The Impact Of Trump's Tariffs On Norway's Investment Strategy (Nicolai Tangen)

Table of Contents

H2: The Direct Impact of Trump's Tariffs on Norwegian Investments

Trump's tariffs, particularly those targeting aluminum, steel, and certain agricultural products, created significant challenges for NBIM. The direct impact stemmed from the fund's considerable holdings in companies across various sectors affected by these trade measures.

H3: Exposure to Affected Sectors:

NBIM's vast portfolio inevitably included companies significantly exposed to the ripple effects of Trump's tariffs. The uncertainty created by these trade wars forced the fund to re-evaluate its risk exposure and adjust its investment strategy accordingly.

- Aluminum and Steel: The tariffs on these metals impacted numerous companies involved in manufacturing, construction, and transportation, forcing NBIM to reassess its holdings in these sectors. This might have involved divestment from some companies heavily reliant on these materials or a more cautious approach to future investments.

- Seafood: Norway's seafood industry faced challenges due to retaliatory tariffs imposed by other countries in response to Trump's actions. This directly affected Norwegian exporters and, consequently, NBIM's investments in related companies.

- Technology: While not directly targeted, the broader economic uncertainty created by the trade war also influenced technology investments. Supply chain disruptions and reduced consumer confidence could have negatively impacted the performance of some technology companies in NBIM's portfolio.

H3: Market Volatility and Investment Risk:

The trade war fueled market volatility, creating significant uncertainty for investors. NBIM, responsible for managing a substantial sovereign wealth fund, had to navigate this volatility effectively.

- Increased Risk: The increased uncertainty amplified investment risk. NBIM likely employed more conservative investment strategies, potentially reducing its exposure to riskier assets.

- Diversification: To mitigate the impact of the trade war, NBIM likely strengthened its diversification efforts across geographies, asset classes, and sectors. This minimized reliance on any single market or industry unduly impacted by tariffs.

- Return Adjustments: The market volatility directly impacted NBIM's investment returns. While precise figures are difficult to isolate, it's likely that the overall return was affected, necessitating a reassessment of long-term projections.

H2: Indirect Impacts on Norway's Investment Landscape

Beyond the direct effects, Trump's tariffs had indirect consequences for NBIM's investment strategy, prompting shifts in its long-term approach.

H3: Geopolitical Shifts and Investment Diversification:

The trade war highlighted the fragility of global trade relationships, prompting NBIM to reconsider its geographic diversification strategy.

- Regional Shifts: NBIM might have reduced its reliance on regions heavily impacted by the trade war, seeking investment opportunities in more stable and less politically volatile areas.

- Emerging Markets: The trade war likely led to a reassessment of emerging market investments, as some developing economies were disproportionately impacted by the global trade slowdown.

- Europe and Asia: Investments in Europe and Asia might have been strategically adjusted, factoring in both the direct and indirect impacts of the trade war on these regions.

H3: Changes in Global Supply Chains and Investment Opportunities:

Disruptions to global supply chains presented both challenges and opportunities.

- Reshoring and Nearshoring: The trade war spurred reshoring and nearshoring trends, creating investment opportunities in companies focusing on relocating production closer to their markets. NBIM might have strategically invested in such initiatives.

- Supply Chain Resilience: The experience likely prompted NBIM to prioritize investments in companies with resilient and diversified supply chains, reducing reliance on vulnerable regions or single suppliers.

- Sustainable Investing: The focus on sustainable and responsible investing might have increased, considering environmental, social, and governance factors within supply chains.

H2: Nicolai Tangen's Leadership and Strategic Response

Nicolai Tangen's leadership during this period was crucial. His responses shaped NBIM's navigation of the complexities brought on by Trump's tariffs.

H3: Public Statements and Policy Positions: While specific public statements might require further research, it's likely Tangen addressed the impact of tariffs on NBIM's strategy, emphasizing the fund's commitment to long-term value creation and responsible investing.

H3: Internal Adjustments and Long-Term Vision: Internal adjustments likely included enhanced risk management processes, more rigorous due diligence for new investments, and a greater emphasis on long-term portfolio diversification. Tangen's long-term vision likely emphasized resilience and adaptability in the face of global economic uncertainty.

H3: Comparison to other Sovereign Wealth Funds: Comparing NBIM's response to other sovereign wealth funds like those of Singapore, Abu Dhabi, or Kuwait reveals potential similarities and differences in strategic approaches to navigating the complexities of global trade disputes. This comparative analysis would offer valuable insights into best practices and adaptable strategies.

3. Conclusion: Understanding the Lasting Effects of Trump's Tariffs on Norway's Investments

Trump's tariffs profoundly impacted Norway's investment strategy under Nicolai Tangen, forcing NBIM to adapt its approach to risk management, diversification, and long-term investment planning. The direct effects included exposure to affected sectors and increased market volatility. Indirectly, the tariffs spurred geopolitical shifts and changes in global supply chains, creating both challenges and opportunities. Understanding NBIM's response is crucial for grasping how sovereign wealth funds navigate global economic uncertainty and the lasting effects of protectionist trade policies. Deepen your understanding of the impact of trade wars on investment strategies by exploring further research on [link to relevant resources]. Learn more about how global trade disputes shape investment decisions of sovereign wealth funds like NBIM.

