Boston Celtics' $6.1 Billion Sale: Analysis And Fan Reaction

Table of Contents

The $6.1 Billion Sale: A Detailed Look

The Buyers and Sellers:

The sale saw the departure of long-time owner Wyc Grousbeck and his ownership group, who had steered the Celtics through significant periods of success and rebuilding. While the exact details of the buyer group remain somewhat opaque, the sheer scale of the transaction underscores the immense value of the Celtics brand. The sale price reflects not only the team's on-court performance but also its substantial off-court revenue streams, strong brand recognition, and prime location in Boston.

- Key figures involved: While the full list of new owners may not be publicly available immediately, the sheer financial power needed to complete such a deal suggests high-profile investors with significant experience in sports and business.

- Motivations for the sale: While the exact reasons behind the Grousbeck group's decision to sell haven't been explicitly stated, it's likely a combination of factors like maximizing return on investment after years of ownership and perhaps a desire to pursue other ventures.

- Financial details of the transaction: The $6.1 billion valuation shattered previous records for NBA team sales, highlighting the exceptional value of the Celtics franchise and the lucrative nature of the professional basketball market. The payment structure, including any potential deferred payments, remains largely confidential.

Record-Breaking Valuation:

The $6.1 billion price tag isn't just a number; it's a testament to the enduring legacy and immense commercial value of the Boston Celtics. This sale surpasses previous NBA team sales by a significant margin, setting a new benchmark for franchise valuations.

- Comparisons to other NBA sales: This sale eclipses previous records, vastly exceeding the prices paid for teams like the Phoenix Suns and the Brooklyn Nets.

- Factors contributing to high valuation: Several elements contributed to this record-breaking price: the Celtics' rich history and consistent success, their passionate and loyal fan base, the lucrative media rights deals in the NBA, the team's location in a major media market, and the potential for increased revenue streams through strategic partnerships and sponsorships.

- Implications for future franchise valuations: This sale signals a potentially significant shift in the market, suggesting that future NBA team valuations could escalate further, driven by increasing media rights revenue, global brand recognition, and the expanding reach of professional sports.

Impact on the Boston Celtics' Future

Changes in Team Management and Strategy:

The change in ownership inevitably raises questions about potential shifts in team management, coaching strategies, and player acquisitions. Will the new ownership group maintain the existing front office structure and coaching staff, or will there be significant changes?

- Potential changes to team strategy: The new owners might bring different philosophies regarding player acquisition, salary cap management, and long-term strategic planning. They may prioritize certain player profiles or adopt a different approach to free agency and the NBA draft.

- Impact on player recruitment: The new ownership's financial resources could potentially lead to increased spending on player salaries and attract top free agents. Alternatively, they may favor a more cost-effective approach prioritizing player development.

- Potential for increased investment in the team: With such deep pockets, the new owners have the financial means to make significant investments in infrastructure, analytics, and player development programs.

Long-Term Financial Implications:

The $6.1 billion sale provides the Celtics with substantial capital for long-term investments. This infusion of money can be leveraged to improve the team's infrastructure, enhance player development, and boost marketing efforts.

- Potential investments in stadium upgrades: TD Garden could undergo renovations and upgrades to enhance the fan experience.

- Increased marketing budget: A larger marketing budget could lead to expanded reach, improved brand awareness, and increased sponsorship revenue.

- Player development programs: Investing in improved training facilities, coaching staff, and analytics can elevate the team's talent pipeline.

- Community outreach: The new owners might significantly increase community engagement initiatives, strengthening the team’s ties to the city of Boston.

Fan Reactions and Social Media Sentiment

Positive Reactions and Hopes for the Future:

Many Celtics fans greeted the news with optimism, focusing on the potential benefits of the increased financial resources and the hope for sustained success.

- Examples of positive social media comments: Social media platforms were awash with positive comments expressing excitement about the future and the potential for increased investment in the team. Many fans shared their hopes for continued championship contention.

