2% Fall On Amsterdam Stock Exchange Following Trump's Latest Tariffs

Table of Contents

Impact of Trump's Tariffs on Global Markets

Trump's tariffs, designed to protect American industries, have inadvertently created a ripple effect across global markets, with the Amsterdam Stock Exchange feeling the impact acutely. The 2% fall reflects the broader anxieties surrounding escalating trade tensions.

Ripple Effect on European Economies

The interconnected nature of the global economy means that the effects of Trump's tariffs are far-reaching. The Netherlands, a significant player in international trade, is particularly susceptible. The 2% fall in the AEX is a stark reminder of this vulnerability.

- Increased import costs for Dutch businesses: Tariffs on imported goods increase production costs for Dutch companies, reducing their competitiveness and potentially impacting profitability.

- Reduced consumer spending due to higher prices: These increased costs are often passed on to consumers, leading to reduced purchasing power and a potential slowdown in consumer spending.

- Uncertainty impacting investment decisions: The unpredictable nature of trade policy creates uncertainty, discouraging businesses from making significant investments and hindering economic growth. This uncertainty directly contributed to the 2% fall in the AEX.

- Comparison to other European markets' reactions: While the 2% fall in the AEX was significant, it's crucial to compare the reaction to other European markets to gauge the specific impact on the Netherlands. Analysis of other indices can reveal the extent to which the decline was unique to the Amsterdam Stock Exchange or a broader European trend.

Sector-Specific Analysis

The impact of Trump's tariffs wasn't uniform across all sectors of the Amsterdam Stock Exchange. Certain industries felt the pinch more acutely than others. The 2% overall fall masked significant variations in individual sector performance.

- Percentage drop in specific sectors: Technology and manufacturing sectors, heavily reliant on international trade, likely experienced steeper declines than others. Agriculture, another major sector in the Netherlands, also faced challenges due to the tariffs.

- Reasons for vulnerability in each sector: Sectors with high import dependencies or those directly competing with American goods were particularly vulnerable. Detailed analysis of each sector's supply chains reveals their susceptibility to trade disruptions.

- Analysis of individual company performance (mention key companies): Examining the performance of individual companies within affected sectors, such as ASML Holding (technology) or Unilever (consumer goods), provides a granular view of the impact. A comparison of their performance before and after the tariff announcement offers valuable insights.

Investor Sentiment and Market Volatility

The announcement of Trump's tariffs significantly impacted investor sentiment, contributing to the 2% fall on the Amsterdam Stock Exchange. Fear and uncertainty were dominant factors in market reaction.

Fear and Uncertainty in the Market

The unpredictable nature of Trump's trade policies fueled uncertainty and risk aversion amongst investors. This sentiment directly translated into the 2% drop in the AEX.

- Increased volatility in the AEX: The market experienced heightened volatility, with significant price fluctuations reflecting investors' anxieties.

- Decline in trading volume: Uncertainty often leads to decreased trading activity as investors adopt a wait-and-see approach. This reduced trading volume further exacerbated the negative market sentiment.

- Flight to safety (investors moving to safer assets): Investors often shift their investments towards safer assets, such as government bonds, during times of uncertainty, reducing investment in riskier assets like stocks listed on the Amsterdam Stock Exchange.

- Analysis of investor behavior using market data: Analyzing trading patterns, investor sentiment indices, and other market data provides a clearer picture of how investor behavior contributed to the 2% fall.

Analyst Reactions and Predictions

Financial analysts offered varied opinions and predictions regarding the future performance of the AEX following the 2% fall. The overall outlook remained cautious but not uniformly pessimistic.

- Quotes from prominent analysts: Including quotes from key analysts provides valuable insights into the prevailing market sentiment and expectations for the future.

- Short-term and long-term predictions: Analysts often provide short-term and long-term predictions for the AEX, incorporating the impact of the tariffs and other economic factors.

- Potential for recovery or further decline: The potential for recovery or further decline depends on various factors, including the duration of the tariffs, the Dutch government's response, and the overall global economic situation.

The Dutch Government's Response and Mitigation Strategies

The Dutch government responded to the 2% fall in the AEX and the broader economic impact of Trump's tariffs through various mitigation strategies. However, the long-term consequences remain to be seen.

Government Initiatives to Counter Economic Impact

The Dutch government implemented several initiatives to cushion the blow of the tariffs and support affected businesses.

- Financial support for affected businesses: Government aid packages and tax incentives aimed at assisting struggling businesses are crucial to mitigating the economic fallout.

- Trade negotiations and diplomatic efforts: The government engages in diplomatic efforts and trade negotiations to address trade disputes and reduce the negative impact of the tariffs.

