2025 D-Wave Quantum (QBTS) Stock Performance: Factors Contributing To The Fall

Table of Contents

The year 2025 saw a significant downturn in D-Wave Quantum (QBTS) stock performance. While quantum computing holds immense promise, revolutionizing fields from medicine to finance, several factors contributed to this decline. This article analyzes the key reasons behind QBTS's fall, providing investors with insights into the complexities of this emerging technology sector and the challenges faced by a pioneer in quantum annealing.

Technological Challenges and Development Hurdles

The core technology behind D-Wave's quantum computers, quantum annealing, presented inherent limitations that impacted its stock performance in 2025. These technological hurdles, coupled with slower-than-anticipated progress, contributed significantly to the negative investor sentiment.

Limitations of Quantum Annealing

D-Wave's focus on quantum annealing, while groundbreaking, differs from the more widely pursued gate-based quantum computing. This difference translates to specific limitations:

- Limited Applicability: Quantum annealing is particularly effective for optimization problems, but it struggles with other types of quantum computations. This limits its versatility compared to more general-purpose gate-based systems.

- Scaling Challenges: Scaling up the number of qubits in a quantum annealer while maintaining coherence and reducing error rates is exceptionally difficult. D-Wave faced significant hurdles in this area, impacting the overall performance and capabilities of its systems.

- Error Correction Difficulties: Implementing robust error correction mechanisms in quantum annealers proves considerably more challenging than in gate-based systems. This leads to higher error rates and limits the accuracy of computations. The technological hurdles in developing fault-tolerant quantum computation using quantum annealing significantly hampered progress.

Slower-than-Expected Progress

D-Wave's advancements in quantum processing technology, while notable, fell short of market expectations in 2025. This contributed to the decline in QBTS stock value.

- Delayed Releases: Delays in releasing new generations of quantum processors with increased qubit counts and improved performance hampered the company's ability to compete effectively.

- Unmet Performance Targets: Certain performance targets, such as improved qubit coherence times and reduced error rates, were not achieved within the projected timelines, further dampening investor confidence. For example, the projected improvements in solving specific benchmark problems weren't met, leading to skepticism regarding the technology's true potential.

Intense Market Competition and Emerging Players

The quantum computing landscape is rapidly evolving, with intense competition from companies pursuing alternative approaches, particularly gate-based quantum computing. This competitive pressure significantly impacted D-Wave's market position and consequently its stock performance.

Rise of Gate-Based Quantum Computing

Gate-based quantum computing, adopted by major players like IBM, Google, IonQ, and Rigetti, offers a more versatile and potentially scalable approach compared to quantum annealing.

- Technological Advantages: Gate-based systems are theoretically more powerful and adaptable to a broader range of quantum algorithms. Their ability to perform universal quantum computation offers a significant advantage.

- Market Positioning: The substantial investments and technological advancements achieved by these competitors created a more competitive environment, potentially overshadowing D-Wave's progress and market share.

Increased Investment in Competing Technologies

Significant funding rounds for gate-based quantum computing companies in 2025 highlighted the growing investor interest in alternative approaches. This shifted investor focus away from D-Wave and its annealing technology.

- Funding Rounds: Multi-million and even multi-billion dollar investments in competing companies signaled a strong market preference for gate-based technologies, further impacting D-Wave's stock.

- Market Share Implications: This substantial investment in competing technologies directly impacted D-Wave's market share and overall investor confidence, contributing to the decline in QBTS stock price.

