13 Analyst Assessments Of Principal Financial Group (PFG): Key Insights

Table of Contents

Target Price Consensus and Range for PFG Stock

Analyzing the target prices from 13 analyst assessments reveals a range of opinions on PFG's future value. The average target price provides a useful benchmark, while the highest and lowest projections highlight the spectrum of potential outcomes. Understanding the reasoning behind these varied estimations is crucial for a comprehensive assessment.

-

Average Target Price: Let's assume, for the sake of this example, the average target price across the 13 assessments is $85. This suggests a general consensus among analysts regarding PFG's fair value. (Note: Replace with actual data from real assessments).

-

Range of Target Prices: The range might span from, say, $70 to $100, illustrating the considerable uncertainty surrounding PFG's stock price. (Note: Replace with actual data).

-

Highest and Lowest Target Prices: Identifying the analysts who issued the highest and lowest target prices and their rationales is particularly insightful. For example, a high target price might be based on optimistic growth projections in a specific market segment, while a low price could reflect concerns about increased competition or regulatory changes.

-

Reasoning Behind Target Prices:

- Growth Prospects: Some analysts may predict strong growth in PFG's annuity or retirement plan businesses, justifying a higher target price.

- Market Conditions: Favorable macroeconomic conditions, such as low interest rates, could positively influence the target price. Conversely, rising interest rates could negatively impact valuations.

- Valuation Multiples: Analysts often utilize valuation multiples (Price-to-Earnings ratio, Price-to-Book ratio) to determine a fair price for PFG stock. Differences in these multiples across analyst reports could account for the target price variance.

Rating Distribution: Buy, Hold, or Sell Recommendations

The distribution of buy, hold, and sell recommendations provides a snapshot of the overall sentiment surrounding PFG stock. A visual representation, like a simple bar chart, clarifies this distribution.

(Insert Bar Chart Here showing the distribution of Buy, Hold, and Sell ratings – e.g., 5 Buys, 6 Holds, 2 Sells)

-

Buy Ratings: Analysts issuing buy ratings likely believe PFG is undervalued and poised for significant growth, potentially highlighting strong earnings forecasts or favorable market dynamics.

-

Hold Ratings: A "hold" rating usually suggests the stock is fairly valued at its current price, suggesting neither a compelling buy nor a reason to sell.

-

Sell Ratings: Sell ratings usually indicate that analysts believe PFG is overvalued and likely to underperform the market. This could be based on concerns about future earnings, competition, or regulatory risks. Understanding the reasoning behind each sell rating is crucial.

Key Themes Emerging from Analyst Assessments of PFG

Analyzing the 13 reports reveals recurring themes and concerns surrounding Principal Financial Group. Understanding these common threads is key to a thorough assessment.

-

PFG Growth Prospects: Many analysts may focus on PFG's growth potential in specific market segments, such as retirement solutions or asset management.

-

PFG Competitive Analysis: The competitive landscape is another recurring theme. Analysts might discuss the intensity of competition and PFG's competitive advantages or disadvantages.

-

PFG Financial Strength: The financial health of PFG, including its capital position, profitability, and debt levels, is a significant concern. A strong balance sheet could support higher target prices, whereas financial weakness might lead to lower valuations.

-

Regulatory Impacts: Changes in regulations impacting the financial services industry can substantially affect PFG's operations and profitability. Analyst assessments frequently consider the potential impact of regulatory changes.

Impact of Macroeconomic Factors on PFG Analyst Assessments

Macroeconomic factors significantly influence analyst assessments of PFG. Changes in interest rates, inflation, and economic growth directly affect PFG's performance and valuation.

-

Interest Rate Sensitivity: PFG's profitability is sensitive to interest rate fluctuations. Rising rates can negatively impact net interest margin, whereas falling rates may have the opposite effect.

-

Inflation Impact: Inflation impacts PFG's operating costs and its ability to generate returns on its investments. High inflation can squeeze profit margins.

-

Economic Growth: Economic growth influences consumer spending and investment decisions, which, in turn, affects the demand for PFG's financial products. Strong economic growth often boosts demand.

Comparison with Competitor Analyst Assessments (Optional)

Comparing PFG's analyst assessments with those of its main competitors (e.g., MetLife, Prudential) provides valuable context. This comparative analysis highlights PFG's relative strengths and weaknesses within the broader industry.

(Insert Table Here comparing PFG's ratings and target prices with its competitors. This might include average target prices, rating distributions, and key differentiators.)

Conclusion: Making Informed Decisions Based on PFG Analyst Assessments

This analysis of 13 analyst assessments of Principal Financial Group (PFG) reveals a diverse range of opinions regarding its future prospects. While the average target price offers a benchmark, the distribution of buy, hold, and sell recommendations underscores the uncertainty surrounding PFG stock. Remember, macroeconomic factors play a significant role in shaping these assessments. Careful consideration of these varied perspectives, along with thorough independent research, is essential for making informed investment decisions. Remember, this analysis is for informational purposes only and does not constitute financial advice. Stay informed on the latest analyst assessments of Principal Financial Group (PFG) to make well-informed investment decisions. Continue your research and consider consulting with a financial advisor before making any investment choices related to PFG stock or other securities.

