Is Apple Stock A Buy At $200? Analyst Sees Potential For $254

Table of Contents

The Analyst's Rationale: Why $254?

Several analysts have weighed in on Apple's future, but one prediction stands out: a potential rise to $254 for AAPL stock. This optimistic forecast, attributed to [Analyst Name] at [Analyst Firm], rests on several key pillars supporting Apple stock price predictions.

-

Strong iPhone Sales and Expanding Ecosystem: The analyst cites consistently strong iPhone sales, even amidst global economic uncertainties, as a primary driver for growth. The continued expansion of Apple's ecosystem, encompassing services like Apple Music, iCloud, and the App Store, further fuels this positive outlook for Apple stock. The stickiness of this ecosystem creates a recurring revenue stream crucial for long-term growth.

-

Growth in Services and Wearables: The analyst highlights the impressive growth trajectory of Apple's Services segment, which includes subscriptions and digital content. The consistent expansion of Apple's wearables segment, including the Apple Watch and AirPods, also contributes significantly to the projected $254 Apple stock target. These diverse revenue streams mitigate reliance on a single product category, enhancing the stability of Apple stock.

-

Expansion into New Markets (AR/VR): The analyst incorporates the potential impact of Apple's anticipated foray into augmented reality (AR) and virtual reality (VR) technologies. While details are limited, the potential market disruption and revenue generation from this area are factored into the $254 Apple stock target price.

-

Financial Modeling and Projections: [Analyst Name] used a discounted cash flow (DCF) model, incorporating projected revenue growth, margin expansion, and a discounted rate based on the current market environment, to arrive at the $254 price target for Apple stock. This model, backed by rigorous financial analysis, is cited in [Source: Link to reputable news source].

Current Apple Stock Performance & Financial Health

Assessing the current Apple stock valuation requires examining Apple's recent financial performance. Apple's financial health is a key factor in determining whether the $254 prediction is feasible.

-

Strong Revenue and Earnings Growth: Apple has demonstrated consistent revenue and earnings growth over the past few quarters, exceeding expectations in many instances. This positive trend underpins the analyst's bullish prediction for Apple stock price.

-

Key Performance Indicators (KPIs): KPIs such as iPhone sales, Mac sales, and Services revenue growth all point towards a healthy and expanding business. Analyzing these metrics provides a detailed view of Apple's overall financial performance and indicates the potential for future growth driving the Apple stock price higher.

-

Market Capitalization and Valuation: Apple’s market capitalization remains substantial, placing it among the largest companies globally. Comparing its valuation multiples (e.g., Price-to-Earnings ratio) to competitors offers perspective on whether the current Apple stock price reflects its growth potential.

-

Recent News and Events: Recent product launches, positive industry reviews, and any impactful regulatory changes have contributed to shaping the current sentiment around Apple stock and may influence its future trajectory.

Risks and Potential Downsides of Investing in Apple Stock at $200

While the $254 Apple stock prediction is enticing, potential investors must acknowledge inherent risks.

-

Economic Slowdown: A global economic slowdown could negatively impact consumer spending, potentially affecting demand for Apple products and impacting the Apple stock price.

-

Competition from Other Tech Companies: Intense competition from other tech giants in various market segments presents a constant challenge to Apple’s dominance and could affect Apple stock performance.

-

Supply Chain Disruptions: Geopolitical instability and unexpected events can disrupt Apple’s supply chain, impacting production and potentially affecting the Apple stock price.

-

Market Volatility: The stock market's inherent volatility means that even the most promising investments can experience significant price fluctuations. Apple stock is no exception.

Alternative Investment Strategies

Diversification is key to mitigating risk. While Apple stock may offer significant potential, it's not wise to concentrate your investment portfolio heavily in a single stock.

-

Diversification within the Tech Sector: Consider investing in other promising tech companies to balance your exposure and reduce your reliance on the performance of just one stock.

-

Diversification across Asset Classes: Explore opportunities in other asset classes, such as bonds, real estate, or alternative investments, to create a more resilient and balanced portfolio. This helps buffer against potential downturns in the tech sector that might negatively impact the Apple stock price.

Conclusion

This article examined the possibility of Apple stock reaching $254, considering an analyst's prediction, Apple's financial performance, and potential risks. While the forecast is positive for Apple stock, potential investors must carefully weigh the potential rewards against the inherent risks before committing significant capital. Is Apple stock a buy at $200 for you? Consider the discussed factors, conduct thorough research, and make an informed decision about investing in Apple stock (AAPL) based on your risk tolerance and financial goals. Remember to consult a financial advisor before making any significant investment decisions.