- Fan forums and blog posts expressing optimism: Numerous online forums and blogs dedicated to the Celtics reflected a generally positive sentiment, with discussions centered on the possibilities created by the sale.

Concerns and Uncertainties:

Despite the overall positive sentiment, some fans expressed concerns about the potential impact on the team's culture and player loyalty.

- Examples of negative social media comments: While fewer in number, some negative comments expressed anxieties about potential changes to the team's identity and the risk of disrupting the winning culture.

- Fan concerns about potential changes: Some fans expressed reservations about potential changes to the coaching staff, front office personnel, and overall team philosophy.

- Anxieties regarding team identity: There were concerns that the new ownership might prioritize profits over maintaining the team's rich history and strong connection to its fan base.

Overall Fan Sentiment:

While there were some concerns, the overall fan sentiment leaned towards optimism. The potential for increased investment and continued success outweighed anxieties surrounding potential changes.

- Statistical overview of positive/negative sentiment: While precise quantitative data is hard to come by immediately, anecdotal evidence suggests a predominantly positive outlook. A thorough social media analysis could provide more concrete figures.

- Insights from fan polls or surveys (if applicable): Future surveys and polls could gather more precise data on fan sentiment and expectations regarding the new ownership.

Conclusion

The $6.1 billion sale of the Boston Celtics represents a landmark moment in the franchise’s history. This record-breaking transaction signals the immense value of the Celtics brand and opens a new chapter filled with both opportunity and uncertainty. While fans have expressed both positive expectations and some concerns about potential changes, the overall sentiment is one of cautious optimism. The significant financial resources now available to the team could lead to improvements in infrastructure, player development, and marketing, potentially fueling continued success on the court.

Call to Action: What does the future hold for the Boston Celtics after this historic sale? Share your thoughts and predictions on the impact of the $6.1 billion sale in the comments section below. Stay tuned for more updates and analysis on the Boston Celtics' future. Continue the conversation using #CelticsSale #NBASale.

