Understanding The Recent Gold Price Downturn: Back-to-Back Weekly Losses In 2025

Table of Contents

The Role of Rising Interest Rates in the Gold Price Downturn

The inverse relationship between interest rates and gold prices is well-established. As interest rates rise, bonds become more attractive investments, offering a higher yield compared to non-yielding assets like gold. This diverts investment capital away from gold, putting downward pressure on its price. Throughout 2025, several significant interest rate hikes by major central banks have directly correlated with dips in the gold market.

- Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. Investors are incentivized to move their funds into higher-yielding investments, reducing demand for gold.

- A strong dollar strengthens, making gold, priced in dollars, less affordable for international buyers. This reduces overall demand, further impacting the price.

- Central bank policies and their influence on interest rates are paramount. Decisions made by the Federal Reserve (Fed) and other central banks significantly influence global interest rates and, consequently, the gold price. For instance, the unexpected rate hike announced by the Fed in July 2025 led to a noticeable drop in gold prices within days.

Impact of a Strengthening US Dollar on Gold Prices

Gold is predominantly priced in US dollars. Therefore, a strengthening US dollar makes gold more expensive for investors using other currencies, reducing demand and putting downward pressure on the price. The strengthening dollar in 2025, fueled by a combination of economic strength and geopolitical factors, has played a significant role in the recent gold price downturn.

- USD appreciation makes gold more expensive for investors using other currencies. This reduces international demand and contributes to lower prices.

- Safe-haven demand for USD reduces the appeal of gold as a safe haven asset. When investors perceive the US dollar as a safer investment, they tend to shift away from gold, reducing its safe-haven appeal.

- Influence of global economic conditions on the USD exchange rate is undeniable. Strong economic performance in the US, coupled with relative weakness in other major economies, can strengthen the dollar and impact gold.

Geopolitical Factors and their Influence on Gold Prices

Geopolitical instability often drives investors towards safe-haven assets like gold. However, in 2025, despite some ongoing international tensions, a period of relative geopolitical calm in key regions has reduced the demand for gold as a hedge against uncertainty.

- Impact of international conflicts or tensions is usually positive for gold. However, the relative calm in certain regions in 2025 has diminished this effect.

- Influence of economic sanctions or trade wars can be significant. These events, while present in 2025, haven't reached a level to trigger a significant flight to safety into gold.

- Role of unexpected political events: While some unexpected political shifts occurred, they haven’t significantly impacted the gold market’s overall sentiment.

Technical Analysis and Market Sentiment

Technical analysis, using charts and indicators, provides insights into price trends. Currently, many technical indicators suggest a bearish sentiment in the gold market. This bearish market sentiment, combined with the factors discussed earlier, has contributed to the gold price downturn.

- Analysis of support and resistance levels shows weakening support levels. This indicates potential for further price declines.

- Interpretation of moving averages and other technical indicators points towards a bearish trend. This reinforces the downward price pressure.

- Assessment of investor sentiment through market surveys or news reports reveals a prevailing bearish outlook. This reflects a lack of confidence in gold's short-term performance.

Conclusion: Navigating the Gold Price Downturn and Future Outlook

The recent gold price downturn in 2025 is a complex issue resulting from the confluence of rising interest rates, a strengthening US dollar, and relatively stable geopolitical conditions. The bearish market sentiment further exacerbates the situation. While predicting the future is impossible, a careful monitoring of these factors is crucial for making informed decisions. Stay informed about the gold price downturn and its potential impact on your investments. Continue monitoring changes in gold price 2025 to make informed decisions regarding your gold investment strategy.