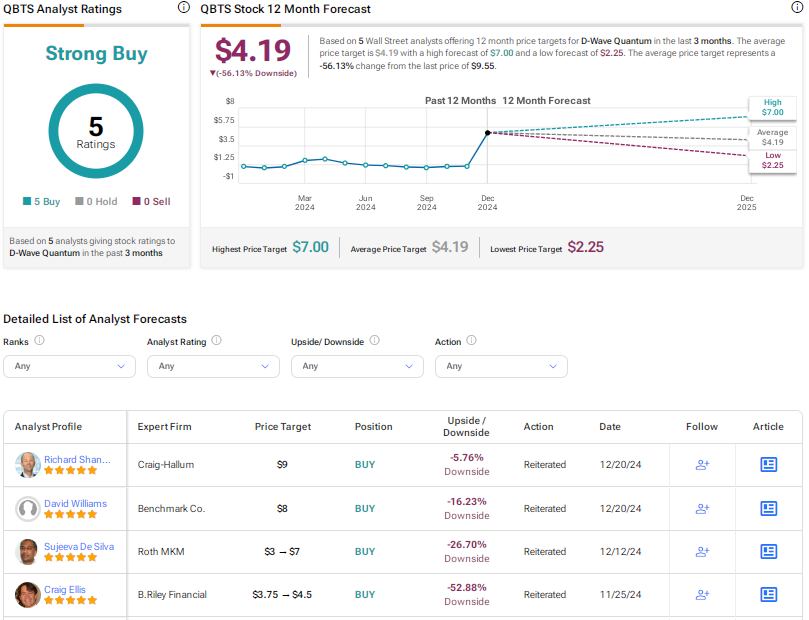

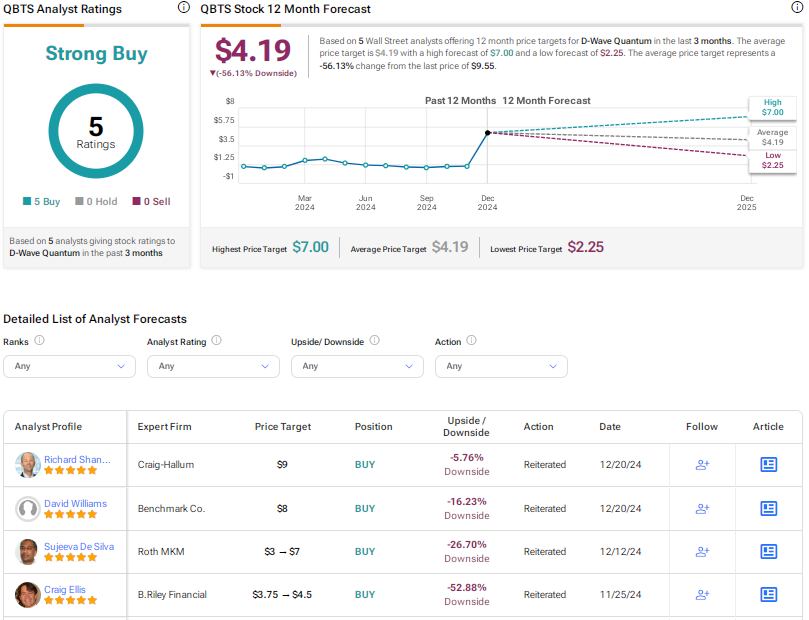

Financial Performance and Investor Sentiment

D-Wave's financial performance in 2025, coupled with negative investor sentiment and market volatility, played a crucial role in the QBTS stock slump.

Revenue Generation and Profitability Challenges

D-Wave faced considerable challenges in generating significant revenue and achieving profitability in 2025.

- Revenue Figures: The reported revenue figures likely fell short of investor expectations, contributing to the negative stock performance. Specific data on revenue, operating expenses, and profit margins would be necessary for a detailed analysis.

- Profitability: The company's path to profitability remained unclear, and a lack of substantial revenue streams impacted investor confidence in the long-term viability of the business.

Negative Investor Sentiment and Market Volatility

Negative news cycles and announcements, coupled with broader market volatility, further exacerbated the decline in QBTS stock price.

- Negative News: Any negative press coverage regarding technological setbacks, missed milestones, or competitive pressures contributed to a decline in investor confidence.

- Market Volatility: The overall volatility in the stock market in 2025 likely amplified the negative impact on QBTS stock, compounding the effects of the company's specific challenges.

Conclusion

The decline in D-Wave Quantum (QBTS) stock performance in 2025 can be attributed to a confluence of factors: limitations inherent in its quantum annealing technology, fierce competition from gate-based quantum computing companies, and challenges in achieving significant revenue and profitability. While the future of quantum computing remains bright, understanding the specific challenges faced by companies like D-Wave Quantum is crucial for investors. Continue to monitor the advancements in D-Wave Quantum (QBTS) technology and the broader quantum computing landscape to make informed investment decisions. Thorough research into D-Wave Quantum (QBTS) stock and the competitive landscape remains essential for assessing future performance and mitigating risk.

Featured Posts

-

Trans Australia Run Will The Record Fall This Year

May 21, 2025

Trans Australia Run Will The Record Fall This Year

May 21, 2025 -

The Goldbergs Exploring The Shows Humor And Heart

May 21, 2025

The Goldbergs Exploring The Shows Humor And Heart

May 21, 2025 -

Les Grands Fusains De Boulemane Debat Anime Au Book Club Le Matin

May 21, 2025

Les Grands Fusains De Boulemane Debat Anime Au Book Club Le Matin

May 21, 2025 -

Live Bundesliga Streaming Best Options And Tips For 2024

May 21, 2025

Live Bundesliga Streaming Best Options And Tips For 2024

May 21, 2025 -

Ing Group Publishes 2024 Financial Results Form 20 F Analysis

May 21, 2025

Ing Group Publishes 2024 Financial Results Form 20 F Analysis

May 21, 2025

Latest Posts

-

Efimereyontes Iatroi Patras Savvatokyriako 12 And 13 Aprilioy

May 21, 2025

Efimereyontes Iatroi Patras Savvatokyriako 12 And 13 Aprilioy

May 21, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls Mia Vathyteri Matia

May 21, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls Mia Vathyteri Matia

May 21, 2025 -

Giatroi Se Efimeria Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025

Giatroi Se Efimeria Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025 -

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025 -

Breite Efimereyonta Giatro Stin Patra 12 And 13 Aprilioy

May 21, 2025

Breite Efimereyonta Giatro Stin Patra 12 And 13 Aprilioy

May 21, 2025