11 Million ETH Accumulated: Analyzing The Impact On Ethereum's Price

Table of Contents

Who is Accumulating ETH and Why?

The accumulation of 11 million ETH isn't a singular event but a confluence of factors involving various market participants. Understanding who's behind this accumulation is crucial to predicting its impact on the Ethereum price.

Large Institutional Investors

Large institutional investors are increasingly recognizing Ethereum's potential. Their strategies often involve long-term holding, leveraging staking rewards, and active participation in the burgeoning DeFi ecosystem.

- Examples: BlackRock, Fidelity, and other significant investment firms have publicly expressed interest in cryptocurrencies, including Ethereum. While specific ETH holdings aren't always disclosed, their presence is felt in the market.

- Investment Size: The precise amount invested by these institutions remains largely private, but their collective buying power significantly contributes to ETH accumulation.

- Public Statements: While many remain tight-lipped about specific holdings, positive comments regarding Ethereum's technology and potential contribute to market confidence.

Retail Investors and HODLers

Retail investors and long-term holders (HODLers) also play a vital role in the ETH accumulation trend. Their belief in Ethereum's long-term prospects fuels continued holding, despite market volatility.

- Trends in Retail Investor Sentiment: Social media sentiment and online forums show a generally positive outlook on Ethereum, particularly concerning its scalability improvements and DeFi applications.

- On-Chain Data: On-chain data reveals a significant portion of ETH is held in long-term wallets, suggesting a reluctance to sell, even during market downturns.

- Average Holding Time: Analysis shows an increasing average holding time for ETH, indicating a growing conviction among retail investors.

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are also significant players in the ETH accumulation narrative. Liquidity provision on DEXs requires locking up ETH, contributing to a reduction in circulating supply.

- Examples: Uniswap, Curve Finance, and other prominent DEXs facilitate large volumes of ETH trading and locking.

- Liquidity Pooling: The mechanism of liquidity pooling on DEXs requires users to lock ETH, effectively removing it from the circulating supply.

- Effect on ETH Supply: This locked ETH directly reduces the available supply, potentially influencing price dynamics.

The Impact of ETH Accumulation on Price

The accumulation of 11 million ETH has considerable implications for its price, primarily through supply and demand mechanics and its effect on market sentiment.

Supply and Demand Dynamics

Increased accumulation directly affects the supply and demand balance of ETH. Reduced circulating supply, coupled with sustained demand, typically exerts upward pressure on the price.

- Supply and Demand Principles: Basic economic principles dictate that scarcity increases value. The accumulation of 11 million ETH contributes to this scarcity.

- ETH Circulating Supply: The overall circulating supply of ETH is a critical factor in price determination. Accumulation reduces this supply.

- Comparison with Other Cryptocurrencies: Comparing ETH accumulation to other cryptocurrencies helps gauge its relative impact on price.

Market Sentiment and Investor Confidence

The accumulation of ETH significantly influences market sentiment and investor confidence. Large-scale buying signals a positive outlook, encouraging further investment.

- Social Media Sentiment: Positive social media buzz surrounding Ethereum, fueled by the accumulation news, enhances investor confidence.

- News Articles and Analyst Opinions: News coverage and analyst predictions often reflect this positive sentiment, creating a self-reinforcing cycle.

- Investor Sentiment Indices: Quantitative indices measuring investor sentiment often show a correlation between ETH accumulation and increased confidence.

Potential Price Predictions (Disclaimer: Cryptocurrency investments are highly volatile. The following are potential scenarios and not financial advice.)

Analyzing the 11 million ETH accumulation alongside other market factors suggests several possible price scenarios:

- Bullish Scenario: Continued accumulation and positive market sentiment could drive significant price appreciation.

- Bearish Scenario: Unforeseen market events or regulatory changes could counteract the positive impact of accumulation.

- Neutral Scenario: The price may consolidate or experience moderate fluctuations, reflecting a balance between accumulation and other market pressures.

Long-Term Implications and Risks

While the 11 million ETH accumulation presents a bullish signal, it's crucial to consider the long-term implications and inherent risks.

Ethereum's Future Development

Ethereum's ongoing development, including Ethereum 2.0, significantly influences the long-term value of ETH. Improvements in scalability and efficiency could drive further price appreciation.

- Key Developments: The shift to proof-of-stake, enhanced scalability solutions, and the expanding DeFi ecosystem contribute to ETH's long-term potential.

- Impact on Price: Successful implementation of these upgrades is likely to positively impact the price of ETH.

- Timelines: While timelines for complete implementation are subject to change, the progress itself generates positive sentiment.

Regulatory Uncertainty

Regulatory uncertainty remains a significant risk factor for the cryptocurrency market, including Ethereum. Changes in regulations can substantially impact price movements.

- Potential Regulatory Scenarios: Various scenarios range from supportive regulations fostering growth to restrictive measures hindering adoption.

- Effects on Price and Market Sentiment: Regulatory clarity can boost investor confidence, while uncertainty can trigger sell-offs.

- Relevant News and Regulatory Developments: Closely monitoring regulatory news is crucial for informed investment decisions.

Market Volatility

The inherent volatility of the cryptocurrency market underscores the risks associated with investing in ETH. Price fluctuations can be dramatic and unpredictable.

- Risk Management Strategies: Diversification, careful risk assessment, and avoiding emotional decision-making are crucial strategies.

- Importance of Due Diligence: Thorough research and understanding of market dynamics are essential before investing in any cryptocurrency.