Featured Posts

-

Evaluating Floridas School Lockdown Effectiveness Protecting Future Generations

May 17, 2025

Evaluating Floridas School Lockdown Effectiveness Protecting Future Generations

May 17, 2025 -

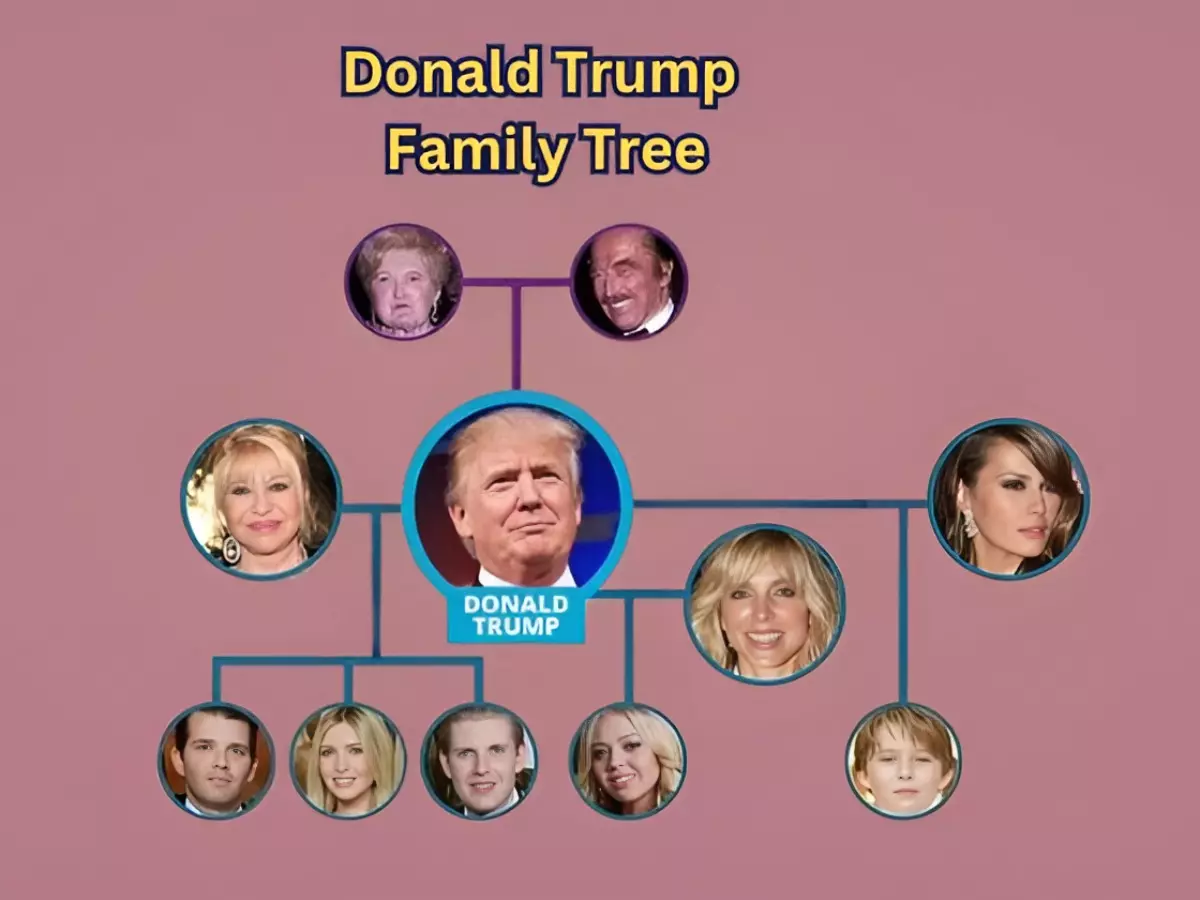

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025 -

Why Were These 10 Great Tv Shows Cancelled

May 17, 2025

Why Were These 10 Great Tv Shows Cancelled

May 17, 2025 -

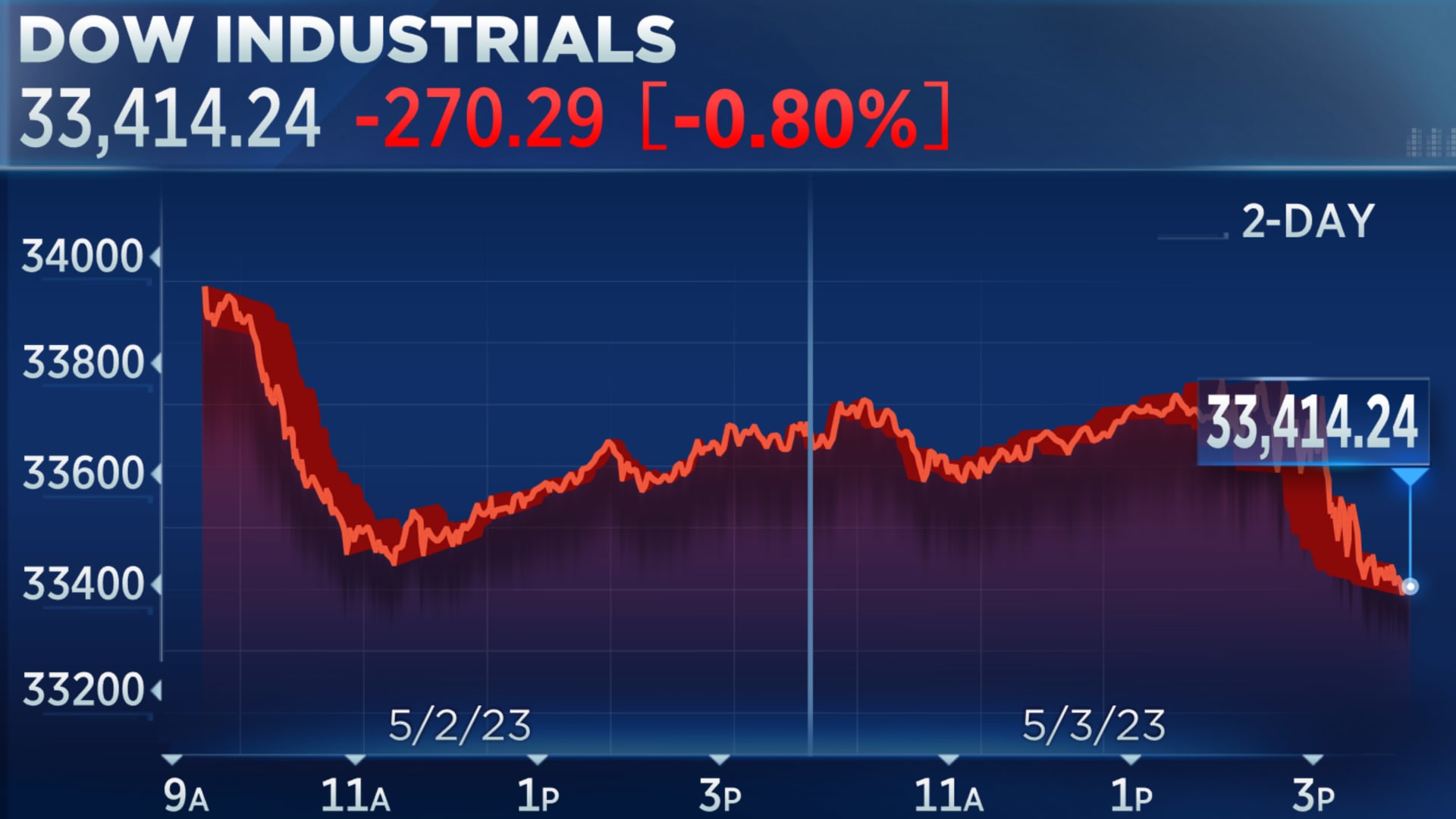

Stock Market Update Strong Earnings Boost Rockwell Automation And Other Big Names

May 17, 2025

