ING Group Publishes 2024 Financial Results: Form 20-F Analysis

Table of Contents

Key Financial Highlights from ING Group's 20-F Filing:

Revenue and Net Income Analysis:

ING Group's 2024 financial performance reflects [Insert actual data from the 20-F here, e.g., a year-over-year increase/decrease] in revenue, totaling [Insert actual revenue figure]. This change can be attributed to several factors, including [Insert specific reasons from the 20-F, e.g., strong performance in specific business segments, market conditions, etc.]. Net income also experienced a [Insert actual data from the 20-F here, e.g., year-over-year increase/decrease] to [Insert actual net income figure].

- Significant Revenue Streams:

- Lending activities: [Insert percentage contribution and brief explanation]

- Investment banking: [Insert percentage contribution and brief explanation]

- Insurance products: [Insert percentage contribution and brief explanation]

- Asset management fees: [Insert percentage contribution and brief explanation]

Keywords: ING Group Revenue, Net Income, Profitability, Financial Performance, Year-over-Year Growth

Balance Sheet Overview: Assets, Liabilities, and Equity:

ING Group's balance sheet reveals a [Insert overall description of the balance sheet, e.g., stable/strong/weakening] financial position. Total assets stand at [Insert actual figure from the 20-F], while total liabilities are [Insert actual figure from the 20-F]. The equity position shows [Insert actual figure and interpretation, e.g., a healthy capital base/concerns about capital adequacy].

- Key Balance Sheet Items:

- Loans and advances to customers: [Insert actual figure and interpretation]

- Customer deposits: [Insert actual figure and interpretation]

- Capital adequacy ratio: [Insert actual figure and interpretation, explaining its significance in relation to regulatory requirements]

Keywords: ING Group Balance Sheet, Assets, Liabilities, Equity, Capital Ratio, Financial Stability

Risk Management and Regulatory Compliance:

ING Group's Form 20-F details a comprehensive risk management framework designed to mitigate potential threats to its financial stability. Key risks identified include:

- Credit Risk: [Insert description of ING's approach to managing credit risk and relevant data from the 20-F]

- Market Risk: [Insert description of ING's approach to managing market risk and relevant data from the 20-F]

- Operational Risk: [Insert description of ING's approach to managing operational risk and relevant data from the 20-F]

- Regulatory Compliance: ING Group demonstrates a commitment to adhering to relevant regulations and reporting requirements. [Insert relevant details from the 20-F regarding compliance and any significant regulatory actions].

Keywords: ING Group Risk Management, Regulatory Compliance, Credit Risk, Market Risk, Operational Risk

Detailed Examination of Specific Segments within the Form 20-F:

Analysis of Wholesale Banking Performance:

The Wholesale Banking segment demonstrated [Insert description of performance, e.g., strong/weak] results in 2024. [Provide specific data points from the 20-F, such as revenue growth, profitability margins, and key performance indicators (KPIs)].

Review of Retail Banking Results:

ING Group's Retail Banking segment showed [Insert description of performance, e.g., steady/improved/declining] performance in 2024. [Provide specific data points from the 20-F, such as customer growth, loan portfolio performance, and net interest margin].

Assessment of Investment Management Activities:

The Investment Management segment experienced [Insert description of performance, e.g., growth/challenges] driven by [mention factors contributing to performance, e.g., market fluctuations, fund performance]. [Provide specific data points from the 20-F such as assets under management (AUM) growth and fee income].

Keywords tailored to each segment (e.g., Wholesale Banking Performance, Retail Banking Trends, Investment Management Returns). Add more H3 sections as needed, based on ING Group’s business segments reported in the 20-F.

Future Outlook and Investment Implications Based on the Form 20-F:

ING Group's management provides an outlook that suggests [Insert management's outlook on future performance as stated in the 20-F]. This implies [Insert implications for investors, e.g., potential for growth/challenges ahead]. The 20-F filing suggests [Insert investment opportunities or risks based on the analysis of the 20-F]. Investors should consider [Suggest considerations for investors based on the financial data and outlook].