Featured Posts

-

The Downfall 17 Celebrities Who Lost Everything Instantly

May 24, 2025

The Downfall 17 Celebrities Who Lost Everything Instantly

May 24, 2025 -

Porsche Now Labubu Porsche

May 24, 2025

Porsche Now Labubu Porsche

May 24, 2025 -

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025 -

The Posthaste Effect How Bond Market Instability Impacts The Global Economy

May 24, 2025

The Posthaste Effect How Bond Market Instability Impacts The Global Economy

May 24, 2025 -

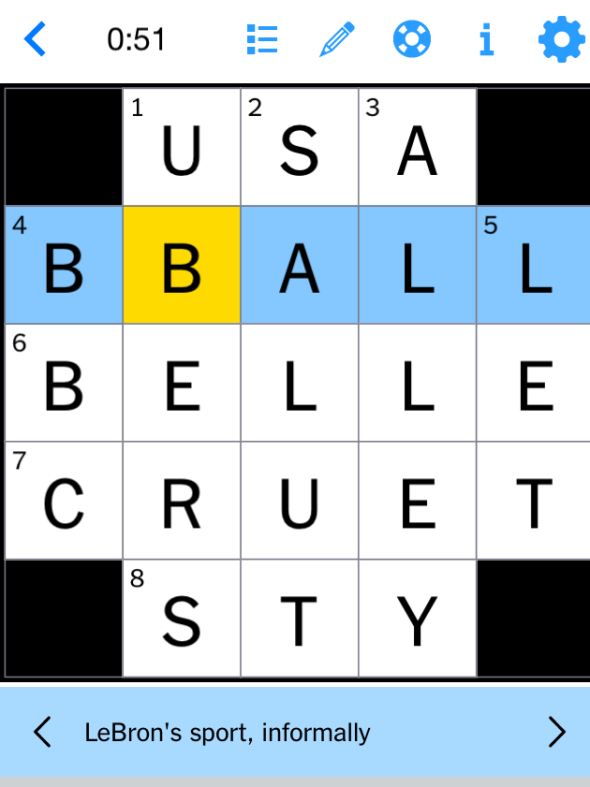

Todays Nyt Mini Crossword March 26 2025 Complete Solutions

May 24, 2025

Todays Nyt Mini Crossword March 26 2025 Complete Solutions

May 24, 2025

Latest Posts

-

Rybakina Leads Kazakhstan To Billie Jean King Cup Finals

May 24, 2025

Rybakina Leads Kazakhstan To Billie Jean King Cup Finals

May 24, 2025 -

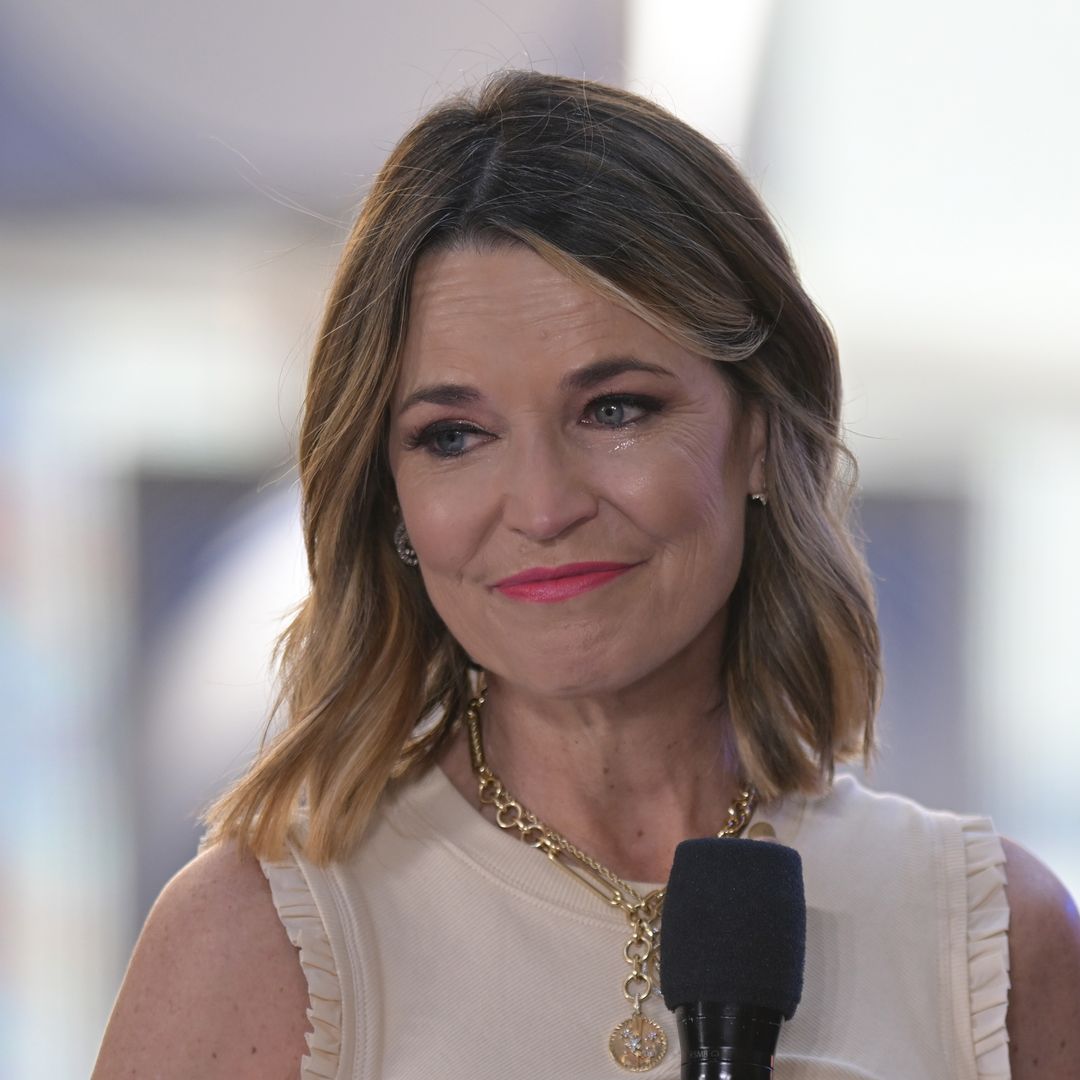

Savannah Guthries Replacement Co Host A Weekday Shake Up

May 24, 2025

Savannah Guthries Replacement Co Host A Weekday Shake Up

May 24, 2025 -

Dylan Dreyer And Brian Fichera New Post Generates Buzz

May 24, 2025

Dylan Dreyer And Brian Fichera New Post Generates Buzz

May 24, 2025 -

The Today Show Dylan Dreyers Close Call And What Happened

May 24, 2025

The Today Show Dylan Dreyers Close Call And What Happened

May 24, 2025 -

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025