Stock Market Update Strong Earnings Boost Rockwell Automation And Other Big Names

May 17, 2025 -

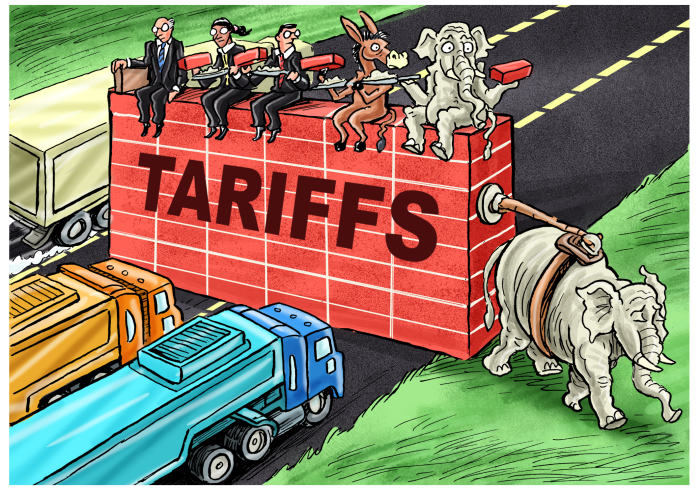

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025

Latest Posts

-

2 2011

May 18, 2025

2 2011

May 18, 2025 -

52

May 18, 2025

52

May 18, 2025 -

5 26

May 18, 2025

5 26

May 18, 2025 -

Asamh Bn Ladn Ke Mdah Alka Yagnk Ka Ayk Hyran Kn Dewy

May 18, 2025

Asamh Bn Ladn Ke Mdah Alka Yagnk Ka Ayk Hyran Kn Dewy

May 18, 2025 -

Alka Yagnk Ke Mtabq Asamh Bn Ladn Ky Mqbwlyt Ka Tjzyh

May 18, 2025

Alka Yagnk Ke Mtabq Asamh Bn Ladn Ky Mqbwlyt Ka Tjzyh

May 18, 2025