2025 Gold Market: First Double-Week Loss Of The Year

Table of Contents

Analyzing the Causes of the Gold Market Decline

Several factors have contributed to this recent dip in gold prices. Let's analyze the key drivers behind this significant shift in the gold market 2025.

Impact of Rising Interest Rates

The inverse relationship between interest rates and gold prices is well-established. Higher interest rates make holding non-interest-bearing assets like gold less attractive. Investors often shift their funds towards interest-bearing accounts or bonds offering better returns.

- Federal Reserve's Influence: The Federal Reserve's monetary policy decisions significantly impact interest rates. Any indication of further rate hikes in 2025 can negatively affect gold's appeal.

- Potential Rate Hikes for 2025: Analysts are predicting several rate hike possibilities for the remainder of 2025, putting downward pressure on gold prices.

- Effect on Investor Sentiment: The anticipation of higher rates fuels a shift in investor sentiment, leading to reduced demand for gold and consequently lower prices.

Strengthening US Dollar

The US dollar's strength exerts considerable influence on gold prices. A strong dollar generally leads to lower gold prices, as gold is priced in US dollars. When the dollar appreciates, it becomes more expensive for holders of other currencies to buy gold.

- Geopolitical Events: Global political instability can strengthen the dollar's safe-haven status, further suppressing gold prices.

- Economic Data Releases: Positive US economic data releases bolster the dollar, influencing the gold market negatively.

- Impact on Dollar and Gold: The interplay between the dollar's strength and gold's price is a critical factor to monitor in 2025.

Reduced Safe-Haven Demand

The recent decline suggests investors are looking beyond gold as their primary safe haven asset. This shift could be attributed to a change in market sentiment and the emergence of alternative investment opportunities.

- Other Asset Classes Gaining Traction: The relative performance of other asset classes, such as certain stocks or bonds, might be attracting investors away from gold.

- Shifts in Risk Appetite: Increased risk tolerance among investors could lead to a reduced demand for the traditionally conservative gold.

- Effect on Gold Demand: This decrease in safe-haven demand directly impacts the overall demand for gold, contributing to price declines.

Impact on Gold Investors and Market Sentiment

The double-week loss has far-reaching implications for gold investors and overall market sentiment.

Short-Term vs. Long-Term Investment Strategies

The recent price drop has different implications depending on investment time horizons.

- Advice for Short-Term Traders: Short-term traders might need to adjust their strategies, possibly considering taking profits or reducing exposure.

- Long-Term Investors' Perspectives: Long-term investors should maintain a steady approach, recognizing that price fluctuations are normal in the gold market. Diversification remains key.

- Importance of Diversification: Holding a diversified portfolio that includes gold as one asset, but not the only one, helps mitigate risk.

Expert Opinions and Market Forecasts

Gold analysts offer varying perspectives on the future of gold. Some predict a continued decline, while others foresee a market rebound.

- Summarizing Various Opinions: Several analysts believe the current decline is temporary, while others see a longer-term downward trend.

- Differing Perspectives on Future Gold Prices: These differing opinions highlight the inherent uncertainty in predicting gold prices.

Potential for a Market Rebound

Several factors could trigger a rebound in gold prices.

- Geopolitical Uncertainty: Escalating geopolitical tensions could re-ignite safe-haven demand for gold.

- Economic Slowdown Scenarios: A global economic slowdown might lead investors back to the perceived safety of gold.

- Potential Shifts in Investor Sentiment: A change in market sentiment, perhaps driven by unexpected economic data, could boost gold demand.

Strategies for Navigating the Gold Market in 2025

Navigating the volatile gold market requires careful planning and strategic decision-making.

Diversification and Risk Management

Diversification is paramount in managing risk effectively.

- Examples of Diversified Portfolios: Include various asset classes beyond gold, such as stocks, bonds, and real estate.

- Hedging Strategies: Employ hedging techniques to mitigate potential losses in the gold market.

- Ways to Mitigate Risk: Thorough research and a well-defined investment plan are crucial for minimizing risk.

Monitoring Key Economic Indicators

Closely monitoring key economic indicators provides valuable insights into market trends.

- Examples of Important Indicators: Inflation rates, interest rates, currency exchange rates, and economic growth figures are all vital data points.

- Resources for Monitoring Them: Reliable financial news sources and economic data websites offer valuable information.

Staying Informed about Market Trends

Staying abreast of market developments is critical for making informed investment decisions.

- Recommend Reliable Sources for Gold Market News: Follow reputable financial news outlets and gold market analysis websites.

Conclusion: Understanding the 2025 Gold Market Fluctuations

The first double-week loss in the 2025 gold market underscores the importance of understanding the factors influencing gold prices. Rising interest rates, a strong US dollar, and reduced safe-haven demand have all contributed to the recent decline. However, potential for a rebound remains, driven by factors such as geopolitical uncertainty and economic slowdowns. By diversifying investments, monitoring key economic indicators, and staying informed about market trends, investors can navigate the gold market effectively in 2025. Continue researching the 2025 gold market and develop a well-informed investment strategy to capitalize on both opportunities and challenges. Consider consulting a financial advisor for personalized guidance tailored to your risk tolerance and investment objectives.