Featured Posts

-

South Bengal Temperature Surge Near 38 C On Holi Festival

May 04, 2025

South Bengal Temperature Surge Near 38 C On Holi Festival

May 04, 2025 -

The Impact Of Trumps Tariffs On Norways Investment Strategy Nicolai Tangen

May 04, 2025

The Impact Of Trumps Tariffs On Norways Investment Strategy Nicolai Tangen

May 04, 2025 -

Migrants Desperate Escape Eight Hours Hidden In A Tree From Ice

May 04, 2025

Migrants Desperate Escape Eight Hours Hidden In A Tree From Ice

May 04, 2025 -

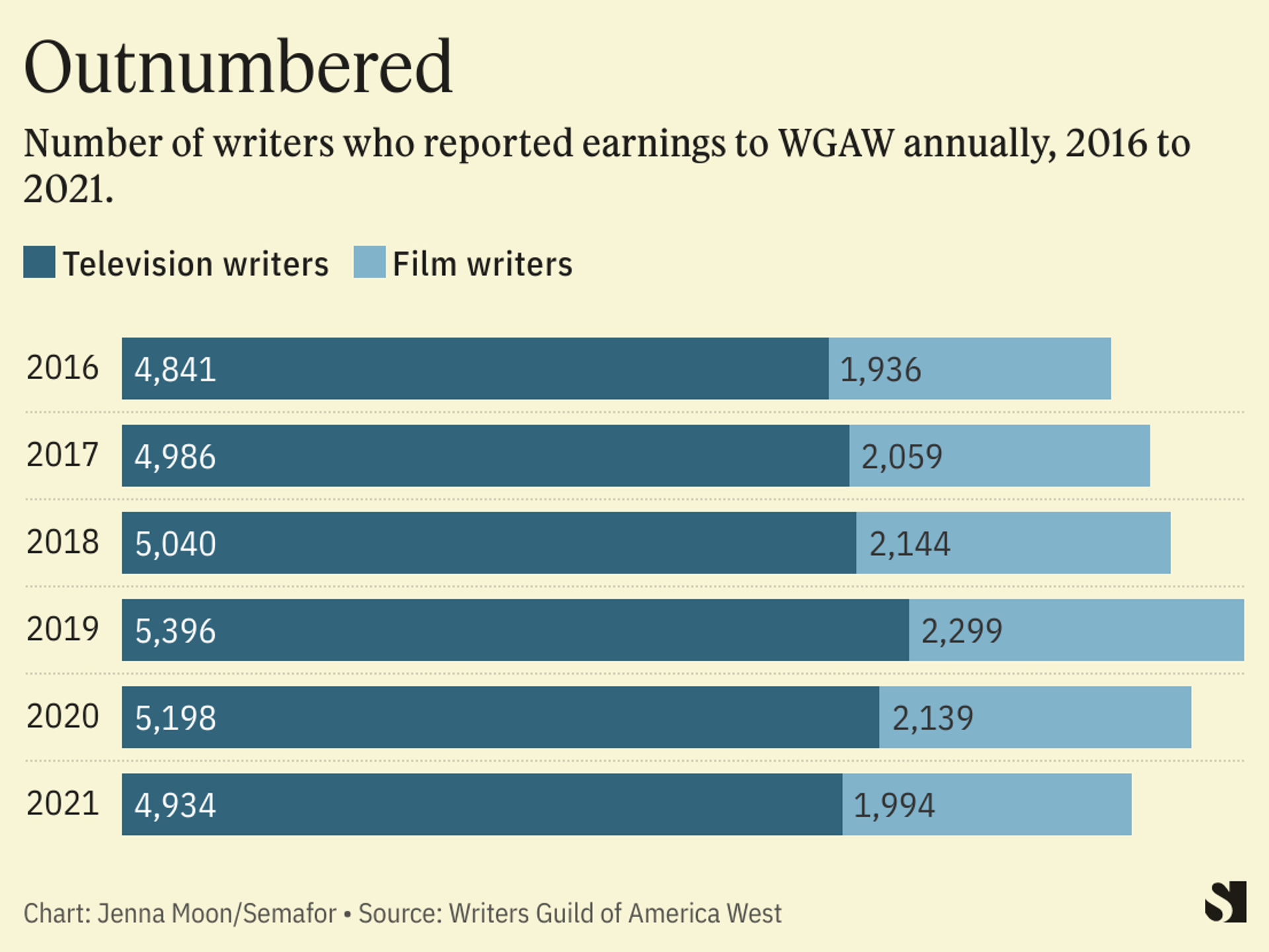

Actors And Writers Strike The Complete Hollywood Shutdown

May 04, 2025

Actors And Writers Strike The Complete Hollywood Shutdown

May 04, 2025 -

Nhl Com Q And A Wolf Discusses Calgarys Playoff Outlook And Calder Contention

May 04, 2025

Nhl Com Q And A Wolf Discusses Calgarys Playoff Outlook And Calder Contention

May 04, 2025

Latest Posts

-

Ufc 314 Paddy Pimblett Throws Exclusive Yacht Party After Dominant Win

May 04, 2025

Ufc 314 Paddy Pimblett Throws Exclusive Yacht Party After Dominant Win

May 04, 2025 -

Peter Distad To Lead Foxs Direct To Consumer Streaming Platform

May 04, 2025

Peter Distad To Lead Foxs Direct To Consumer Streaming Platform

May 04, 2025 -

Paddy Pimblett Celebrates Ufc 314 Victory With Private Yacht Dance Party

May 04, 2025

Paddy Pimblett Celebrates Ufc 314 Victory With Private Yacht Dance Party

May 04, 2025 -

Fox Appoints Peter Distad To Head Its Dtc Streaming Service

May 04, 2025

Fox Appoints Peter Distad To Head Its Dtc Streaming Service

May 04, 2025 -

Paddy Pimbletts Post Fight Yacht Party Ufc 314 Celebration

May 04, 2025

Paddy Pimbletts Post Fight Yacht Party Ufc 314 Celebration

May 04, 2025