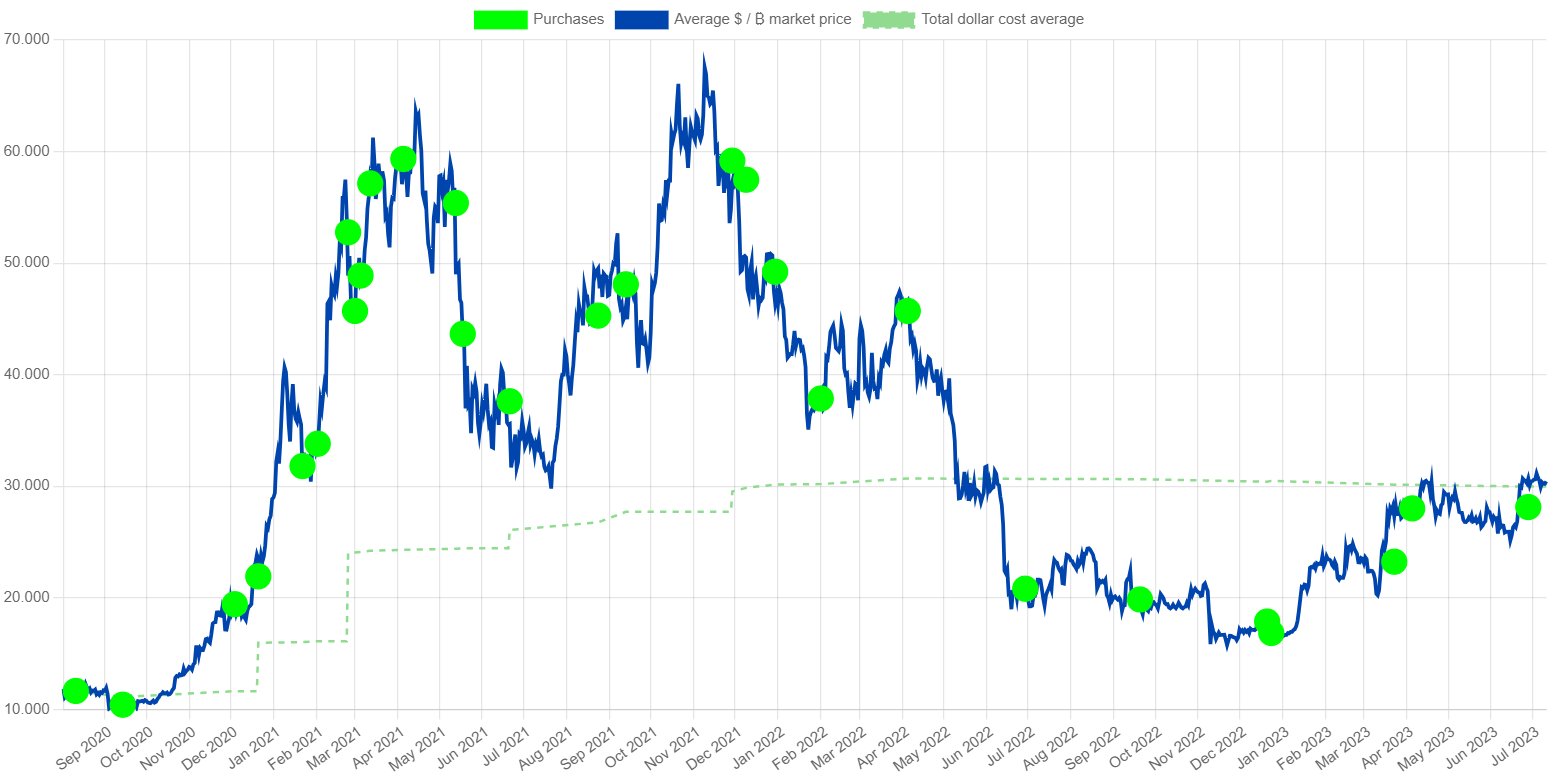

- Historical Data on ETH Price Volatility: Reviewing past price movements provides insights into the potential for future volatility.

Conclusion

The accumulation of 11 million ETH represents a significant event in the Ethereum market. While this accumulation suggests a positive outlook, influenced by institutional investment, retail holding, and DEX activity, it's crucial to consider the impact on supply and demand, market sentiment, and long-term factors such as regulatory developments and technological advancements. Understanding the dynamics of 11 million ETH accumulation is crucial for navigating the Ethereum market effectively. Stay updated on the latest news and trends to make informed decisions about your ETH investments. Remember that cryptocurrency investments are inherently volatile, and conducting thorough research is essential before making any investment decisions.

Featured Posts

-

Investing In 2025 Micro Strategy Stock Compared To Bitcoin

May 08, 2025

Investing In 2025 Micro Strategy Stock Compared To Bitcoin

May 08, 2025 -

Victoria Del Psg En Lyon Analisis Del Partido

May 08, 2025

Victoria Del Psg En Lyon Analisis Del Partido

May 08, 2025 -

El Emotivo Gesto De Pulgar Un Mensaje Al Corazon De Flamengo

May 08, 2025

El Emotivo Gesto De Pulgar Un Mensaje Al Corazon De Flamengo

May 08, 2025 -

Dupla De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao Contra O Gremio

May 08, 2025

Dupla De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao Contra O Gremio

May 08, 2025 -

Bone Bruise Sidelines Jayson Tatum Game 2 Update

May 08, 2025

Bone Bruise Sidelines Jayson Tatum Game 2 Update

May 08, 2025