- Policy changes aimed at stimulating economic growth: Policy adjustments aimed at boosting economic growth and diversification are crucial in reducing reliance on sectors vulnerable to trade shocks.

Long-Term Economic Outlook for the Netherlands

The long-term effects of Trump's tariffs on the Dutch economy and the Amsterdam Stock Exchange remain uncertain. The 2% fall is a significant indicator of potential long-term challenges.

- Potential for economic slowdown: The tariffs could potentially contribute to a slowdown in economic growth in the Netherlands.

- Impact on employment: Job losses in affected sectors are a potential consequence of the economic slowdown.

- Opportunities for adaptation and diversification: The crisis presents an opportunity for the Dutch economy to adapt and diversify, reducing reliance on sectors vulnerable to international trade disruptions.

Conclusion: Analyzing the 2% Fall on the Amsterdam Stock Exchange

The 2% fall in the Amsterdam Stock Exchange following Trump's latest tariffs underscores the significant impact of protectionist trade policies on global markets. This analysis highlights the interconnectedness of the global economy and the vulnerability of even strong economies to external shocks like trade wars. The reasons behind the 2% drop are multifaceted, encompassing increased import costs, reduced consumer spending, investor uncertainty, and a flight to safety. The Dutch government's response will play a crucial role in shaping the long-term economic outlook.

Key takeaways: The interconnected nature of global markets leaves even strong economies like the Netherlands vulnerable to external shocks. The 2% fall in the AEX demonstrates the significant impact of trade wars on investor confidence and economic performance. Understanding these global trade dynamics is crucial for informed decision-making.

Call to action: Monitor the Amsterdam Stock Exchange closely to track the evolving situation. Stay updated on Trump's tariff policies and their potential ripple effects. Understand the impact of global trade on your investments and adjust your strategies accordingly. Understanding the intricacies of the Amsterdam Stock Exchange and the implications of global trade policies is essential for navigating the complexities of the modern financial landscape.

Featured Posts

-

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025 -

Top Gear And Accessories For Ferrari Lovers

May 24, 2025

Top Gear And Accessories For Ferrari Lovers

May 24, 2025 -

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025 -

Fastest Ferraris Top 10 Standard Production Models Ranked By Track Time

May 24, 2025

Fastest Ferraris Top 10 Standard Production Models Ranked By Track Time

May 24, 2025 -

Analyzing Jordan Bardellas Chances In The Upcoming French Elections

May 24, 2025

Analyzing Jordan Bardellas Chances In The Upcoming French Elections

May 24, 2025

Latest Posts

-

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025 -

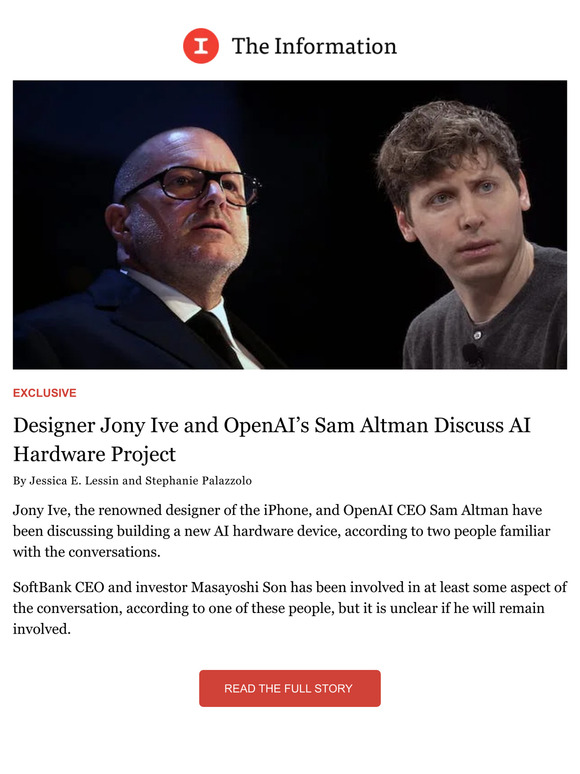

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025 -

Universals Epic 7 Billion Investment Escalating The Theme Park Arms Race Against Disney

May 24, 2025

Universals Epic 7 Billion Investment Escalating The Theme Park Arms Race Against Disney

May 24, 2025 -

Exclusive Sam Altman And Jony Ives Undisclosed Project Details Revealed

May 24, 2025

Exclusive Sam Altman And Jony Ives Undisclosed Project Details Revealed

May 24, 2025 -

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025