Featured Posts

-

Lizzos Britney Spears Janet Jackson Comparison Ignites Fan Debate

May 04, 2025

Lizzos Britney Spears Janet Jackson Comparison Ignites Fan Debate

May 04, 2025 -

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025 -

Keir Starmers New Immigration Policy A Response To The Farage Challenge

May 04, 2025

Keir Starmers New Immigration Policy A Response To The Farage Challenge

May 04, 2025 -

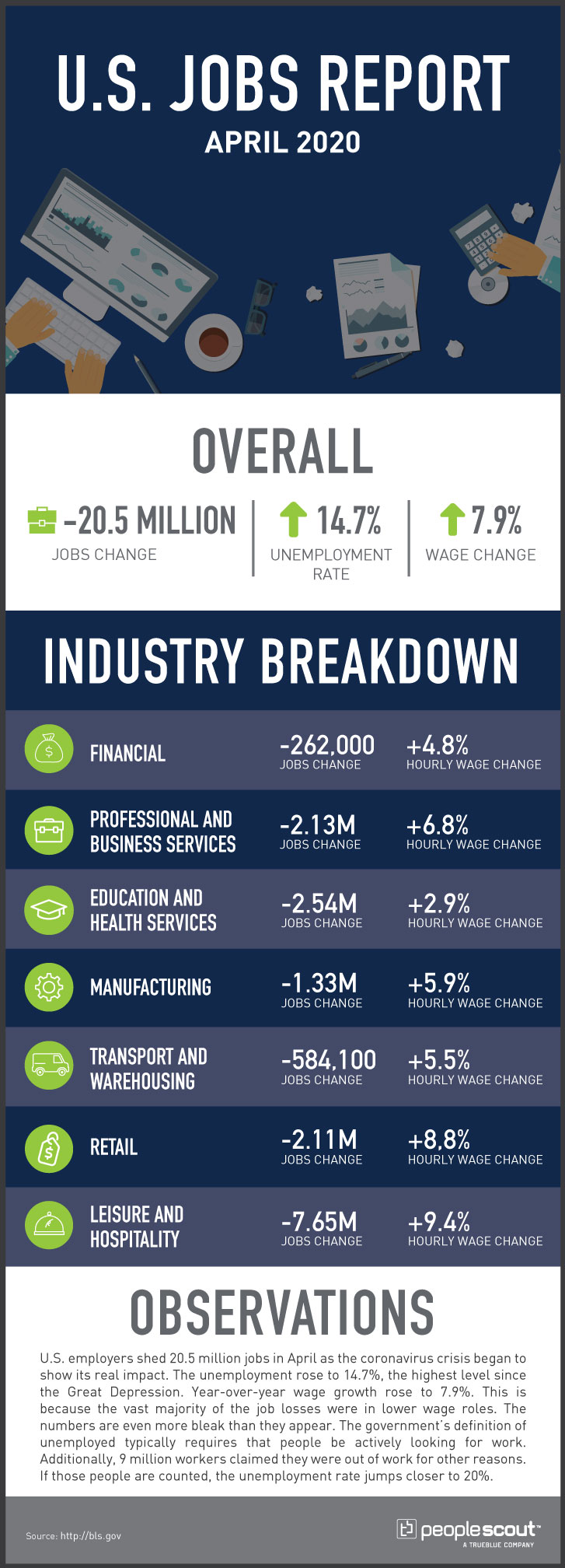

U S Jobs Report 177 000 Jobs Added In April Unemployment Steady At 4 2

May 04, 2025

U S Jobs Report 177 000 Jobs Added In April Unemployment Steady At 4 2

May 04, 2025 -

Court Strikes Down Trumps Executive Action Against Perkins Coie

May 04, 2025

Court Strikes Down Trumps Executive Action Against Perkins Coie

May 04, 2025

Latest Posts

-

Detroit Sports Fans Rejoice Red Wings And Tigers On Fox 2

May 04, 2025

Detroit Sports Fans Rejoice Red Wings And Tigers On Fox 2

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 Main Event Opening Odds Analysis

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Main Event Opening Odds Analysis

May 04, 2025 -

Red Wings And Tigers Games Fox 2 Simulcast Schedule

May 04, 2025

Red Wings And Tigers Games Fox 2 Simulcast Schedule

May 04, 2025 -

Ufc 314 Main Event Volkanovski Vs Lopes Opening Odds Breakdown

May 04, 2025

Ufc 314 Main Event Volkanovski Vs Lopes Opening Odds Breakdown

May 04, 2025 -

Indy Car And Fox A Partnership For The Future Of Motorsports

May 04, 2025

Indy Car And Fox A Partnership For The Future Of Motorsports

May 04, 2025