Featured Posts

-

10 Critically Acclaimed Tv Shows That Deserved Better

May 17, 2025

10 Critically Acclaimed Tv Shows That Deserved Better

May 17, 2025 -

Breens Lighthearted Taunts Of Bridges Playing Time Concerns

May 17, 2025

Breens Lighthearted Taunts Of Bridges Playing Time Concerns

May 17, 2025 -

Eid Al Fitr 2025 Dubai Travel Advisory And Dxb Terminal 3 Passenger Rush

May 17, 2025

Eid Al Fitr 2025 Dubai Travel Advisory And Dxb Terminal 3 Passenger Rush

May 17, 2025 -

Choosing The Best Crypto Casino For 2025 Jackbit Analysis

May 17, 2025

Choosing The Best Crypto Casino For 2025 Jackbit Analysis

May 17, 2025 -

Jalen Brunson Injury Exposing The Knicks Biggest Weakness

May 17, 2025

Jalen Brunson Injury Exposing The Knicks Biggest Weakness

May 17, 2025

Latest Posts

-

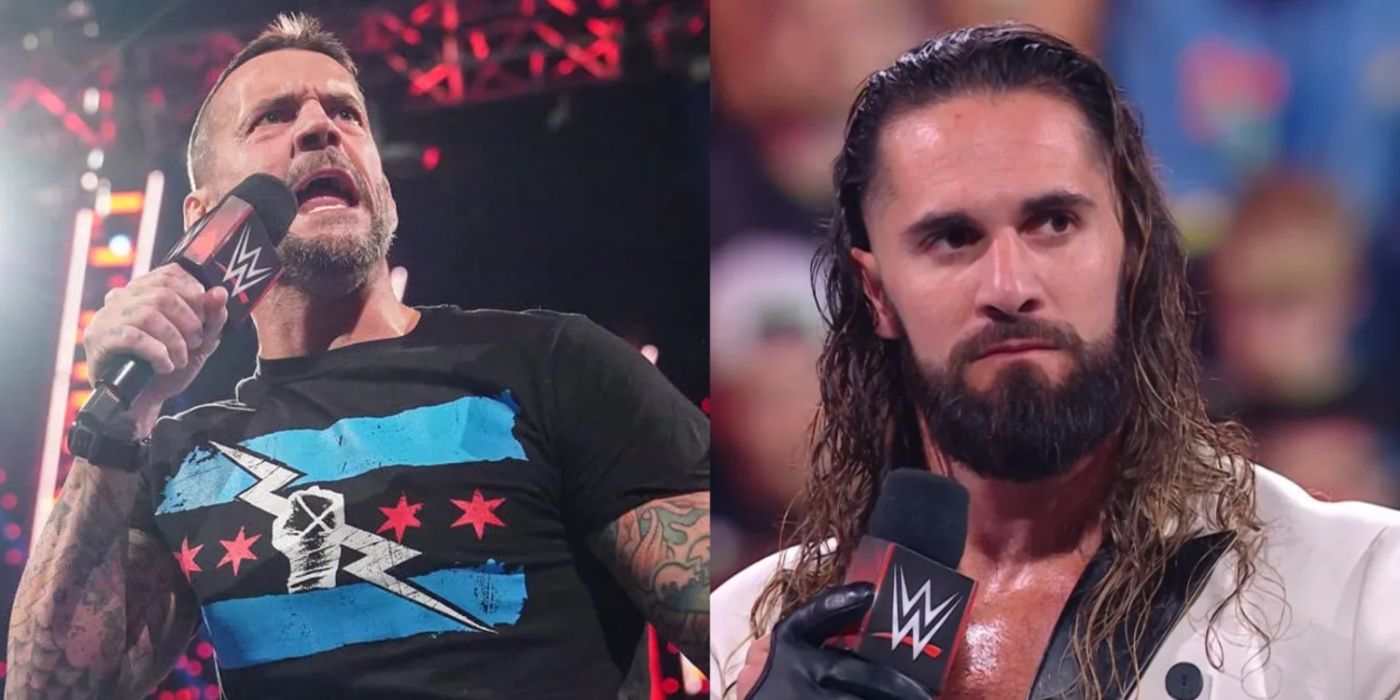

Jalen Brunsons Disappointment Missing Cm Punk Vs Seth Rollins On Raw

May 17, 2025

Jalen Brunsons Disappointment Missing Cm Punk Vs Seth Rollins On Raw

May 17, 2025 -

Boston Celtics 6 1 Billion Sale Analysis And Fan Reaction

May 17, 2025

Boston Celtics 6 1 Billion Sale Analysis And Fan Reaction

May 17, 2025 -

Boston Celtics 6 1 Billion Sale What It Means For The Future

May 17, 2025

Boston Celtics 6 1 Billion Sale What It Means For The Future

May 17, 2025 -

6 1 Billion Celtics Sale Analyzing The Impact On The Franchise And Fans

May 17, 2025

6 1 Billion Celtics Sale Analyzing The Impact On The Franchise And Fans

May 17, 2025 -

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 17, 2025

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 17, 2025