has decreased, indicating a healthier financial structure.

- Interest Coverage Ratio: This ratio, showing the ability to pay interest expenses, has increased, reflecting the improved financial capacity.

- Enhanced Access to Future Financing: Improved creditworthiness opens doors to more favorable financing terms in the future.

Potential Risks and Challenges

While the debt sale offers significant benefits, certain risks and challenges remain. The primary risk is interest rate sensitivity. A rise in interest rates could increase the cost of future debt refinancing. X Corporation needs to monitor market conditions and proactively manage its financial risk profile to mitigate this potential challenge.

- Interest Rate Risk: Fluctuations in interest rates could affect the cost of future debt.

- Refinancing Risk: Successfully refinancing the debt at maturity will depend on market conditions and X Corporation's continued creditworthiness.

- Mitigation Strategies: X Corporation may employ hedging strategies to mitigate interest rate risk. Maintaining a strong credit rating and robust cash flow will also be crucial.

Conclusion

X Corporation’s recent debt sale represents a significant step in its financial transformation. By strategically restructuring its debt and securing funding for future growth, the company has enhanced its financial health and positioned itself for long-term success. The careful planning and execution of this debt sale demonstrate a commitment to responsible financial management.

Call to Action: Stay informed about X Corporation's financial progress and learn more about the ongoing impact of this transformative debt sale by following our blog for further updates and analysis on X Corporation’s financial strategy and future endeavors.

Featured Posts

-

2000 Yankees Diary A Game Recap Of The Victory Against The Royals

Apr 28, 2025

2000 Yankees Diary A Game Recap Of The Victory Against The Royals

Apr 28, 2025 -

Nixons Shadow Will The U S Dollar Experience Its Worst 100 Days

Apr 28, 2025

Nixons Shadow Will The U S Dollar Experience Its Worst 100 Days

Apr 28, 2025 -

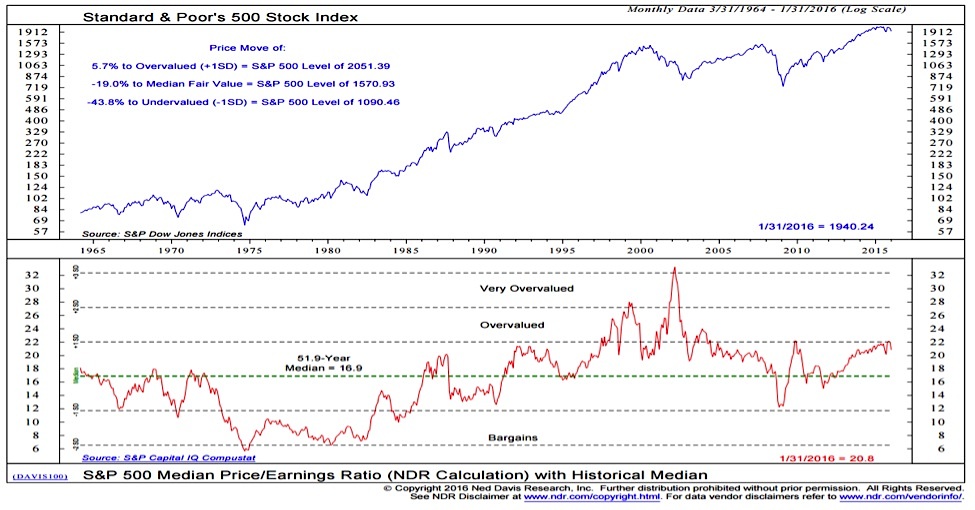

Investor Concerns About High Stock Market Valuations Bof As Response

Apr 28, 2025

Investor Concerns About High Stock Market Valuations Bof As Response

Apr 28, 2025 -

The Luigi Mangione Phenomenon Understanding His Supporters

Apr 28, 2025

The Luigi Mangione Phenomenon Understanding His Supporters

Apr 28, 2025 -

Nuclear Talks Us And Iran Remain Divided After Latest Discussions

Apr 28, 2025

Nuclear Talks Us And Iran Remain Divided After Latest Discussions

Apr 28, 2025

Latest Posts

-

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025 -

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025