Featured Posts

-

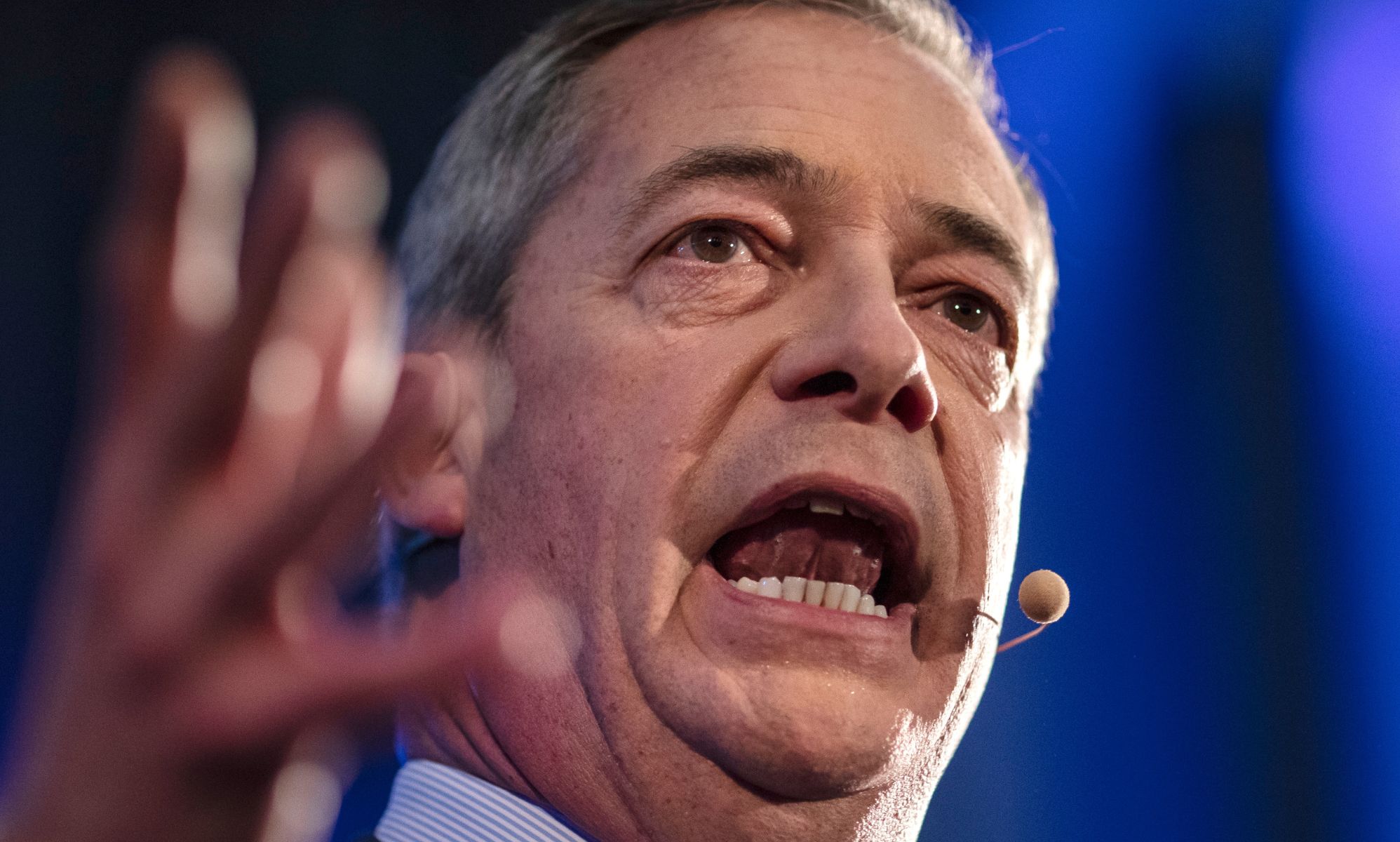

Nigel Farages Savile Slogan Reform Party Sparks Online Outrage

May 04, 2025

Nigel Farages Savile Slogan Reform Party Sparks Online Outrage

May 04, 2025 -

The Cusma Negotiations Carneys Meeting With Trump And Whats At Stake

May 04, 2025

The Cusma Negotiations Carneys Meeting With Trump And Whats At Stake

May 04, 2025 -

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Growth

May 04, 2025

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Growth

May 04, 2025 -

Belgiums 270 M Wh Bess Navigating The Complexities Of Merchant Market Financing

May 04, 2025

Belgiums 270 M Wh Bess Navigating The Complexities Of Merchant Market Financing

May 04, 2025 -

Is Britney Spears Imitating Janet Jackson Lizzos Claim Sparks Online Fury

May 04, 2025

Is Britney Spears Imitating Janet Jackson Lizzos Claim Sparks Online Fury

May 04, 2025

Latest Posts

-

Analyzing The Alleged Rivalry A Timeline Of Blake Lively And Anna Kendricks Interactions

May 04, 2025

Analyzing The Alleged Rivalry A Timeline Of Blake Lively And Anna Kendricks Interactions

May 04, 2025 -

A Comprehensive Timeline Of The Reported Feud Between Blake Lively And Anna Kendrick

May 04, 2025

A Comprehensive Timeline Of The Reported Feud Between Blake Lively And Anna Kendrick

May 04, 2025 -

Blake Lively Vs Anna Kendrick Tracing The Timeline Of Their Alleged Feud

May 04, 2025

Blake Lively Vs Anna Kendrick Tracing The Timeline Of Their Alleged Feud

May 04, 2025 -

Unmasking The Truth A Timeline Of The Blake Lively Anna Kendrick Conflict

May 04, 2025

Unmasking The Truth A Timeline Of The Blake Lively Anna Kendrick Conflict

May 04, 2025 -

Comparing Styles Blake Lively And Anna Kendricks Understated Red Carpet Looks

May 04, 2025

Comparing Styles Blake Lively And Anna Kendricks Understated Red Carpet Looks

May 04, 2025