Keywords: ING Group Stock, Investment Outlook, Future Growth, Financial Projections

Conclusion: Understanding ING Group's 2024 Performance through the Form 20-F Analysis

This analysis of ING Group's 2024 Form 20-F filing reveals [Summarize key findings, e.g., a mixed performance with strengths in certain areas and challenges in others]. Understanding the intricacies of this report is crucial for investors and stakeholders to make informed decisions. The Form 20-F provides invaluable insight into the company's financial health, risk profile, and future outlook. We encourage you to continue researching ING Group's financial performance and stay updated on future filings using the ING Group 20-F keyword and other relevant search terms. For further in-depth analysis, exploring resources such as financial news websites and independent research reports is highly recommended.

Featured Posts

-

Cassis Blackcurrant A Deep Dive Into The Flavor Profile

May 21, 2025

Cassis Blackcurrant A Deep Dive Into The Flavor Profile

May 21, 2025 -

Groeiend Autobezit Drijft Occasionverkopen Bij Abn Amro Omhoog

May 21, 2025

Groeiend Autobezit Drijft Occasionverkopen Bij Abn Amro Omhoog

May 21, 2025 -

Building A Food Empire Lessons From A Young Louth Entrepreneur

May 21, 2025

Building A Food Empire Lessons From A Young Louth Entrepreneur

May 21, 2025 -

Athena Calderones Rome Milestone A Look At The Event

May 21, 2025

Athena Calderones Rome Milestone A Look At The Event

May 21, 2025 -

Will Climate Risk Affect My Ability To Buy A Home

May 21, 2025

Will Climate Risk Affect My Ability To Buy A Home

May 21, 2025

Latest Posts

-

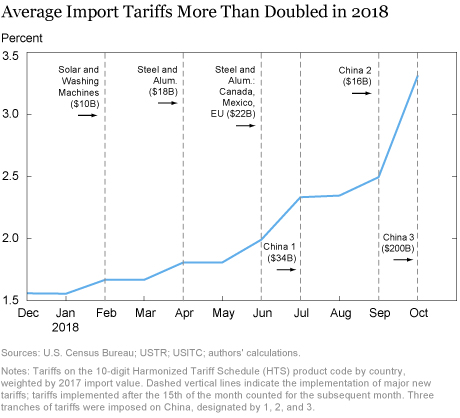

Canadian Government Rebuts Oxford Report On Us Tariffs

May 21, 2025

Canadian Government Rebuts Oxford Report On Us Tariffs

May 21, 2025 -

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Ftc Vs Meta The Defense Begins

May 21, 2025

Ftc Vs Meta The Defense Begins

May 21, 2025 -

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025 -

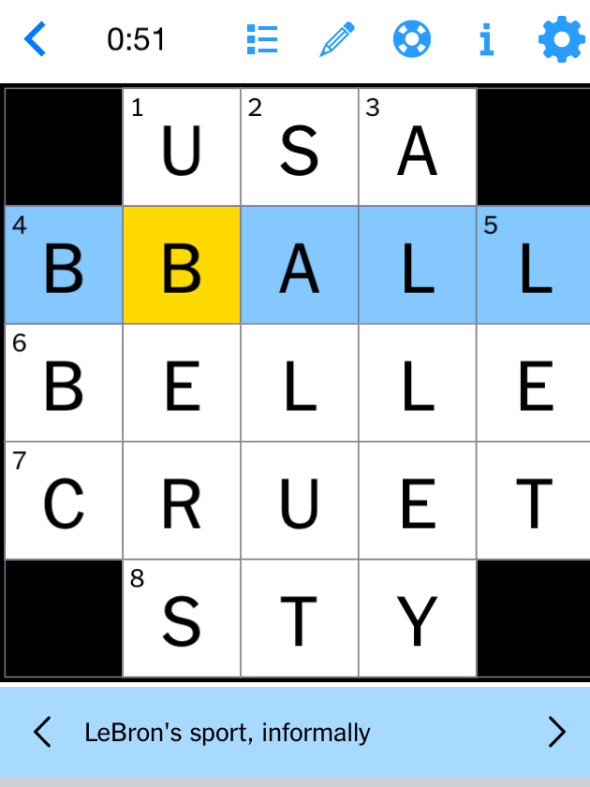

Nyt Mini Crossword Solutions March 13 Hints And Full Answers

May 21, 2025

Nyt Mini Crossword Solutions March 13 Hints And Full Answers

May 21, 2025